The house of cards in the form of negative real profitability may collapse soon

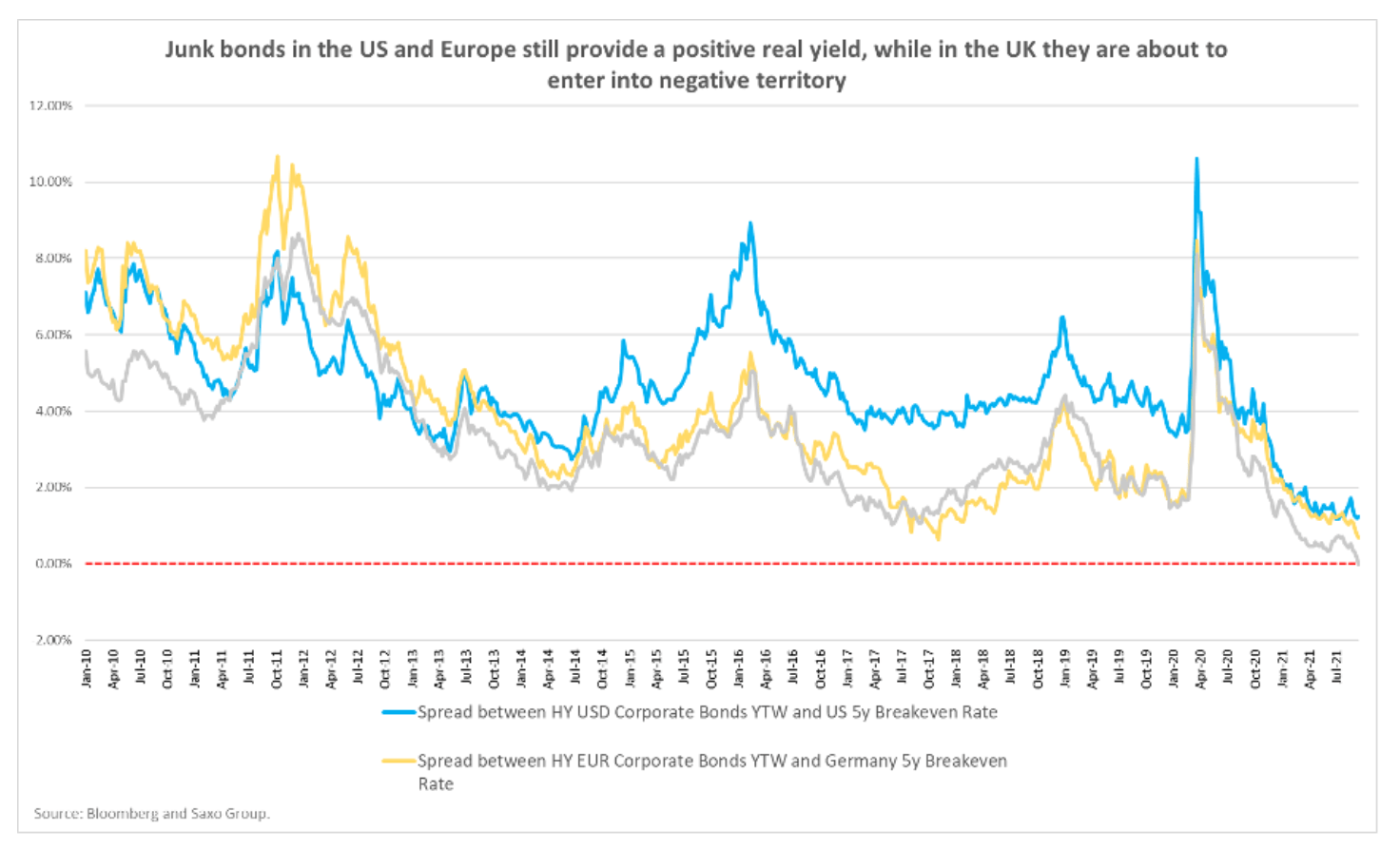

The main theme of the investment narrative in the coming months will be real profitability. Since the Covid-19 pandemic, financial markets have become heavily dependent on lax financing conditions provided by negative real yields. To avoid real losses, investors have been encouraged to take more risks and thus junk bond spreads have narrowed to pre-2008 levels. high-risk assets are inevitable.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

The link between real yields and break-even yields: what does this mean for bond investors?

