Investors play for rebound - the most popular stocks among traders

The most popular shares among Polish clients of Saxo Bank in the second quarter

After a deep correction in the market in March, in the second quarter investors largely played a rebound, reviving the stock market to levels before the COVID-19 pandemic. For S & P500 index it was the best quarter since 1998. This tendency is also clearly seen in the ranking of the most popular shares among Polish clients Saxo Bank.

Globally, Saxo customers have become part of the trend followed by the market. After difficult moments at the turn of March and April, the shares began to record record increases. Much has already been written and said how strong it was "come-back", how many resistances were broken, and how many peaks were conquered. Investors believed in the V-shaped reflection, i.e. the immediate reaction of exchanges and a return to the situation before the announcement of the pandemic. However, it seems that one should be careful in such an optimistic approach.

We are just starting the season of companies' financial results for the second quarter, and hence information on the real impact of economic closure on the condition of companies. Additionally, 80% of the S&P index companies did not issue a recommendation in the first quarter, leaving investors in complete uncertainty. As a warning, the news of a re-emerging COVID infection could be a warning, which could spell another wave of the pandemic, although a lifeblock similar to the previous one is unlikely, the spread of the virus will undoubtedly affect stock markets. We will then know the true winners and losers of the New Order in which we live.

The most popular shares in the second quarter

- Amazon.com

- Tesla

- Gilead Sciences

- A

Apple, Microsoft and also A are the most popular companies and steam locomotives of the S&P index. By adding Netflix, we see the driving force behind this popular benchmark. Thus, we cannot be surprised by investors that they trusted recognized brands - especially since they operate in areas that have benefited from quarantine, basing their activities on digital technologies.

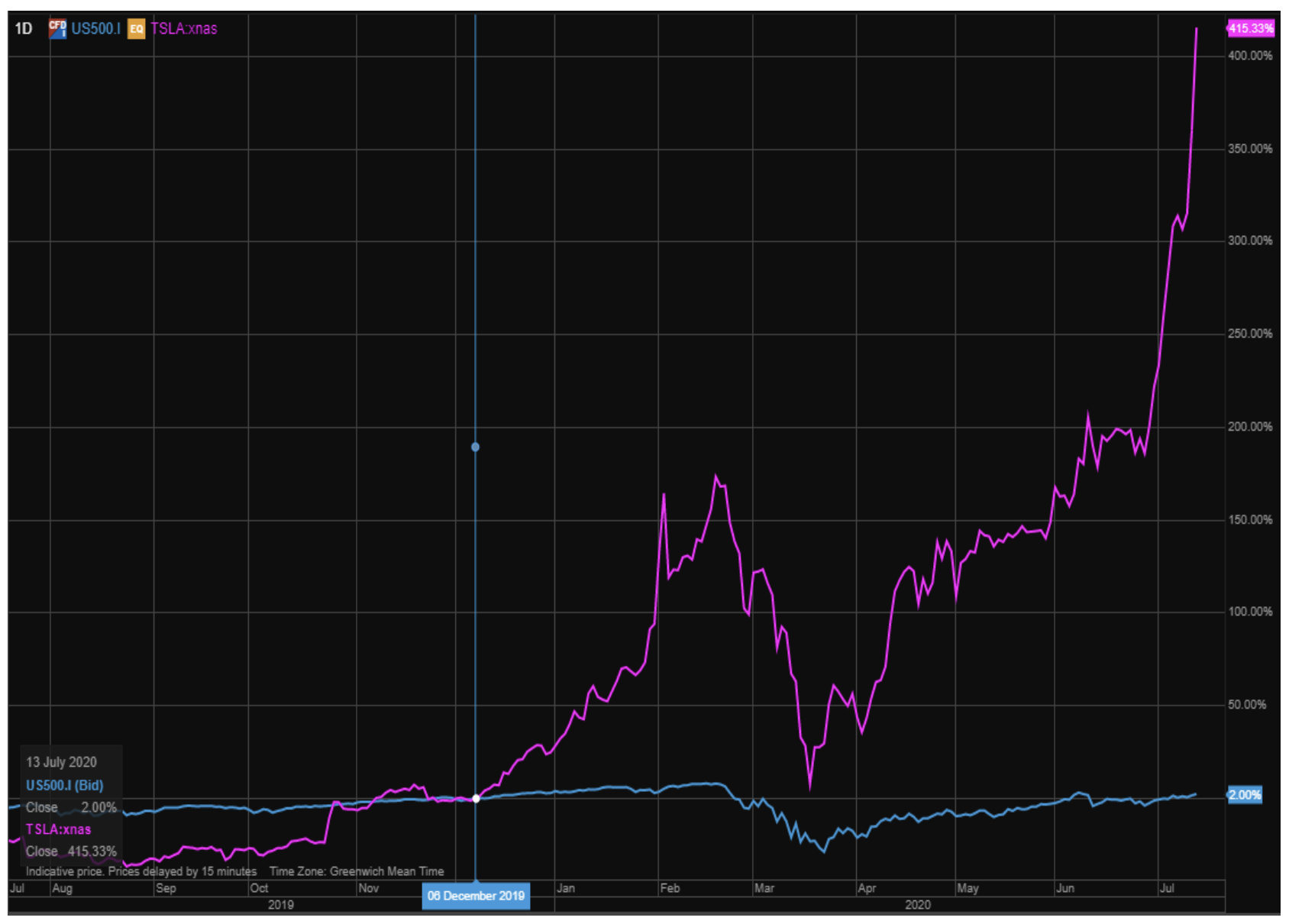

For example, the following charts show Berkshire Hathaway and Bank of America against the Index, and Amazon i Netflix compared to the S&P 500. The percentage results since the end of 2019 confirm that only certain economic segments have caught the train following the locomotive.

To extend the perspective, I also present an stock chart Tesla compared to US500, although the car maker is not part of the index, it is probably only a matter of time before the criteria for this are met. Especially if the results of Elon Muska look like in the first quarter of 2020, which was the third in a row with a positive result.

The phrase is worth commenting Boeing, which was popular among Polish customers at the beginning of the quarter. It has been confirmed that the administration's support and the title "too big to fail" give more possibilities to get out of difficult situations. Although compared to the last day of 2019, the company's shares are still slightly below the line, but compared to the worst period of the end of March 2020, they increased by 90%.

Hope for a return to life without restrictions is also strong among investors, understandable, so it is clear that companies looking for a vaccine or medicine that reduces the impact of COVID-19 on our everyday lives have attracted their attention. Among customers from the Vistula River Gilead - the manufacturer of the drug Remdesivir, intended to improve the health of those affected by the coronavirus, has gained the greatest popularity It is one of the most recognizable companies potentially involved in looking for a solution that could help people who are sick or prevent the spread of the virus. Since the turn of February and March and the first information about the company's product, when its shares jumped by more than ten percent, the share price did not fall below the level of USD 70, maintaining a 10% increase. Despite the lack of details, many controversies and uncertainties, the company that comes out first with the solution will turn out to be the winner on the world's stock exchanges.

Author: Tomasz Szymula, analyst Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)