Porsche IPO - will it catch up with its Italian rival - Ferrari?

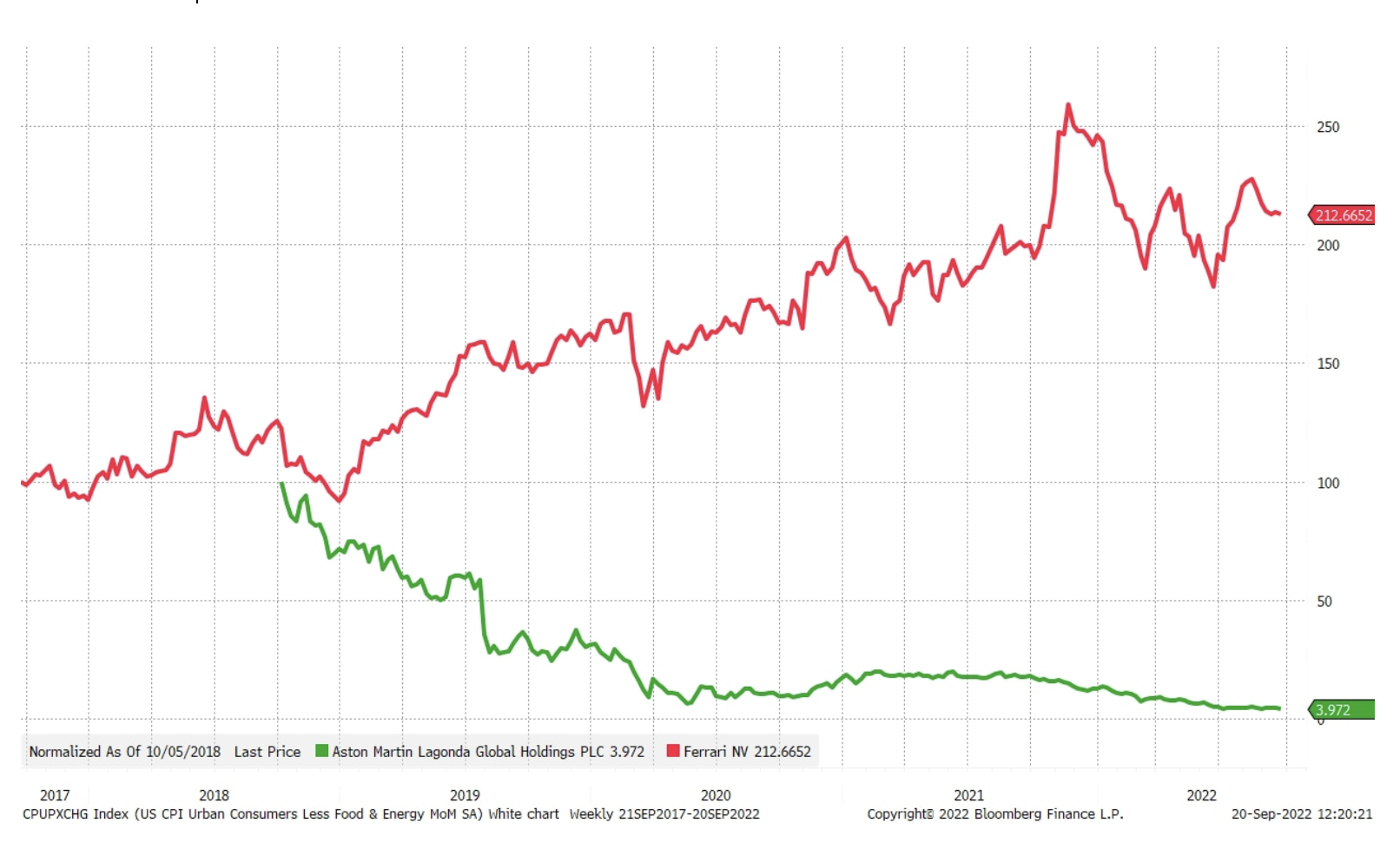

In recent years, manufacturers of luxury cars, incl. Ferrari i Aston Martin, went public with very different success. While Ferrari has been a spectacular success, Aston Martin is on the verge of bankruptcy, which has happened many times in the history of this proud British car brand. Volkswagen recently announced that it plans to stock the car maker and brand Porsche, with an initial public offering valued on September 28, with the first trading day set for September 29.

