Coronavirus lowers ... interest rates [EUR / USD analysis]

Fear of coronavirus and the strong inhibition of global economic growth caused by it, which in several cases may end in recession (e.g. in Italy), caused a decrease in market interest rates and increased expectations for a loosening of monetary policy by central banks.

Interest rates down - when?

Expectations for money cost cuts have increased most in the US and US Federal Reserve (Fed). Currently, the money market is fully pricing-in the 25 basis point cut through April. If this happened, the range of fluctuations in the federal funds rate would be reduced to 1,25-1,50 percent. This is not the end, however. The market is pricing-in 3 cuts in total until March 2021, while until recently it priced in at most one cut, and the Fed itself suggested that the next move would be a rate hike.

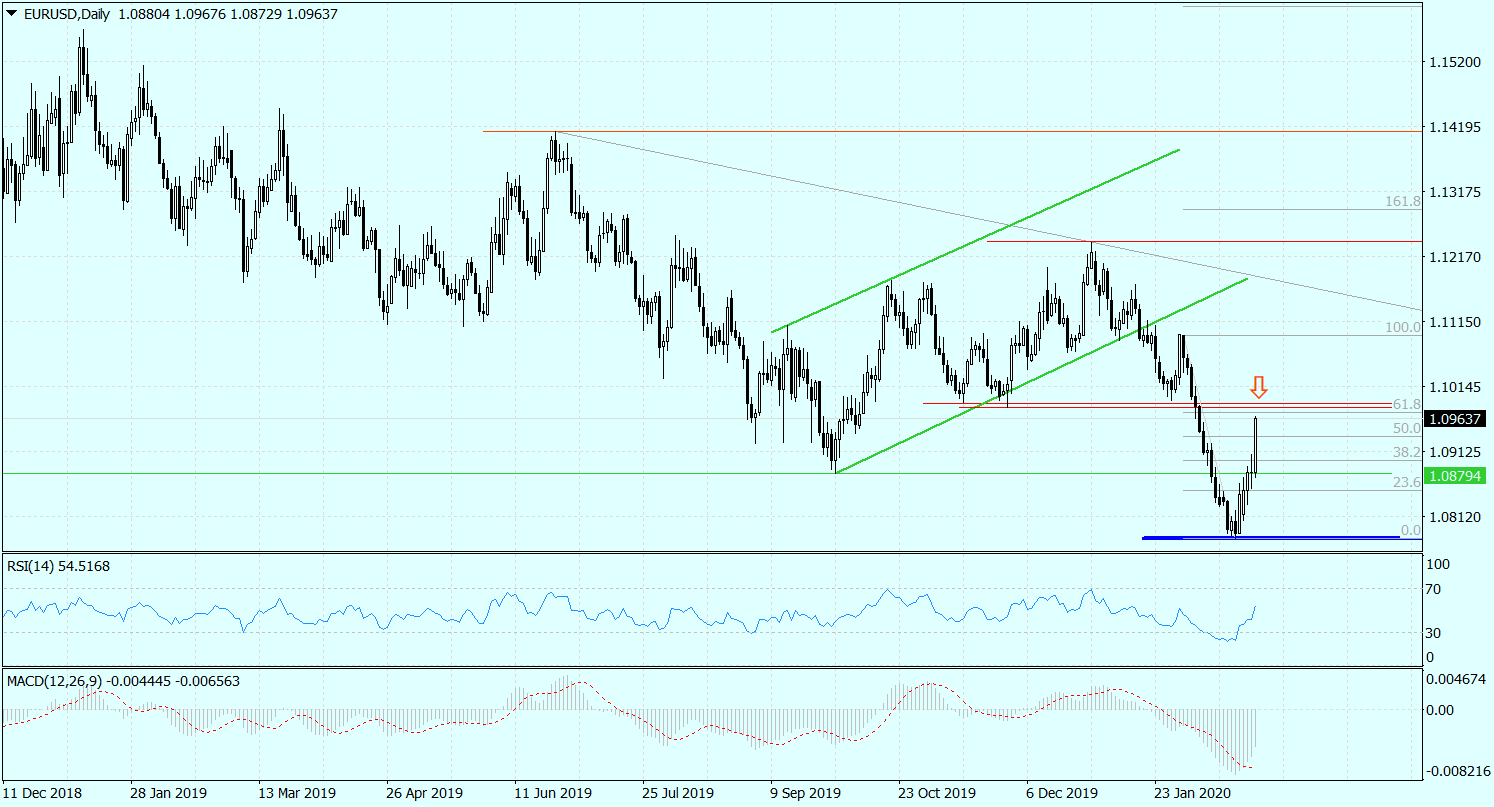

This change in expectations regarding Fed policy fully explains the recent jump in EUR / USD from the hole at 1,0778 to levels above 1,0960 today.

Chart EUR / USD, D1 interval. Source: MT4 Tickmill.

The coronavirus epidemic is also concerned European Central Bank (ECB), and the market began to price a cut in Euroland money cost by 10 basis points by the end of the year. Currently the deposit rate is at -0,50 percent and the refinancing rate at 0,0 percent.

The exception is not the Polish market. On Wednesday, the FRA market fully priced a reduction of 25 basis points by the Monetary Policy Council (MPC) of interest rates in Poland in the next 12 months, and in the perspective of 24 months by a total of 40 basis points. Currently, the main rate in Poland is at the level of 1,50 percent, and the MPC has for many months pledged that rates will remain unchanged until the end of its term.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Coronavirus lowers ... interest rates [EUR / USD analysis] eur / usd interest rates fed](https://forexclub.pl/wp-content/uploads/2020/02/eurusd-stopy-procentowe-fed.jpg?v=1582810448)

![Coronavirus lowers ... interest rates [EUR / USD analysis] coronavirus exchange](https://forexclub.pl/wp-content/uploads/2020/02/koronawirus-gie%C5%82da-102x65.jpg?v=1582802841)

![Coronavirus lowers ... interest rates [EUR / USD analysis] cryptocurrency retirement](https://forexclub.pl/wp-content/uploads/2020/02/kryptowalutowa-emerytura-102x65.jpg?v=1582818936)