Big comeback thanks to Chinese fiscal stimulus

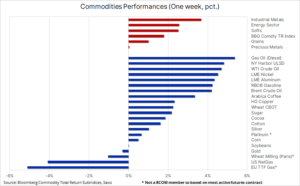

The Bloomberg Commodity Index recorded an increase on a weekly basis for the first time in six weeks, and therefore also on a monthly basis, with energy and industrial metals gaining the most value last week in response to fiscal stimulus in China and dynamic economic growth in United States in conditions of lower inflation. The main source of support for raw materials recently, however, has been the correction of speculative positions, allowing weakened markets and sectors to recover - at this stage, primarily due to covering short positions by hedge funds, which started the year with the weakest belief since 2015 that commodity prices will rise. .

The commodities sector, which had been under little selling pressure for some time, finally found new buyers last week, contributing to overall strengthening in most sectors, mainly industrial metals and energy. The demand forecast improved after the People's Bank of China, in its latest economic support move, surprised the market by announcing a larger-than-expected reduction in reserve requirements. The decision, seen as an attempt to shore up confidence in an economy struggling with disinflation, a housing market collapse and the recent $6 trillion stock market decline, enabled a rebound in the stock market while supporting the rise in prices of iron ore and industrial metals key to China.

Moreover, US GDP surprised on the upside in the fourth quarter, and combined with the cooling of inflation rates, this did not negatively affect the markets' faith in interest rate cuts in the United States, with a 50/50 chance that the first one will take place at the FOMC meeting on March 20. Market sentiment has also improved with US treasury bond yields falling again and the earnings reporting period for US companies showing positive surprises so far. Taken together, these events caused the Bloomberg Commodity Index to increase on a weekly basis for the first time in six weeks, and therefore also on a monthly basis, with crude oil and fuel products gaining the most in value last week. He recorded the worst results natural gas from the EU and the United States due to the prospect of warmer temperatures in the few remaining weeks of winter, which reduces the risk of a sharp increase in demand for this raw material in the event of frost.

The energy sector, for which last week was the best since October, received support in the form of growing geopolitical risk, even though the Chinese authorities asked Iran to limit Houthi attacks in the Red Sea, announcing that if China's interests are harmed, it could affect trade relations with Iran. Additionally, a large weekly decline in U.S. inventories also provided support, although this result was slightly distorted by the recent cold snap that slowed production, imports and refinery operations; growth was also positively influenced by the news that China, the world's largest importer oil, increased their efforts to support the economy. As a result, Brent and WTI oil prices broke the upper limit of the previous ranges, and technical purchase transactions provided additional upward momentum.

Industrial metals, whose prices have remained low for many months, have so far made an unsuccessful attempt to rise higher. The metals that have hit the hardest so far - nickel and aluminum - have seen the biggest strengthening, with the latter receiving additional support from a possible extension of the EU's ban on imports of Russian aluminum products from 12% to 100% as part of the upcoming 13th sanctions package against Russia, which is due to be approved by February 24. At the same time, copper prices increased - the initial strengthening was caused by short-selling traders based on erroneous assumptions, who turned the previous net long position in HG copper futures contracts into the largest net short position since 2022.

We maintain a positive forecast for copper, taking into account the prospect of increasingly limited supply on the market in the second half of the year. However, given current concerns about China despite the latest round of fiscal stimulus, and continued speculation about the timing, pace and extent of upcoming interest rate cuts in the United States, price direction for now will likely be guided by short-term investment strategies such as strengthening as a result of covering short positions last week.

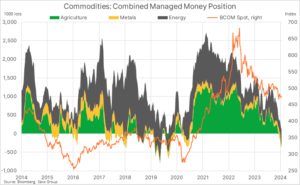

Short covering is a key factor in the recent bounce

The main source of support for commodities recently has been the de facto correction of speculative positions, enabling weakened markets and sectors to recover - at this stage, primarily due to covering short positions by hedge funds and CTAs, which started the year with the weakest belief since 2015 that raw material prices will increase. An analysis of the weekly Commitment of Traders report, which covers the positions and changes made by money managers in the largest futures markets in the United States and the European Union, shows that in the week ending January 16, almost half of the contracts we track were maintained in net short positions .

