Poles in bank deposits are losing a record 4,7 percent.

On annual bank deposits, which ended in July 2021, their holders lost almost 4,7 percent. This is due to high inflation and a very low interest rate on deposits. As the study proves Individual Investor Pulse organized by eToro, of the 12 nationalities surveyed, Poles most often indicate that inflation is a threat to their investment portfolio. This is a good time to look for alternatives to bank deposits.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Inflation is raging, investments are a real loss

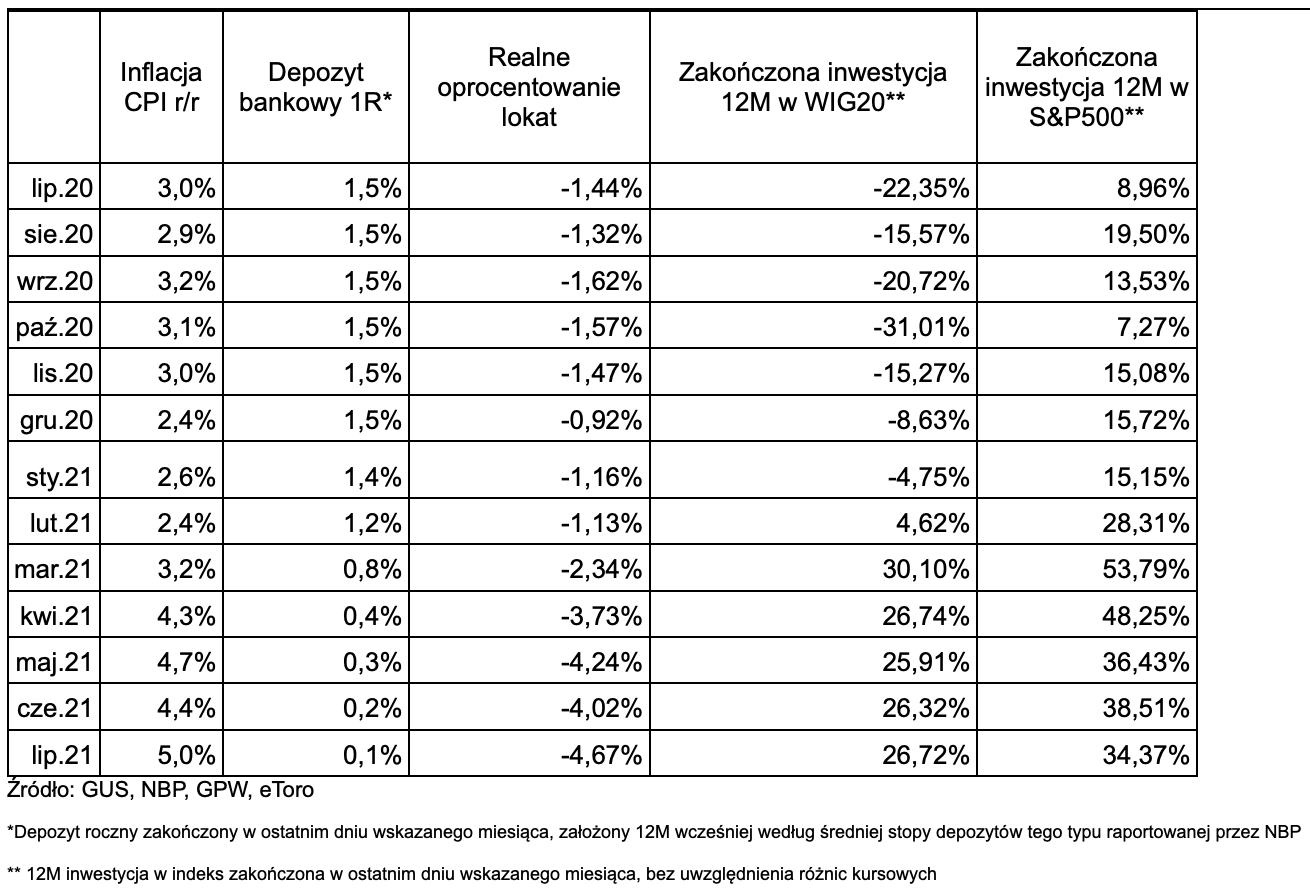

If in August 2020 we opened an annual deposit with a bank with an average market interest rate of 0,1 percent. (average interest on deposits 6-12 months according to NBP), after a year it turned out that we lost as much as 4,67 percent. - the value of our savings has actually dropped. This is due to the annual inflation, which at the end of July 2021 was 5%. y / y This is the highest real loss on investments observed in 15 years. In the previous months, losses were smaller due to lower inflation, as well as higher interest rates on deposits, which fell from 2020% from March to August 1,2. at 0,1 percent The coming months will bring further painful disappointment to bank deposit holders, as inflation will remain at a similar level and the average interest rate on annual bank deposits fluctuates around zero.

Poland has the second highest inflation in the European Union, so it is not surprising that Poles fear it the most. According conducted by eToro The survey of the Individual Investor's Puls is precisely the Poles who predict the further price increase to the greatest extent. As much as 50 percent. Poles believe that in the next year we will expect a significant increase in the prices of goods and services - this is a record reading, because the average for 12 countries is 30 percent. Another 41 percent. Poles believe that this increase will be small. In total, a further increase in prices is forecast by as much as 91 percent. Poles, with the global average of 85 percent. (with a predominance of small-height responses). It is worth emphasizing that inflation expectations are one of the main reasons for winding up the inflationary spiral. People who are afraid of a further decline in the value of money strive to spend it as soon as possible, and thus further increase inflation.

Bank deposits vs stock market indices

If we compare bank deposits with 12-month investments in the capital market (WIG20, S & P500), we can see that investors had much more opportunities to earn on the latter, but also to make losses. The US stock exchange S & P500 index in the annual periods ending from July 2020 to June 2021 brought from 7 percent. (10/2020) to over 53 percent. profit (03/2021), and it did not bring a loss in any period (we did not take into account the differences in the USD / PLN exchange rate here). It was different in the case of the WIG20 index, which brought losses in 7 out of 12 readings. He started to bring profits in the last 12 months from March 2021. Of course, this comparison is only indicative, because equity investments involve a much higher risk and are not a simple alternative to a bank deposit. Such an alternative could be a risk-controlled investment portfolio consisting of stocks and cash or bonds. It cannot be ignored, however, that the growing number of investors in the capital market are people discouraged from bank deposits due to their low interest rates. And the coming months with significant losses on expiring deposits can only strengthen this trend.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)