Productivity, innovation and valuation power have never been so important

Even before Russia's invasion of Ukraine, equities were under pressure from rising commodity prices and worsening interest rate forecasts. The war and the subsequent severe sanctions against Russia made world conditions unpredictable and extremely uncertain. As the future becomes more and more uncertain, the precautionary principle dictates an increase in the equity risk premium with the consequent downward revaluation.

The valuation of shares is primarily the result of four factors: increase in revenues, EBITA margin, increase in investment needs and the discount rate of future cash flows. While sustained inflationary pressures may help boost nominal revenue growth, all three other factors go in the wrong direction.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Rising costs of enterprises' inputs on raw materials, energy and wages not only cause greater volatility of operating margins, but also their compression, which we have already observed in the case of profits for the third and fourth quarter. As there has been underinvestment in the physical world for over a decade (capital expenditure in the global energy and mining sectors is historically low) and global supply chains will reconfigure due to increasing geopolitical tensions, incremental investment is likely to be greater. Central banks seriously underestimated the inflationary pressurebecause the world economy has already exhausted the readily achievable benefits of globalization and prior investment. The world economy has clearly reached its physical limits, which is generating inflationary pressure. Central banks will have to curb demand through tightening financial conditions, which includes higher interest rates and a higher discount rate for future cash flows. All of the above factors will lead to lower stock valuations.

