The Sejm, GDP and inflation, or what may affect the zloty exchange rate this week

The previous week on the financial market in Poland was marked by the Monetary Policy Council (MPC) and another change in the perception of the future monetary policy that the Council and the president National Bank of Poland She served the markets with Adam Glapiński. Nowadays, almost no one has any doubts that the next one will be published by March "Inflation Report", interest rates in Poland will not change. Investors are also becoming more and more convinced that in 2024 the space for interest rate reductions in Poland will be rather small. This leads us to expect that the coming months and quarters will be good for the zloty.

EUR / PLN daily chart. Source: Tickmill

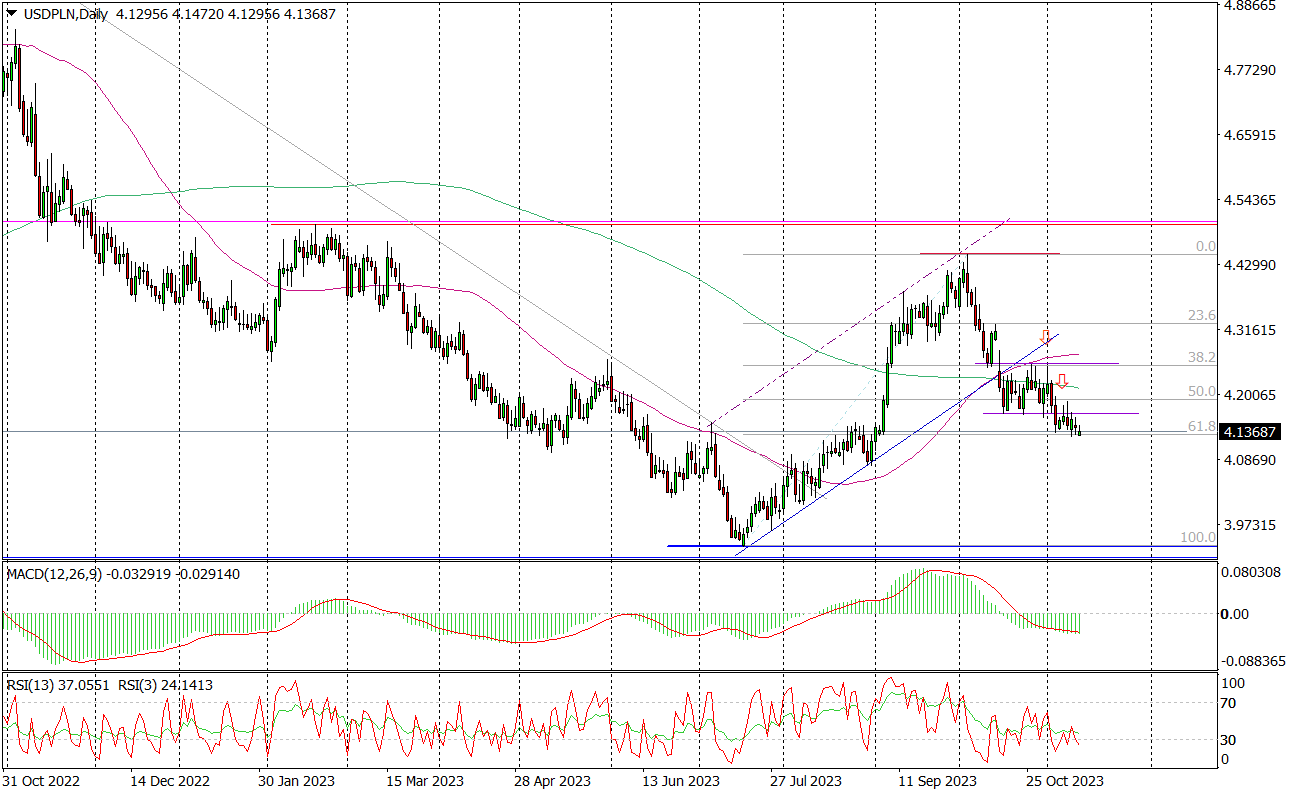

USD / PLN daily chart. Source: Tickmill

This week, domestic factors may once again influence the valuation levels of Polish assets. However, just like last week, this will not be the only factor determining their behavior. Especially when it comes to the Warsaw Stock Exchange.

The first session of the Sejm after the elections

The first session of the Sejm after the October parliamentary elections will take place today, which will trigger a major political change in Poland. Although we will probably have to wait until mid-December for a new opposition government, led by President Andrzej Duda, today's session of the Sejm may already trigger the political processes preceding the change of power.

September's data on Poland's balance of payments will also be published today, but they are unlikely to have a major impact on the mood.

This should be the impact of the preliminary data on the Polish Gross Domestic Product (GDP) for the third quarter of 2023, published on Tuesday. According to market forecasts, in the period July-September this year. the economy was growing at a rate of 2,2%. quarter to quarter and 0,3 percent year to year, after GDP recorded a decline of 1,4% in the second quarter. on a quarterly basis and by 0,6 percent on an annual basis. It cannot be ruled out that these results will be slightly better than forecast. Moreover, in the coming quarters, the economy is expected to enter a faster and, above all, more durable path of economic growth, which together may already give a demand impulse for the zloty, the Warsaw Stock Exchange and the Polish debt.

On Wednesday, October data on CPI inflation in Poland will be published, which, according to preliminary estimates, decreased to 6,5%. with 8,2 percent Y/Y in September. The meaning of this data will be neutral. Thursday's publication of core CPI inflation data should not cause any major emotions, as it will probably drop to 7,9-8%. with 8,4 percent a month earlier.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)