Geopolitical risk and Forex – which currencies may benefit from the conflict?

This week, geopolitical risk is in focus again and orders aimed at securing investments may continue to prevail. The dollar and gold continue to be supported by the current macroeconomic framework and the risk of conflict. CHF and JPY are also gaining in attractiveness as safe investments, with JPY less so and CHF also struggling with a lack of support from monetary policy. AUD strengthening in the event of better-than-expected data from China may be volatile, just like today's NZD rally after the announcement of the election results.

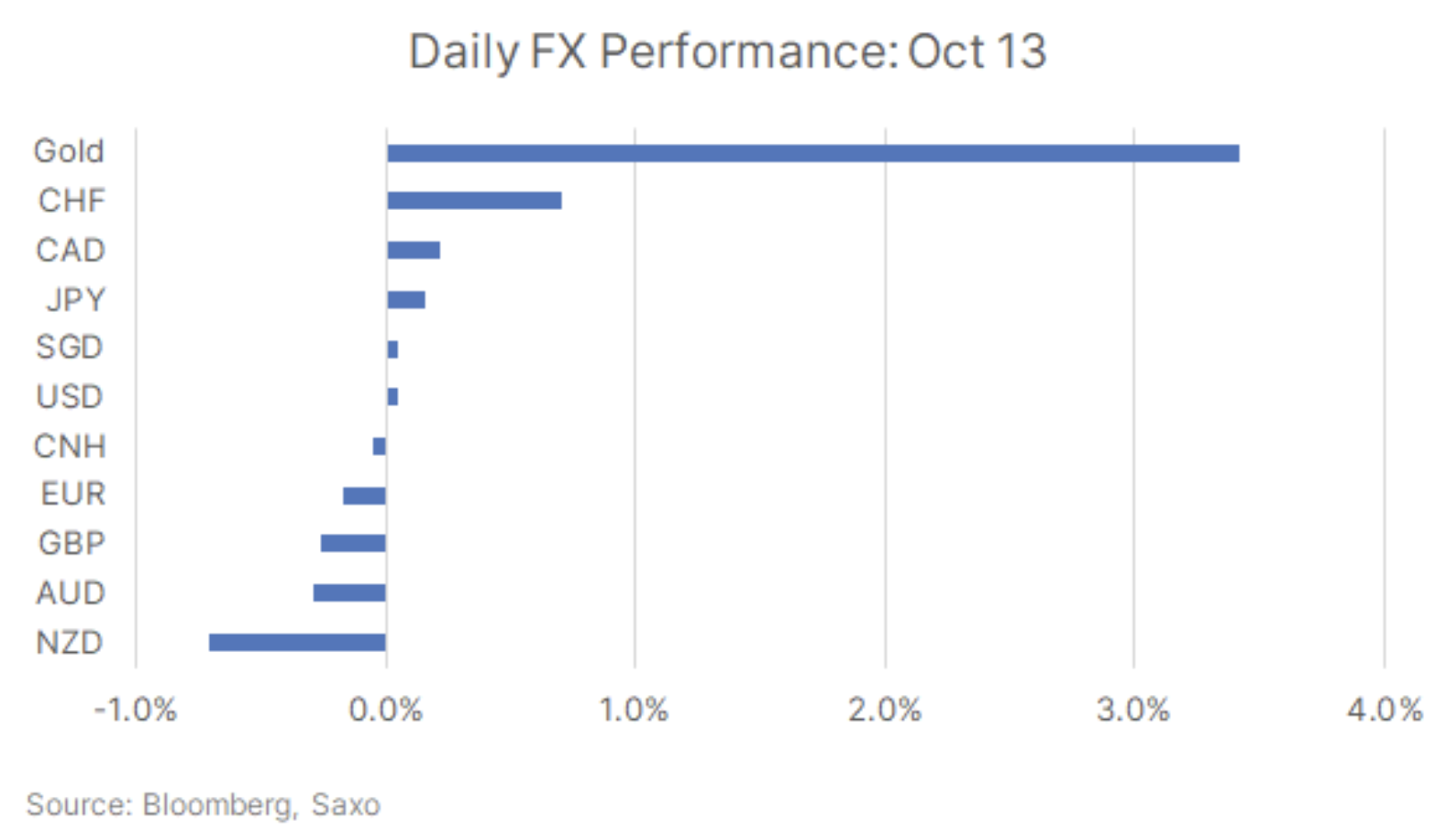

Friday's price action was a clear example of a flight to safe havens. There was a depreciation of shares, while bonds, the dollar, the Swiss franc and gold went up. The Israeli military threatened to carry out "wide-ranging land operations" and a potential invasion of the Gaza Strip, causing over half a million Palestinians to flee south. Remarks from Iran that the country "he will not remain just an observer", also fueled anxiety, in particular on oil markets, given this year's significant increase in Iranian crude oil production and exports. This resulted in a significant increase in interest in oil, causing the price of Brent crude oil to increase by 5,7%.

During the Asian session, however, some of these trends were slightly reversed, and the United States and its allies tried to prevent further escalation of the conflict between Israel and Hamas. Geopolitics will continue to be a key driver of markets in the week ahead as investors continue to weigh the risk of escalation against Americans' desire to prevent the conflict from spreading to other Middle Eastern countries.

The dollar and gold remain the preferred safe havens due to their strengthening due to various factors. The dollar, in addition to its geopolitical premium, continues to benefit from the resilience of the U.S. economy and transactions carry. We have already noted that the dollar's growth potential is becoming limited, and the advantage of the transaction carry may also decline as they become more expensive amid rising volatility and falling bond yields.

Simultaneously gold additionally benefited from the decline in real yields, as the push to hedge investments with Treasuries lowers nominal yields and inflation expectations remain anchored, however, a stronger dollar could lead to some trade-off on gold yields.

Other safe havens include CHF and JPY, however, JPY plays a lesser role in this situation due to the greater risk associated with higher oil prices in the context of imports of this raw material. Monetary policy does not support CHF either, because the main problem is no longer inflation, but the risk of recession. Another way to play this situation could be taking advantage of the potential increase in oil prices, most visible in the case of NOK and CAD, in addition to subsequent USD buy orders. Meanwhile, the EUR is at risk due to a potential energy shock.

