Forecast by Saxo Bank Q3: Bond market - the beating heart of the European revolution

The bond market will be the beating heart of the European revolution. Harmonizing financing costs across the euro area and a common fiscal budget will be key to building a much better monetary union. The pace of this change will further accelerate the election of the new government German and the issuance of Community solidarity bonds under the NextGenerationEU (NGEU) fund.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

This revolution began last year after the conclusion of the agreement on the NGEU fund by the member states. Under this program, the euro area will issue joint solidarity bonds financed by area-wide taxes on a much larger scale than ever before. This program will contribute to the leveling of financial conditions across the euro area as part of a Deep Monetary Union.

The elections in Germany will accelerate the in-depth change initiated by the NGEU fund. According to the latest polls, representatives of the Green Party are likely to be members of the future government of the Federal Republic of Germany; perhaps they will even chair Cabinet deliberations. The campaign of the Green Party focuses on the need to increase fiscal spending and strengthen European integration. This policy translates directly into higher yields on German government bonds and a reduction in spreads throughout the euro area.

Both the NGEU fund and the elections in Germany are signals that the number of green investments will increase in the future. Therefore, the new paradigm in the area of European government bonds will entail a more extensive issue of joint green solidarity bonds.

A better and greener European Monetary Union

The European Commission plans to issue 30% of the NGEU as green bonds. However, this share may only increase in the future.

Demand for instruments that take into account economic, social and corporate governance issues Environmental, Social, and Corporate Governance, ESG) already exceeds supply today. Their popularity will grow as ESG regulations are introduced around the world and investors are becoming more aware of the importance of these aspects. On the one hand, the solid performance of green bonds compared to traditional instruments encourages investors to increase their exposure to ESG instruments. On the other hand, the long-term horizon of such investments appeals to policy makers as it contributes to sustainable and inclusive growth.

Debtors show interest in the possibility of issuing green bonds as this may lower the cost of capital. In fact, the premium paid under these bonds (the so-called greenium) is currently -2 to -6 basis points; the negative premium reflects the deficit of these instruments.

