Jen - the lost safe haven. Fears related to the banking sector are easing?

The surprise increase in US consumer confidence in March despite concerns about the banking sector reflects the fact that limited labor supply remains more important to the average consumer. If concerns about the banking sector do not increase and the US economy and inflation remain stable, the Japanese yen could wipe out most of its gains in the near term. However, US consumers most likely will feel the onset of recession in the second half of the yearwhen the supply of credit decreases. It cannot be ruled out that the future president Bank of Japan, Ueda, will change its current policy, which will allow the yen to strengthen further.

There is a sense of calm in the markets at the moment, especially compared to the chaos of the last few weeks, when concerns about the banking system began to emerge. This calmness is primarily due to the fact that no other bank has declared bankruptcy in recent days. Whether this is enough to improve risk appetite will only be known in a few weeks/months, when it will turn out whether this improvement will be permanent.

The US economy is temporarily in good shape, but in the second half of the year there may be a decline in consumer spending

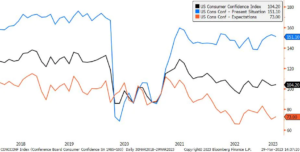

American consumers for now ignore banking concerns. The Conference Board's US Consumer Confidence Survey signaled a further improvement in March with a score of 104,2 compared to an upward revised score of 103,4 (consensus: 101,0) in February. The current situation index fell from 153 to 151,1, while expectations rose from 70,4 to 73,0. Such a high rate may come as a bit of a surprise as the cut-off date for the study is March 20, just a few days after US banks filed for bankruptcy. The improvement in sentiment, despite the insolvency of banks and the decline in the stock market, is probably the result of lower fuel costs, a persistent employee market and rising wages. It can be assumed that average consumers will only feel the effects of tightening lending conditions later in the cycle.

Meanwhile, high inflation and interest rates, as well as the risk of limiting the availability of credit, indicate that consumers they may become more careful in the second half of the year. A deterioration of the situation on the labor market cannot be ruled out either. If the data start to suggest that the situation on the labor market may deteriorate, and given that the market is already factoring in the interest rate cuts by the Fed since QXNUMX, it is difficult to assume that the "bad news is good" syndrome will continue to prevail message".

Concerns about the banking sector may have subsided, but other factors still need to be factored into valuations

As part of this (perhaps illusory) sense of calm, the US 4-year Treasuries returned above 38,2%, erasing almost 5,1% of the downward trajectory from a March 8 high of 3,6% to a 24% low of 60 March, as well as reproducing large movements of over 9 bps from this period. Despite this sharp decline amid concerns over a banking crisis, the Japanese yen has only gained 3,4% against the US dollar since March 12, which is not a remarkable feat considering the Japanese yen depreciated by more than 2022% against the US dollar in 131,80 when the profitability increased. However, the recent increase in yields, as well as improved sentiment, offset the recent gains of the Japanese currency related to its safe investment status. USD/JPY strengthened to 129,64 from a low of XNUMX recorded late last week.

Risk related to the banking sector may be decreasing nowhowever, a lasting consequence of the events of the last 2-3 weeks will be a shift of deposits from smaller banks to larger banks and to money markets or other safer/higher yielding facilities. As a result, banks will have no choice but to tighten lending standards, which will cripple the momentum of the economy. Markets are yet to factor in the risk of an upcoming recession, which has increased significantly as a result of recent developments in the banking sector.

A change in Japan's yield curve control policy is still possible

President Kuroda is ending his term in a few days, and future president Kazuo Ueda has signaled that he intends to continue his current policy. However, it ruled out further changes to Japan's yield curve control policy, a wage and inflation pressures in Japan continue to mount. This year's spring wage negotiations at Japan's largest companies resulted in an average wage increase of 3,8% for the financial year starting in April, which exceeded market expectations.

There is no doubt that this applies to only a small part of Japanese corporations, but this weakens the argument that inflation in Japan is not driven by strong consumer demand and its rate of growth will slow down as the cost of imported raw materials decreases. Headline inflation may be easing due to falling commodity prices, base effects and fiscal measures, but core inflation readings remain high and the scope for price pressures is also increasing.

This means further pressure on the Bank of Japan to change its policy. During today's speech in parliament, President Kuroda also made a suggestion strengthening wage pressure in Japan. The tone of this speech was a clear change from his earlier extremely dovish stance and allows for a possible policy change by the new central bank governor.

Last year, the Bank of Japan did not bow to the enormous pressure of the market, as it would have meant a loss of credibility. However, given the easing market pressure and persistent inflationary pressure, it will be the perfect excuse for the central bank to change its policy. For this to happen, financial problems must remain under control, and a possible global recession would have to be shallow so as not to significantly worsen Japan's economic outlook.

Year-end flows and short-term risk

Today's sharp drop in the Japanese yen may have been due to year-end flows as Japanese companies close their books on March 31. If concerns about the banking sector continue to ease, the US economy remains stable, or there are further inflationary shocks as a result of this week's PCE reading or the next CPI reading, market valuations could become a bit aggressive.

The Fed anticipates a pause after peaking rates (~5,1%), but the market is still pricing in three rate cuts this year. This gap could indicate some short-term pressure on the Japanese yen.

For USD / JPY may target 133, which is close to the 23,6-day moving average and represents a 135% retracement, but the more important test will be XNUMX. However, in the medium to long term, when the risk of recession starts to intensify, the Japanese yen will still have room to strengthen, especially in currency pairs such as EUR/JPY or GBP/JPY.

More Saxo analyzes are available here.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)