US CPI reading: understand inflation and its impact on investment portfolios

Inflation is a key metric that traders and investors watch for its effect on portfolios. This impact may be direct – in a situation where high inflation absorbs the return on investment – or indirect, when changes in central bank policy affect individual asset classes in different ways. So it's worth discussing the different measures of inflation, the key indicators to watch, and how to use inflation information in an investment context.

What is inflation?

Inflation is an indicator of the increase in prices over time, which in everyday life is usually felt in the form of higher prices of goods in stores during a given period. In technical terms, inflation refers to an increase in the price of a basket of selected goods and services in an economy. In other words, it is the rate of decline in the purchasing power of a particular currency over a period of time, as rising prices mean that less goods and services can be bought with one dollar than before.

There are a number of factors that can cause inflation, ranging from changes in food or energy prices or disruptions in the supply chain to an increase or decrease in the supply or demand of money. In general, inflation can be either demand-driven or cost-driven. Demand inflation demand-pull inflation) occurs when the level of demand for goods and services exceeds short-term supply. Entrepreneurs respond to increased demand by increasing prices. cost-cost inflation cost-push inflation) is associated with supply shocks, as a result of which rising production costs are transferred to consumers by increasing the prices of goods and services.

Inflation measures - CPI, PCE, PPI

Inflation in the United States is measured by several different agencies, each of which uses its own indicators. The most common is the Consumer Price Index or CPI. Consumer price index) measured by the Bureau of Labor Statistics (BLS) and published around the middle of each month.

Another popular measure of inflation is the Personal Consumer Expenditure Price Index or PCE. personal consumption expenditure index), measured by the Bureau of Economic Analysis (BEA) and published at the end of each month. Historically, it has been rare for the two measures of inflation to differ significantly, but this has recently changed.

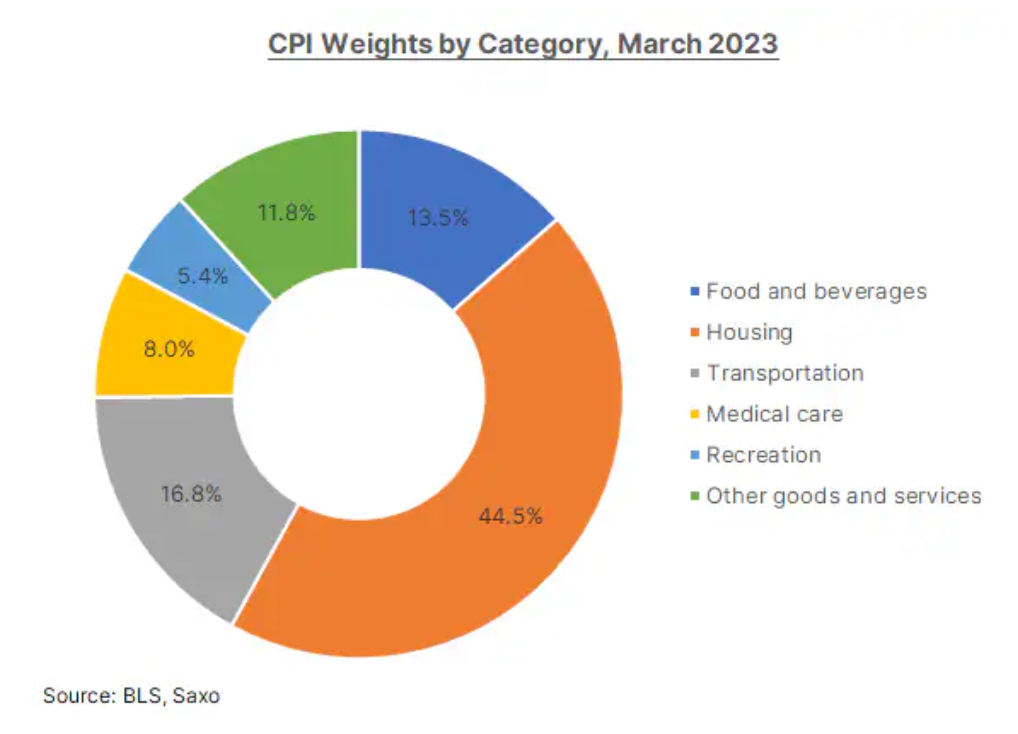

Essentially, the CPI measures the change in direct spending by all urban households in relation to a defined basket of goods and services. All expenditure items are divided into over 200 categories forming eight basic groups: food and beverages, housing, clothing, transport, medical care, recreation, education and communication, and other goods and services. The three largest components of the CPI are housing, transport and food/drinks.