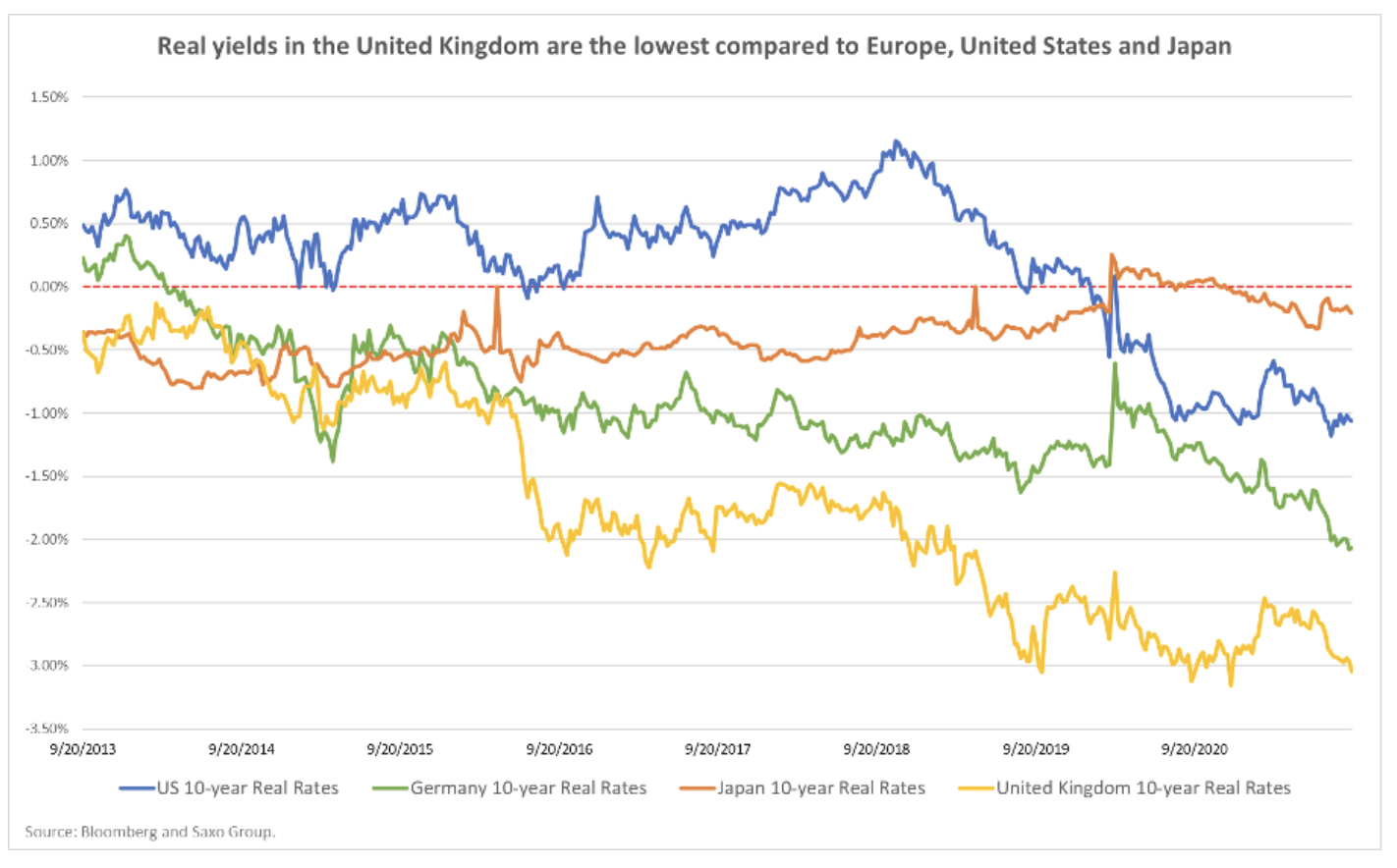

The real profitability consists of nominal profitability minus the profitability above the break-even point. Since the onset of the Covid-19 pandemic, an exceptionally accommodative monetary policy has resulted in a decline interest rateswhile continuing to stimulate inflation expectations. As a result, real yields turned strongly negative and fell to a record low level. However, as central banks consider withdrawing fiscal stimulus, higher nominal yields and lower inflation expectations can be expected. Such an acceleration in real profitability growth may pose a threat to high-risk assets.

