Cryptocurrencies - now also for institutions, not only for the initiated

In the last quarter of 2020, cryptocurrencies recorded excellent results, and the capitalization of the entire crypto market hit record levels. During the quarter Bitcoin has appreciated almost threefold, and was followed by many other alternative currencies ("alt-currencies"), such as Ethereumwhich has doubled in value; this trend also extended into 2021.

An important factor in the cryptocurrency boom was the increased interest in the institutional area and the growing enthusiasm for DeFi ("decentralized finance"), thanks to which crypto entrepreneurs can play standard financial instruments beyond the control of companies or governments. The DeFi industry evolved from Ethereum as an introduction to the so-called stable currencies - stablecoinsrelated to fiat currencysuch as USD as well as to more advanced solutions. In addition, in December, the initial stage of the Ethereum upgrade, ETH 2.0, was started in order to safely and permanently increase the number of transactions. The question is whether these factors are strong enough to keep the cryptocurrency market boom throughout 2021.

About the author

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Benefits of decentralized currency

The fiat money supply is controlled by governments and central banks through the discretionary printing of money. Historically, this has often led to hyperinflation - one of the earliest examples may be the Western Roman Empire. As it started to expand rapidly, there has been an increase in military, logistics and administrative spending. To cover them, the Romans minted new coins with less and less content silverwhich meant a decline in the wealth of citizens and a devaluation of the currency. Its decline and the related hyperinflation ultimately led to the fall of the empire.

Historically, the fear of devaluing the monetary system has led people to turn to ineffective barter methods, and in the present day to inflation-protected assets such as gold or broadly understood commodities. Although Bitcoin is still too volatile to be considered a "safe haven", the decentralized nature of cryptocurrencies attracts investors as a hedge against inflation, as became apparent in 2018, when Venezuela was hit by one of the biggest hyperinflations since World War II world.

Due to the limited supply of Bitcoin of 21 million BTC, the characteristics of this currency to some extent resemble those of some rare commodities such as gold. In line with this analogy, Bitcoin can be seen as a financial option in the event of a collapse of the current fiat money system, or at least in the event that the fiat money system breaks down faster than in the case of a decentralized cryptocurrency system.

End of Ethereum congestion

Due to the limited supply and energy costs associated with verifying mining transactions, Bitcoin is considered more than other cryptocurrencies, such as Ethereum, as an asset that enables value security. Ethereum also has industrial applications, as does silver in the commodities area, where 50% of its supply goes to the industrial sector. The Ethereum network enables the creation of smart contracts - pre-programmed transactions that are triggered automatically upon meeting certain conditions, provided that the necessary transaction fees have been paid in the network. They are widely used outside the financial industry, for example in the context of registering property rights, examining insurance claims or managing voting systems.

