July is good for stocks - the market focuses on a soft landing

US stocks rose 9,3% in July as the market increasingly relies on a soft landing in the economy amid fading inflationary pressures and a significant easing in financial conditions from a very tight level at the end of June. We are also looking at the earnings of companies in the second quarter, which turned out to be positive - gains on the index MSCI World rebounded by almost 13% compared to the first quarter. This week we will focus on the results of Caterpillar, Alibaba, BMW and Adidas.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

One of the best months for action in 50 years

Last month turned out to be extremely favorable for global financial assets with US stocks gaining 9,3% after decisions FOMC regarding interest rate hikes and Powell's comments during the press conference, who avoided giving any guidelines and stressed that the Fed was moving towards data-dependent on its policy. For the time being, the market sees this as an indication that the Fed will soon slow down the pace of its monetary policy tightening and continue to price-in for rate cuts next year.

The market appears to be assuming that the economy will in fact soft-land as inflationary pressures are easing. This is a far-reaching assumption given the uncertainty and the fact that many of the factors behind inflation continue to exist. The full effects of last year's inflation for consumers have not yet materialized, so investors should continue to be cautious.

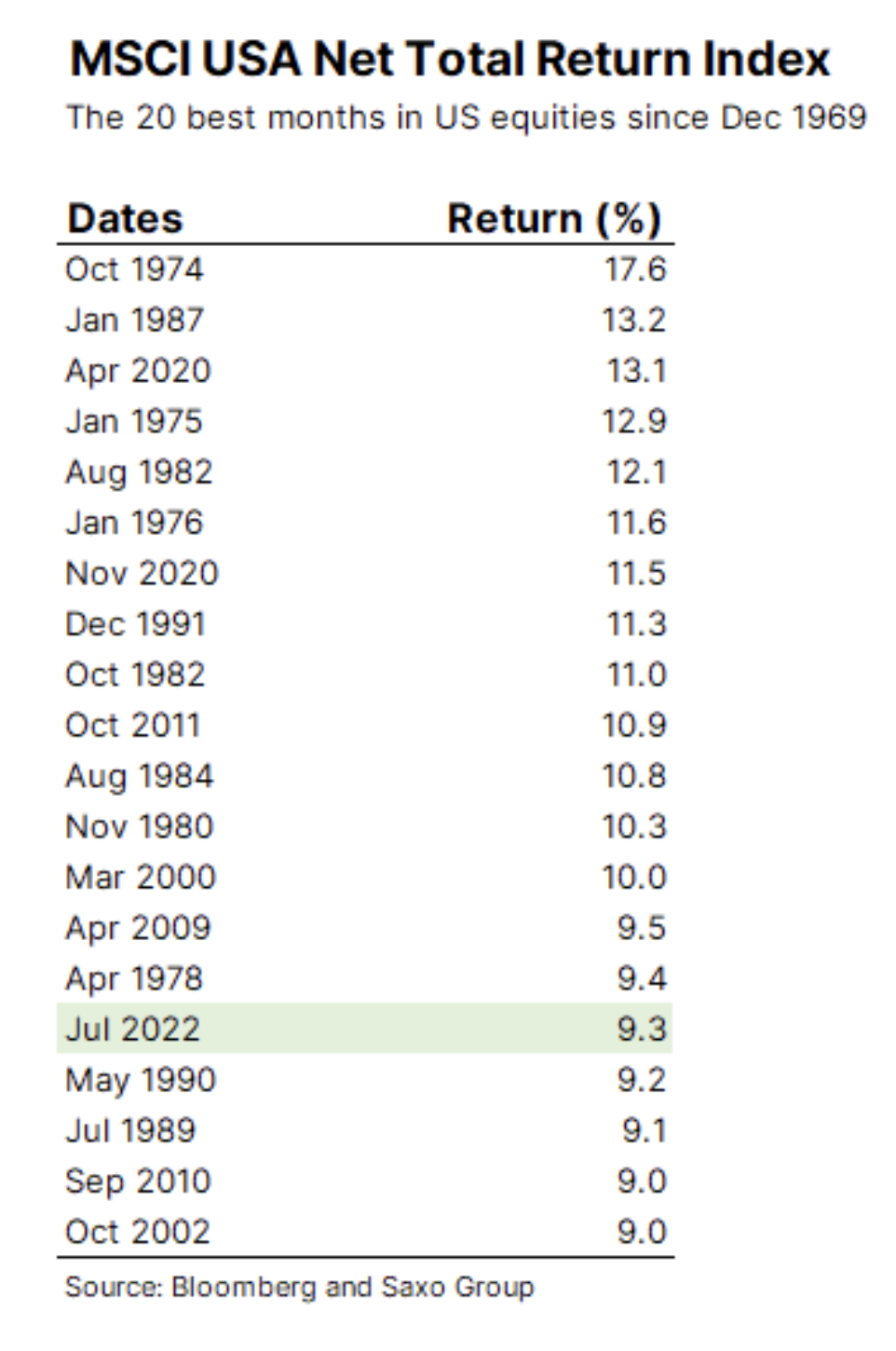

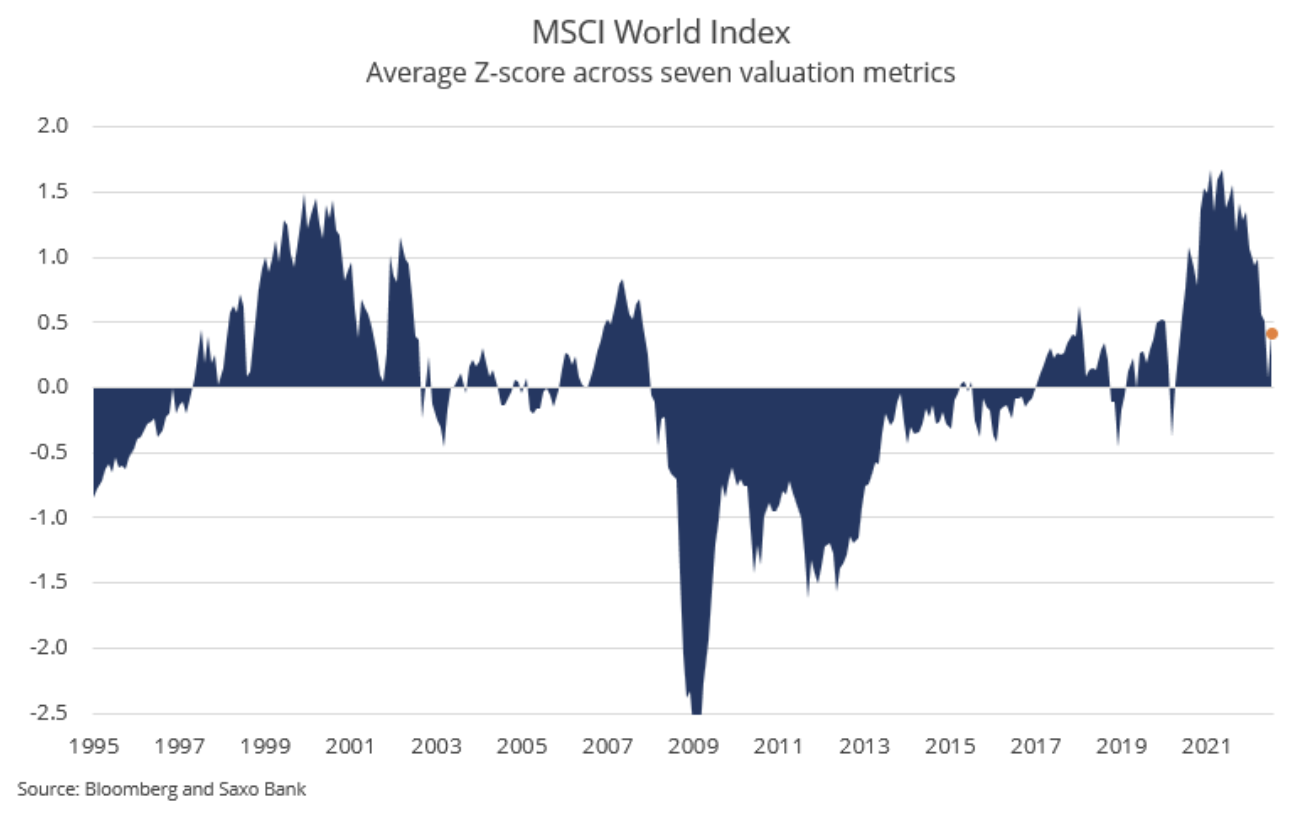

The MSCI USA Net Total Return Index recorded its 1969th best month since December 0,4, and the key question now is whether this momentum continues or whether there will be effects of a return to the average that will drive stock indices down. In the short term, the effects of a return to the average dominate, therefore, in statistical terms, one should expect that the trajectory of the action will reverse in the near future. The July rally also pushed equity valuations up to XNUMX standard deviations for the MSCI World index, which is somewhat exaggerated given the three-month average performance of the Chicago Federal Reserve Index (Chicago Fed National Activity Index) in June was negative, which suggests a significant slowdown this year.

