Broken Economic Models - Saxo Bank QXNUMX Forecasts

There is this famous quote: "If it ain't broke, don't fix it" – this seems to be the operating model of all central bankers and politicians since the 80s, with each market cycle repeating the previous cycle's policy response of stalling, sham moves, and further straining our already debt-saturated economies. The above quote should read more like:

"Why does it keep breaking down, and every time we try to make repairs, the damage just goes on and on?"

This quarterly forecast is devoted to this issue. With the start of the new year, the market is trying to return to global economic standards before the Covid pandemic and the outbreak of the war in Ukraine, another round of mass borrowing is taking place as interest rates fall and further hopes for inflation to subside.

Models to be corrected

In our opinion, this is a completely wrong vision of what the world needs. We think the models just broke. The same mechanisms that failed to predict rising inflation are now forecasting its peak, the peak interest rate rise Fed and a general return to higher returns on assets, bypassing issues such as the energy scarcity crisis (both in terms of base load and lack of investment) and the drive to diversify and deglobalize supply chains. From the perspective of mainly OECD countries, we are also dealing with the formation of new, dangerous, potential trade and financial alliances (Russia, China, India and Saudi Arabia), as well as with too low productivity, which is not able to ensure real growth or decrease inequality.

The same model for most of the second half of 2022 assumed a 2023% probability of a recession in the United States! With the beginning of XNUMX, it is already visible that the chances of a "soft landing" and shallow recession are even. The models just don't work. In 2022, it turned out that excess demand has decreased but not disappeared, and the supply function remains below demand, so there is a real risk that medium and long-term inflation will not reach the magic 2% or even 3%, but will most likely reach around 4 %.

