Dollar above PLN 5. The currency market is getting nervous

For the first time in history, you have to pay more than PLN 5 for a dollar. The Swiss franc broke this barrier earlier, and the euro seems to be going in the same direction, but for now it is stopped by the resistance around PLN 4,80.

The dollar for 5 zlotys, the euro for 4,80 zlotys

Wednesday morning brings a continuation of the zloty depreciation. At 09:54 the dollar had to be paid 5,0181 against PLN 4,9867 on Tuesday at the end of the day and against today's maximum at PLN 5,0349. The euro cost PLN 4,7960 and the Swiss franc PLN 5,0540.

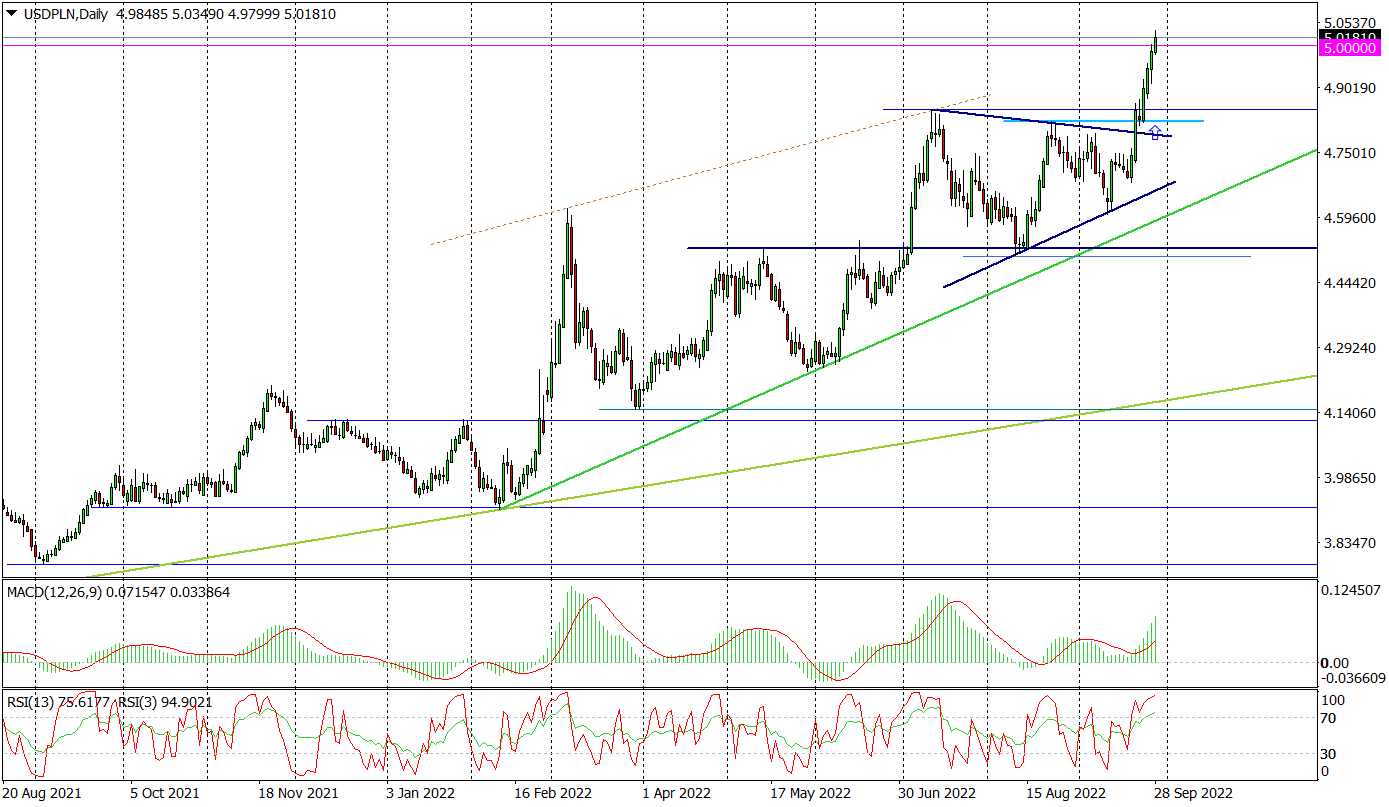

USD / PLN daily chart. Source: Tickmill

Fears of a global recession, fear of a deepening energy crisis in Europe after yesterday's "leak" from the Nord Stream gas pipeline, rampant inflation, depressing EUR / USD exchange rate, but also domestic topics such as the still high negative real interest rates in Poland, the slowing economy, the lack of coordination of monetary and fiscal policy, the practical resignation from the KPO money, or even the recent media reports on the major reconstruction of the Polish government, including the replacement of the prime minister, weigh on the Polish currency. The next few days can be very nervous in this respect. One should take into account the high volatility in Polish pairs. Also because additional emotions will be triggered by the September inflation data in Europe (including Polish data), as well as geopolitics (Putin's speech is scheduled for Friday).

