Reduced oil production and a strong dollar in the spotlight

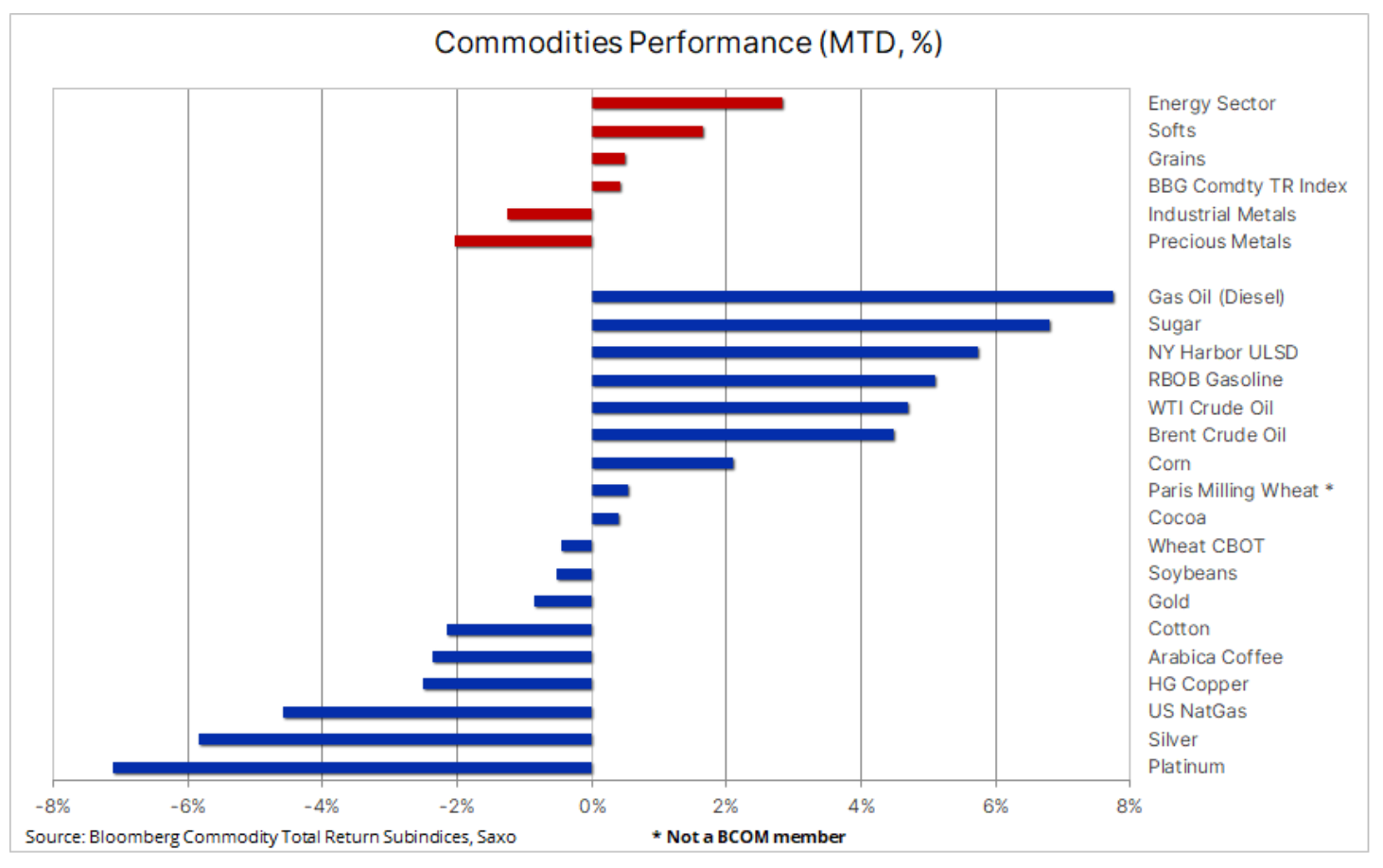

In the first full week of September, there were three significant developments that affected commodity prices: general sentiment soured as the dollar hit a six-month high and near record high against the Chinese renminbi, Saudi Arabia and Russia extended their current voluntary production cuts until the end of the year , and the prospect of a favorable scenario of peak interest rates in the United States was pushed to the background after economic data once again showed the strength of the economy. Essentially, these events made the Bloomberg Commodity Overall Return Index (Bloomberg Commodity Total Return) saw a slight increase on a monthly basis, with the strengthening of crude oil and fuel products offsetting losses in precious and industrial metals.