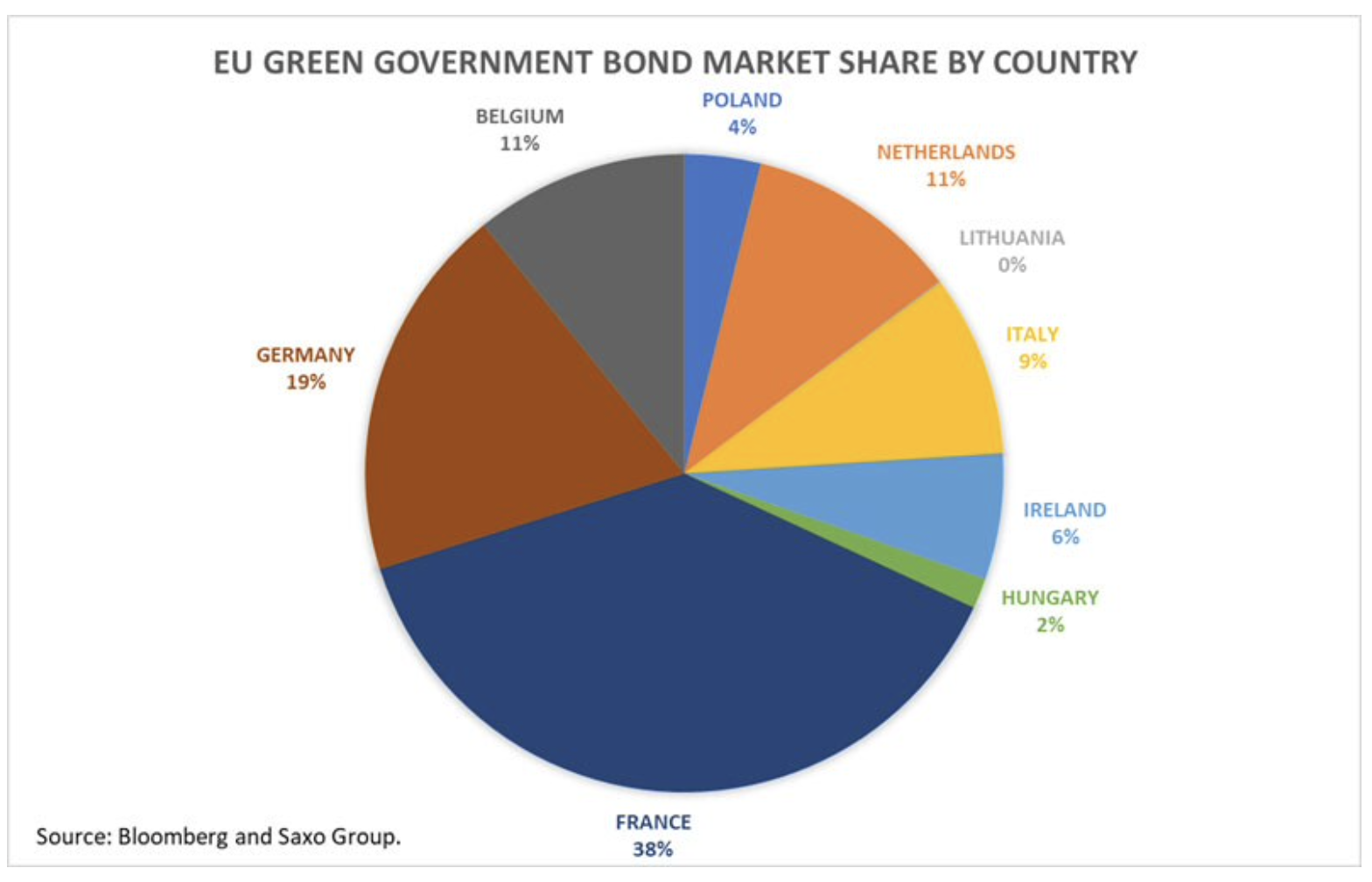

In Europe, around 1% of all outstanding government bonds are green. According to Bloomberg data, almost 60% of European green treasury outstanding bonds were issued by France and Germany. At the same time, some countries, such as Spain, have not yet entered the green market. The data shows that governments need to do even more to meet the ever-increasing demand for green bonds.

More of the same can be expected by the time of the German elections

Until the German elections, it can be expected that European government bonds will behave in the same way as it has been since the beginning of this year. They will be sensitive to profitability growth US treasury bonds and talks on limiting asset purchases on both sides of the Atlantic.

Such talks matter much more to the United States than to Europe. However, they will affect US government bonds, pushing up yields in the euro area as well, as the correlation between German and US government bonds remains positive.

At the same time, we predict that EBC will maintain its soft stance until fall as demand for European government bonds remains subdued despite continued support. The last issue of German 1,7-year treasury bonds turned out to be a technical error. The German financial agency (Finanzagentur GmbH) has allocated only EUR 2,5 billion out of the target amount of EUR XNUMX billion. Investing in German government bonds with near-zero yields is dangerous due to the inflationary environment. Investors are also deterred by the fact that ten-year US treasury bonds backed against the euro with a three-month forward rate offer higher yields than most European government bonds.

Check it out: How to invest in German government bonds [Guide]

In this context, the withdrawal of support is unprofitable for the ECB as it could seriously hamper the refinancing operations of ordinary debt of the Member States. The central bank is therefore likely to wait until the elections in Germany before modifying its monetary policy.

In order to put the ten-year German government bond yield trend in context, it is worth looking at the key technical levels. In May, the 0,40-year bond yields fell from their two-year highs. If this decline continues amid the communiqué signaling easing monetary policy, they may find support around -XNUMX%.

However, the long-term trend for German government bonds is for continued growth, coupled with improved economic outlook and inflation pressures. Therefore, although the ECB will maintain its easing monetary policy, it is unlikely that yields will remain negative in the long run.