The relationship between real yields and yields above the break-even point is a compass for bond investors and can be summarized as four phases:

- Real yields are falling, yields above the break-even point are falling. This occurs when economic conditions worsen, as was the case with the Covid-19 pandemic. Central banks then lower interest rates and provide fiscal stimulus. Investment grade corporate bonds and safe harbor assets benefit from this scenario. On the other hand, higher risk bonds initially go down and then slowly stabilize.

- Real profitability is growing, profitability above the break-even point is increasing. Yields have hit the bottom and the economic recovery continues, leading central banks to withdraw from accommodative monetary policy. In this phase, returns on government, junk and emerging markets bonds begin to normalize at the expense of US Treasury bonds.

- Real yields are falling, yields above the break-even point are rising. Under this scenario, the economic situation improves. Central banks, however, are prone to ignore higher inflation expectations on the basis that the economy requires stimulus. In this situation, the junk bonds find buyers, while the safe assets remain within the range.

- Real profitability is rising, profitability above the break-even point is falling. In this case, central banks begin to implement a more aggressive monetary policy to prevent the economy from overheating. Junk and emerging market bonds are losing out, while higher-rated defensive bonds are performing very well.

The first phase quite accurately describes the situation during the Covid-19 pandemic. On the other hand, the second and third phases can be allocated to specific periods of the current year. For example, the second phase describes the transactions reflectivewhich we could see in the markets in February.

