It will be an interesting week in the markets with the epidemic in the background

The new week started with a strong deterioration in sentiment in the financial markets, which resulted in a sale of assets considered risky. All because of the coronavirus. This will be one of this week's topics. However, not the only one. It is also worth following members' speeches Fed, PMI indices and the conference Tesla.

Stock exchanges are clearly correcting

German DAX and the French CAC40 losing over 3% each, stock exchanges in Athens and London falling almost 4%, US indices falling by 2%, the dollar strengthening against most world currencies, and the commodity market falling - this is the beginning of the week in the financial markets. All because of the recurrence of fears of the coronavirus pandemic.

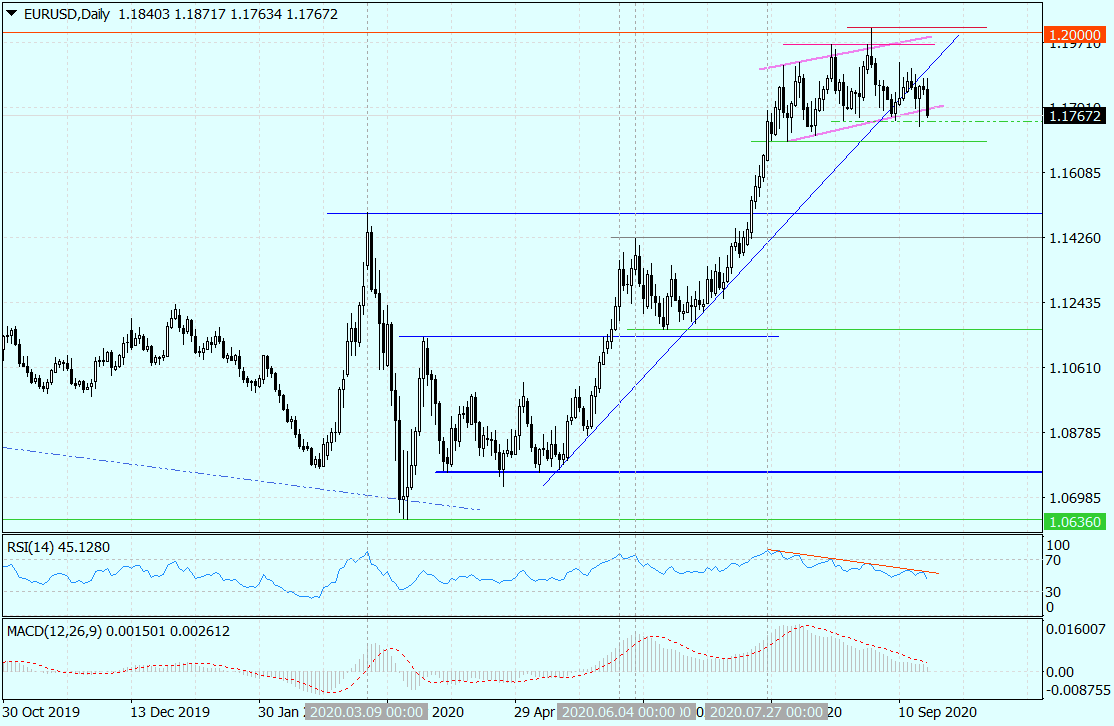

Chart EUR / USD, D1 interval. Source: MT4 Tickmill.

Why did this topic come back just now, despite the fact that the number of infected has been increasing for many weeks? It seems that a certain pain threshold has been exceeded. Second, and this may be much more important, markets have so far ruled out massive lockdowns in the event of the second coronavirus wave. Now it is not so obvious. Governments simply may not have a choice. This is well illustrated by the example of Great Britain. Today's big drops in the London Stock Exchange and the losing pound are the result of reports that Prime Minister Boris Johnson is considering introducing another lockdown if the situation continues to worsen.

This week's financial markets will not only be an epidemic. They will also listen carefully to numerous speeches by Fed representatives. Including four-fold speeches by Fed chairman Jerome Powell.

Another important point of the week will be the Wednesday's publication of flash PMIs for September. From Japan, through France, Germany, the Eurozone and Great Britain, and ending with the USA. Overall a slight improvement is expected from August. Its absence could be very badly received.

PMI indices important event of the week. Source: macroNext.

And the last topic that may touch the markets will be the behavior of Wall Street. And here the decisive factor may be ... Tesla. There will be a conference on Tuesday "Battery Day"during which Elon Musk is to present new, more efficient batteries. If, as it says, they turn out to be groundbreaking, it may be an impulse that will end the 3-week correction on Wall Street, while improving moods in all financial markets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)