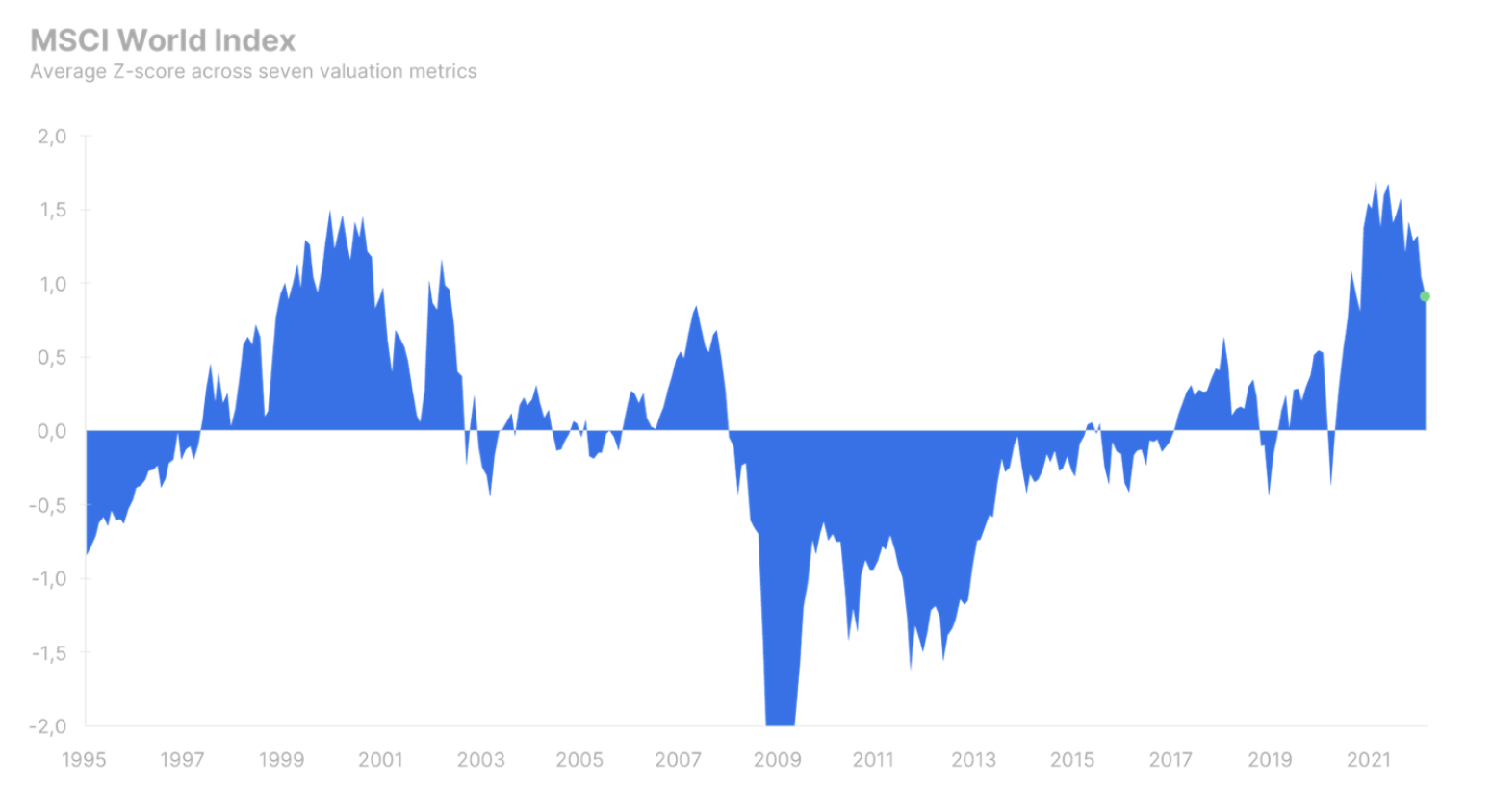

Despite the negative vector of all major drivers of stock valuation, in February 2022 the MSCI World index was still valued at 0,9 standard deviations (corresponding to the 86th percentile of the valuation) above its historical average since 1995. available opportunities we believe equities should be valued closer to their historical average, reflecting increased uncertainty and difficulties in modeling growth and margins. This means a decline in the index value MSCI World by an additional 10-15%.

It all depends on productivity and innovation

The large-scale war in Europe and the chaos in commodities markets have exacerbated inflationary pressures and stocks have found themselves in an environment unheard of since the 70s. High inflation is essentially a tax on capital and raises the bar on return on capital, so inflation in an absolute way filters out weaker and unproductive companies. The days when low interest rates and excess capital kept zombie companies alive longer than necessary are over.

Warren Buffett, in his letters to shareholders in the 70s, argued that the key to survival is productivity, innovation or valuation power. pricing power). The latter is often a function of productivity and innovation and coincides with a large market share - or company size in general - ensuring economies of scale. Over the past year, we have mentioned mega-capitalization a lot in the context of a theme in times of inflation. The world's largest companies are the last to feel the effects of tighter financial conditions, and their valuation power enables them to pass the effects of inflation on to their clients for a longer period than for smaller entities.

