OBI 2018: Polish investor more and more similar to German

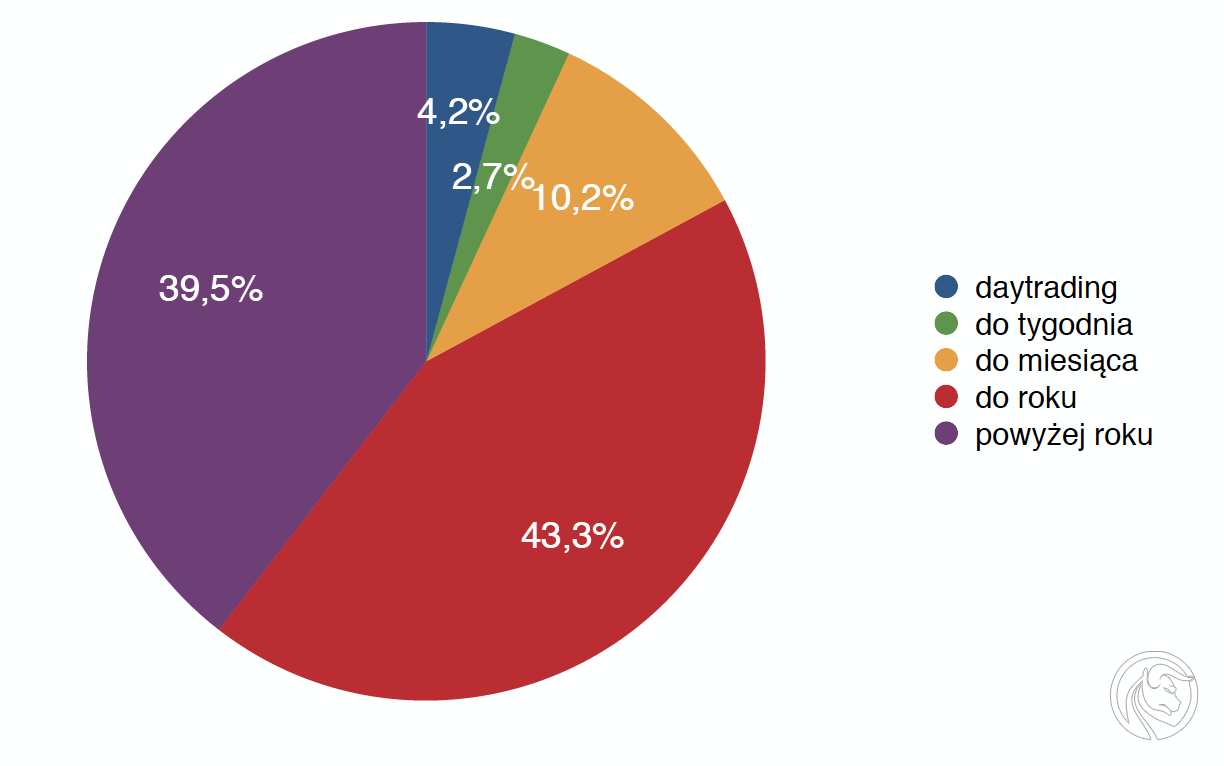

The Association of Individual Investors presented the results of the 16th National Investor Research. This time, 3912 people took part in the survey. How does a statistical Polish individual investor look like? He is a middle-aged man with a university degree. He has been investing in his spare time for 8 years. It has 7 companies in its portfolio and holds shares for one year.

Pole (almost) like Germany

Over the years, a certain trend can be seen among respondents. With each edition of our survey, the profile of a Polish individual investor looks more and more like an investor from Germany. Poles, however, are not equally involved in company meetings or general meetings. There are more differences, but it must be admitted that they are becoming more and more blurred.