A particularly interesting aspect of this debut is the maze-like ownership structure: Volkswagen owns the Porsche brand and production, but is itself owned by Austrian the Porsche-Piech family. The story of this bizarre ownership structure began with the privatization of Volkswagen in 1960, when a law entered into force providing that any shareholder holding more than 20% of the shares would have a veto over any resolution. The German government left itself a 20,1% stake, and thus control over the company. In 2005, Porsche SE (a holding company owned by the Porsche family) began to accumulate shares in Volkswagen and by 2006 it already controlled 25,1%. In October 2008, Porsche SE holding announced that it had already acquired 42,6% with options for a further 31,5%; the target was 75% to consolidate Volkswagen's cash position in the Porsche SE balance sheet. The government continued to hold 20,1%, and short sellers began to cover short positions, bringing the share price briefly above € 1, making Volkswagen the most valuable company in the world. Ultimately - according to the shareholding data - the Porsche SE holding obtained control over 000% of the shares. In 53,3, Porsche and Volkswagen merged and Porsche AG was separated as a subsidiary of Volkswagen AG. The distribution of voting rights in Volkswagen is presented in the chart below.

Detailed information about the debut

Według the prospectus Porsche AG will divide its share capital into two parts comprising 455,5 million shares, respectively ordinary and privileged (a reference to the iconic 911 model), with the voting rights of the owners of the former. Share class to be listed on the Frankfurt Stock Exchange under the symbol P911, are preference shares that do not give voting rights, but entitle to dividends EUR 0,01 per share higher than ordinary shares.

Volkswagen plans to sell 25% plus one share of Porsche AG to Porsche SE, giving the holding family and the Porsche family minority shareholder status with the right to block decisions. In addition, Volkswagen plans to sell 25% of the preference shares in the market and yesterday it was announced that the number of subscriptions to the offer had already been exceeded many times over the entire price range from EUR 76,50 to EUR 82,50; entities such as Qatar and Norwegian state-owned wealth funds or the T. Rowe Price investment holding have already committed to purchase under the IPO. The indicated price range puts Porsche AG at EUR 75 billion, which is close to the Volkswagen Group market value of EUR 91,6 billion. The scale of the public offering of Porsche AG shares could make it the fifth largest public listing in the history of Europe.

Volkswagen is selling Porsche AG shares in a public offering to achieve a dual purpose. First, it wants to reduce the discount on the valuation of Volkswagen shares resulting from cross-ownership; second, unlock more value generated by a luxury brand (Porsche). In addition, the IPO will increase capital for an extremely capital-intensive process at the Volkswagen Group assuming that all cars from this manufacturer will be electric in ten years. Volkswagen is expected to raise around EUR 19,5 billion from the public offering, with the promise to pay out a special dividend totaling approximately EUR 2023 billion by early 9,6.