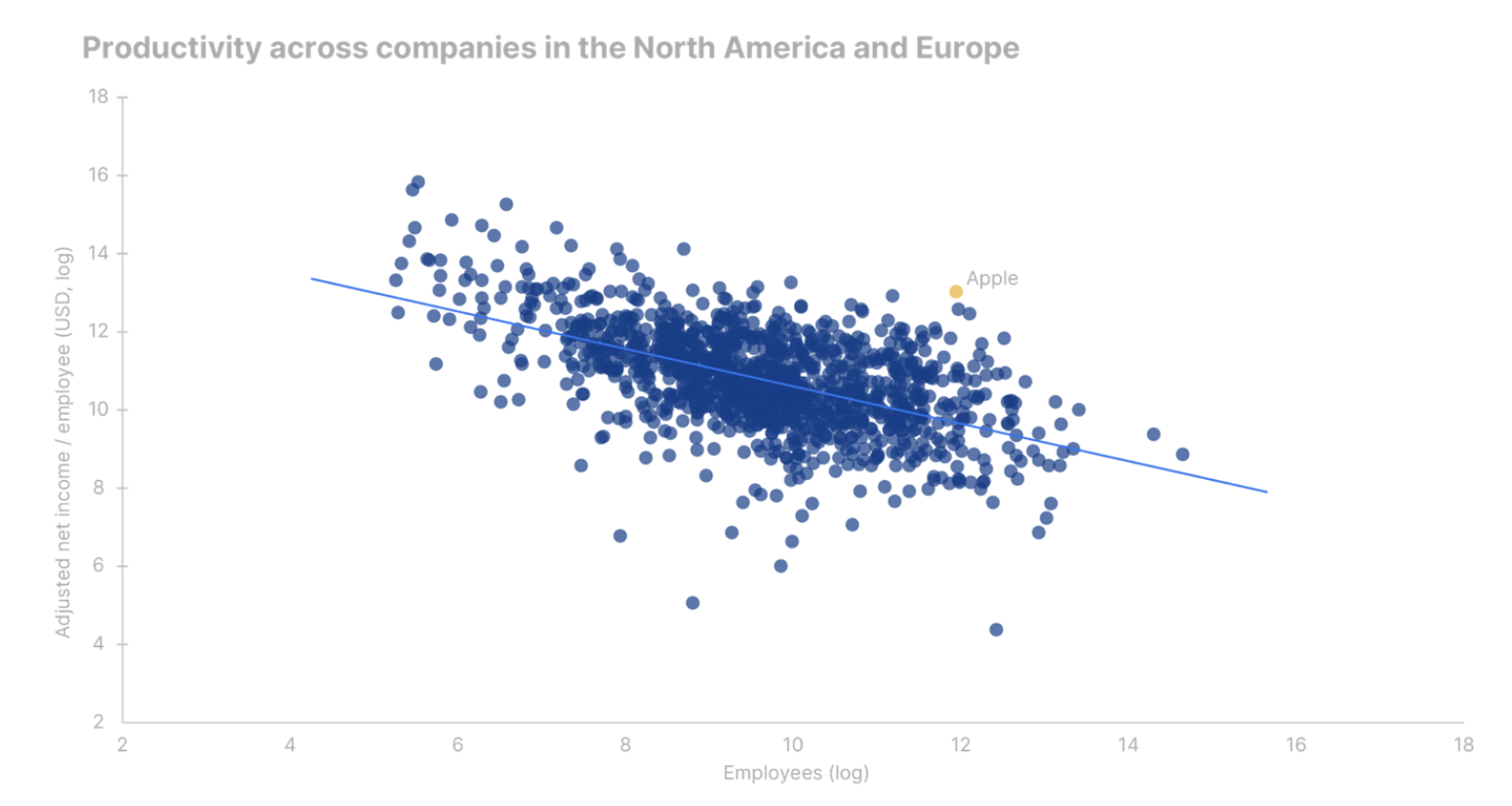

In addition to the sheer size of the company as a means of surviving inflation and higher interest rates, companies that are productive have a better chance of survival. Productivity can be measured in a number of ways, but we analyzed the adjusted net income per employees in order to have a uniform measure that could be used across all industries. This measure can be related to the number of employees and will show a negative correlation. This means that the larger the company, the lower its profits per employee. In other words, the return on company size is diminishing, which should come as no surprise. If a company strives to maximize profits, it is often at the expense of productivity, but any losses in productivity are offset by economies of scale within the business, and this allows it to achieve higher levels of total profits.