Essentially, these events made the Bloomberg Commodities Index of Overall Return (Bloomberg Commodity Total Return) recorded a slight increase on a monthly basis, and the losses of precious and industrial metals were offset by the increase in the prices of the so-called soft products, cereals and, above all, energy, led by diesel and petrol.

Crude oil and fuel products

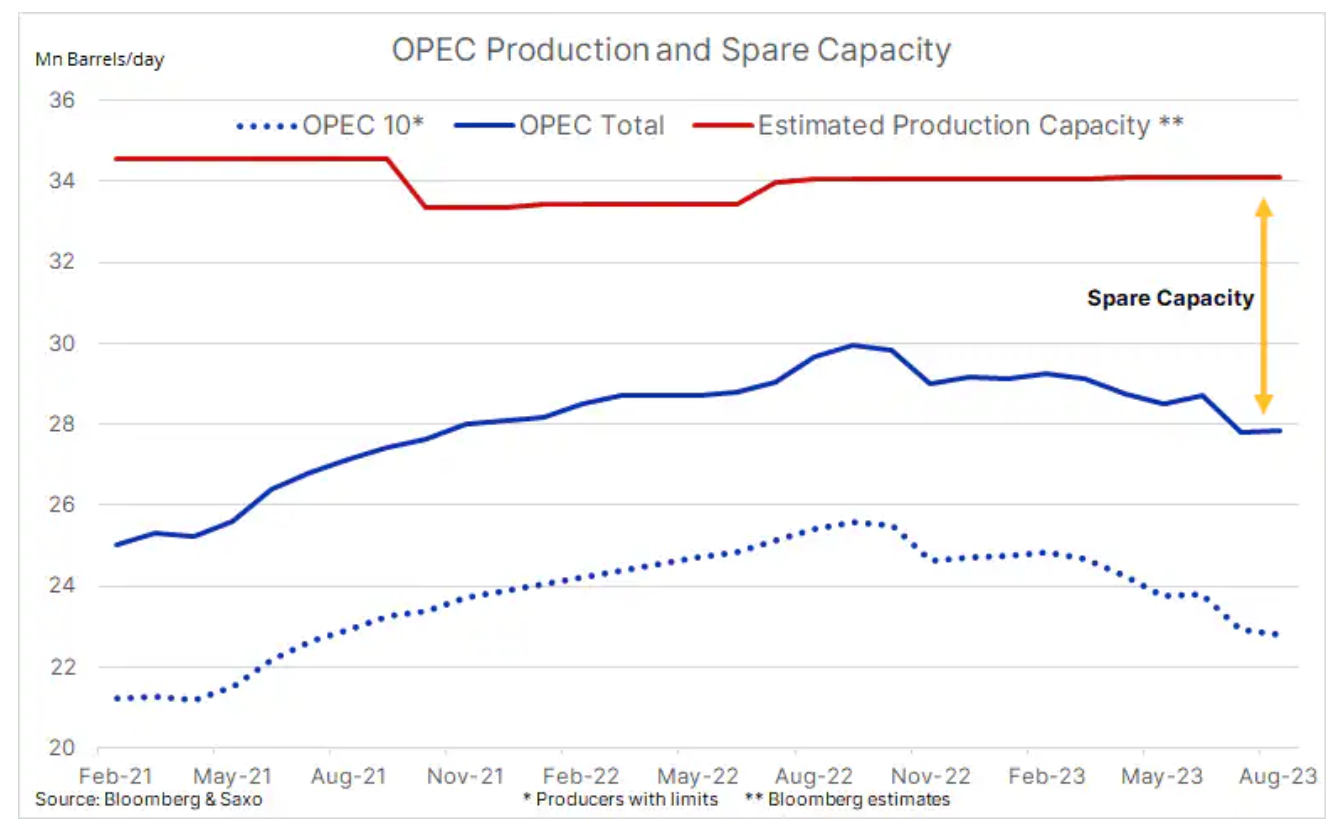

The biggest news in commodity markets this week was the decision by Saudi Arabia and Russia to extend their current voluntary production and export cuts until the end of the year. Although the cuts were expected to be extended, the fact that they lasted for three months instead of the usual one month surprised the market and the political decision contributed to price increases oil and fuels due to the next wave of buy orders from traders looking for further upward momentum. Artificial supply constraints - it should be noted that OPEC production reserves have exceeded 6 million barrels, the highest level since 2015 - are likely to tighten further by October, when refinery demand for crude oil will decline due to maintenance.

In addition, limited supply continues to be felt in the refined market, where higher prices could drive inflation up in the coming months, thus supporting interest rate hikes by the US Federal Reserve, thus increasing the risk to growth and demand through 2024. Futures on Friday Diesel oil prices in the US and especially Europe surged, supporting a Brent crude rebound above $90 after Russia announced plans to cut diesel exports from its key western ports by a quarter this month due to the aforementioned seasonal refinery maintenance and to keep more fuel in the country to prevent price increases. The European ICE Gasoil futures traded at $131 a barrel, an eight-month high, while the New York Ultra-light Sulfur Diesel futures traded above $138 a barrel.

From a technical point of view, Brent crude oil has been on an upward trend since July and must maintain support at USD 89, as a breakout could result in the liquidation of long positions towards USD 87,50 by traders who decided to place buy orders after the news about the extension of production cuts. However, the medium-term uptrend remains stable, with trendline support near USD 85, potentially representing the bottom of a new, higher range supported by OPEC's active supply management. We do not join the supporters of the price of USD 100 per barrel, but we do not rule out a relatively short period in which the price of Brent crude oil may exceed USD 90.