Grain and soybean fundamentals do not yet point to a sustained economic recovery

Also important is the weakened grain sector, which last week attempted to rebound from a four-year low, thus forcing into action hedge funds and other large speculative investors who have been net sellers of six major grain futures contracts since November soybeans listed on the Chicago Stock Exchange. The latest COT report showed net short positioning rising to 496 contracts, the second-largest bet on a price decline on record; only the net short position in May 000 was greater, amounting to 2019 contracts. This position then contributed to a four-week rebound that sent the Bloomberg Grain Index up 707%.

In our opinion, the current fundamentals do not justify strengthening on such a scale because it is not the right time - at this time of year there are no major unknowns that could cause such a move. Currently, the market is focused on weather conditions in South America and the potential harvest volume, while in the United States, where spring sowing is still several months away, the main focus is on slowing export sales, which could result in a higher result at the end of the current crop year. While a low may have already been set, the potential for renewed strength after the current short covering phase appears limited, but given how much crop futures have fallen, any rebound in short covering could still prove significant.

Crude oil is breaking out from the limits of the current range

WTI crude, the best performer of all commodities last week, received an upside boost with a technical break above $75,50 and $80,50 for Brent crude oil - forcing investors to rethink the strategy that has seen them changing their trading for several weeks. long exposure from WTI to Brent crude in the belief that production growth will continue to put pressure on prices in the United States, while conflict in the Middle East will provide relative support to prices in Europe and Asia. Although the general increase in oil prices since the lows of early December resulted in the total net long position in Brent and WTI crude oil increasing by as much as 85% to PLN 317. contracts, the gap has clearly shifted in favor of Brent crude, which accounted for 72% of the total net long position in the last reporting week. Brent crude was also supported by a relatively faster increase in the deport, i.e. the spread between near-term and deferred futures contracts. As an example, the three-month spread between March and June futures contracts has widened to USD 1,22 per barrel in Brent crude, providing long-only investors with a three-month annualized carry rate of 6%, while a similar spread in crude oil WTI at USD 0,65 per barrel provided only 3,4%, which is a significant difference for investors, making Brent crude oil more attractive from an investment point of view.

We remain of the view that, barring major supply disruptions in the Middle East, both WTI and Brent are likely to remain within ranges around $75 for WTI and $80 for Brent, with no single factor will be strong enough to change the dynamics of the market, which is dividing its attention between, on the one hand, concerns about economic growth, in particular in China and the United States, and rising non-OPEC+ production, and, on the other hand, OPEC+ production cuts and geopolitical risks . Additionally, changes in the expected pace of interest rate cuts in the United States may impact risk appetite. In the short term, the WTI price will face resistance at USD 77,65, the two-hundred-day moving average, with upside potential limited to around USD 80 per barrel in our view.

A sharp drop in the price of silver attracts new buyers; gold looks for direction based on economic data

The precious metals sector has struggled to keep up with the gains seen in other sectors, and while for gold the past week was relatively quiet ahead of Friday's release of the important report on the US PCE deflator - the FOMC's favorite inflation indicator - for silver it has been a rollercoaster, from decline to two-month low on Monday to a strong rebound thanks to China-led industrial metals strengthening.

Gold traded in its tightest range since December 2021, with strong support in the $2000-2005 area, with upside potential remaining subdued until the timing, pace and extent of future interest rate cuts in the United States and European Union become more precise. Until the first cut, the market may be a bit too optimistic, increasing expectations regarding a rate cut to levels that expose prices to a correction. In this context, the near-term direction of gold and silver prices will continue to be dictated by incoming economic data and their impact on the dollar, yields, as well as expectations of interest rate cuts.

Silver, which had been on a relatively strong downtrend last month, fell below $22 on Monday before rebounding strongly as lower prices helped attract new buyers. A weekly close at or above $23 will create an interesting technical pattern, with a hammer pattern potentially signaling a trend reversal similar to those seen on the previous three occasions.

More analyzes of commodity markets are available here.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response