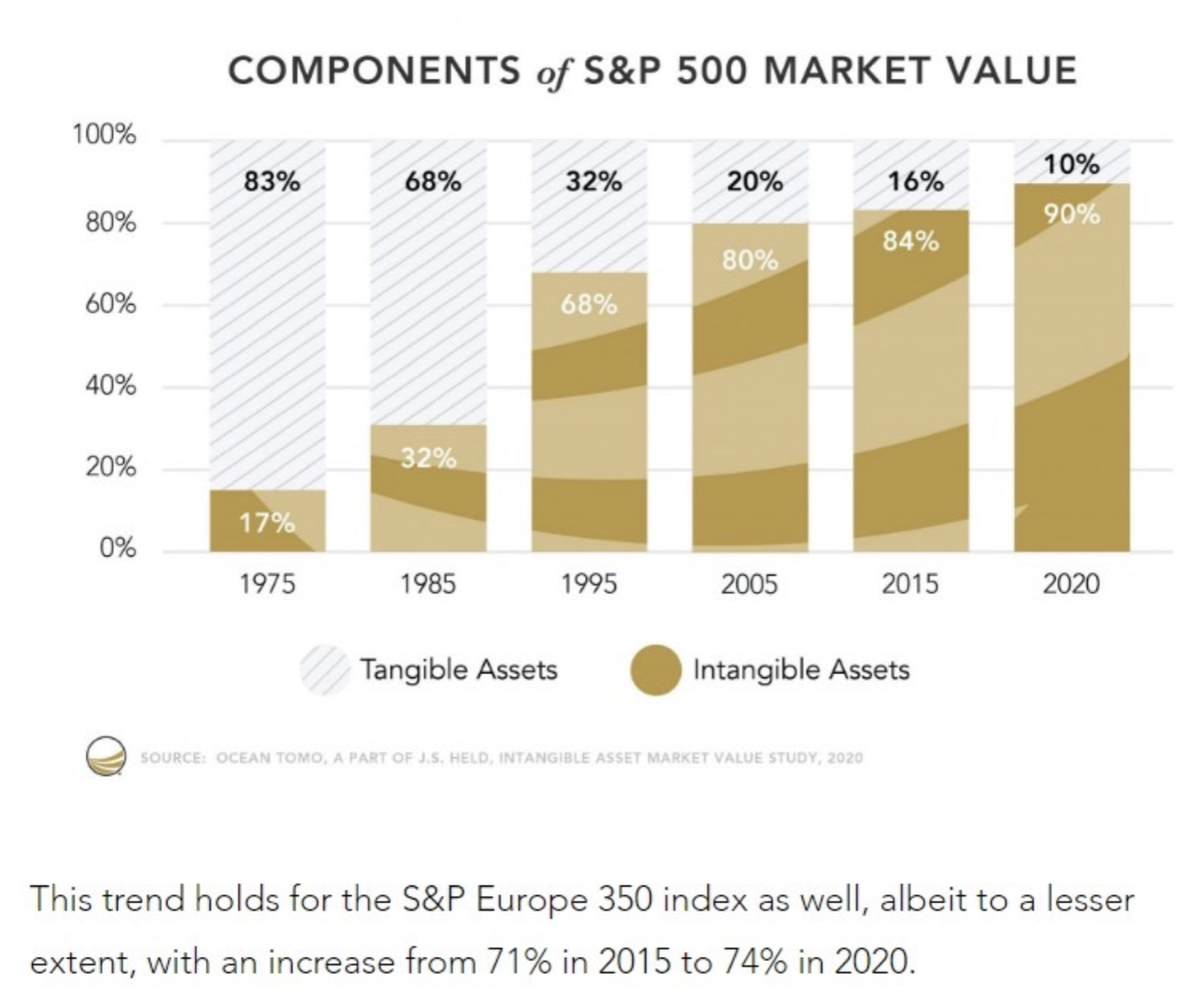

This means the need to focus on the real economy, i.e. the tangible things we can touch and see, as opposed to the intangible digital economy. Intangible assets today account for 90% of the market value the S&P 500 index. Ninety percent! This means that the real economy is too small to meet the ambitions of fiscal and monetary policy, the green transition, and even the power-hungry global digitalization. We simply need to build more infrastructure, produce cheaper and more environmentally friendly energy and, above all, become more productive.

New foundations

Many experts view the current supply shortage and other constraints as an obstacle to the economy's growth potential and return on assets. In reality, however, we are most likely to innovate and change when we are under the greatest pressure. We believe that the higher marginal cost of capital, constraints on available energy, and the inability of central banks and political systems to allow markets to truly discover prices will lead to a complete break with the old models - which will be positive, however, because it will allow us to move forward. The negative breakthrough came in 2022 when both bonds and equities went down. In 2023, we have new foundations.

The peak level of interest rates is already close – it has not happened yet, but it is getting closer every day. Consumers continue to spend money in the form of pandemic cash and savings, and at some point in 2023 they will start using credit financing. We have full employment. Financial conditions are looser than last June, when the US Federal Reserve began raising rates by 75 basis points. Finally, and importantly, China moved away from the "zero Covid" policy and some actions directed against the private sector.

We believe that President Xi's retreat from the zero-Covid policy, policy towards tech companies and, above all, towards the residential real estate sector will be crucial for the remaining months of 2023. Last year, China imported less energy, showed low demand for raw materials and kept the economy at a maximum of 70% of its potential. China's leaders now understand that the gradual decline in private initiatives over the past decade has left China's economy vulnerable and vulnerable. This will mean again broad support for fiscal spending, much of it on infrastructure, support for housing loans, expanding the balance sheets of state-owned banks and reopening the economy to the world.

This may be the biggest event in 2023 and it is possible that it will take place even before the publication of this forecast. Find the right graph and notice what China's intensifying expansion did to the global economy in 2003 (after joining World Trade Organization), 2009 (after the global financial crisis) and 2016 (after the currency devaluation). We expect the scale of China's credit impulse to match what happened in 2007-2009, as the three-year lockdown means that China's fiscal expansion will last longer and be deeper than usual.

Summation

The first quarter is likely to be dominated by the struggle between a soft landing and a recession. For now, the likelihood of a soft landing is growing rapidly, and the likelihood of a recession is declining. We recognize this and, as a result, in the first quarter, we are betting on a long position in high-risk assets, but at all times it should be borne in mind that fundamentally nothing has changed. We remain long in energy and deglobalization as the economy benefits from the easing of financial conditions. This means that by the second half of 2023 inflation will return, economic growth will surprise positively globally, but mainly in Europe and the United States, and the Fed will be forced to resume interest rate hikes after only a short break (without intending to start long series of cuts later this year). This follows the path of Fed chairman Volker from 1979-1982.

The models have broken down, but before anything changes, the market is likely to factor in another round of drag and fall in QXNUMX.

About the Author

Steen Jakobsen, Chief Economist and CIO Saxo Bank. Djoined Saxo in 2000. As a CIO, he focuses on developing asset allocation strategies and analyzing the overall macroeconomic and political situation. As head of the SaxoStrats team, Saxo Bank's internal team of experts, he is responsible for all research, including quarterly forecasts, and was the founder of Saxo Bank's outrageous forecasts. Before joining Saxo Bank he cooperated with Swiss Bank Corp, Citibank, Chase Manhattan, UBS and was the global head of trade, currency and options in Christiania (currently Nordea). Jakobsen's approach to trading and investing is thought-provoking and is not afraid to oppose consensus. This often causes debate among the global market community. Every day, Jakobsen and his team conduct research in various asset classes, covering major macroeconomic changes, market movements, political events and central bank policies. With over 30 years of experience, Jakobsen regularly appears as a guest at CNBC and Bloomberg News.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)