Precious metals

The trend in the precious metals market continues to be shaped by economic data coming out of the United States, as it will ultimately determine the direction the US Federal Reserve decides to take on interest rates. Weaker-than-expected economic data helped end the August rally as it fueled expectations of peaking interest rates and subsequent rate cuts in 2024, forcing investors to cover short positions created in response to the rise in the dollar and bond yields.

The deterioration in US economic data proved to be temporary and last week the PMI reading - in both the manufacturing and services sectors - showed improvement, with the headline and prices paid component of inflation exceeding expectations, thus again increasing the likelihood of a quarter-point Fed rate hike in November to over 50%, and with it the probability of another delay in the implementation of the favorable peak interest rate scenario for precious metals.

The sharp shift in interest rate expectations has helped boost bond yields while reducing the number of expected 25-basis-point rate cuts next year from five to four. However, the dollar remains one of the main sources of inspiration for gold traders, and last week the Bloomberg dollar index, which monitors a basket of 11 major currencies, reached a six-month high. The spike in oil prices following Saudi Arabia's decision to extend its unilateral production cut until the end of the year likely prevented gold from weakening even further, as it contributed to a rise not only in inflation but also in concerns about economic growth.

At Saxo, we patiently maintain an optimistic outlook on gold, and therefore also on silver. We believe that in the coming months, the price of the yellow metal will eventually reach a new record. The timing of the new upside momentum will however remain heavily dependent on the US economic data as we wait for the FOMC to switch from rate hikes to rate cuts; until then, as before, we will probably see further chaotic actions of traders in the market.

