Platinum at the top, gold consolidating, oil under pressure

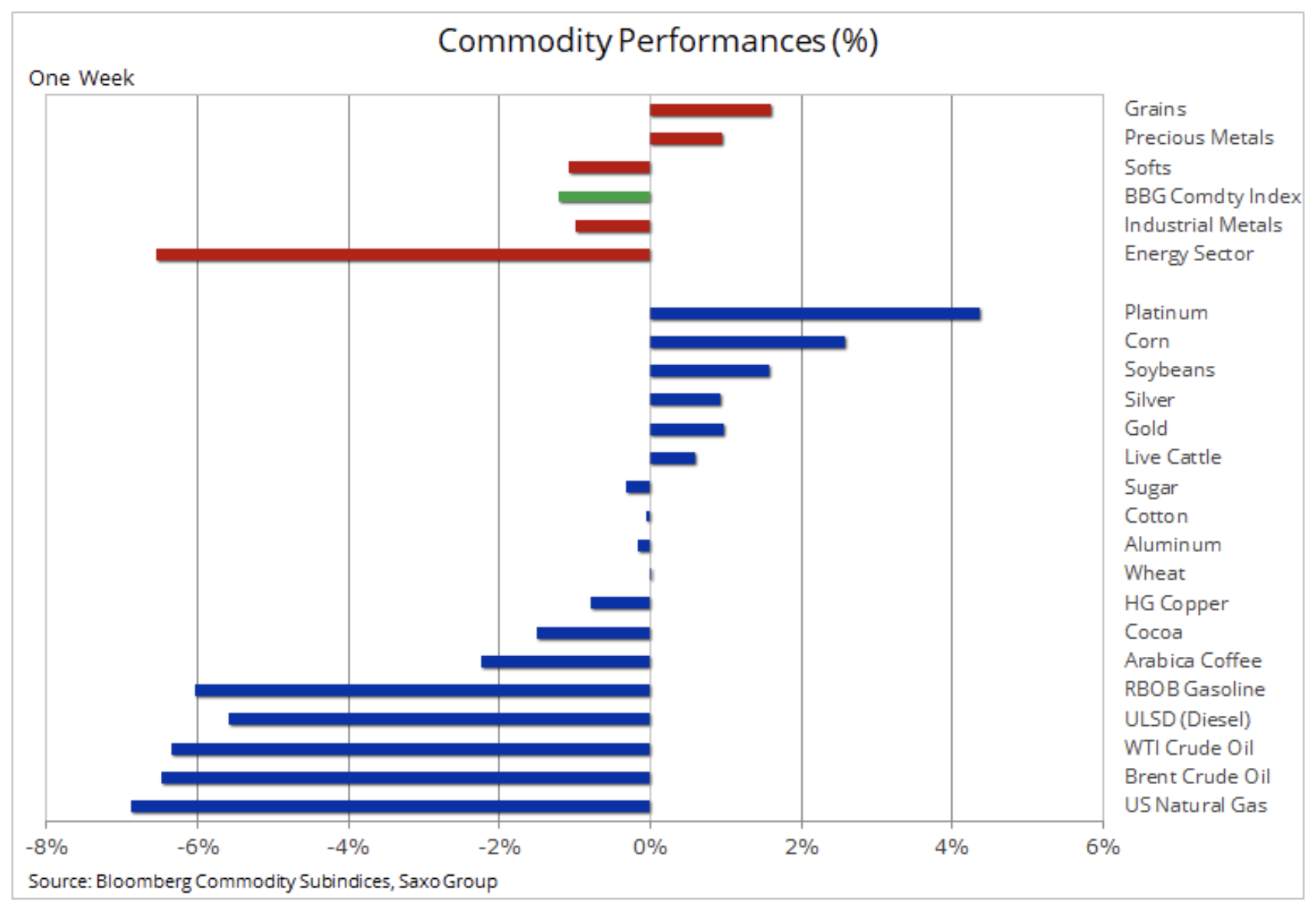

The Bloomberg Commodity Index, which monitors a basket of major commodities evenly broken down into energy, metals and agriculture, slipped for the second consecutive week. The risk appetite, as reflected by the behavior of US mega-capitalization stocks, ran into setbacks after a period of intense activity in July and August. Combined with the slowdown in the dollar's decline, the rise in coronavirus infections and concerns about the timing of the vaccine, this played a significant role in shaping the market.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Last week, the energy sector recorded the biggest losses, which amid signals of weakening fuel demand led to a downward revision in oil and fuel prices to better reflect the current fundamentals, which show signs of weakening. The cereals sector maintained strong momentum ahead of Friday's US government report, which was widely expected to confirm a decline in production due to unfavorable weather conditions and a decline in inventories driven by solid Chinese demand.

