Inflation only supported AUD for a short time

Inflation in Australia increased 0,8% in the third quarter. quarter on quarter, and although these data were in line with analysts' forecasts, the annual inflation rate dropped from 3,8 percent. up to 3 percent in the period under review, it was the market that saw these figures as approximating an interest rate hike by the Reserve Bank of Australia. This interpretation was influenced by the fact that core inflation was the highest in 6 years.

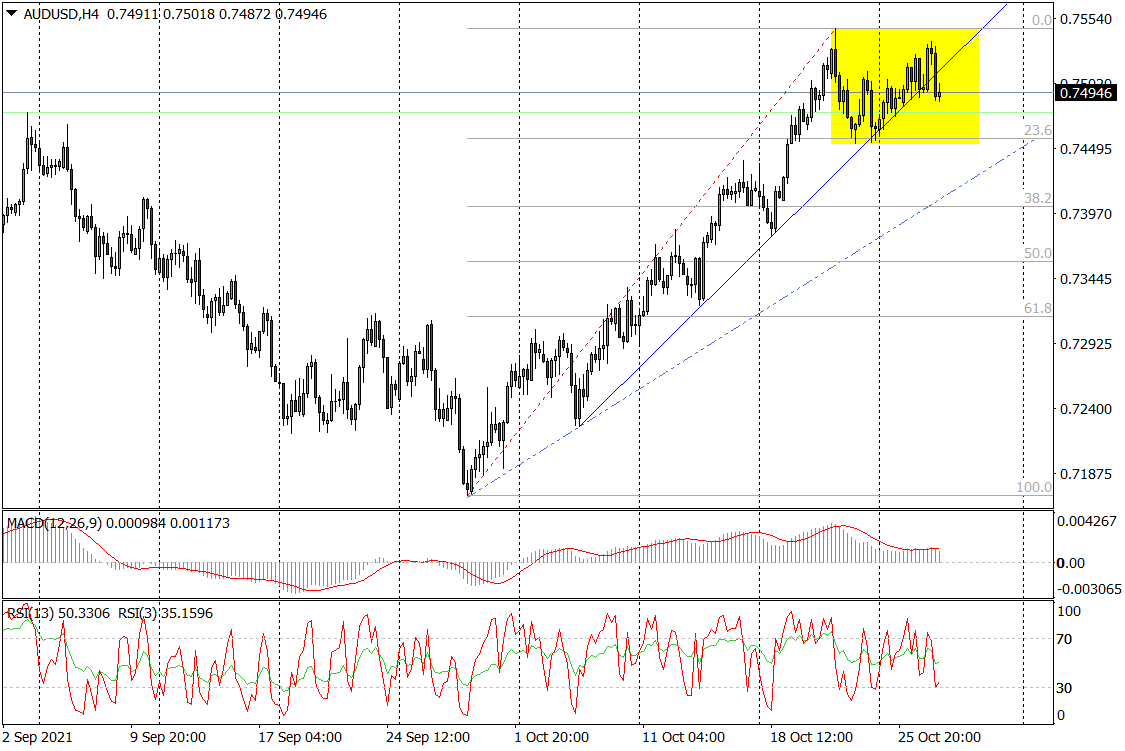

After the publication of inflation data, yields on Australian bonds soared, and the Australian dollar began to appreciate. AUD / USD exchange rate It rose in the morning of Polish time to 0,7536 from 0,75 yesterday at the end of the day and approached the maximum from last Thursday, when the "Australian" was paid 0,7546, which is the highest since the first days of July.

However, the proximity of resistance from a week ago stopped the demand impulses, which was additionally caused by deteriorating moods in the global markets and the related increase in risk aversion. As a result, at noon the AUD / USD rate returned to 0,75 again.

AUD / USD daily chart, H4. Source: Tickmill

This unsuccessful attack on the highs could contribute to deeper profit-taking and pull the AUD / USD back to 0,7454, which is the lower consolidation limit in which the AUD / USD chart (H4) has been around for over a week. So far, there are no technical signals from the chart to allow a breakout from this consolidation. Especially that its lower limit additionally strengthens the support in the form of 23,6 percent. abolition of Fibo increases from September 29 - October 21 this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)