After finding trendline resistance at $1, gold returned to testing the two-hundred-day moving average, currently at $947, ahead of the $1 level, the 918 Fibonacci correction of the August rally line. Basically, the metal is stuck in a narrowing range, currently between $1 and $910.

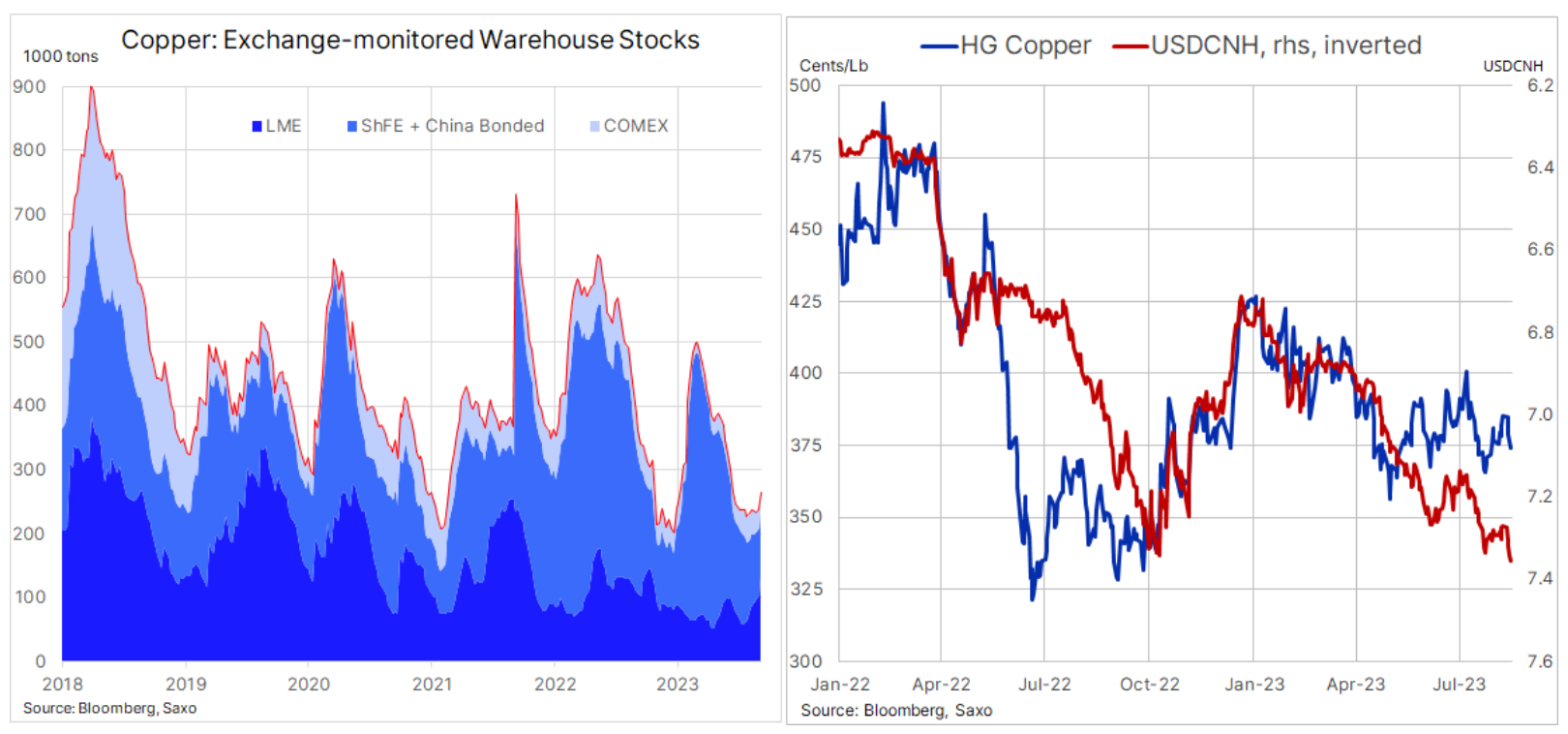

Copper

Futures contracts for copper listed on the London and New York stock exchanges headed for a weekly decline of 2,5% after sentiment deteriorated as the dollar strengthened, primarily against the Chinese renminbi, which approached a record low amid concerns about China's economic growth. The largest increase in copper inventories on the London Metal Exchange in two years, amounting to almost 30% contributed to negative sentiment, although the overall level of inventories monitored by the exchanges in New York, London and Shanghai remains historically low.

