The boom in agricultural products continues despite the strong dollar

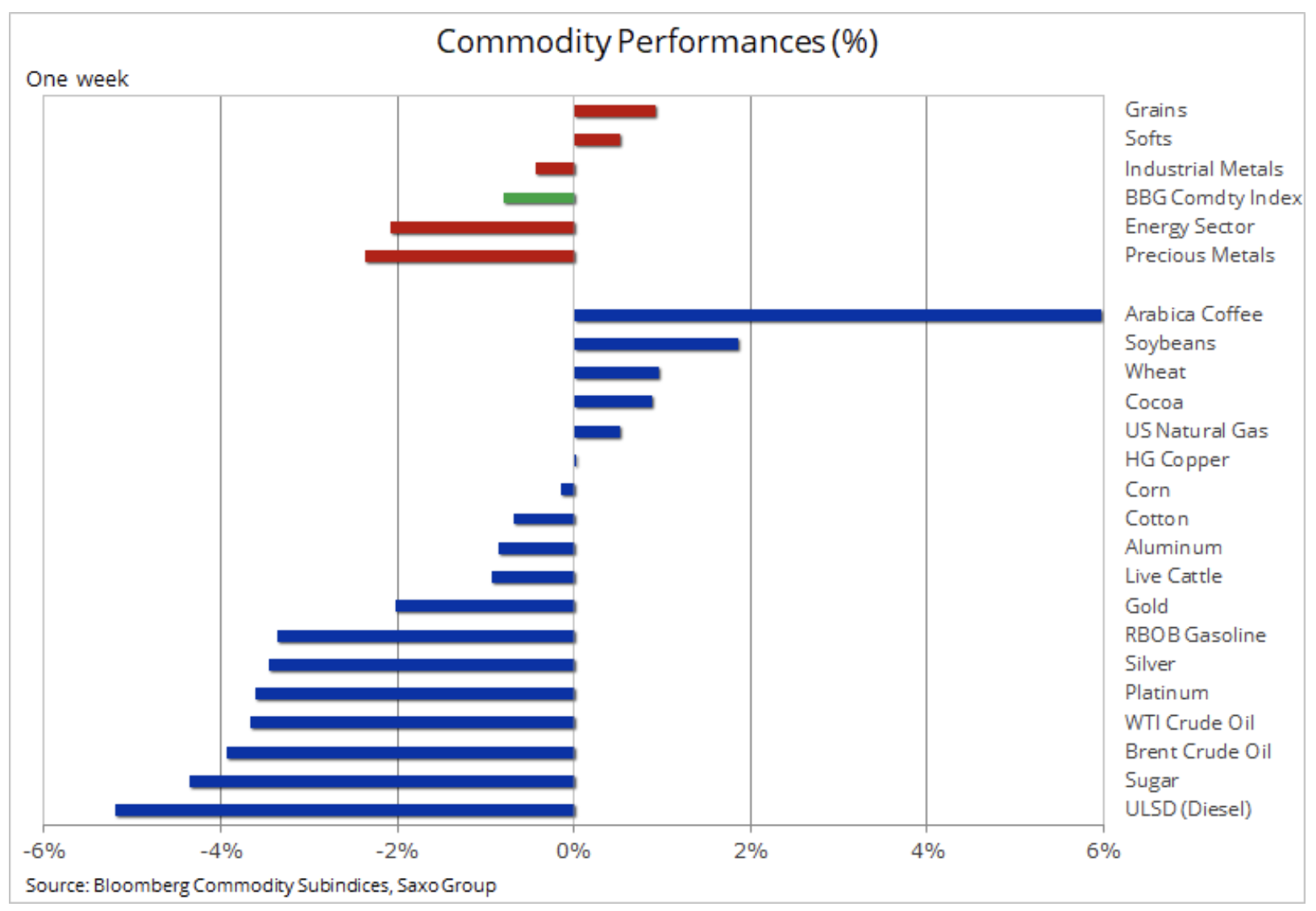

Similarly to the stock market, also in the commodity markets, last week saw profit taking. After six consecutive weeks of gains, the Bloomberg commodity index plunged 1%, driven primarily by a sharp pivot in the dollar. The US currency found buyers, in particular against the euro, in response to the European Central Bank's "impassable limit" comment after the EUR / USD pair hit its highest level of EUR 2018 since May 1,20.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Clothing saw the long-awaited downward widening of the existing narrow range as concerns about demand, the coming refinery repair season and a stronger dollar contributed to profit taking. The zloty did not manage to return above USD 2 / oz, which resulted in a wave of sales after the unexpected strengthening of the dollar and an increase in profitability in response to better than expected economic data from the United States. While demand for gasoline has risen, distillates such as diesel and aviation fuel, unavoidable products of the gasoline-making process, dropped ULSD Diesel last week to its lowest position.