However, monetary policy makers prefer to focus on the (core) PCE as it is said to better reflect recent consumption trends, given that the CPI formula, until recently, only updated item weights twice a year (and from 2023 - only once a year), while the PCE index - every quarter. As a result, PCE effectively reflects substitution effects whereby consumers start to buy other products due to relative price differences, therefore the CPI is usually higher than PCE because it does not capture the process of substituting products with cheaper alternatives.

Another reason for preferring the PCE index is that it takes into account spending by both urban and rural consumers as well as spending by third parties on their behalf, unlike the CPI, which defines consumption spending more narrowly and only made directly by consumers.

While CPI and PCE measure inflation from the consumer's point of view, there is a third measure, the Producer Price Index or PPI. Producer Price Index) – also published by BLS, presenting inflation from the perspective of producers. The PPI measures the average change over time of the selling prices received by domestic producers for their products.

Inflation measures – core and core

Other common terminology includes headline inflation (Ang. headline inflation), which reflects the general change in the price level, and core inflation excluding the most volatile prices (Ang. core inflation), calculated excluding changes in the prices of certain commodities known to be volatile or seasonally volatile, such as food and energy prices.

However, in the case of core inflation as measured by the median or trimmed mean (Ang. underlying inflation) the components of inflation showing the lowest or highest price changes in the basket are excluded in order to eliminate immaterial distortions or transitory factors. If, for example, a hurricane causes a significant change in, say, the price of apples, or a yearly subsidy to medical services causes a temporary decrease in health care costs, then these effects must be eliminated to get a true picture of the "underlying" price pressure in the economy.

Why is inflation so important to markets?

It is easy to understand that inflation affects consumer spending because it reduces their purchasing power. However, some implications are also unavoidable for investment portfolios, as inflation can also reduce the value of the return on investment. In addition, inflation drives central banks to act, as it is usually their responsibility to bring inflation down to a long-term target. Therefore, central banks try to control inflation by regulating the pace of economic activity by raising or lowering short-term interest rates. This has a different impact on individual asset classes.

The Federal Reserve has a dual duty of maintaining maximum employment while maintaining price stability. in 2012 FOMC published a communication on the long-term goals and strategy of monetary policy (Statement on Longer-Run Goals and Monetary Policy Strategy), in which he set a long-term inflation target of 2%. However, in August 2020, a flexible targeting system for average inflation was adopted, under which inflation may be above 2% for a period of time until the average returns to 2%.

How to use CPI readings in an investment context?

The most frequently used instruments for expressing opinions on US inflation are:

- US Dollar and other currency pairs with USD such as USD/JPY or EUR / USD

- US Treasuries,

- Commodities quoted in USD,

- Indices such as NASDAQ or S & P 500,

CPI readings are usually watched closely by traders and investors as they influence the central bank's decision to raise or lower interest rates, which strongly affects market sentiment across asset classes. The actual inflation reading is compared not only with the central bank's target, but also with the market forecast.

Typically, inflation above the central bank's target or public expectations leads to a tightening of monetary policy, which has a negative impact on equities (due to expectations of weaker economic activity) and the face value of fixed income investments (due to expectations of higher yields), as well as a stronger currency. On the other hand, inflation data below expectations or target may trigger monetary easing, which will push stocks and bonds up while the currency may come under pressure. On such key data/event release days, investment strategies such as momentum trading or fade the data trades, discussed in article on the US report on employment in the non-farm sector. Options trading is also quite popular on the days of the CPI release due to the increase in volatility.

It is important for investors to consider the impact of inflation on portfolio return and to maintain a constant allocation to inflation-healing assets to hedge the portfolio against unexpected spikes. Popular inflation hedges include inflation-protected bonds such as Treasury Inflation-Protected Securities (TIPS) or floating rate bonds (so-called floaters), raw materials or real estate. Gold also tends to perform well when real interest rates are low or negative, i.e. when inflation is high but interest rates are still low.

About the Author

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

Charu Chanana, market strategist in the Singapore branch Saxo Bank. She has over 10 years of experience in financial markets, most recently as Lead Asia Economist in Continuum Economics, where she dealt with macroeconomic analysis of Asian emerging countries, with a focus on India and Southeast Asia. She is adept at analyzing and monitoring the impact of domestic and external macroeconomic shocks on the region. She is cited frequently in newspaper articles and appears regularly on CNBC, Bloomberg TV, Channel News Asia, and Singapore's business radio channels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)