China's commodity imports surged last month amid the expected seasonal recovery in economic activity. Due to the fact that the effects of government fiscal stimuli are also beginning to be visible on the raw materials market, as well as the liquidation of inventories for many months in the face of uncertain economic forecasts, the prospect of the implementation of further stimuli indicates a period of replenishing inventories to meet future demand for finished products. Imports of coal and copper ore rose to record levels, imports of crude oil reached the third highest level on record, and imports of iron ore are at their highest level in three years.

Fundamentally, copper remains resilient, and despite stagnant manufacturing PMIs - typically well correlated with copper demand - Chinese demand remains surprisingly strong. He contributed to this strong and government-backed green transition demand for batteries, electric traction motors, energy storage and grid modernization.

Long-term investors continue to point to the lack of major mining projects that would ensure a steady stream of future supplies. This confirms our structural long-term constructive outlook as green transition metals demand grows and mining companies face rising input costs due to higher diesel and labor costs, ore grade deterioration, rising regulatory costs and interventions and significant climate change causing disruptions ranging from floods to droughts.

For now, as with gold, we remain patiently optimistic with HG Copper still trading in the $3,50-$4 range. In the short term, price direction will primarily be influenced by changes in the Chinese Yuan exchange rate, as speculative investors who currently hold a small net short position in HG copper will continue to adjust their positions accordingly.