Conclusions for the market: Buying the dollar remains beneficial in the event of slight declines related to geopolitical uncertainty, even though the upside potential is increasingly limited. Gold (XAU/USD) may be the preferred safe haven due to the decline in real yields, while the role of CHF and JPY in this regard is relatively limited. The EUR/CHF rate has fallen below 0,95 and may reach 2022 lows of 0,9410.

AUD: Waiting for data from China and announced stimuli

Any instances of AUD strengthening remain volatile. The reason to stay away from risk-sensitive currencies is not only because of the current geopolitical risks, but also because economic growth rates are slowing and persistent levels of inflation continue to make the macro environment extremely complex. However, the AUD/USD pair still finds support at 0,63, even if its upside potential is limited.

Data on economic activity and GDP in China, which will be published on Wednesday, may prove crucial. If these data turn out to be better than expected, rhetoric about the impact of incentives on activity will prevail. After the Chinese returned from vacation, calls to re-stimulate the economy have also intensified and any such measures may temporarily support the AUD. Minutes of the meeting Rebuildables, which will be published on Tuesday, is unlikely to change the situation. The AUD/USD pair could target 0,64, but USD strength and geopolitical considerations are likely to remain the overarching themes this week.

Conclusions for the market: Potential dynamic strengthening of AUD/USD if data on activity in China surprises to the upside this week, but the overall picture remains negative.

NZD: Opposition victory brings respite

The weekend elections brought victory for the opposition National Party and the end of the six-year rule of the Labor Party, and Christopher Luxon will become the new prime minister. The new government will have to face difficult economic forecasts, a RBNZ forecasts a recession as it plans to keep interest rates high to limit inflationary pressures. The NZD strengthened following the earnings announcement, but the market will soon refocus on geopolitics and the overarching strength of the USD. Tomorrow morning, New Zealand will also release the CPI reading for Q1,9 - expected to rise to 1,1% q/q compared to 5,9% q/q in Q6,0, but fall to XNUMX% y/y compared to the previous quarter a reading of XNUMX% y/y. Lower inflation may result in further lower expectations for RBNZ interest rate increases, putting pressure on NZD.

Conclusions for the market: Following the weekend's election, which resulted in an opposition victory, the NZD/USD pair has returned above 0,59, but geopolitics and macro themes may still mean another test of the year-on-day low at 0,5859.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)