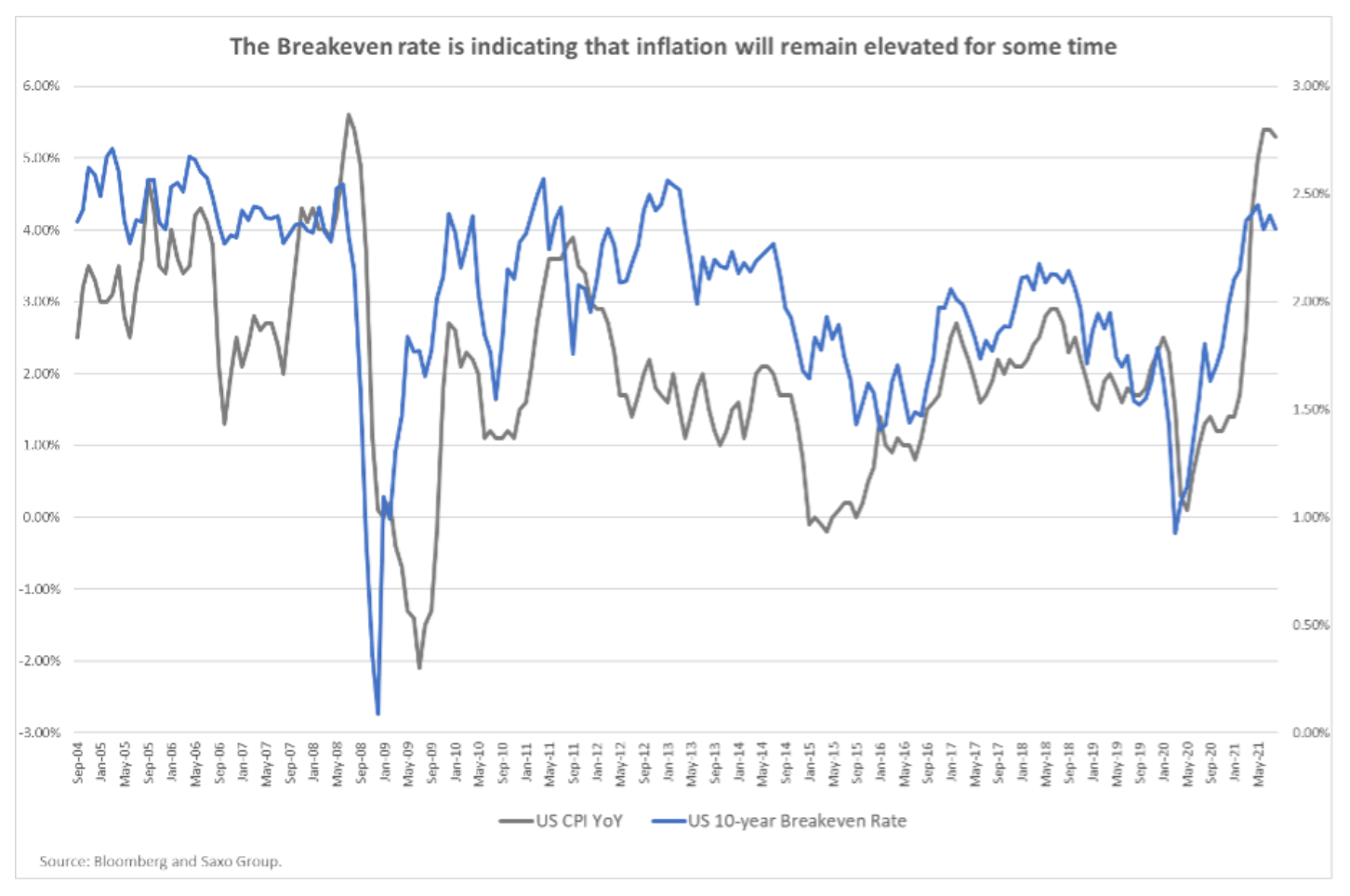

Now the bond market is entirely dependent on central banks' approach to inflation and their decisions on how to solve this problem. American Federal Reserve inflation decided to be temporary, providing wide-ranging support for bonds. However, one should not ignore the fact that the Fed's reluctance to limit asset purchases increases the risk of rising inflation. Even if the central bank starts to reduce the scale of the bond purchase program, inflation will inevitably be stimulated until the bond purchases are brought to zero.

Therefore, the main question investors should ask themselves is:

What scale of inflation are central banks willing to tolerate and at what pace are they able to withdraw their support?

In our opinion, the later the support is withdrawn, the more aggressive the actions of central banks will have to be, which will result in an unexpected increase in real yields, which will contribute to increased volatility in the market and will pose a threat to weaker corporate bonds.