Agricultural products

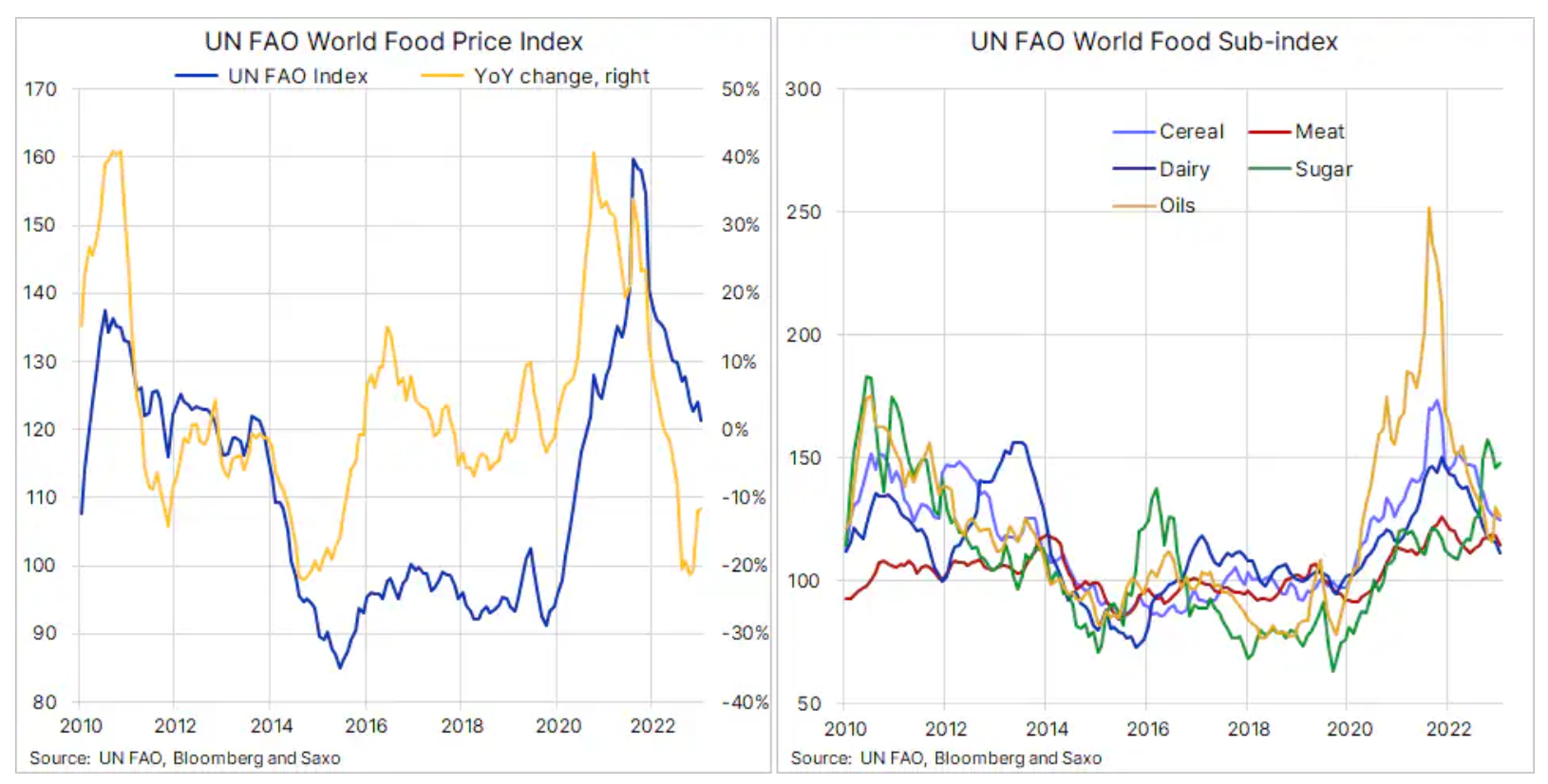

Despite recent strengthening in rice and sugar due to export restrictions and the impact of hot weather on production in Asia, the FAO Global Food Price Index continued its gradual decline last month. This index, which tracks over 90 price quotations divided into five groups: meat, dairy products, cereals, vegetable oils and sugar, averaged 121,4 points in August, which means a decline of 2,1% on a monthly basis and of 11,8 % compared to the same period last year.

The index has suffered a steady decline since reaching a record high in March 2022, when Russia's attack on Ukraine sent prices of wheat, corn and edible oils soaring. Since then, supply forecasts have been improving, and despite concerns that El Niño could negatively impact agricultural production in Asia and South America in the coming months, harvests in the Northern Hemisphere appear to be strong enough to prevent any short-term price spikes.

Turning to the FAO index, last month's decline reflected declines in all groups except sugar, which strengthened on drought fears in India and Thailand. In the cereals group, there was a sharp divergence between a 3,8% decline in international wheat prices and the FAO General Rice Price Index, which rose 9,8% month-on-month to a 15-year high amid tight global supplies ahead of a new harvest and a July ban on exports of white rice indicates w Indian.

