Options: Extended rack strategy - Long and Short Strangle

In the previous post on options, we mentioned rack strategywhich allows you to earn in the event of high volatility. However, its disadvantage was the relatively high costs of buying call and put options, the strike price of which is close to the current market price (ATM). This article will introduce a slightly modified frame. The strategies are called extended rack (long strangle) and inverted extended rack (short strangle). Therefore, long strangle stratega allows to reduce costs, but the cost is lower probability of profit realization.

Check it out: Options - how to invest with them [Introduction]

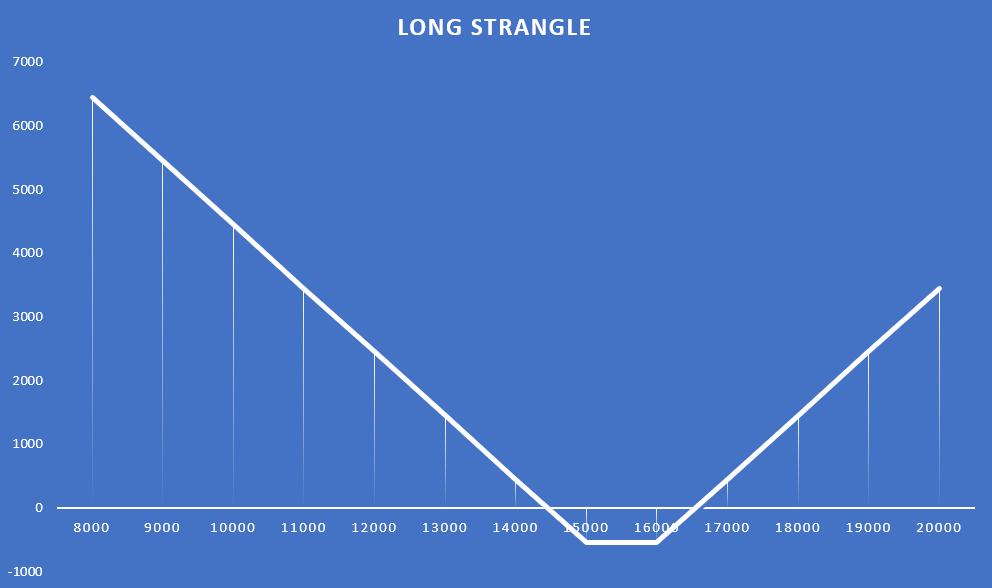

Long strangle strategy

As mentioned before, the extended rack strategy is a modification of the basic rack strategy. Instead of buying a call and put option with the same strike price, a strategy is created with options with different strike prices. Most often, the strategy is created after the simultaneous purchase of call and put options, which are "out of money" (OTM). This solution allows to significantly reduce the costs of the strategy. However, nothing is for free. The Break-even Potentials (BEPs) are much further from the current price than is the case with the "classic" rack strategy. As a result, the investor receives a lower potential loss (premiums for OTM options are lower than for ATM options), but the strategy's cost is much lower probability of making a profit. It is also worth remembering that the strategy should be built during the period when the implied volatility is lower (options are relatively cheaper).