Precious metals continued to consolidate over a relatively wide range; both goldand silver showed an increase on a weekly basis. Signs of a worsening relationship between the US and China, along with continued demand for inflation hedging investments, as evidenced by strong gold demand through publicly traded funds, have helped offset the difficulties of an overall decline in risk appetite.

Platinum

Last week, she was at the top of the table platinum, which usually remains in the shade of gold. In its latest quarterly report, the World Platinum Investment Council (WPIC) has revised its forecast for 2020 from surplus to deficit. This report explained the changes caused by the pandemic, which limited access to recycled materials, as well as deliveries from South Africa - the world's largest producer - which translated into an increase in global risk, which both the Council and Saxo Bank predict that in it will continue to drive investor demand for hard assets.

Since the diesel scandal a few years ago, the ratio of platinum to premium gold has moved to a discount of more than $ 1 per ounce. While gold hit a record high, platinum did silver (another semi-industrial metal) remains well below record levels. In early 2008, platinum peaked at $ 2 / oz, then plunged by as much as 300% on the global financial crisis at the end of this year.

From an investment perspective, the biggest challenge for platinum remains its lack of liquidity, given that the metal market is much smaller than the gold market. This is one of the likely causes of a situation where platinum - despite a better outlook - has experienced weak demand from asset managers who operate in amounts that are difficult to obtain for this metal.

The key area of resistance is now between $ 1 / oz and $ 000 / oz, where there has been a rejection several times in the last three years.

