How to buy Pfizer shares? Everything about investing in a Pfizer company [Guide]

Pfizer is the world's largest pharmaceutical company. In recent days, it has made headlines in all media due to the recent information that they have invented an effective COVID-19 vaccine. Does this mean a long-term boom in the share price? How to invest in this American concern and what do you need to know about it? How to buy Pfizer shares? We check.

Pfizer's current price chart

Basic information about Pfizer

| Logo |  |

| Name | Pfizer Inc. |

| Headquarters | New York, USA |

| creation date | 1849 |

| Stock symbol | Pfe |

| trade | Pharmacy |

| Capitalization | $ 217 billion |

| Dividend | Present in several = 3,88% |

| Web page | https://www.pfizer.com/ |

History of the foundation of Pfizer

Pfizer is currently the largest pharmaceutical company in the world. It is an American company listed on the NYSE, founded 171 years ago (in 1849) by two Americans of German origin: Charles Pfizer and Charles Erhardt. The company employs nearly 100,00 people worldwide.

Early years of operation

One of the first Pfizer products was santonin, which has anthelmintic and anti-parasitic effects. The drug turned out to be a great success, however, the highest revenues in the first years of operation were generated by the production of citric acid. It is thanks to this product that Pfizer was able to dynamically develop and buy more factories and laboratories.

The period of two world wars

As a result of World War I and broken supply chains of intermediates for the production of citric acid, Pfizer developed a new method of obtaining this product based on fermentation. During World War II, the company mass-produced penicillin, which was needed to treat wounded soldiers.

At the end of World War II, penicillin became less profitable to produce, prompting the company to look for more profitable products. Thus, oxytetracycline was invented, an antibiotic that has anti-inflammatory, anti-allergic and bacteriostatic effects on bacteria such as tuberculosis, spirochetes, Mycoplasma, and Chlamydia. Oxytetracycline is also a protozoal.

With the invention of Oxytetracycline, Pfizer transformed itself from a chemical company into a pharmaceutical company with its own research facilities.

Second half of the XNUMXth century

The period after the end of the world wars is the time of intensive development of the company and its expansion into markets all over the world. In the 50s, Pfizer opened its subsidiaries in Belgium, Brazil, Canada, Cuba, Mexico, Panama, Puerto Rico and the UK. In the 80s, Pfizer invented Piroxicam, an anti-inflammatory, analgesic and antipyretic drug that is mainly used to treat osteoarthritis and rheumatoid arthritis.

The beginning of the XNUMXst century

After 2000, the company's growth was mainly driven by acquisitions and mergers. In 2000, Pfizer acquired Warner-Lambert for $ 111,8 billion, and in 2003, it purchased Pharmacia to acquire the rights to their product, celoxib. Celeoxib is an anti-inflammatory and analgesic drug used in rheumatoid arthritis, neuralgia, inflammation of the muscles and nerves. In 2003, Pfizer also acquired Esperion Therapeutics, and in 2004, Merdica, in 2005, Vicuron Pharmecuticals. In 2009, Pfizer acquired its biggest competitor Wyeth to date for $ 68 billion. After the merger with Wyeth, Pfizer became the largest pharmaceutical company in the world with annual revenues in excess of $ 20 billion.