Example

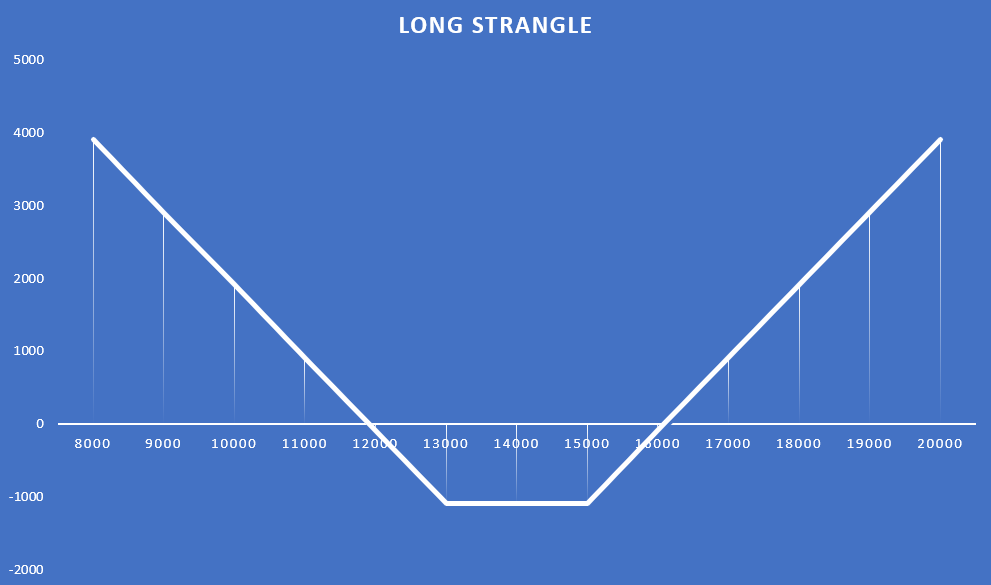

On January 12, the course DAX index it hovered around 14 points. The investor decided to build an extended rack strategy by purchasing a call option with an exercise price of 000, the premium of which was 15 points. At the same time, he bought a put option with an exercise price of 000 points, paying 442 points. Both options were to expire on September 13, 000. Thanks to the option with a longer execution period, the investor had 643 months to realize the positive scenarios. These scenarios include a decline in the DAX index below 17 points (a decrease in the index by 2021%) or an increase above 8 points (an increase in the index by 11%). Below is a graphic presentation of the said strategy.

As of August 27, 2021, there are only three weeks to exercise the call and put options. The DAX index at the end of the day was 15 851 points. The call option price rose to 882 points. On the other hand, the increase in the DAX 30 index caused the put option to drop to 7,90 points. If the investor wanted to sell these options, he would get 889,9 points. This would mean a trade loss of 195,1 points (before commissions).

Asymmetrical strangle

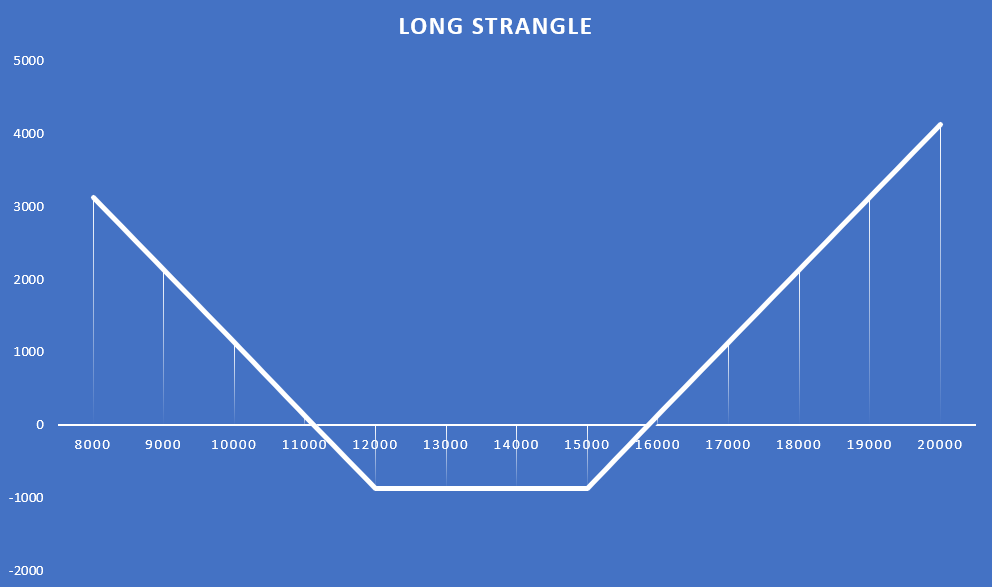

As a rule, it is assumed that the distance between the two options should be the same (the investor is not sure of the direction). However, nothing prevents you from "outweighing" one side. It may be that the strike distance of one option will be closer to ATM than to the other. In the case of the earlier strategy, it might look like this:

- On January 12, purchase of a call option with an exercise price of 15 - price of 000 points;

- on the same day purchase of a put option with an exercise price of 12 - price of 000 points.

As a result, the profitability profile of the strategy has changed. The "zero" points have been shifted to the left. The investor will earn in a situation when the DAX 30 drops below 17 11 points (a decrease by 133%) or when the index rises to the level of 20,48 points (an increase by 15%) by 867 September.

If the investor wanted to sell his options on August 27, 2021, he would receive a total of 885,5 points, which would give a net profit of 11,5 points gross. As a result, the return on investment would be only 1,32%. As you can see, despite the limited costs of the strategy, it is necessary to change the underlying instrument very rapidly.