foundations

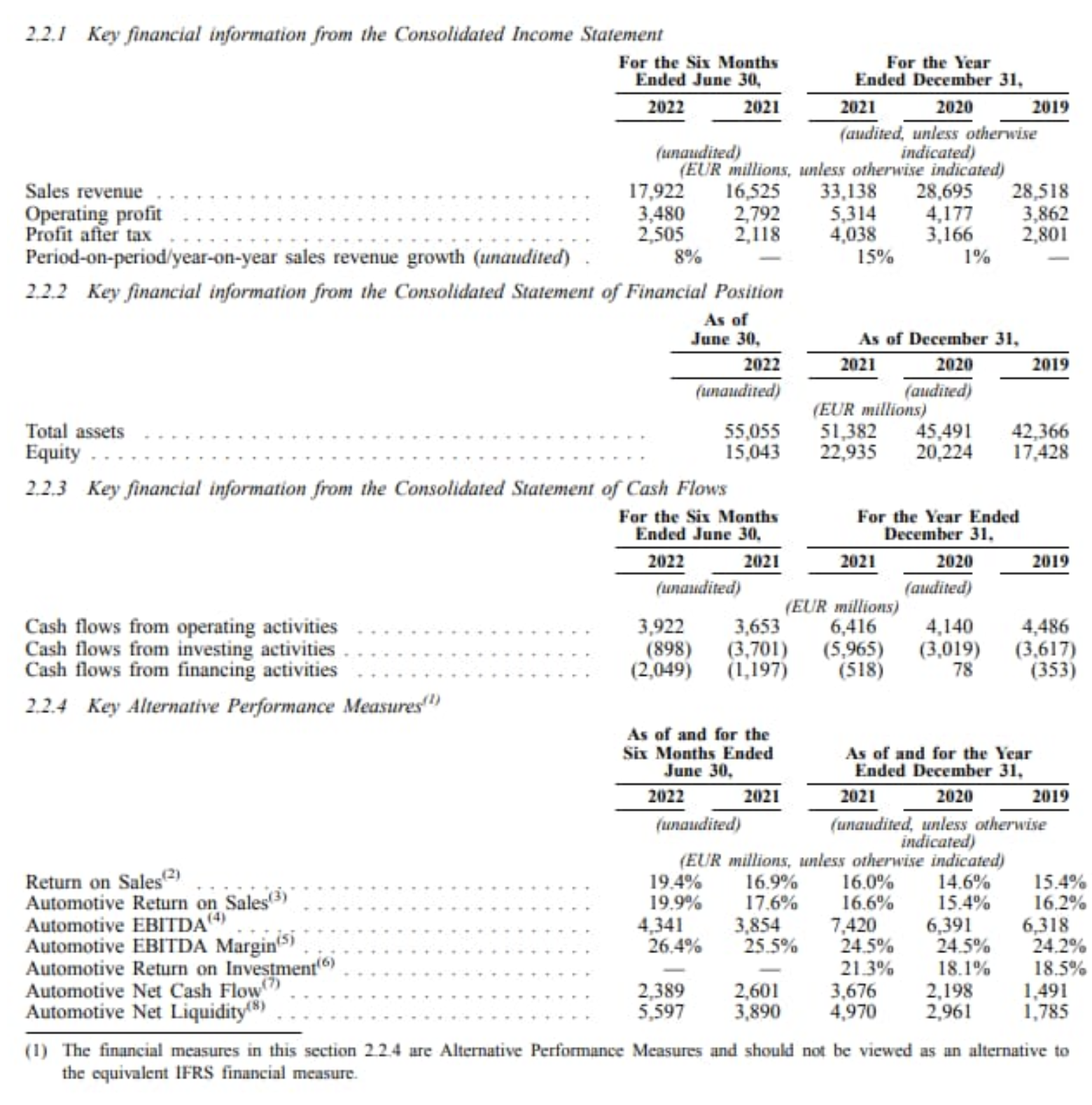

Porsche is a well-run company with revenues of EUR 2021 billion in 33,1, operating profit of EUR 5,3 billion, and EBITDA EUR 7,4 billion, translating into an EBITDA margin of 24,5% - a good result, although not matching Ferrari's 2021 margin of 35,7%. It should be emphasized that Ferrari is a company that can generate even greater profits from each car produced due to the higher status of the brand. The estimated market value of EUR 75bn and EBITDA of EUR 7,4bn in 2021 translates into a 10,1x multiplier which is significantly lower than the Ferrari multiplier (22,2 x market value to EBITDA), suggesting that Volkswagen and the Porsche family want a successful debut and are aware of the current market volatility. Porsche revenues grew by 8% in the first half of 2022 with a strong cash flow generation of EUR 3,9 billion, which is good considering the overall weakness of the automotive industry, but still lower than Ferrari, which in In Q17,3 and Q24,9, its revenues increased by XNUMX% y / y and XNUMX% y / y, respectively.

The main question for Porsche's potential shareholders is whether the company is able to successfully complete the transformation towards full car electrification with unchanged or even higher margins. If we compare Porsche and Ferrari, it is clear that there is potential for improvement and growth if Porsche manages to improve its operations and develop an already strong brand. The Volkswagen concern has announced that the synergy between the Volkswagen capital group and Porsche will continue to exist, however, in our opinion, greater autonomy is the key to Porsche's future success.

Risk

One of the absolutely key risk areas for Porsche stock is the escalating cost of living crisis as rising energy costs lower Europeans' disposable incomes. It is most prone to falling demand during this difficult period the luxury consumer goods sector, of which the automotive industry is a part. Although Porsche belongs to the most exclusive segment of the automotive industry, selling its products to the top 1% group in terms of income and affluence, this segment of society can also significantly reduce consumption during the current energy crisis and high inflation. Since Porsche buyers are well-off, it is not unfounded to assume that downturns in the stock and bond markets could seriously affect sentiment among the world's richest 1%. Another risk for Porsche is a strong rebound in the euro, which would lower international turnover and reduce the company's competitiveness abroad. The war in Ukraine or new Covid outbreaks could also affect supply chains and the demand for Porsche cars.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)