The agricultural sector gained again, although the pace of growth was slower than in the last three weeks. This sector's performance was positively influenced by concerns about weather conditions, the general weakening of the dollar, strong demand in China for key agricultural products, and the economic recovery following the collapse in QXNUMX. Last week, the five best performing commodities were agricultural products: the leader was kawaand the next places were taken soybean and wheat.

Gold

The price of gold it went down but stayed within its current range as the dollar was the main source of inspiration for traders. There are, however, indications that the metal lost momentum after a failed attempt to re-break above $ 2 / oz. Despite support from a weaker dollar and record low real US 000-year yields, gold quickly began looking for support, ultimately found before the $ 1 / oz level.

The market as such ignored the disastrous all-day collapse in the US stock market last Thursday. The 5% drop in Nasdaq only wiped out several-day gains, as it came as the valuations of many giant-capitalization tech stocks hit levels unjustified by any ratios. Only the accelerated sell-off of stocks could have a negative impact on gold. In order to cover losses in other markets, traders - just like for a short period in March - can return to selling gold to gain access to liquidity.

Due to the fact that the zloty did not manage to take advantage of the above-mentioned favorable conditions at the beginning of the week, the short-term forecast indicates an extended period of consolidation and potentially a larger correction than before. In order to establish direction, one should focus on the dollar and the real trajectory of US yields. As you can see in the chart below, the three lower highs are problematic and may signal a need for a deeper correction as short term long positions exit the market in search of better entry levels. We currently have the following support levels on the radar:

- $ 1 / oz - recent lows and level at which certain breakout patterns may indicate exiting long;

- 1 USD / oz - decline by 837% from March low to August high

Petroleum

The price of crude oil has plunged as a result of weaker margins as refineries struggled with an overhang of unwanted distillates such as diesel and jet fuel. An additional factor was the already mentioned dollar strengthening and some concerns about the current pace of demand growth. This was evident in the context of time spans. For example, the spread between the first and second WTI crude oil futures is currently the largest since June.

The cost of transporting crude oil from the Middle East to China has fallen to its lowest level since May 2018 as Chinese demand is slowing down after the record wave of purchases following the March / April price slump. In addition, the risk of falling prices with the approaching deadline increased the demand for downside protection, and the volume of WTI crude oil put options reached its highest level since mid-June.

From a transactional perspective, a fall below the June ascending trend line could signal a longer period of a sideways trend, with downside risks initially limited to around 40. Longer stock market correction and / or further dollar appreciation, coupled with negative developments on Covid-19 , could pose the greatest threat to our projected oil price increase towards the end of this year and the beginning of 2021.

Copper

Copper turned out to be a commodity unaffected by neither the dollar, nor the stock market correction. The metal quickly found support after a mini-correction as a result of declining supply on the London Metal Exchange, where copper inventories fell to their lowest level since 2005. The main factor here was the Chinese economy, which continues to recover from the initial pandemic.

The traditional ability was demonstrated once again silver to outrun gold in both directions. Earlier this week, silver reached another three-year high against gold after the XAU / XAG ratio briefly dropped below 70 ounces of silver to one ounce of gold. After the downward correction of gold, silver plunged again with both metals trading at 73, while the XAG / USD pair sought support around $ 26 / oz.

Arabica coffee

Coffee performed best on the back of the strengthening of the Brazilian real and the shrinking market. Stocks in warehouses monitored by exchanges have fallen to their lowest level since 2000. Over the past few years, large supply has contributed to one of the largest contagion in the commodity markets. The bigger it is contagion, the more profitable a speculative investor will be from a short position. A few months ago, twelve months old contagion exceeded 10%; now it has dropped below 3%, removing the main reason to sell during the bull market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)