The Fed is still asking itself - to raise or not to increase?

The CPI reading in the United States turned out to be still high and in line with expectations, except for core inflation m/m. The headline CPI index rose by 0,4%MoM in February, however the core index (excluding food and energy) went up by 0,5% as compared to 0,4% in January. The annual headline inflation rate fell from 6,4% to 6,0%, while the core inflation rate fell from 5,6% to 5,5% y/y.

The disinflation narrative regarding commodity price inflation received only modest support, with core commodity prices remaining unchanged as compared to the previous rise of 0,1%MoM. Service price inflation remains stable – the prices of basic services went up by 0,6%MoM compared to the previous 0,5%MoM, while the cost of shelter increased by another 0,8%MoM. Powell's preferred "superbase" inflation rate (supercoreexcluding shelter and rent) rose from 0,36% to 0,5%, the highest level since September.

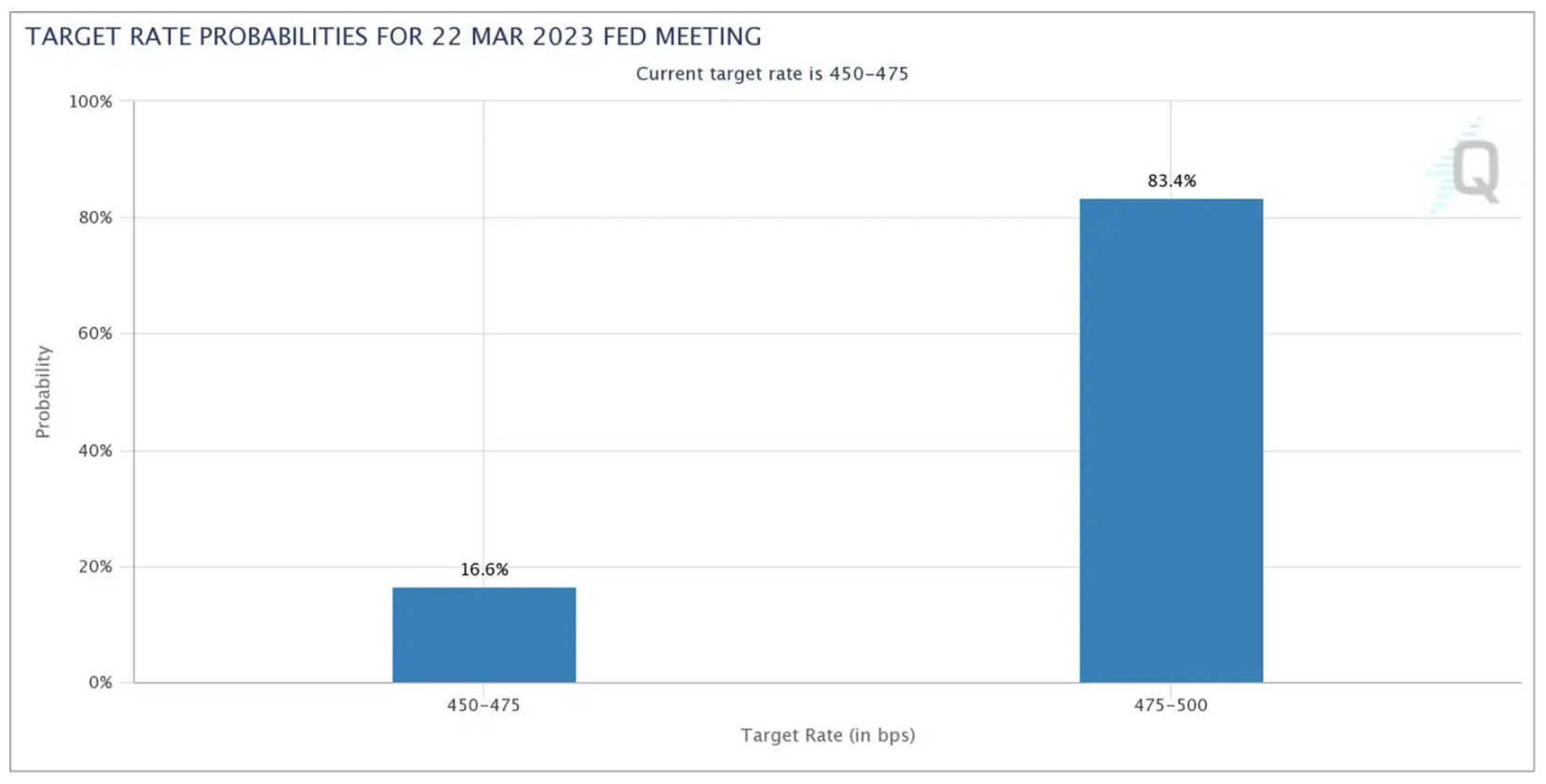

Due to persistent problems with lowering inflation, it may be too early to do so Federal Reserve took its foot off the gas, despite mounting financial risks and fears of a slowdown in economic growth. Markets are pricing-in again that the probability of a 25 bp rate hike exceeds 80% after falling below 50% at the beginning of the week. The condition is, however, that there are no further disturbances in the market in the period preceding the announcement of the decision on rates on March 22.

Using the right tools for the right cause

There is no doubt that the risk of a financial crisis has further complicated the ability of US monetary policy to respond. However, given the government's response to financial risk, there are reasons to assume that they have retained sufficient room for maneuver to further fight inflation. Withholding hikes or even cutting rates at the March meeting, despite the current calm in the market, would cause panic among investors, who would consider it a signal that the Fed is potentially still cautious about systemic risk. The inflation reading is no relief yet, and the Federal Reserve will need to uphold its credibility in fighting inflation.

It will therefore be important for the Fed to decouple monetary policy from financial risk, while remaining ready to respond to any market disturbance so as not to cause further panic. In September Bank of England similarly, it had to react to market disturbances by increasing short-term liquidity, however, monetary policy remained focused on price pressure and since then the rate hikes amounted to 175 bps.

