The euro stands still, while the dollar rises

The EUR / PLN exchange rate remains in a sideways trend, while the USD / PLN exchange rate goes up, reacting to the decline EUR / USD quotations. This tendency in the domestic FX market may persist until the end of the week.

The euro is extremely stable

Tuesday morning in the domestic currency market will be marked by the continuation of the consolidation of the euro against the zloty, with the simultaneous rise of the dollar against the Polish currency. You had to pay PLN 4,6426 for the euro, which is a level similar to Monday's close, while the USD / PLN exchange rate rose on the 4th consecutive day and tested the level of PLN 4,3454, which was a simple reaction to the strengthening of the dollar in the markets global, including the decline in EUR / USD below USD 1,07.

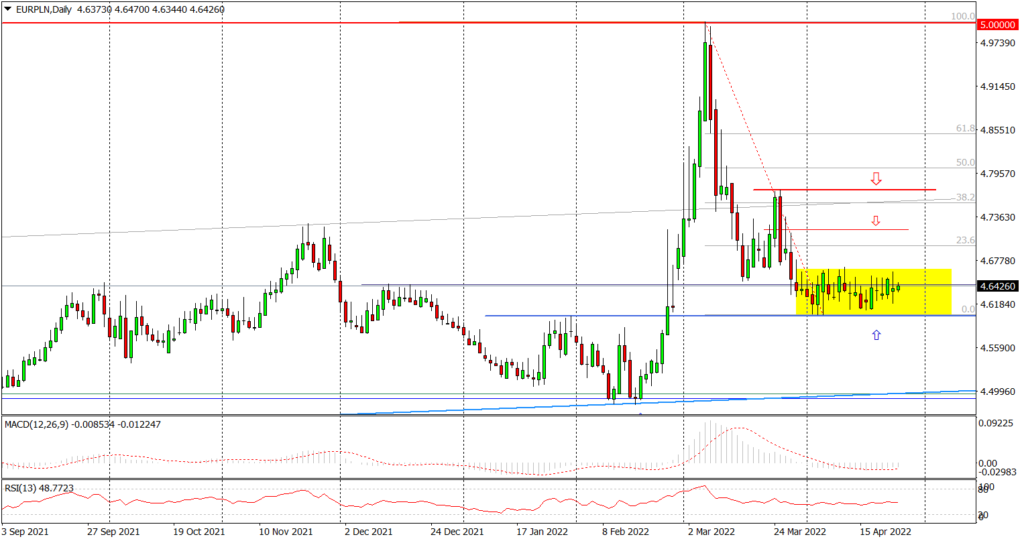

EUR / PLN daily chart. Source: Tickmill

USD / PLN daily chart. Source: Tickmill

In the morning the Polish FX market was relatively calm. It might be more interesting in the afternoon. Then the entire series will be published US data, which may additionally increase the volatility on EUR / USD and thus indirectly affect the USD / PLN quotations. In the afternoon he will also decide on interest rates Bank of Hungary, which will be an important reference to the monetary policy pursued by the Monetary Policy Council.

Since the end of March, the EUR / PLN exchange rate has remained in a sideways trend, following very strong "war" turmoil lasting from mid-February. This 5-week low volatility of the euro against the zloty is the result of waiting for the emergence of new strong impulses that will somehow disturb the outlook on the nearest future of the Polish economy and the domestic currency.

Consolidation of the EUR / PLN quotations at the same time reduces the volatility in other Polish pairs, the quotations of which are the result of changes in these currencies in relation to the common currency. As a result, just like today, the USD / PLN quotes are a product of the EUR / USD behavior. This correlation allows us to expect that with the continuation of the consolidation of EUR / PLN quotations, the USD / PLN exchange rate may still go up at the end of April and the first days of May. Such an increase will be driven by the anticipation of the May interest rate hike by the Fed and the probable further decline in the EUR / USD before this decision. It is possible that the dollar will approach PLN 4,37-4,39 in the near future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)