Creating a strangle "in installments"

The book strangle strategy requires the simultaneous purchase of call and put options, which are OTMs. However, sometimes a trader can create a strangle as a result of an optimization strategy. What could it look like? The investor chose a directional strategy, which is to buy a call option. After some time, the price of the underlying instrument rose. This resulted in an increase in the value of the call option and a decrease in the prices of put options (the impact of volatility was omitted). The investor is concerned that a market correction may appear soon. At the same time, he does not want to get rid of the call option. For this purpose, he acquires a put option which is OTM. In the event of a decline in the price of the underlying instrument, the put option grows, which partially covers the losses on the call option. In the event that the price does not decrease (stay the same or increase), the investor will suffer a loss on the put option.

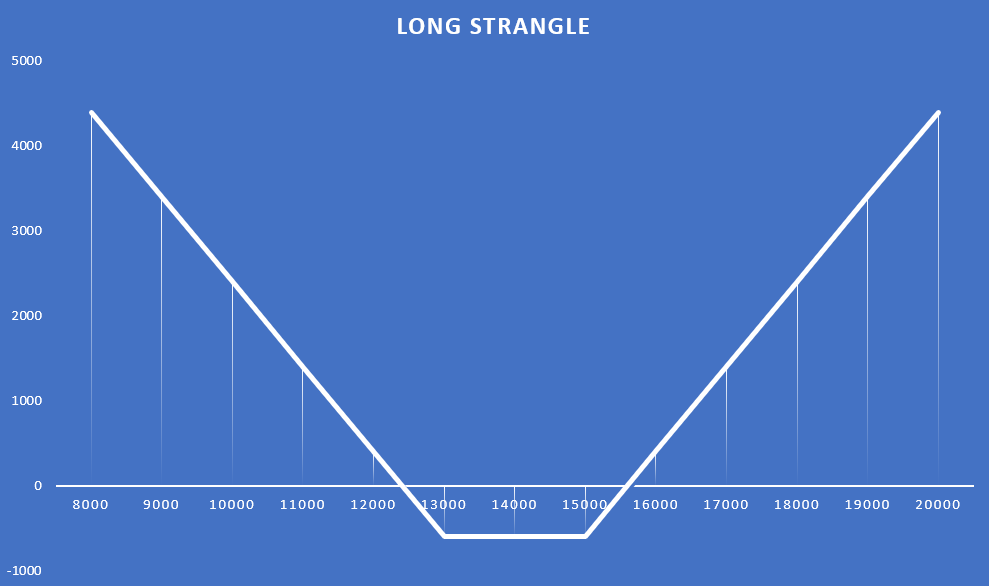

An example can be once again a transaction on options on the DAX 30 index. On January 12, the investor buys a call option with an exercise price of 15 points. The premium paid for the option was 000 points. The option expires on September 442, 17. By April 2021, 16, the index had increased to 2021 points. The investor, fearing a possible downward correction, purchased a put option with an exercise price of 15 points. The option expires on September 500, 13 and its value at the time of purchase was 000 points. As a result of this transaction, an extended rack formation was created with the following appearance:

The maximum loss on the transaction is 597 points. As a result, the investor will earn if the exchange rate drops below 12 points and above 403 points. If the investor wanted to close the position on August 15, he would receive 597 points, i.e. he would have a profit on the transaction of 27 points. Thus, the profitability of the transaction would be 889,9%.

You can also imagine a transaction of an extended rack created in installments by buying a put option, which is ITM (has an intrinsic value). An example is the purchase of a put option on April 20 with an exercise price of 16 points and expiring on September 000, 17. At the time of buying the option, the DAX was around 2021. The transaction price of the option was 15 points. The intrinsic value of the option was approximately 350 points (1103-650).

Interestingly, despite paying over 1500 points for both options, the maximum loss for such transactions was 545 points. This is because when the second leg of the rack was built, both options were ITM. So when the option expires, which one will be "in money". The payout pattern is:

As you can see, the investor will generate a loss on the transaction when the DAX rate will be between 17 and 14 points on September 455. As you can see, the profitability area has been shifted to the right in relation to the previous trade.

In a situation where an investor would like to sell his options on August 27, he would receive 882 points from the call option and 260 points from the put option. Total option income would be 1142 points. The cost of the strategy was 1545 points. As a result, the loss on the said transaction would be 403 points.

