Exposure to luxury is not just about purchasing an expensive watch

There are certain sectors that are extremely attractive to investors. One of them is "luxury". But is it worth investing in luxury goods or is it something reserved "for a select few"? Let's take a look at how this sector of the market has performed, how to gain exposure to it, and what factors to pay special attention to before investing in luxury.

What is "luxury"?

Luxury stocks can be defined as shares of companies that sell high-end goods and services that are considered expendable but desirable. Some examples are watches, cars, diamonds, leather goods, fashion, perfumes and wine. There are several key features of luxury stocks:

- Association with exclusivity, high quality and prestige. Luxury brands exude an aura of uniqueness around their products.

- High prices. Luxury goods are priced well above non-luxury alternatives. Luxury brands do not compete on price.

- Focus on legacy, craftsmanship and tradition. Luxury brands emphasize their history, origin and traditional production methods.

- Impact on culture and consumers. Luxury brands shape consumers' aspirations and desires. Owning luxury goods signals status.

- Investments in innovation to maintain product quality. Luxury brands are constantly introducing new solutions while maintaining the brand's heritage.

- Production at the place of origin. The production of luxury goods is often concentrated in the historical or cultural place where the brand was born.

In summary, luxury stocks are stocks of companies dealing in superfluous but prestigious and desirable goods and services, with an emphasis on heritage, quality and exclusivity. You should also take into account the fact that luxury is a relative concept. For a large number of people around the world, Nike may be considered a luxury brand, while others would describe Nike as a mainstream company.

How to gain exposure to luxury?

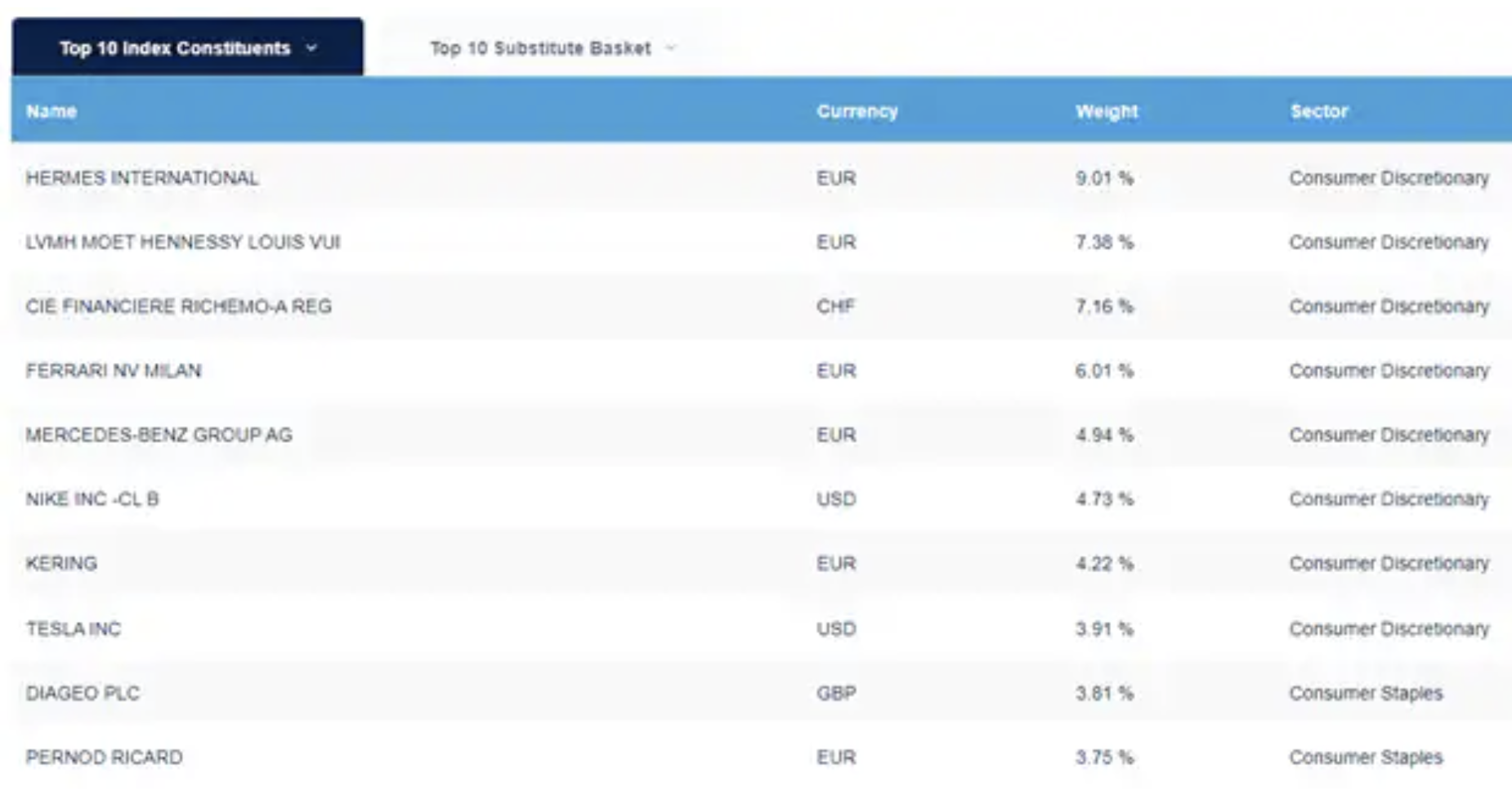

One of the pillars of success in investing is diversification. This also applies to luxury, and the easiest way to gain exposure to luxury is to invest in a luxury goods ETF. Such an ETF consists of several such stocks, providing investors with very easy exposure to these assets. ETF fund available on the Saxo platform is Amundi S&P Global Luxury UCITS ETF. Those who dig deeper into this fund will find companies that may not meet the criteria for being called "luxury." Below are the 10 largest companies in the fund Amundi S&P Global Luxury UCITS ETF.

