The bull market in commodities shifts to the next gear

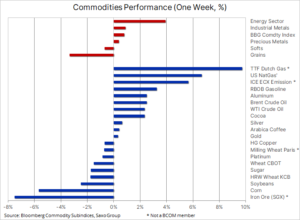

SThe commodities sector posted a profit for the second week in a row, and the Bloomberg spot index hit its latest ten-year high at the close. Over the past three months, most commodity-tracking indices have been sidering due to a stronger dollar, less pressure on reflation, concerns about an economic slowdown in China and, above all, the Coronavirus Delta variant, which raises some doubts about the strength of the global recovery. However, after a slight correction of 5%, the above-mentioned spot index started to gain again on the growth and demand-driven energy and industrial metals sectors.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

This underlines the continued demand in the market not only from financial or "paper" investors but also, more importantly, from end users, which has a positive effect on prices as it supports the relatively limited demand and supply forecasts for a number of key raw materials. The drive to green transformation, one of the main reasons for the positive outlook for this sector, has only just begun. After several months of particular hardship due to weather conditions around the world, government pressure to move away from the carbon economy appears to be increasing. This can further restrict the supply of many "green" metals, from copper and aluminum to zinc and nickel, not to mention numerous rare earth metals and even platinum and silver.

At the same time, this pressure could reduce investor appetite for fossil fuels and other high-carbon raw materials years before global demand begins to decline. Despite very solid earnings this year, mining stock prices have followed the broader market, highlighting the difficulties in a booming and growing sector at a time when investors and banks are no longer or are no longer able or willing to support these companies for various reasons.

In the context of short-term events affecting the market, the first major hurricane to hit the United States this season was Ida, which burst into Louisiana earlier this week, causing numerous floods and power cuts. This affected the energy sector: the production of oil and natural gas in the Gulf of Mexico was halted and some refineries were forced to close, disrupting the normal flows of oil and fuel products. At this point, around 1,7 million barrels of crude oil per day were halted and it is estimated that the capacity of refineries on the Gulf Coast has dropped by nearly 2 million barrels per day.

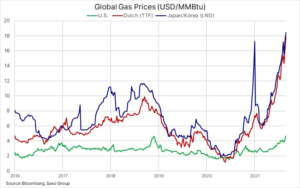

NATGAS

Sector natural gas, which has experienced strong growth in recent months, has received additional support in the form of potential disruptions to LNG export terminals on the Gulf Coast. In Europe, the Dutch TTF benchmark hit a record high of EUR 52,85 / MWh, or USD 18,5 / MMBtu. A similar situation also took place in Asia, where the Japanese-Korean benchmark approached the record level of USD 19 / MMBtu in January. This sector has benefited greatly from the reduction of global supplies due to the strong economic growth, hot weather, and in Europe - also from the reduction of supplies from Russia. As a result, electricity bills have risen sharply, the prices of coal as a replacement have soared, and so have the cost of carbon offsetting.

Considering the small gas reserves in both Europe and Russia, the outlook for a winter shortage of this raw material is real, and the final bill will be paid by consumers and the industrial sector. Some companies may even be forced to cut production to reduce demand.

Crops

Hurricane Ida has hit the agricultural sector the hardest as it has been forced to halt shipments from a key export terminal on the Gulf of Mexico coast. The price of corn has dropped to its six-week low, while the price of soybeans has fallen to its low in June. The timing could not be worse given that both crops are about to begin harvesting soon, and Midwestern farmers ship much of their crops down the Mississippi River, from where they continue out into the world across the Gulf of Mexico. The effects of this situation are already visible: China has changed its order to short-term soybean deliveries, instead of the United States choosing Brazil. Investors and traders also wait nervously for the publication of the US Department of Agriculture (USDA) monthly report on agricultural products on September 10; the report may include an upward revision following the recent easing of drought concerns in key growing regions.

Precious metals

After fully recovering from the decline in early August gold It had a sideways rate in the first days of September as the market struggled to find enough momentum to attack the key resistance level of $ 1. However, with ten-year real US bond yields below -835% one week before and one week after the monthly US employment report and the dollar hitting its lowest price in four weeks, the result turned out to be somewhat disappointing. Apart from concerns about the timing of the start of the Fed's reduction in asset purchases, it may also be due to the continued bull market in global equities, which reduced the demand for diversification.

Despite the prospect of an eventual commencement of the reduction of the US's wide-ranging bond purchase program Federal Reserve we maintain an upward outlook for gold. This is based on our belief that the dollar may depreciate after it reaches its peak in US economic growth, and that gold at current prices is already reflecting higher, potentially up to 25 basis points, real yields. In addition, a further boom in commodity markets, primarily in the energy and industrial metals sectors, is likely to draw investors' attention back to inflation.

Other investment metals such as silver or platinum, also showed sideline; silver in particular has made a series of unsuccessful attempts at relative appreciation. XAUXAG's account, reflecting the cost of one ounce of gold in ounces of silver, which rose sharply in July and August as silver struggled with problems, attempted to reverse the downside, but the 75-ounce level was repeatedly impassable. Breaking this level could signal a new period of appreciation for silver, especially if it manages to break the key resistance at $ 24,50.

Petroleum

Clothing it approached its monthly high after a week in which the forecast improved again. Price rose sharply after a correction in August supported by a weaker dollar and a better outlook for Chinese demand after recent coronavirus-induced lockdowns, as well as further US inventory drops and temporary production shutdowns. In addition, the group of producers from OPEC + presented an optimistic short-term demand forecast, which approved an increase in production in October by another 400 barrels per day. Prices also benefited from the Bloomberg study on OPEC production, showing that last month Nigeria and Angola mined nearly 000 barrels per day, which corresponds to a monthly increase in OPEC + production below their allotted amount. This highlights concerns that reactivating the current paper production reserves of OPEC + may not be as easy as it becomes necessary due to increased demand.

This week China will release trade data for August, including oil imports (on Tuesday), while on Wednesday the US Energy Information Administration (EIA) will present a short-term forecast for the energy market. Less emphasis on coronavirus issues, shrinking shipments, rising risk appetite and a reduction in long speculative positions have tipped the scales of price risk back up.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)