Key products of the Pfizer company

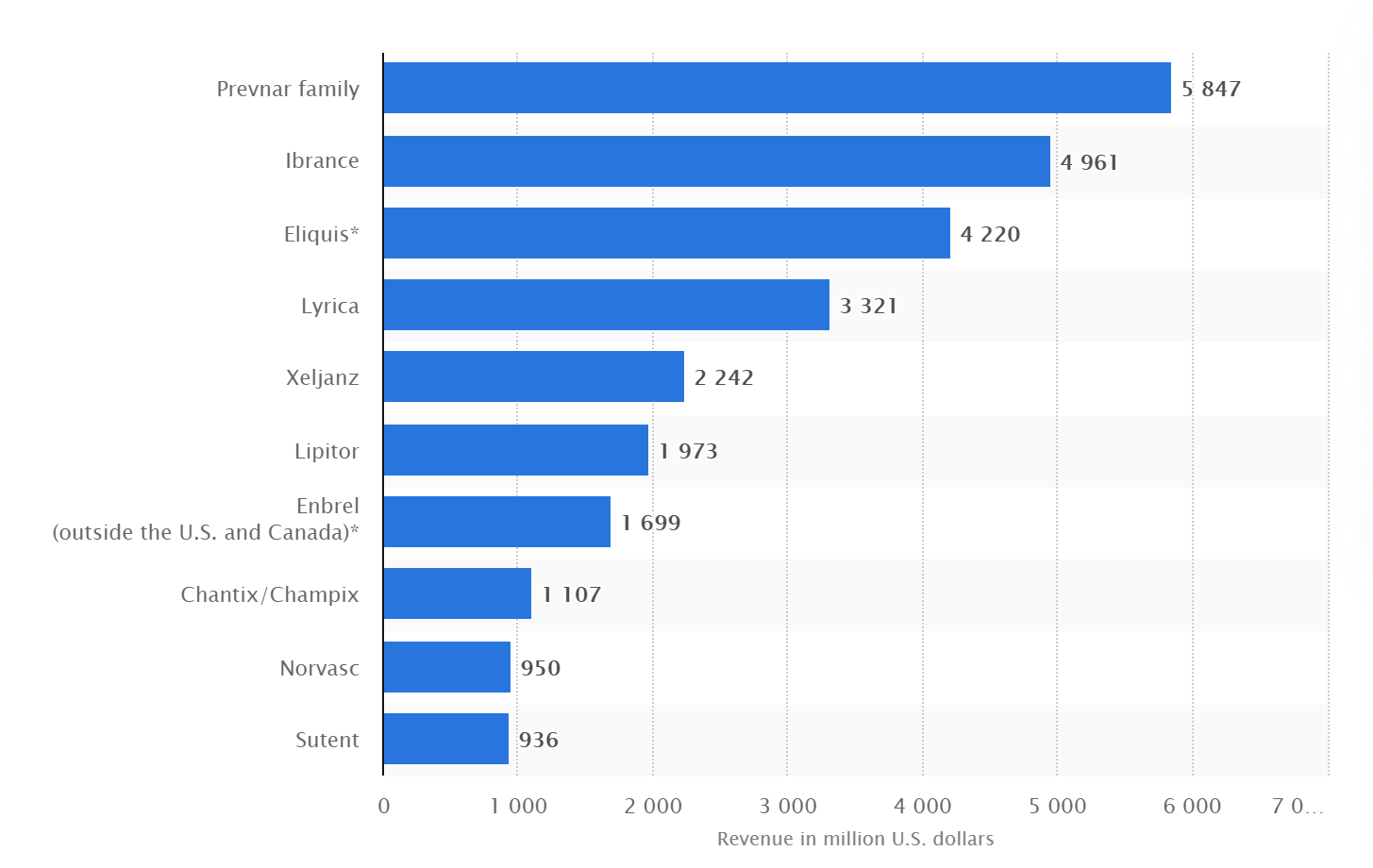

Pfizer has nearly 40 pharmaceutical products currently on sale. For the purposes of this guide, we will briefly characterize five of them that bring the company the highest revenues.

Prevnar

Vaccination against pneumonia, middle ear and invasive disease caused by pneumococci in infants, children and adults. In Poland, it is one of the recommended additional vaccinations (not reimbursed by the National Health Fund). The vaccine was approved for use in the European Union in 2009, and in the United States in 2010. In 2019, revenues from the sale of this vaccine amounted to $ 5,8 billion.

Ibrance

A cancer medicine used to treat advanced breast cancer. The active substance in the drug is palbociclib. Palbociclib inhibits the activity of enzymes that regulate cell growth and division. In some cancers, the amount of these enzymes is increased, allowing the cancer cells to multiply uncontrollably. Ibrance delays the growth of cancerous breast cancer cells. The drug has been on the market in the European Union since 2016. In 2019, Ibrance's sales revenue was $ 4,9 billion.

eliquis

Eliquis is an anticoagulant medicine. The active substance in this product is apixaban, which blocks one of the main clotting factors. It is used in people at risk of stroke due to the formation of blood clots. In 2019, Pfizer generated revenue of $ 4,2 billion from Eliquis sales.

Lyrica

Lyrica is an anti-epileptic medicine that contains the active substance pregabalin. The indications for the use of this drug are neuropathic pain, epilepsy and anxiety disorders. Pfizer's 2019 revenue from Lyric sales is $ 3,3 billion.