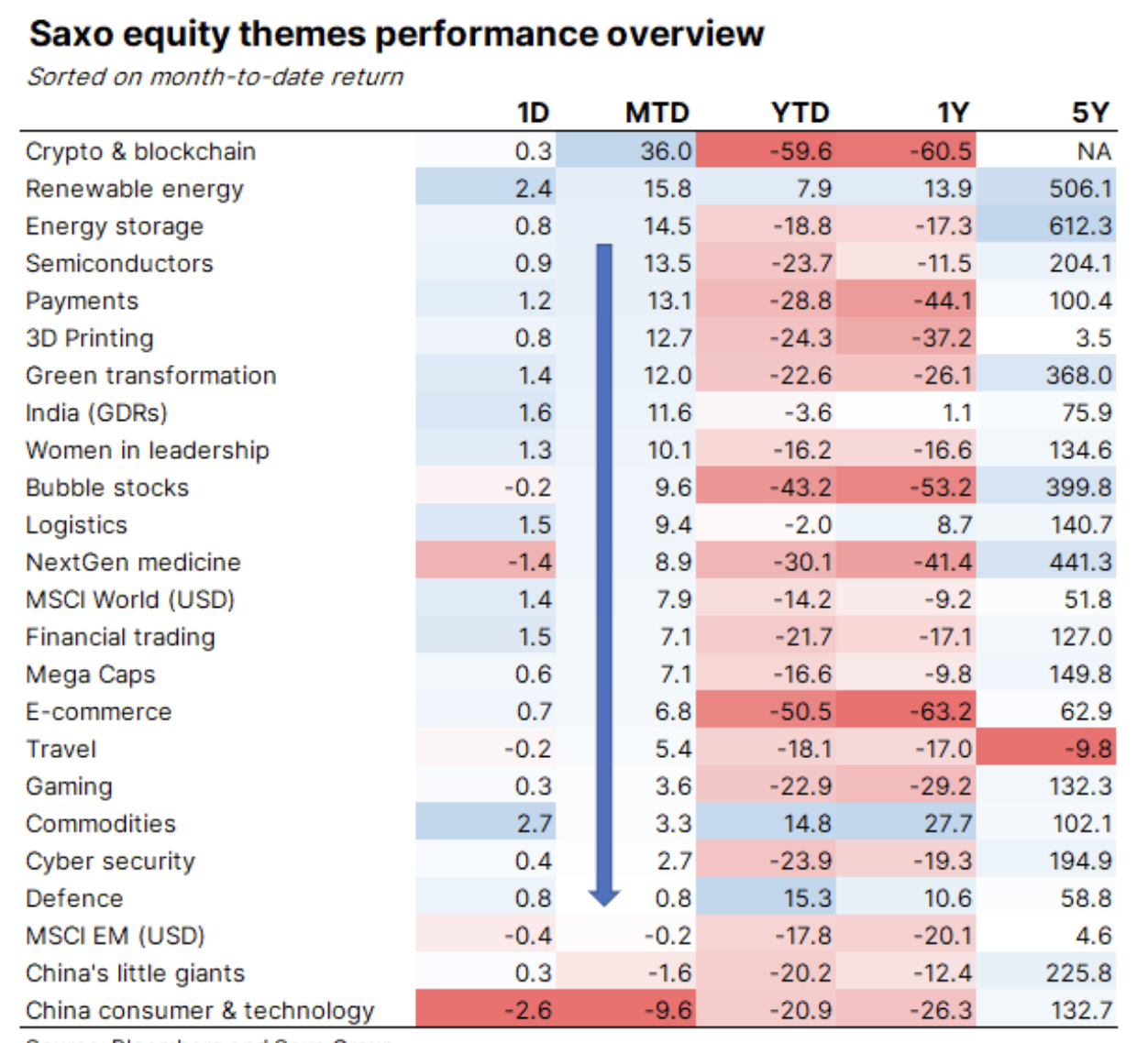

In the context of our thematic baskets, an excellent month was recorded by cryptocurrency companies, as cryptocurrencies are the purest expression of risk taking. Renewable energy and energy storage stocks have also performed well in the wake of the ongoing energy crisis in Europe, which increases the need for new and fast solutions to Europe's energy needs as the entire continent is shutting down from Russia. The worst performance in July was recorded by Chinese tech and consumer stocks, which fell 9,6% as Beijing's belt-tightening continues to weigh on economic growth and access to financing in US public markets becomes increasingly difficult as many Chinese entities may be removed from the indices in the future.

Profits for the second quarter are bouncing backwards

In Q12,9, companies were hit hard by rising production costs that lowered operating margins, and forecasts worsened with galloping commodity prices and the war in Ukraine. Aggressive cost cutting and price increases made companies rebound: in QXNUMX profits rose by XNUMX% q / q, driven by the widespread acceleration in revenue growth, higher prices as a function of inflation, and an increase in operating margins.

In the case of companies from the index Nasdaq 100 The increase in revenues in QXNUMX is almost flat, while in the case of companies from the MSCI World index it is clearly higher, which results from a significant increase in tangible revenues compared to intangible revenues.