German government bond yields will turn positive by the end of this year

European bond yields can only increase in the context of the elections in Germany, the increasingly better economic outlook for Europe and the stimulus provided by the EU's recovery fund.

Although the new German government is likely to move away from the austerity regime, the NGEU fund will eliminate some inequalities between individual countries. The incentives provided by this fund will offset the risk on government bonds and will reduce spreads compared to German bonds.

Improving macroeconomic outlooks will also play a key role in increasing profitability as the economy will recover and inflationary pressures will force the ECB to consider "a slight reduction in asset purchases" by the end of this year or early next year.

How much can bond yields increase?

Until the end of this year, two scenarios are possible:

# 1) Stabilization of German government bond yields around 0,10%

This will happen in a situation where reflation transactions will not reappear until the time of the elections in Germany. Under this scenario, yields will follow a sideline on both sides of the Atlantic. However, the government with representatives of the Green Party will force German government bond yields to become positive anyway, with resistance around 0,10%.

# 2) Stabilization of German government bond yields around 0,6%

Such a scenario will take place if the pace of talks in the United States on limiting asset purchases accelerates in the summer, which will push up the yields on US treasury bonds. Thus, the yields on German bonds may turn positive even before the elections in Germany. The government with representatives of the Green Party will contribute to an increase in profitability, and as a result, the yields of ten-year treasury bonds may break above the resistance at 0,10%. Thus, they would enter the area of rapid growth, where the next resistance level would be 0,6%.

A new paradigm for European government bonds: Italy's BTP will benefit most from narrower spreads

Positive German government bond yields would represent a positive change for European government bonds as their values have not been positive since May 2019. However, positive German government bond yields would mean that European government bond yields would also have to increase.

To better understand the future shape of the European government bond market, it is worth looking at Italy, where government bonds are offering the highest yields in the euro area at the time of writing this article.