Xeljanz

A drug used in rheumatoid and psoriatic arthritis. Other uses of the drug include ulcerative colitis. The active substance is tofacitinib. Tofacitinib blocks the action of enzymes that play an important role in causing inflammation, which is a key component of rheumatoid and psoriatic arthritis. Revenue from the sale of Xeljanz in 2019 amounted to USD 2,2 billion.

COVID-19 vaccine

Pfizer has recently become famous with the announcement that the company has invented an effective vaccine for Covid-19. The preparation is a genetic vaccine based on the mRNA fragment of the virus that codes for the viral protein.

44 thousand people participated in the vaccine effectiveness research. people. In 90% of them, the vaccine proved to be an effective protection against covid-19.

The Pfizer vaccine must be stored at -70 * C, which makes its distribution a logistical challenge. At temperatures of an ordinary cold store (-20 * C) it can only be stored for 5 days.

So far, no serious side effects of the vaccine against Pfizer's Covid-19 have been reported. However, it is not yet known for how long the vaccine will provide us with immunity against the coronavirus that causes Covid-19.

How to Invest in Pfizer

Stocks and CFDs

Pfizer shares are traded on the New York Stock Exchange (NYSE) under the symbol PFE. To buy Pfizer shares, you need to open a brokerage account with a broker that allows you to buy shares on the American stock exchange.

You can also purchase contracts for difference (CFDs) on shares of Pfizer u Forex brokers. CFDs are characterized by leverage and the ability to earn both on price increases.

Where to buy Pfizer shares

Below is a list of offers from selected brokers offering both ETFs, CFDs on ETFs, stocks and CFDs on Pfizer shares.

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 3 - CFDs on stocks 16 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Traditional shares and CFDs

How to buy Pfizer shares, i.e. which instrument is better - traditional stocks or CFDs? It all depends on our expectations, strategy and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the short term, CFDs allow you to maximize your profit thanks to leverage, even when there is low volatility in the market and although fees are usually higher.

ETF

If you are interested in a more diversified investment in the pharmaceutical market, with a strong presence of Pfizer, it is worth looking for ETFs for the pharmaceutical market in the USA.

[FTXH] First Trust Nasdaq Pharmaceuticals ETF

-

- Issuer: First Trust

- Annual fees: 0.60%

ETF oriented towards the most liquid pharmaceutical companies in the United States. Pfizer Inc. is responsible for 7.87% of the share basket. Other large pharmaceutical companies include Bristol-Myers Squibb (8%), Horizon Therapeutics (7.77%) and Johnson & Johnson (7.66%). In total, the fund invests in 29 pharmaceutical companies. FTXH manages $ 248 million and pays dividends of 0.75% per annum. The profit for the last year is nearly 20%, while the average annual profit for the last 3 years is 8.38%, which is a good result.

[IHE] iShares US Pharmaceuticals ETF

-

- Issuer: Blackrock

- Annual fees: 0.42%

IHE is an ETF that buys companies from the broadly understood US pharmaceutical sector. The fund has 49 different companies, weighted by market capitalization. The fund invests as much as 20% of its assets in Johnson & Johnson. Another 17% in Merck & Co. Pfizer Inc. is 4,53% of the value of assets held by the fund. The annual fees are lower than FTXH, only 0.42% with an annual dividend of 1.23%. IHE has $ 370 million under management. Despite a completely different capital allocation than FTXH, the results of both ETFs are similar. The profit for the previous year in the case of IHE is 21.30%, and the average annual for the last 3 years is 8.91%.

Where to invest in ETF

Currently, we can only buy ETFs based on the following indices on the WSE: WIG, S&P i DAX. However, most forex brokers have quite a wide range of ETFs and CFDs for this instrument. For example on XTB today we can find over 400 instruments of this type, in Admirals almost 397, a Saxo Bank almost 3000.

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Pfizer shares? Everything about investing in a Pfizer company [Guide] how to buy pfizer stocks](https://forexclub.pl/wp-content/uploads/2020/11/jak-kupic-akcje-pfizer.jpg?v=1605543553)

![How to buy Pfizer shares? Everything about investing in a Pfizer company [Guide] black friday forex club allegro competition](https://forexclub.pl/wp-content/uploads/2020/11/black-friday-konkurs-forex-club-allegro-102x65.jpg?v=1605606678)

![How to buy Pfizer shares? Everything about investing in a Pfizer company [Guide] trader of the month October 2020](https://forexclub.pl/wp-content/uploads/2020/11/trader-miesiaca-pazdziernik-2020-102x65.jpg?v=1605515804)