The NBP raises inflation forecasts. What about the golden one?

The March projection brought a small earthquake. The NBP has significantly raised its inflation forecasts for the coming years. Will this be an introduction to zloty appreciation?

The results of the March meeting of the Monetary Policy Council did not surprise. In line with forecasts, the Council did not change interest rates in Poland, leaving the main rate at a record low of 0,1%. Surprises, however, lurked in the communiqué after the meeting. It was the forecasts from the latest March "Inflation Report" NBPwhich will be officially presented on Monday, March 8.

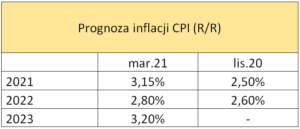

According to the projection (...) there is a 50% probability that the annual price growth will be in the range of 2,7-3,6% in 2021 (against 1,8-3,2% in the November 2020 projection), 2,0 , 3,6-2022% in 1,6 (compared to 3,6-2,2%) and 4,2-2023% in XNUMX. - such a sentence was included in the Council's communication. Nothing less than that means a strong upward revision of inflation forecasts in relation to those from the November projection. Especially for this year. The NBP currently assumes that the average annual inflation in 2021 will amount to 3,15%. In November, she predicted that it would be 2,5 percent.

Inflation forecasts in Poland in 2021-2023 based on NBP projections

The NBP currently expects that inflation in Poland will permanently exceed the inflation target of 3% for the next three years. (middle of compartment). Does that mean it will start lifting soon interest rates? None of these things. However, the emergence of a discussion on a possible normalization and ultimately future tightening of the monetary policy in Poland is very real. Such topics will appear in spring, when the economy starts to accelerate more and more, which will translate into inflation. Inflation forecasts prepared by the NBP are bolder than market consensus. According to a recently published survey by the Reuters agency, economists in February assumed average annual inflation this year and in 2022 at 2,8 percent, and in 2023 they expected it to slow down to 2,5 percent. Observing the current global inflation trends, as well as the incoming hard data, it can be safely said that at least this year inflation will be closer to the one forecast by the NBP than the market. And temporarily they may come back above 4%. This may happen as early as May, when the impact of the base effect diminishes.

The zloty did not react to new forecasts yesterday. On the contrary. Rising bond yields around the world, and in fact the market fear of this growth, have weakened it. There is no doubt, however, that the room for further zloty depreciation, even in the case of a significant deterioration in sentiment in financial markets, has drastically narrowed.

At the same time, the door to its future fortification was opened wide. Hence, there is a good chance that the recent increases in EUR / PLN will slow down in the PLN 4,55-4,56 zone, which is a potential return zone. And then the pair will start a long march south, which in the summer may bring a test of around PLN 4,30, and later even lower.

EUR / PLN daily chart. Source: Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)