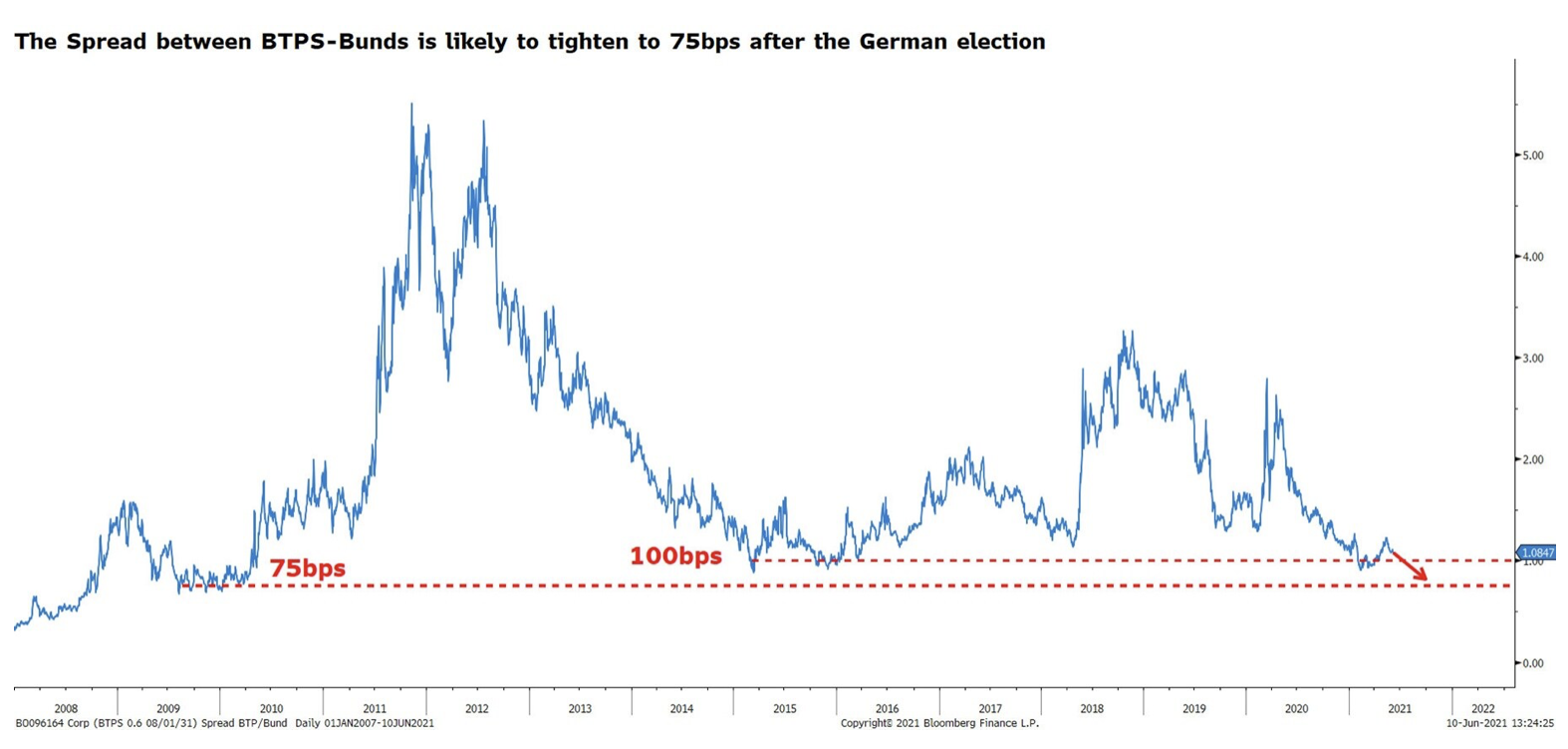

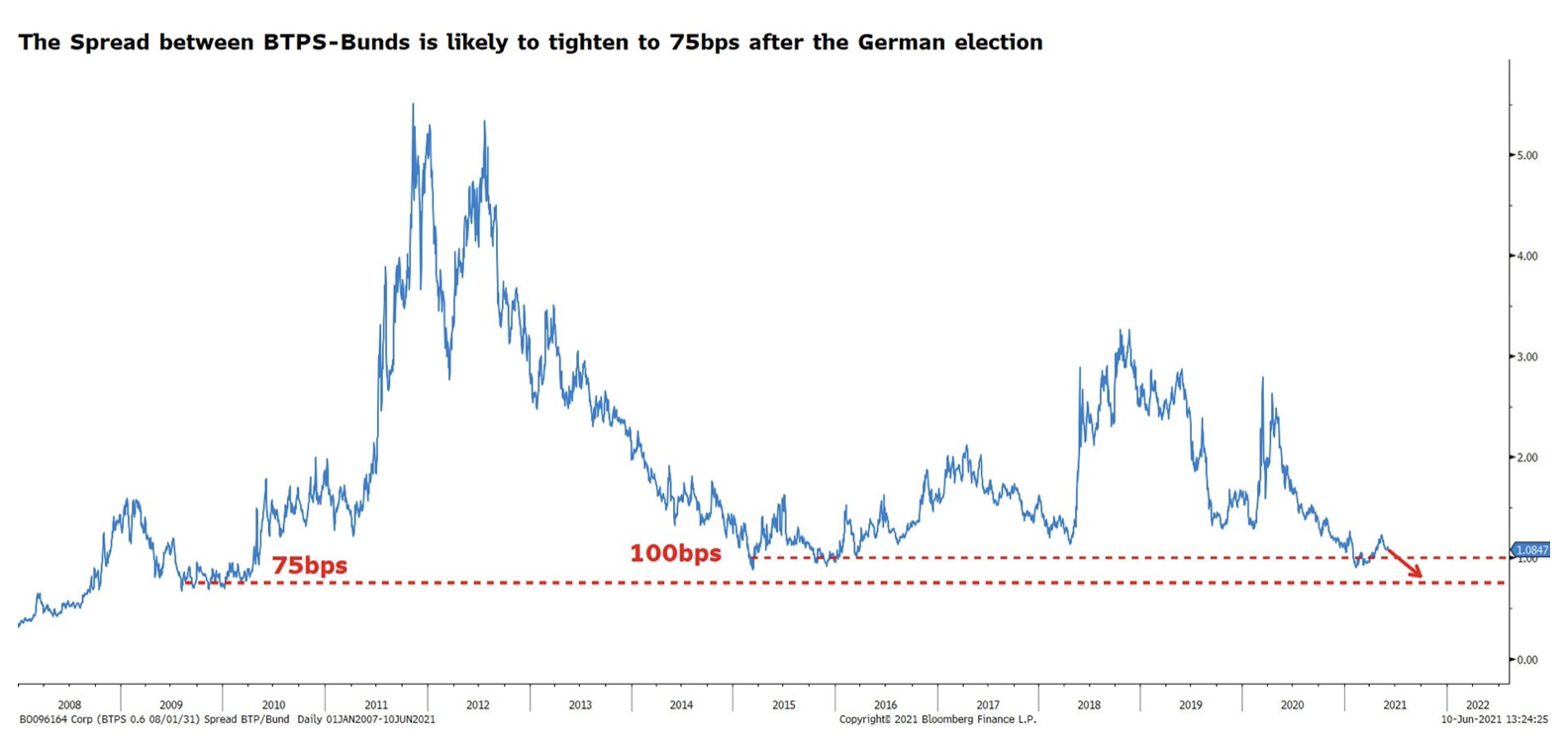

Since the beginning of this year, the spread of Italian and German government bonds has been in the range of 90-126 basis points. When Mario Draghi became Prime Minister of Italy, the spread narrowed to the smallest since 2015. However, after the reopening of the economy, it widened beyond 100 basis points.

In the short term, this spread may widen due to divergences in the economic recovery and downward sentiment amid increased volatility in the bond market. In the long run, however, we expect the spread to narrow significantly and stabilize around 75bps.

We anticipate that the narrowing of the spread may be much greater for BTP compared to other European bonds due to the stable political environment provided by Draghi and the payouts from the NGEU fund, with Italy as the biggest beneficiary. The noticeable improvement in the risk level will contribute to an increase in demand among investors who will find the opportunity to sell German Treasury bonds to replace them with papers with higher yields.

Although the narrowing of the spread will strengthen the BTP, it will take place when the yields on German government bonds increase. This means that under the worst-case scenario, yields on German 0,6-year government bonds will increase to 1,4%, and yields on Italian 0,10-year government bonds will stabilize around 0,9%. Under the most optimistic scenario, yields on German bonds will stabilize in the area of XNUMX%, and on Italian bonds - around XNUMX%.