Technical situation in the charts

The recent increases in USD / PLN, which today pushed this pair above PLN 5, are not a big surprise, after the daily chart of this pair broke through the triangle formation on September 21, breaking the local peak in August and breaching the peak in July. It is only surprising that the supply side did not defend the psychological support at the level of PLN 5. It is also a signal that the upward trend in USD / PLN may be continued.

Where is the peak for USD / PLN? The latest example with the British pound collapse makes us cautious in forecasting such a potential peak. It cannot be ruled out that it will be set significantly above the current levels. Especially that the situation on the EUR / PLN chart is starting to look worrying.

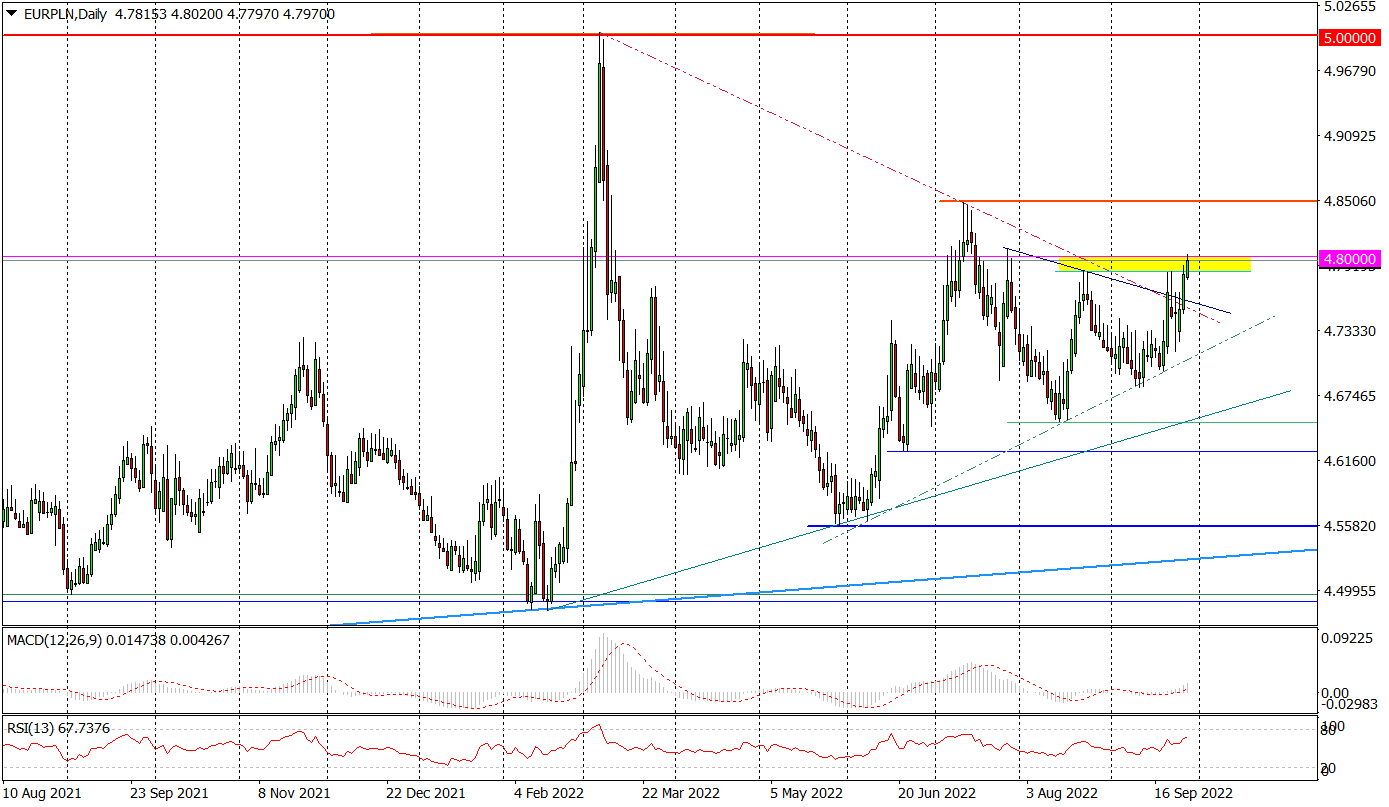

EUR / PLN daily chart. Source: Tickmill

The EUR / PLN pair, after yesterday breaking the resistance created by the lines connecting the last highs, is now attacking the resistance zone with the upper limit at PLN 4,80. A break higher would open the way for a stronger upward move. A minimum of 5 PLN, but in practice even 10-15 PLN. This would automatically mean a further sell-off of the zloty against other major currencies and the dollar around PLN 5,15.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)