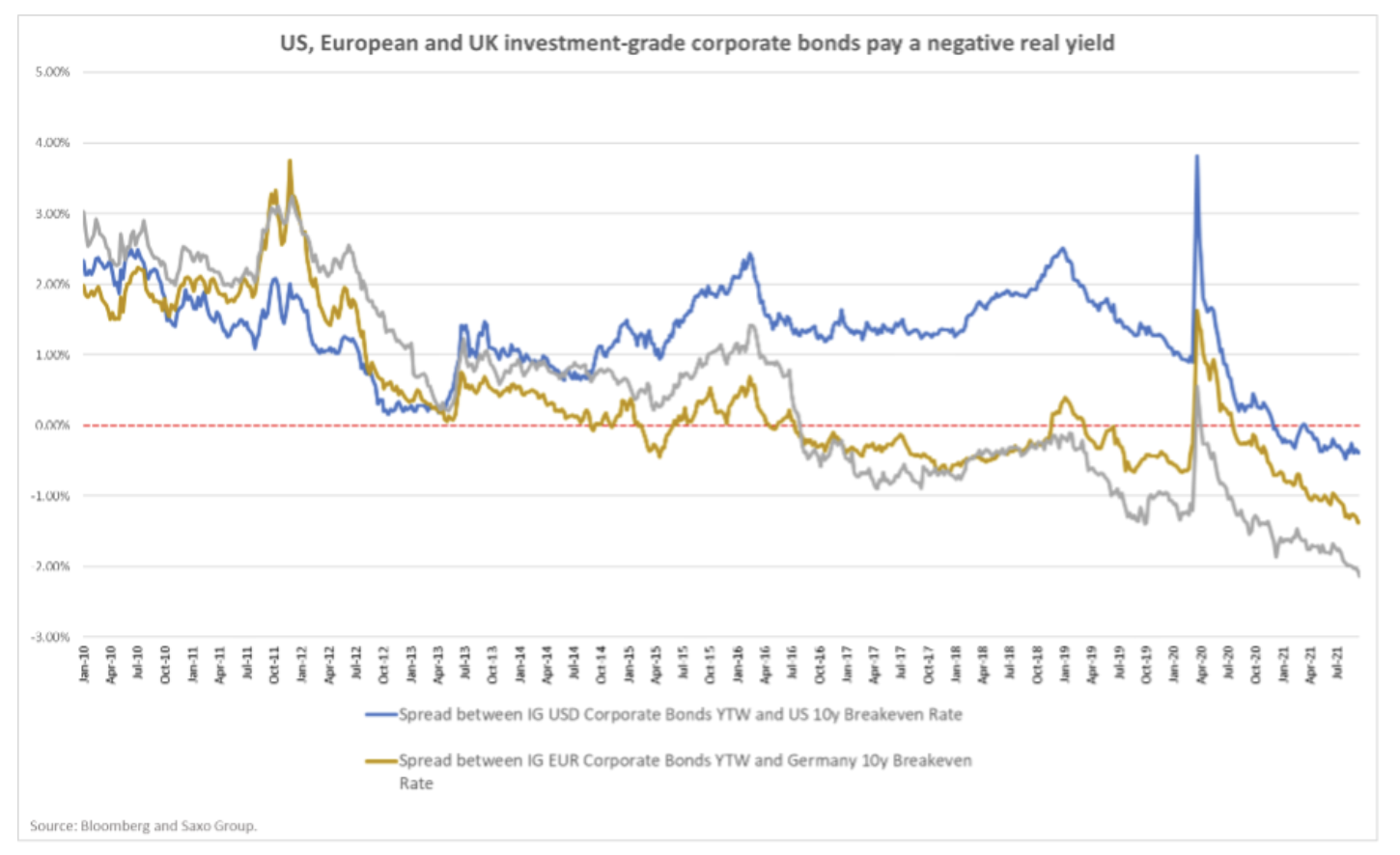

Corporate bond spreads are entirely dependent on the monetary policy of central banks

Corporate bond spreads, and venture capital assets in general, are more responsive to yield volatility than to their actual level. However, despite the events of this year, while government bonds in the United States and the Old Continent rose relatively strongly, corporate bonds remained almost unchanged. In the US, ten-year yields in February rose by 45 basis points, however corporate bond spreads increased by just 10 basis points over the same period. The situation is similar in the United Kingdom, where ten-year government bond yields quadrupled in the same month. At the same time, the spreads of high-rated corporate bonds even narrowed by seven basis points, reaching their lowest level since January 2018.

The economic recovery was in favor of corporate bond spreads this year, which contributed to the increase in profits after the opening of the economy. However the situation may change dynamically if inflationary pressures become permanent and central banks are forced to restrict asset purchases in a more aggressive manner than forecasted. Currently, the market does not price aggressive monetary policy at all, providing extensive support to all companies, including those with weak balance sheets (referred to as "zombies"). Yet record-tight corporate bond spreads pose a risk as they are heavily dependent on accommodative monetary policy. As central banks become more aggressive, you can expect spreads to widen significantly and bankruptcies to increase.

High inflation and a rise in the yield curve: bond segments that can benefit

As already mentioned, monetary policy is crucial to the performance of corporate bonds. If central banks continue to tolerate inflationary pressures, it is safe to assume that corporate bond spreads will continue to be supported and will benefit companies that have benefited most from the economic opening.

If we expect inflation to continue and the yield curve to boom against a stable monetary policy, there are exciting opportunities in the banking and financial sectors. Banks take out short-term loans to make long-term loans. A steeper yield curve would therefore improve their net interest margins. In addition, banks will continue to reap the benefits of a reflective environment as the economy opens up and demand for credit and investment increases. Financial intermediaries and insurers will also benefit from this, as a healthy economy means increased investment activity.

Cyclical industries can also perform well in such an environment, with industries that can easily pass on higher costs to their customers. So far, producers of basic materials and raw materials have managed to do so despite soaring raw material prices. On the other hand, non-cyclical industries such as the food and beverage or retail sectors have proved to be less able to pass on costs to customers.

The situation will be different if central banks are forced to implement a more aggressive monetary policy in order to limit the rise in inflation. In such a scenario, the most important thing is to stay on the defensive and limit the duration of the bonds to a minimum, and the quality to a high level. In the context of the rapid deterioration of financial conditions, support will be provided to defensive industries, such as the consumer basic goods or communal services sectors. However, the appropriate choice of duration will still be of key importance. For example, utility company bonds have inherently very long maturities and are more sensitive to an upward trend in the yield curve.

All Saxo forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)