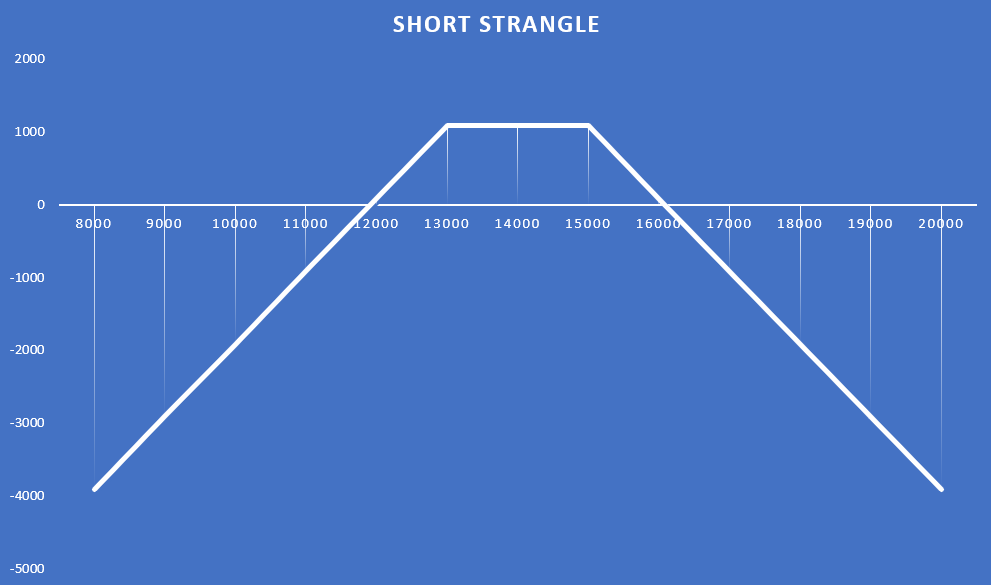

Short strangle

This is an "inverted extended rack" strategy that offers the opportunity to make a profit in low volatility. Short strangle is built using two options: put and call. Both are to have the same expiration time and are OTM. The investor sells these options (short position on call and put options). As a result, he receives a bonus that is his maximum profit. The potential loss may be many times greater than the potential profit. A loss will arise when the price of the underlying instrument rises or falls sharply. The best situation for short strangle players is when a trade is assumed in a situation of high volatility (options valued with a higher time premium) and then the market begins a narrow consolidation (low price volatility). Periods when implied volatility is below the historical average are a weak time to issue call and put options.

Below is an example of a short strangle strategy in which the investor issues two call and put options on January 12, 2021. Both options expire on September 17, 2021. More detailed information on the options listed below:

- call - execution price 15 points, bonus received 000 points;

- put - execution price 13 points, bonus 000 points received.

As a result, the investor will receive a maximum profit of 1085 points when the DAX at the end of September 17, 2021 is between 13 and 000 points. At the same time, the profit area is between 15 and 000 points. The payout profile is as follows:

Short strangle as a defense strategy

Sometimes the short strangle strategy may emerge as a defensive strategy. Such a strategy may arise when an investor has made a call option that is loss-making. At the same time, he expects a side move or a slight decline in the underlying instrument to be more likely now. As a result, he may issue a put option that is "in money" to partially cover the loss.

As an example, we can use the example on options on the DAX 30 index. On January 12, 2021, the investor put a call option on the DAX 30. The strike price is 15 points. Thanks to this, the investor received 000 bonus points. On April 442, the price of the call option rose to 20 points. This meant a loss of 826 points. The investor decided to issue a put option with an exercise price of 384 points. Thanks to this transaction, he received 16 points. This made it possible to cover losses from the call option. However, the cost of doing so is to expose yourself to the risk of loss in the event of a further sharp change in the underlying asset. In the case of writing the call option, the sharp drop in the DAX rate was beneficial for the investor. Currently, a profit on the transaction will be possible only when the index price is between the level of 000 1103 and 14 455 points. The chart showing the profit and loss profile of such a strategy looks like this:

Summation

The long strangle strategy is intended for investors who are not sure in which direction the price of the underlying instrument will go. At the same time, the investor assumes that the price of the instrument will change rapidly. Buying options with different strike prices that are OTM is "cheaper" than the regular rack strategy (both options are ATM). However, the cost is a larger area of potential loss. For this reason, the expected price movement must be very large. It is best to build a strategy in periods when implied volatility is low. Then the time premium for the option is lower than "under normal circumstances". This reduces the cost of the strategy and can increase the likelihood of achieving a profitable trade.

In the case of the short strangle strategy, the trader only earns if the price of the underlying instrument does not move too rapidly. At the same time, short strangle has a higher probability of generating profit than is the case with the short rack strategy. This is due to the larger "profit area". Short strangle should be assumed in situations of high implied volatility and expected market consolidation.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Feeder Cattle? [Guide] how to invest in livestock - feeder cattle](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-bydlo-hodowlane-feeder-cattle-300x200.jpg?v=1693821591)