We have a lot of earnings releases this week; the most important of them are listed below. We are curious to see how German companies such as BMW, Adidas, Bayer and Vonovia will perform this week, given the energy crisis in Europe. Caterpillar, which is, will be important de facto a barometer of the global construction industry and thus of the macroeconomic environment. On Wednesday, it is also worth watching Booking due to information on the future situation in the consumer goods sector, while on Thursday the topic of the day will be Alibaba - China is still weakened, and the e-commerce giant appeared on the SEC list of foreign shares that may be removed from the weekend. US indices.

- Tuesday: Kweichow Moutai, Generali, Mitsubishi UFJ, BP, Koninklijke DSM, AMD, Caterpillar, PayPal, Starbucks, Airbnb, Occidental Petroleum, Marriott International, Uber Technologies, Ferrari, Electronic Arts

- Wednesday: Nutrien, Maersk, AXA, Societe Generale, Siemens Healthineers, BMW, Infineon Technologies, Vonovia, Nintendo, JDE Peet's, CVS Health, Booking, Moderna, Regeneron Pharmaceuticals, Fortinet, Albemarle, eBay, MercadoLibre

- Thursday: Novo Nordisk, Credit Agricole, Merck, Bayer, Adidas, Beiersdorf, Toyota, SoftBank, Glencore, ING Groep, Eli Lilly, Alibaba, Amgen, ConocoPhillips, EEA Resources, Air Products and Chemicals, Block, DoorDash, Twilio

- Friday: Canadian Natural Resources, Suncor Energy, Allianz, Deutsche Post, Naturgy Energy Group

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)