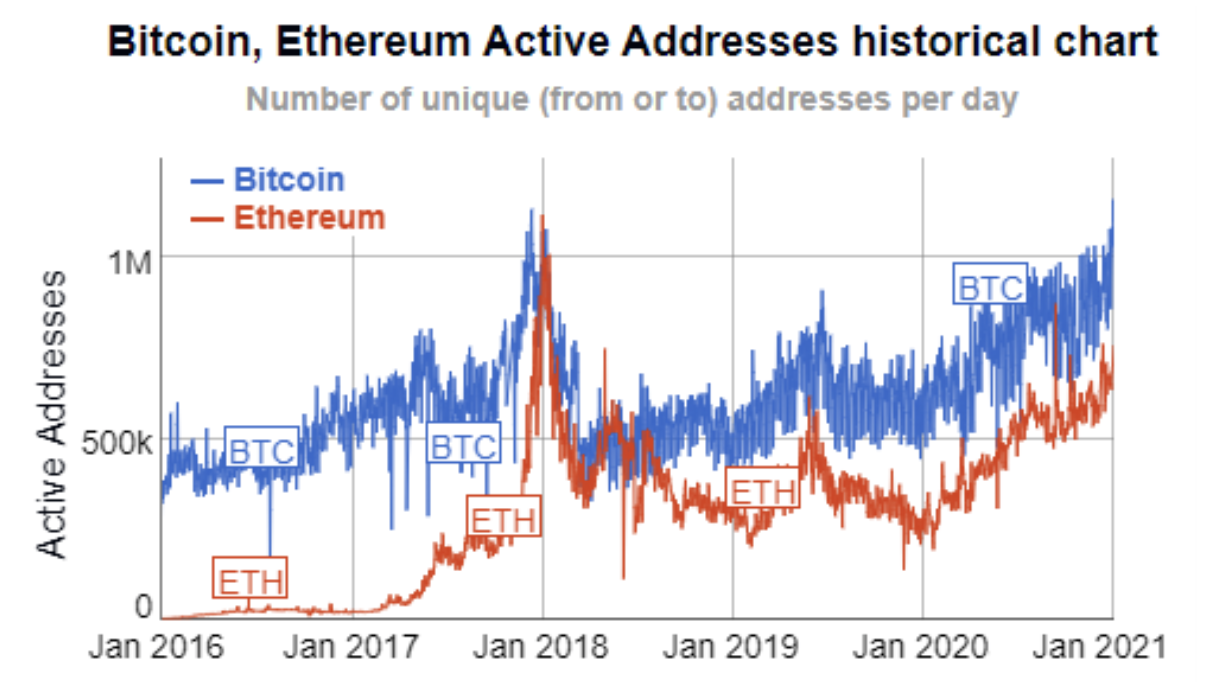

This range of applications is currently very limited as the Ethereum network only processes a small number of transactions per second. This means high transaction fees as market participants are vying for bandwidth and therefore upgrading to ETH 2.0 is critical to network growth. Ethereum's user volume, as measured by the number of unique active addresses, is still well below its peak activity at the end of 2017, in contrast to Bitcoin, where the number of active addresses reaches new highs (see chart below).

In addition to a significant improvement in throughput, upgrading to ETH 2.0 will dismiss the verification process from energy-intensive miners, who as such do not necessarily invest in ETH. This will be replaced by a system where ETH holders will be able to decide to invest (stake) some of their ETHs and participate in the validation process. Instead, they will be rewarded with newly issued ETHs, but may lose part of their stake if they make any attempt to influence the transaction. The constant influx of new emissions keeps the ETH inflationary and the long-term holder who is not actively betting will suffer an impairment. However, the overriding goal of Ethereum is to keep inflation low enough to have the right number of validators and thus keep the network safe.

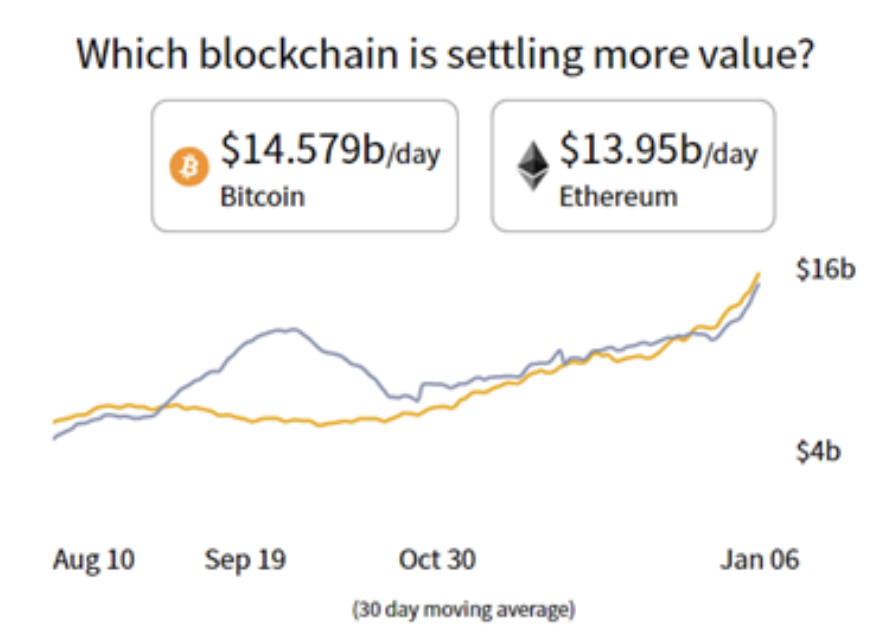

According to Money-movers.info (see chart below), the daily value of transactions settled on the Ethereum network already in September exceeded the value of Bitcoin, which confirms the wide use of ETH as opposed to BTC. However, at the end of the year, Bitcoin regained its leadership position as a result of investors' strong interest in the BTC boom and high ETH fees.

Using cryptocurrency exposure analogously to options

In today's financial markets, investors are forced to select stocks and equity-linked instruments to obtain a positive return. Even though crypto investors are likely to have made significant profits in 2020, the enormous volatility of cryptocurrencies means that trades should be handled with extreme caution.

An example was the situation in mid-March last year, when the value of BTC and ETH fell by almost half in just one day as a result of panic in the markets caused by the rising number of cases of Covid-19. In addition to hedging against inflation, an investment in cryptocurrencies can be akin to including in your options portfolio as a bet that can be reduced in value to zero or that can yield multiple returns.

In the context of 2021, apart from speculative investors, the positive sentiment in the area of cryptocurrencies will depend on the spread of this form of investment, as well as on the development of technological infrastructure enabling it to meet the growing requirements.

At the same time, the threat of regulation and the possibility of hacking the system remains on the horizon. In 2020, cryptocurrencies from investments for insiders became institutional. This is due to two factors: the possibility of placing 3-5% of your wallet on something that can bring you multiple profit, and unimaginably large amounts of fiat money in circulation. Younger generations, and now increasingly cash managers as well, are willing to bet that technology will win over money devoid of any value.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)