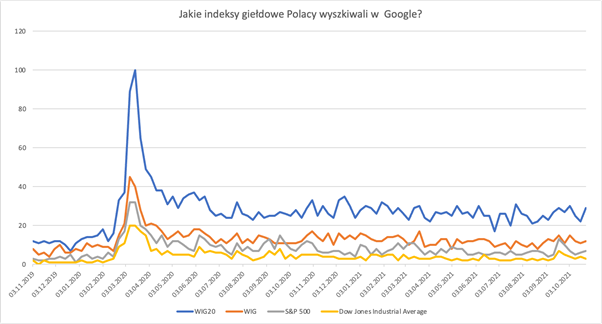

DJIA and S & P500 not very popular in Poland

The American DJIA and S & P500 indices are much less popular in Poland than Wig20 and WIG. This is not surprising, because few Poles invest in the global market all the time.

The S & P500 and Dow Jones Industrial Average (DJIA) are the two most important indices that dominate when we talk about US stock markets. The 500-company S&P seems to better reflect US equities, has higher capitalization, and is often used as a gauge of the overall US market. The DJIA, on the other hand, consists of only 30 companies, but it is much more famous and has a 125-year history behind it. For this reason, it is used by analysts for long-term comparisons that are not possible for indices with a shorter history.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

The DJIA is searched for 4 times more often on Google than in the world S & P500. Interestingly, it is different on the Vistula and information about the S & P500 is searched more often. At some points, its popularity is surpassed by our domestic WIG index, which includes all companies from the Warsaw Stock Exchange (meeting the criteria for participation in the index, currently 349 companies out of 425 listed). The most popular index among Poles, however, remains the WIG20, which is searched many times more than the WIG and S & P500. This also applies to crisis moments, such as the declines in February and March 2020.

Source: Google Trends 2.11.2021

The DJIA and S & P500 indices are the base for numerous ETFs. S & P500 it is more diversified (shares of 500 companies), it also includes more companies from the technology and communication sector (38% - weighted by market capitalization). The DJIA covers only 30 companies and focuses on the industrial sectors (17%) and finance (16%). Companies z DJIA are on average larger and at the same time have a lower valuation.

From the beginning of the year, the value of the S & P500 increased by 23,8%, and the DJIA by 18,1%. The former has done better in recent years due to the technology boom, but has performed worse in the long run. These indices also slightly double their composition, which is important when diversifying investment portfolios. At DIJA, the most important companies are UnitedHealth (UNH), Goldman Sachs (GS) and Home Depot (HD). In Apple's S&P 500 (AAPL), Microsoft (MSFT) i Amazon (AMZN).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)