Dollars, dollars, dollars. USD / PLN above 4,20.

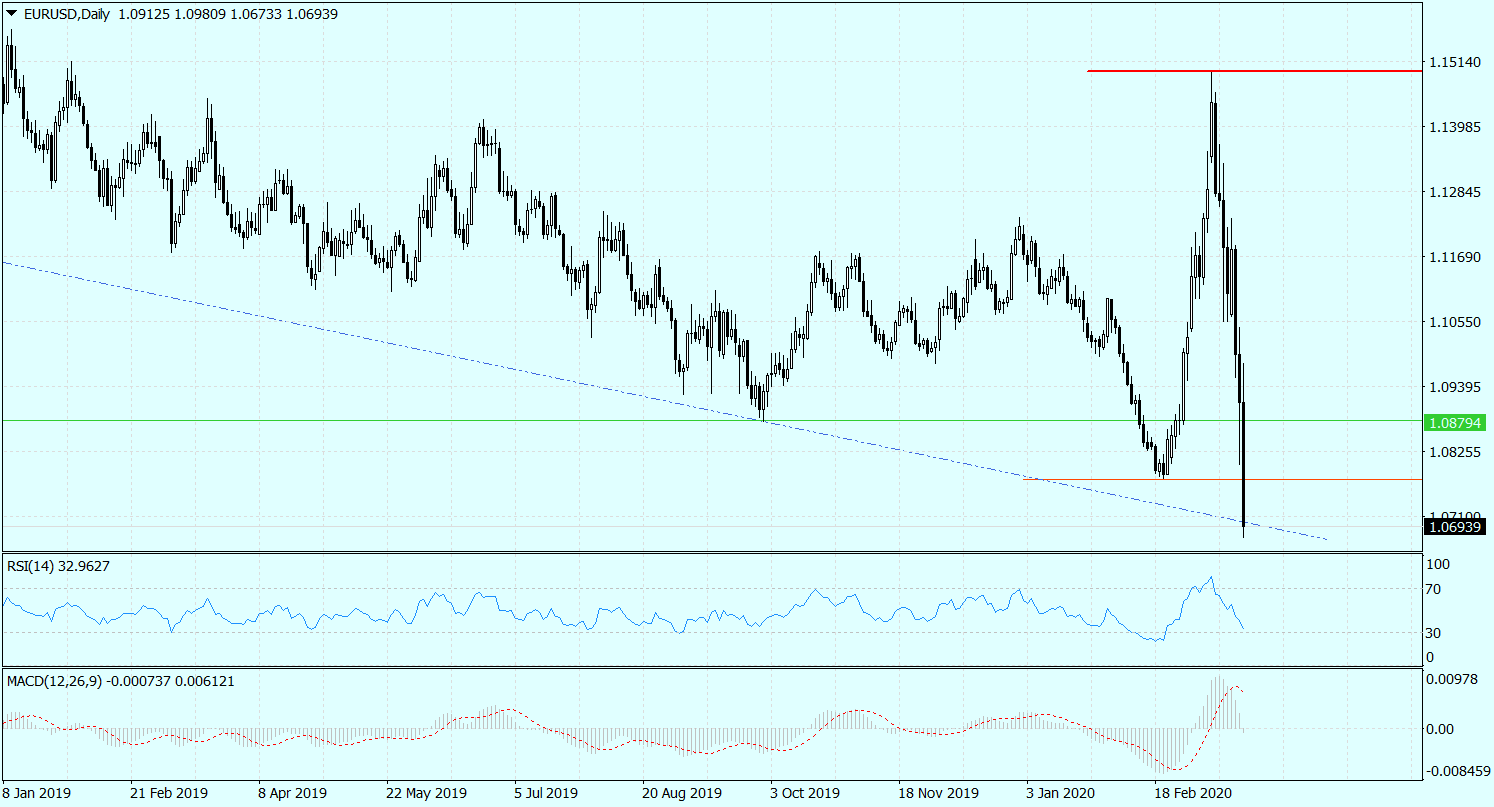

Dollars, dollars, dollars - criminals shouted at hotels and city marketplaces in righteous times. Then they wanted to sell dollars. Today, the whole world wants to buy them. The last days bring an unseen dollar rally for a very long time. Markets are afraid of the consequences of the coronavirus epidemic, they are looking for liquidity and are buying the dollar for power. As a result, the course EUR / USD, which attacked around 9 on May 1,15, today fell back below 1,07, breaking the February hole. Thus, the equally strong growth impulse from the turn of February and March was more than abrogated, when the speculative game was underway for unprecedented interest rate cuts by the American Federal Reserve. And in fact such reductions have taken place. Feet in the US have been cut to zero. The Fed additionally launched the QE program. Meanwhile, the dollar is even stronger. This shows the scale of market fear.

Diagram EUR / USD, D1 interval. Source: MT4 Tickmill.

What next with EUR / USD? The situation is not clear. On the one hand, it may be that the increases from the turn of February and March were a trap that the demand side fell into, which now will cost it dearly. Consequently, the EUR / USD will collapse and fall to around 1,00. On the other hand, it can be concluded that both the earlier attack on 1,15 and the current descent below 1,07 are simply anomalies within the side trend, which, however, will not significantly affect this trend. Hence, as it has been for many recent months, new holes on the chart will again be an opportunity to buy the euro, because there will be an upward rebound that will raise the rate above the nearest resistance (1,0778), negating sales signals. Which scenario to choose? Unfortunately both are equally likely.

Dollars versus PLN

The dollar gains not only to the euro, but also to the zloty and many other currencies. What happened on the USD / PLN chart in the last 3 days has gone beyond any imagination. The October 2019 summit (PLN 4,0237), which just a week earlier seemed insurmountable, burst like a match and the course fired around PLN 4,27, trying to attack the December 2016 summit (4,2789) . The balance of power on the daily chart, where the only weapon of supply is strong redemption, such an attack suggests. What's more, if you stick to the technical analysis, after breaking above 4,2789 the next resistance is only around 4,43 PLN. There, the supply barrier is created by a line connecting the highs of February 2009 and December 2016. Now it is hard to believe that 4,43 could be tested. Well, but a week ago it was difficult to believe in an increase to 4,27 PLN.

Chart USD / PLN, D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)