All in all, Italian debt will also suffer losses in the context of rising German bond yields. However, Italian government bonds will be more resilient compared to bonds of other countries.

THE BIGGEST LOSSES IN THE CONTEXT OF THE GROWTH OF GERMAN BONDS ARE BROKEN BY FRENCH, SPANISH AND PORTUGUESE TREASURY BONDS

It can be expected that the narrowing of spreads will be a less of a leitmotif for other European government bonds. Worryingly, the ultra-low yields offered by other European government bonds expose investors to significant losses.

For example, at the time of writing this article, French OATs offer a yield of roughly 0,3% and the spread between French and German government bonds is 55 basis points. If German bond yields rise to 0,1% and the spread remains broadly unchanged, ten-year French government bond yields can be expected to rise to 0,65%. In absolute terms for French OATs, this would mean a capital loss of 5%. For comparison, in the case of BTP, this loss would be imperceptible if the spread fell to 75 basis points in the context of rising German bond yields.

Now assume that German government bond yields increase to 0,6%. In that case, the ten-year OATs would depreciate around 10%. In the case of BTP, this loss would be 5%.

The key issue in this case is the need to create a buffer against an increase in interest rates. Treasury bonds with lower yields of such security will not provide and will expose the investor's portfolio to the interest rate risk.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)