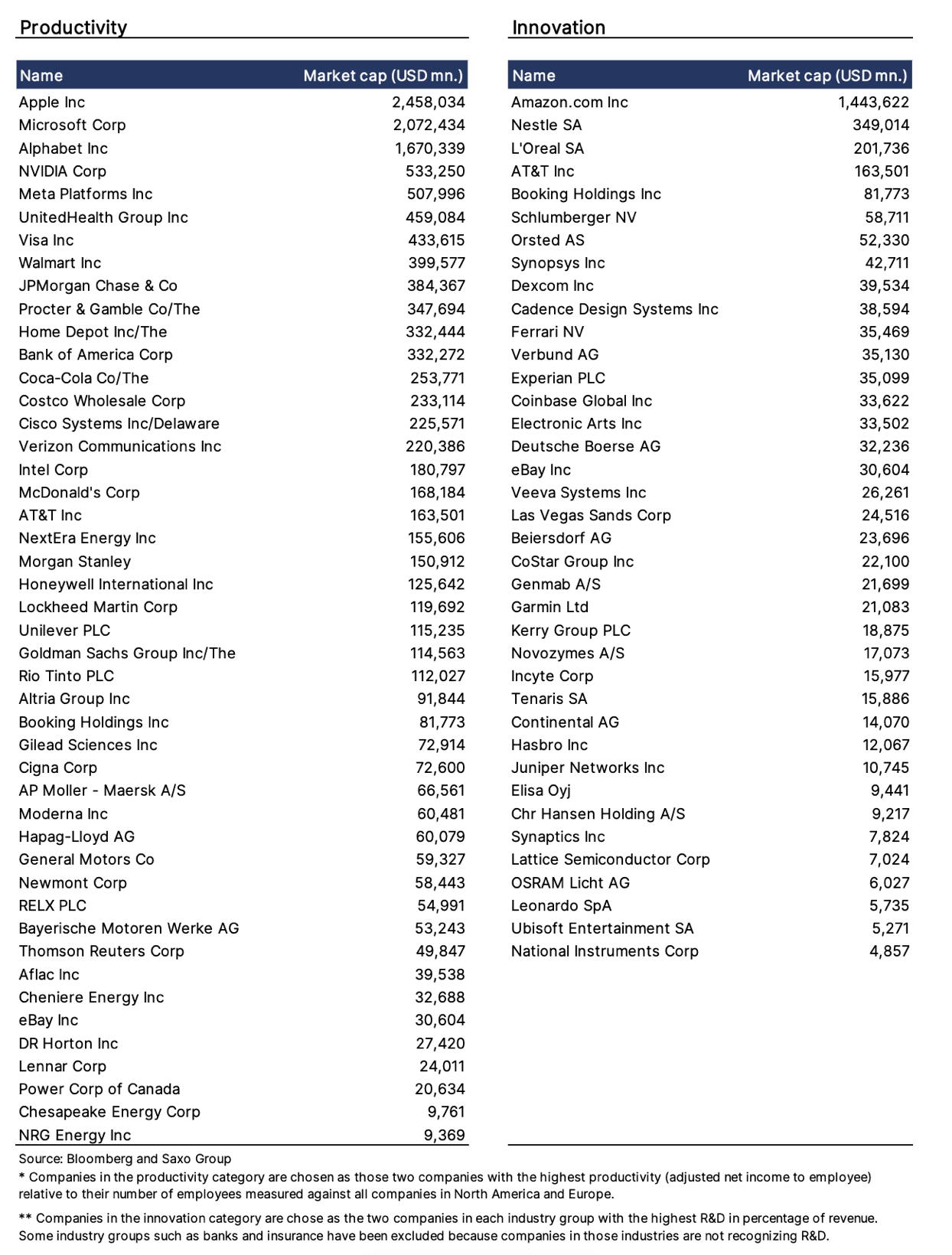

Companies that rank well above the regression line (see chart) are those that have a significantly higher profit per employee (productivity) than what their size would suggest. It is the most productive company in the world in relation to its size Apple Lossless Audio CODEC (ALAC), (point marked in orange). Companies that are well above the regression line have to do something right. In the table below on Productivity and Innovation, we present the top two companies in each industry group with the greatest distance to the regression line below.

There is a large body of scientific literature linking research and development (R&D) intensity to future equity returns; many studies have found a positive relationship regardless of the intensity measure used. In our analysis, we chose the percentage share of research and development in revenues as a measure of the intensity of research and development. As with our productivity ranking, we selected two companies from each industry group with the highest R&D intensity; we excluded industry groups that do not conduct research and development, such as banking or insurance. Productivity and innovation list should not be treated as an investment recommendation, but as an objective list of companies that obtained the highest scores based on our selected indicators of productivity and innovation. These indicators do not guarantee the achievement of better results in the future.

A radical change in security policy in Europe

Over the next decades, the date on February 24, 2022, when Russia launched its full-scale invasion of Ukraine, will mark a turning point in which European security policy changed after World War II. Since its end, European countries belonging to NATO have every decade reduced their military spending expressed as a percentage of GDP to such an extent that in 2019 it amounted to only 1,2%, while in the United States it amounted to 2020 in 3,7. 2006%. This significant discrepancy - despite the 2 NATO agreement obliging member states to spend at least XNUMX% of GDP - was the main cause of attacks on NATO and the European countries of former US President Donald Trump, who accused them of doing too little. Europe has long argued that it allocates its resources to non-military areas that serve to provide security within NATO, but nothing reveals that the emperor is naked, like a "black swan" event.

After Russia's invasion of Ukraine, all countries in Europe said that their continent had changed, and it was obvious that they had to step out from under Washington's military umbrella. Germany has declared that it will indefinitely increase military spending to over 2% of GDP, thus signaling a major change in security policy. In 2019, the 27 Member States of the European Union spent EUR 168 billion, and if military spending rises to 2030% of GDP by 2 - assuming that GDP shows an upward trend - in 2030 this amount will increase to EUR 346 billion , which means an increase by 8,4% per annum. In the event of an acceleration in military spending, which is quite likely, the pace of growth in the coming years will be double-digit. As stated by Moretti et al. (2021), defense-related R&D expenditure is by far the most important form of public subsidies for innovation and spills over to privately funded R&D, resulting in an overall increase in productivity. While in Europe, increasing military spending is linked to the terrifying invasion of Ukraine, it could contribute to long-term economic growth and increased innovation across Europe.