Agriculture

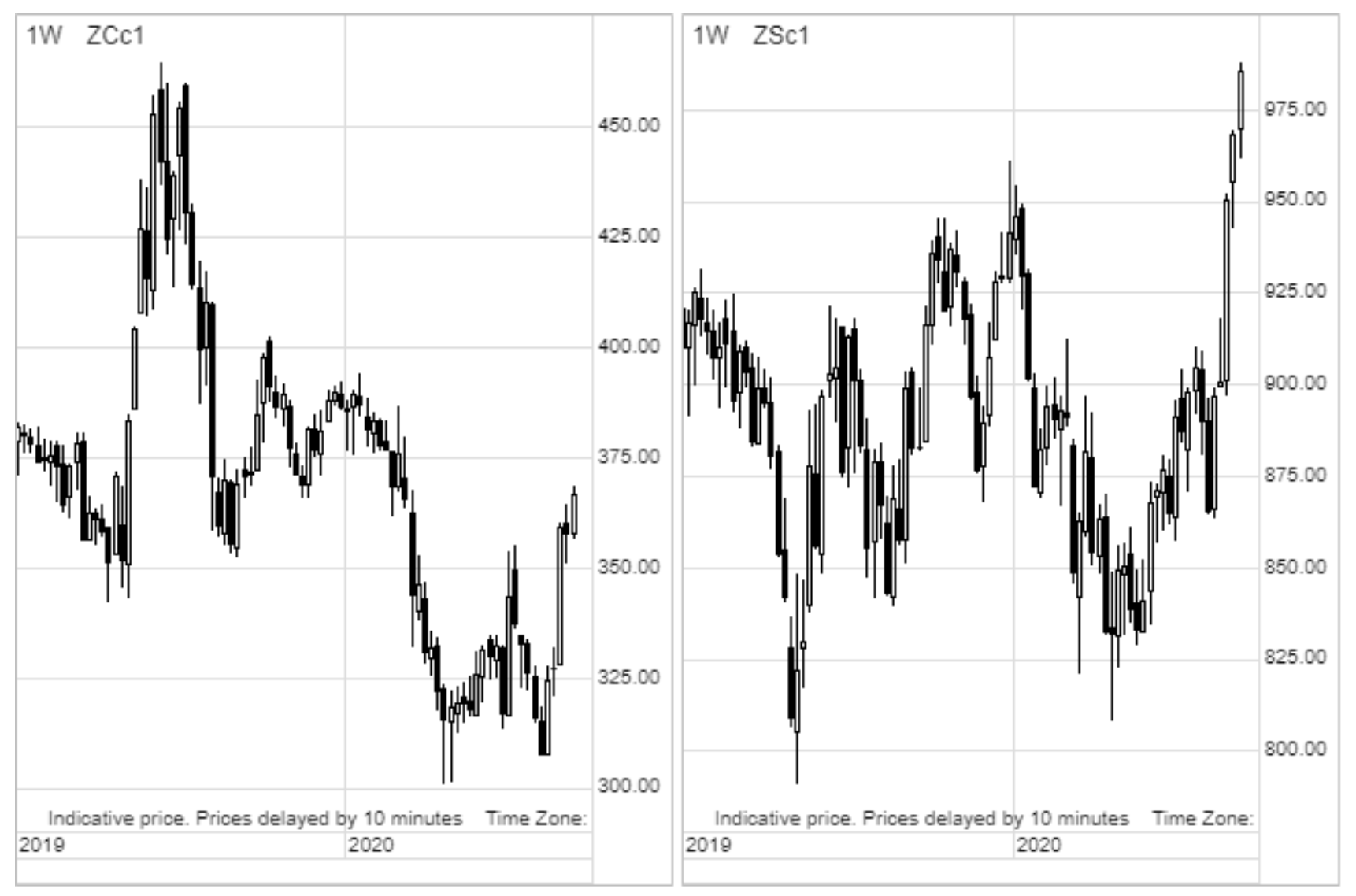

The cereals sector has posted strong gains over the past five weeks amid concerns over weather conditions, a weak dollar and solid Chinese demand, which together provided grounds for a boom. Total long position in Chicago-listed futures on corn, wheat and soybeans in the week ending September 1 reached 214 flights, about 000 flights above the five-year average for the same period. This is interesting because during this period of the year, funds tend to carry out net sales due to the lack of unknowns before the new harvest begins.

With this in mind, the market waited for the US Department of Agriculture's monthly report on production, yields and inventories to be released Friday. In a report on estimated global supply and demand for agricultural products (World Supply and Demand Estimates, WASDE) - Published after the finalization of this article - grain traders were looking for data to support the recent strong boom and long position growth across the sector.

Petroleum

Clothing remains under pressure from weaker fundamentals as the recovery in global energy demand continues to show signs of holding back. Many countries around the world, particularly in Europe and Asia, are currently facing the second wave of the coronavirus. As a result, the recovery in fuel demand has stalled due to working from home and the lack of business and vacation travel - indicating that it will take longer than expected to return to pre-pandemic energy demand levels.

During the sideways trend since June, the physical market data began to signal that price and current fundamentals were not moving at the same pace. Among other things, there was an increase contagion, and spot prices were increasingly discounted to the following month(s) as tanks filled up in response to low refinery margins caused primarily by the overhang of unattractive diesel and jet fuel. As a result, demand for tankers increased in the context of floating oil storage facilities, while Saudi Arabia lowered its official October sale price in response to a drop in demand from key customers such as China.

The adjustment was made possible by a deterioration in overall risk appetite, reflected in the correction of US tech stocks and the buy-back of the dollar. In the case of Brent crude oil, the technical impulse was to break the upward trend of June, which finally brought the price and fundamentals dynamics a bit closer.

We do not anticipate a new dramatic decline in crude oil, but we must acknowledge that the coronavirus and doubts over the timing of vaccination may delay the recovery towards $ 50 / b for Brent crude oil until next year. The inhibitory recovery in demand will affect the decisions of the OPEC + group, which increased production before demand recovered enough to absorb the additional volumes of barrels.

OPEC and the International Energy Agency (IEA) will provide fundamental guidelines for the oil market following the publication of their monthly oil reports on September 14 and 15, respectively.

Brent crude oil found support at the well moving average of $ 39,50 / b, however, as speculators have only just begun reducing bullish positions, a correction could push it back towards $ 36,50 / b before a support can be found. The overall level of risk appetite as reflected by the stock market and dollar developments will continue to be a key source of inspiration for traders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)