Cryptocurrency ETFs: From "no way" to "maybe"

Relations between the cryptocurrency industry and the U.S. Securities and Exchange Commission (SEC) have not been the best lately, but it seems that the two sides have finally come to an agreement given that the SEC has apparently changed its view on cryptocurrency listed funds exchange-traded (ETF). If approved by the SEC - which we believe is likely - these types of funds could generate a significant influx of investors in the Bitcoin and Ethereum space.

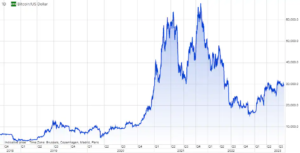

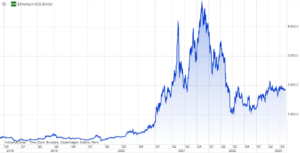

The cryptocurrency market is volatile, largely unregulated, has a limited trading history, and there are currently heated discussions about whether cryptocurrencies still have any intrinsic value. Regardless of the position on the issue, there is broad consensus that these attributes make the cryptocurrency market stand out from most other markets. Accordingly Cryptocurrencies are a poor benchmark against other markets; the only exceptions are speculative bubbles created by fledgling but long-awaited technologies. In this case, no other market is better suited for comparison purposes. Putting the two markets together, there are significant parallels between cryptocurrencies and the recent surge in artificial intelligence, including the seemingly one-way flow of capital to anything related to AI.

SEC involved in the cryptocurrency market

in 2023, after the collapse of the FTX cryptocurrency exchange, the US Securities and Exchange Commission (SEC) has shown significant involvement in the cryptocurrency market. It should be emphasized that the position of the SEC regarding this market was not positive this year. On the contrary, it has led to increased scrutiny and increased uncertainty in perhaps the most important cryptocurrency market, the United States.

To name just a few examples: earlier this year Kraken, recognized cryptocurrency market, agreed to a $30 million settlement with the SEC after the agency said the organization of Kraken's staking service was too similar to securities trading. As part of the settlement, the exchange also agreed to stop providing the staking service to customers in the United States. Subsequently, the SEC took legal action against two other major entities in the exchange area: Coinbase, the largest cryptocurrency exchange in the United States, and Binance, the largest exchange in the world, including its American subsidiary operating under the name Binance US.

The allegations stemmed from the accusation that these exchanges operated as unregistered stock exchanges. Although the scope of allegations against Binance is a much broader, overarching issue - whether a significant part of cryptocurrencies and related products should be classified as securities – is essential for the entire market. The answer to this question could have potentially far-reaching consequences, including making many cryptocurrencies no longer eligible for trading in the United States. Such an outcome would have a profound impact on the respective ecosystems of these cryptocurrencies.

In this context, as pointed out by the SEC, the only cryptocurrency that can be definitively excluded from classification as a security is bitcoin. SEC Chairman Gary Gensler made it clear last year that bitcoin should be considered a commodity, not a security, although he stated that he believes most cryptocurrencies are securities:

“The rules are clear. Based on the facts and circumstances, I believe most of these tokens are securities."

On the other hand, the Coinbase exchange challenged the position of the SEC, arguing that it does not trade in securities, which is why the commission filed a lawsuit against Coinbase in June. So it was a difficult year to say the least when it comes to regulations in the United States. Currently, however, it seems that the SEC may have some positive impact on the cryptocurrency market, as the agency may change its position on a key issue, namely on the issue of cryptocurrency exchange-traded funds (ETFs).

Bitcoin futures ETFs and all that

Cryptocurrency ETFs have been the Holy Grail of the investment community since Cameron and Tyler Winklevoss (that's right, the twins from The Social Network) applied for the first spot bitcoin ETF in 2013. The exchange-traded fund is expected to accumulate significant assets as it allows retail and institutional investors outside of cryptocurrencies to effortlessly gain exposure to bitcoin under precise regulation. Despite this The SEC rejected the Winklevoss brothers' proposal for an ETF stressing that the cryptocurrency market is vulnerable to manipulation and does not provide sufficient protection for investors. The twins made one more attempt, but in 2018 the SEC again rejected the proposal to create a bitcoin fund.

Since then, countless companies have tried unsuccessfully to convince the SEC to approve bitcoin ETFs. Despite the denials, the SEC gave the market a little taste of cryptocurrency funds in 2021 when it approved a regulated futures-based Bitcoin ETF. This was a long-awaited decision as the market hoped that this type of fund would be easier to attract external capital and saw it as a step towards creating a spot ETF. Bitcoin futures funds have attracted the right amount of capital, with the largest of them, ProShares Bitcoin Strategy, managing assets worth around $1,1 billion.

That being said, since such funds are based on bitcoin futures, incur additional costs related to the monthly rollover of contractsmaking ProShares Bitcoin Strategy ETF, for example, outperform bitcoin this year. Because these funds are exposed to bitcoin futures rather than the bitcoin spot price, they have received much less capital inflows than would have been possible with a spot fund, meaning that bitcoin has seen a limited return on these funds.

BlackRock kicked off the party in June

Then, unexpectedly, the world's largest asset management company, BlackRock, joined the game in mid-June, applying for a bitcoin spot fund. This was quite significant, primarily given BlackRock's position in global financial markets, but also given the company's ETF success rate. The SEC has approved as many as 575 funds reported by BlackRockwhile only one was rejected. In other words, the company took the matter seriously. For some reason, BlackRock must have been firmly convinced that it was she who would receive the green light from the SEC.

BlackRock's filing has emboldened many other companies, including Fidelity, Ark Invest and WisdomTree, to apply for bitcoin spot funds. In favor of this type of funds is also the fact that at the end of June Volatility Shares managed to obtain first approval for a leveraged bitcoin futures ETF, so it seems that the SEC has actually changed its opinion on cryptocurrency funds.

And so we come to the beginning of August, when another ETF avalanche saw the light of day. In just a few days, multiple companies – including ProShares, Bitwise, and Grayscale – have applied to create Ethereum futures funds. Such applications have been filed many times, but so far the SEC has asked companies to withdraw the application up to seven days after the date of filing. In this case, no company withdrew its application, although about two weeks have passed since the first notification.

Given the above circumstances, we are optimistic and believe that both the bitcoin spot fund and the futures ETF will Ethereum will be approved by the SEC in the next six months. We conservatively assume that the probability of approval of the application within 6 months is 50%, respectively. The SEC likely sees the ethereum futures ETF as a minor change to the status quo, as it replicates the model of an existing bitcoin futures fund, only using a different cryptocurrency. This means that a possible ETF on ethereum may be launched as early as mid-October, even before any potential bitcoin spot fund.

We can, of course, return to square one with regard to securities regulation. This is pure speculation with many unknowns, however, if the SEC approves the ethereum ETF, it may indicate that, as with bitcoin, the SEC does not view ethereum as a security, as there could be a discrepancy between approving an ethereum ETF on the one hand, and continuing to hold that ethereum is a security on the other hand. Under this assumption, it would reduce the regulatory risk associated with ethereum.

More Saxo analysis available here.

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)