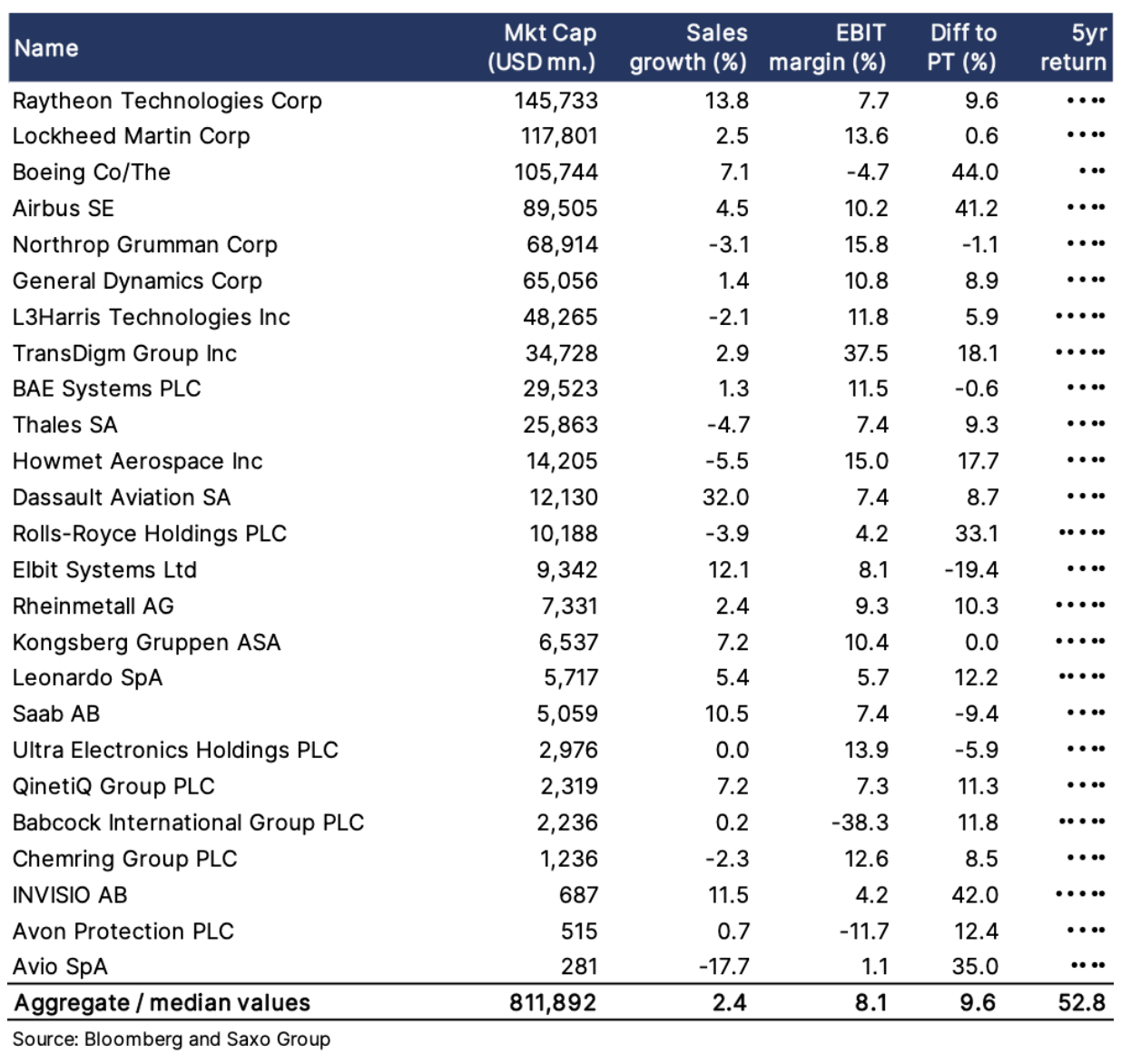

Therefore, we have a positive approach to armaments industry as an investment topic, and our defense thematic basket includes 25 defense companies in the United States and Europe. These companies provide exposure to military spending and should be taken as a list of inspiration and not as an investment recommendation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)