This is an ETF suitable for people who are comfortable with this list of top 10 holdings. The rest may consider creating their own selection of luxury stocks. Why? Because diversification reduces risk. Below we list some stocks (and some of their sub-brands) that may provide inspiration:

- Hermes

- LVMH Louis Vuitton, Moët & Chandon and Givenchy

- Tapestry Jimmy Choo, Versace and Michael Kors

- sub-brand Burberry Burberry

- Compagnie Financiere de Richemont Cartier, Montblanc and Piaget

- Moncler Stone Island and Moncler

- Ferrari

- Prada, Miu Miu and Church's

- Porsche

Results

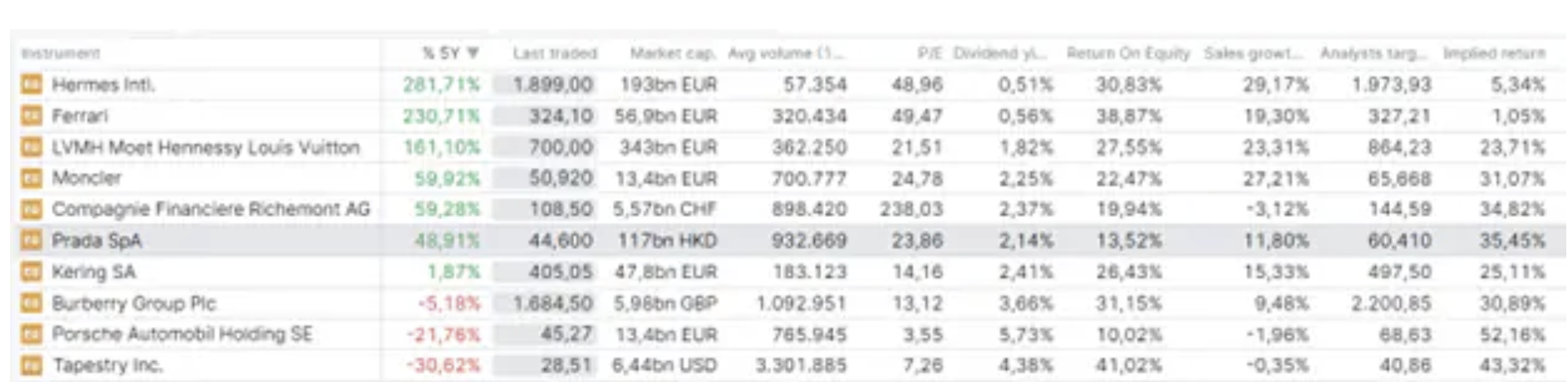

Despite the aura of wealth, success and high quality surrounding luxury products, it does not translate into all investments made in this sector. If you look at the five-year results of the companies mentioned, we are not surrounded only by glitz and glamour.

To get some context on how prices have been over the last 5 years (prices as of November 14, 2023):

- Nasdaq 100 (QQQ)+ 127%

- Amundi S&P Global Luxury UCITS ETF+ 69%

- S&P 500 Index (SPY)+ 61%

- The clear winners in luxury over the last 5 years have been:

- Hermes+ 282%

- Ferrari+ 231%

- LVMH+ 161%

- On the other hand, five-year results were negative for:

- Tapestry – 30%

- Porsche – 22%

- Burberry – 5%

In short, the topic of luxury (ETF) performed better than S&P 500 index over the last 5 years, but underperformed compared to the Nasdaq 100 technology index. The performance of individual luxury stocks ranged from -30% to +277%, highlighting the importance of choosing the right assets.

Current valuation

The table below contains indicators regarding the current valuation. It is worth noting that the winners of the last 5 years have - if we believe the analyst consensus - the smallest growth potential (last column). Also from the P/E perspective (i.e. comparing the share price to the profit it generates)

they seem to be expensive (P/E close to 50). And so the million-dollar question arises: Will these companies be able to maintain their performance over the last five years? Looking at the essence of luxury goods - rarity and very high quality - they seem to be in the right place, but the valuations of these two brands seem to be tight.

In practice

When considering investing in luxury stocks, it is worth remembering a few tips:

- It is worth ensuring proper diversification; either through an ETF or by selecting a few luxury companies

- You should invest in established luxury brands with heritage and history;

- The key is to invest in brands that care about innovation to stay relevant, but at the same time maintain an aura of exclusivity;

- Luxury brands are able to command premium prices, which can lead to higher profit margins. However, be wary of brands that grow too quickly or dilute their exclusivity;

- The brand's cultural impact and loyal customer base may indicate pricing strength and stable demand;

- It is important to take into account the fact that the luxury goods market is more resistant to economic slowdowns because affluent customer bases are less affected.

Wnioski

In summary, investing in established luxury brands with heritage, innovation and cultural influence can increase portfolio diversification in the long run. However, investing in this segment requires careful analysis of brand strength and valuations. The risk helps reduce the selection of a few companies (or ETFs) in this segment.

Author Peter Siks, investment educator, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response