Nuclear versus offshore wind

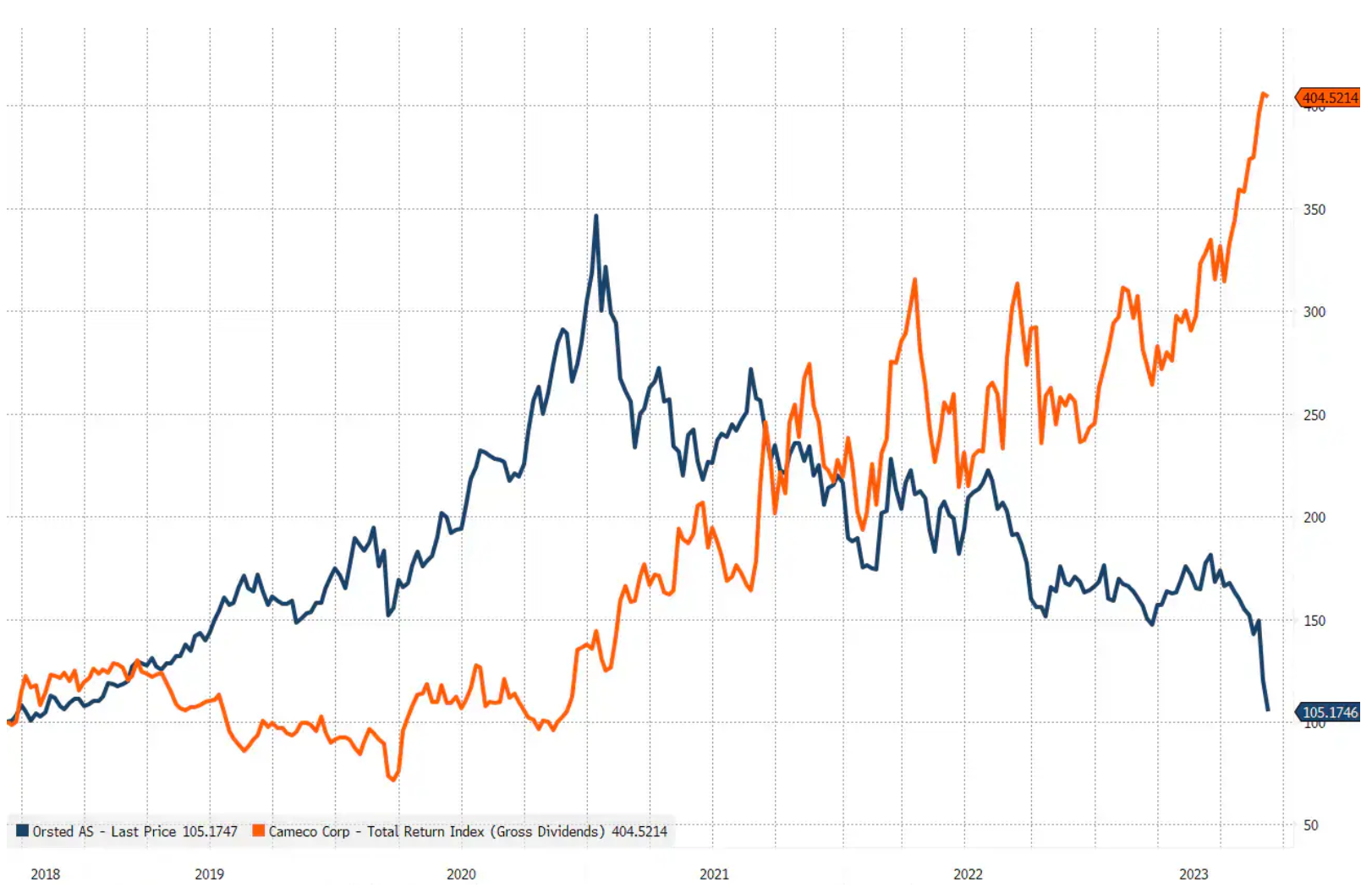

A strong slump in the share prices of the Danish company Orsted caused significant problems of the company's ventures in the field of offshore wind energy in the United States put offshore wind energy into question in the context of the green transformation. Worse still, Orsted said it would have to abandon some of its offshore wind projects if it didn't get more tax breaks in the United States. In addition, this week the British government has not received any offers regarding the latest offshore wind project after warnings from potential contractors that the assumptions did not take into account rising costs.

In August, the segment recording the best results was nuclear energy, and a chart comparing the results of Orsted (one of the world's largest constructors of offshore wind farms) and Cameco (one of the world's largest uranium miners and suppliers of nuclear energy technologies) shows a major change in sentiment. Our view on nuclear power remains positive as we see policy makers concluding that nuclear power is the only zero-carbon, large-scale, high-energy-density solution that can significantly increase the base load. Given this year's installed capacity of solar panels, it seems more and more certain that solar energy will prove to be the long-term winner in the renewable energy market.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)