| Polish Investor | German Investor |

|

|

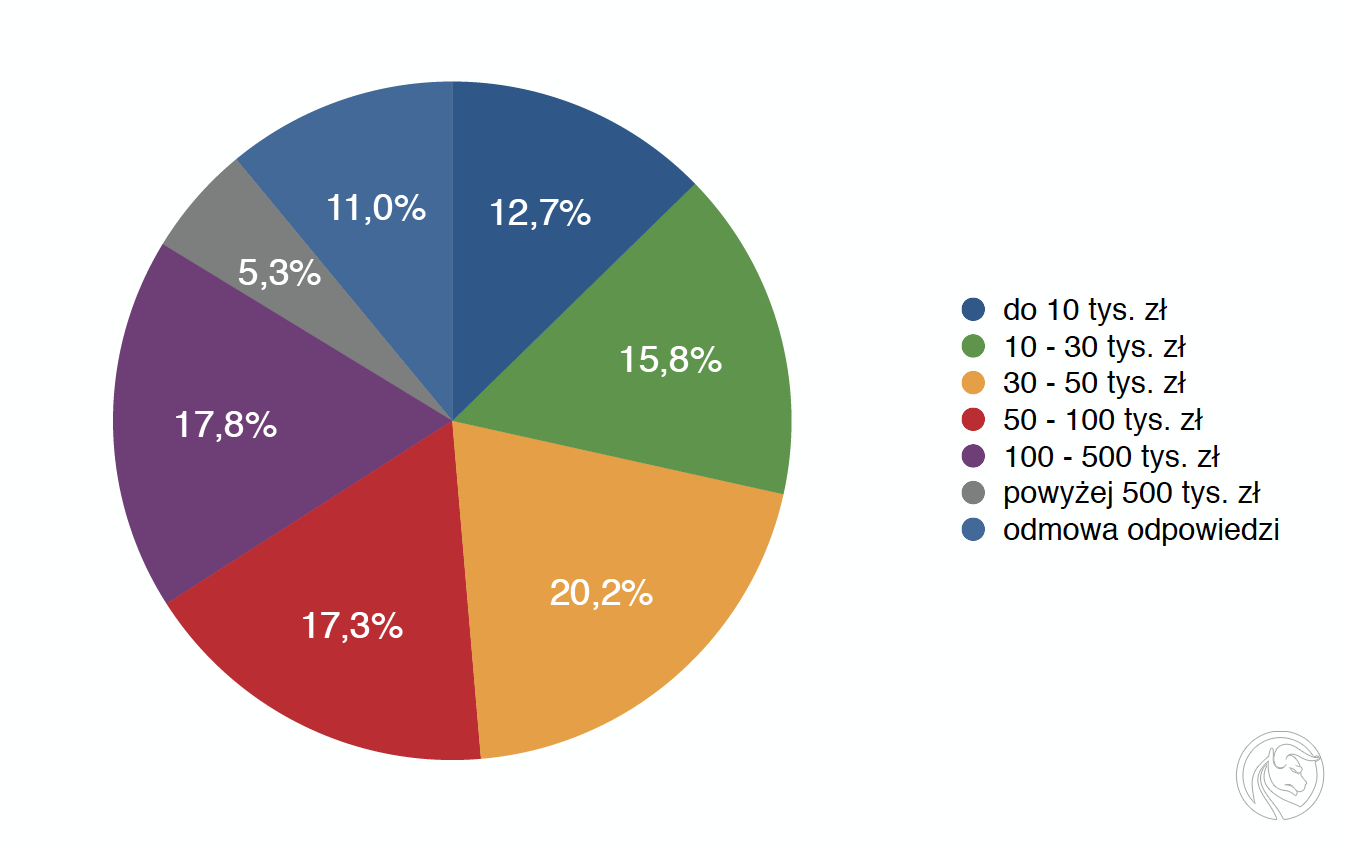

The Pole creates the most responses as a person who invests after hours without allocating more than 1 hours a day. He does it on his own account and without the help of third parties, and for this purpose he allocates slightly over 50 000 PLN.

In what, and how, we invest

The respondents' answers clearly indicate WSE shares (up to 81,2%). Bank deposits (24,2%) were in second place and New Connect shares (22%). Forex took only the fifth place with the 14,9% result. However, it should be remembered that SII, which is the author of the study, specializes in the stock market.

At the end of the entire list of instruments, a new item appeared - cryptocurrencies. As many as 6% of the respondents, i.e. over 230 people, declared that they invest in this type of asset.

The study also poses a question about the investment time horizon (in the context of the action). The dominant answer is "to year" (43,3%), and "Over a year" (39,5%). Is this the result of consolidation on the WSE? Day-trading, which is certainly the most popular in the context of Forex / CFD, was marked by only 4,2% of respondents.

We invest. Even though we don't trust ...

An exceptionally interesting element of the research is the indication by the respondents of the weakest features of the domestic capital market. The leading answer for many years is Belka tax, but in the second position this year was the answer "Market crimes". It was chosen by 36,6% (1434 from 3918 people), while last year only 20,8% gave this answer.

In the question about enrollment in the PPK (Employee Capital Plans), the vast majority declared that they would not do it. When asking why - over 50% expressed a lack of trust in state solutions.

This clearly shows how little confidence we have in the domestic capital market and the ideas presented by the government. Will anything be able to change this, especially in the face of the ongoing "KNF scandal"?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)