Credit risk under watch

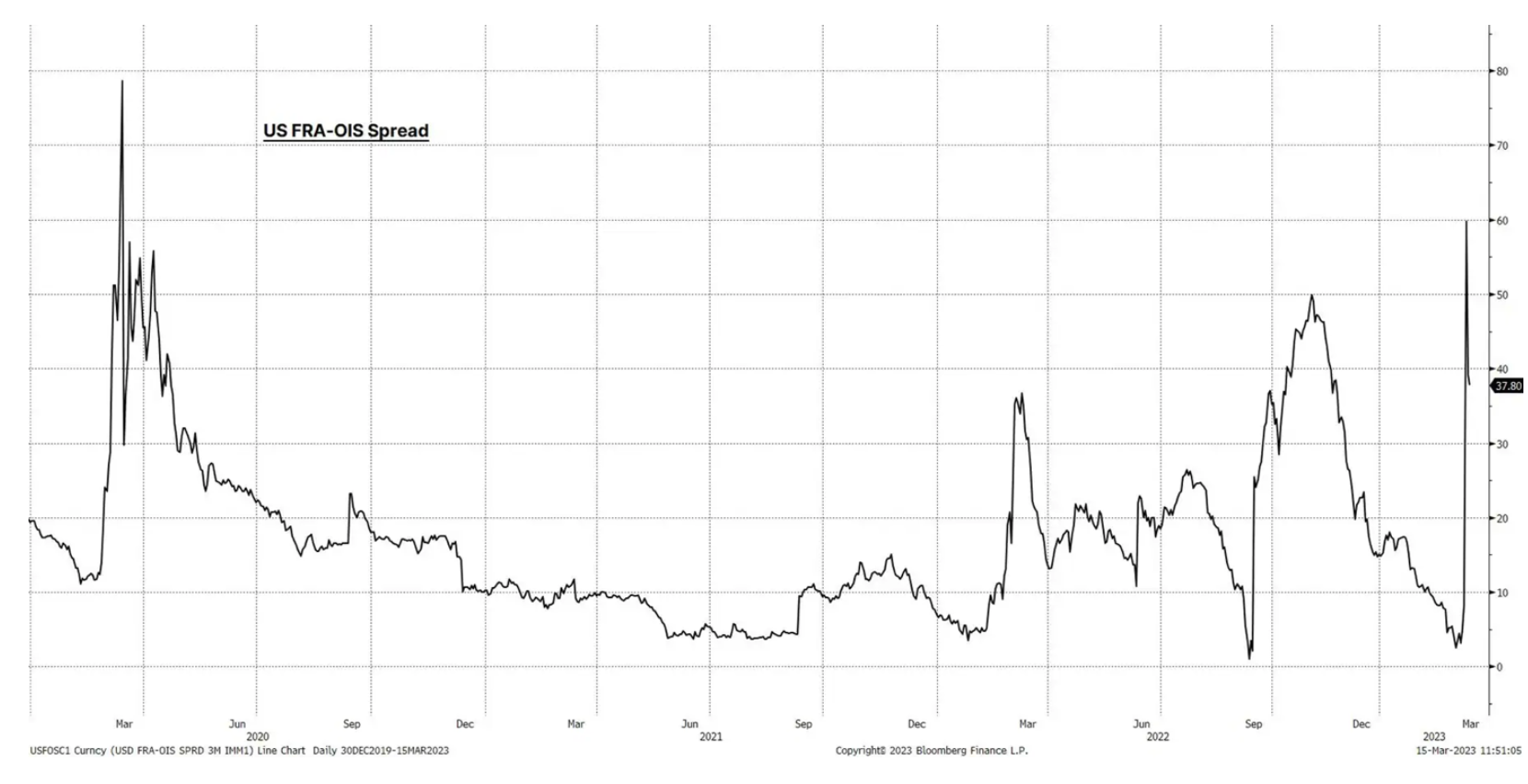

Monitoring the credit market remains crucial to assess further stresses in the system. Peter Garnry, Head of Capital Strategies Sax, In this article lists the key metrics to watch. FRA/OIS Spread, i.e. the spread between the US three-month interest rate forward contract (FRA) and the three-month indexed swap contract overnight (OIS), is a key indicator of funding stress. This gap has increased to its highest level since March 2020, although it has narrowed somewhat now. However, many unknowns remain and monitoring this indicator remains essential. If this spread increases again or stays elevated, it will be a signal that the system remains vulnerable and vulnerable to further shocks.

An additional cause for concern are yesterday's mass events credit rating downgrades in the US banking sector. Moody's downgraded the outlook for the US banking system from stable to negative and decided to review six US lenders for a possible rating downgrade. The S&P agency also changed the status of the First Republic bank to Negative Creditwatch, i.e. with the possibility of a rating downgrade in the short term.

Another key indicator worth watching are financial conditions in the United States, which tightened the most in the current cycle, mainly due to the increase in credit spreads. This could have a much greater impact on the economic growth forecast or the outlook for the stock markets than a large interest rate hike, which takes time to translate into the economy.

Implications

Even if the Federal Reserve remains focused on inflation in the short term, the long-term path is currently quite uncertain. Growth concerns have increased and banks are likely to tighten lending conditions, which could have a bigger and faster impact on the real economy than a rate hike. However, with inflation still uncomfortably high, which could be further exacerbated by the reopening of the Chinese economy and the Fed's increased liquidity, it means we may be heading towards stagflation.

Another key issue to consider is that corporate margins may shrink further, and the impact may be incomparably more significant for smaller firms (as best reflected in the RUSSELL 2000), as bank failures translate into deterioration of sentiment. The NFIB (American Association of Small Businesses) survey published yesterday also shows that inflation was the biggest problem for small businesses in the United States in February.

Therefore, in a sense, the growing risk of a slowdown in economic growth may cause yields to fall, but the risk premium is likely to increase. In the short term, yields can be highly volatile as growth dynamics, inflation and market risk are interpreted. However, the flight to high-quality assets is likely to predominate as we enter a tougher economic environment.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)