The future of the energy-intensive proof-of-work protocol looks dark

While the world is experiencing an energy crisis, high energy consumption by the current proof-of-work consensus protocol, both BitcoinAnd Ethereumshould not go unnoticed. Although ethereum is moving away from proof of work this year, bitcoin is predicted to keep it while still consuming a lot of electricity - but it is likely to come with some serious challenges.

About the author

About the author

Mads Eberhardt, Cryptocurrency Market Analyst, Sax Banks. Cryptocurrency Market Analyst at Saxo Bank. He gained experience as a trader at Bitcoin Suisse AG and founder http://BetterCoins.dk (website taken over by Coinify).

Bitcoin risks the wrath of politicians by consuming electricity

Since its launch in January 2009, bitcoin has used a consensual protocol called proof-of-work to verify transactions in your network. This protocol is very energy intensive as it affects the countless servers that keep the network alive. In return for a large amount of electricity and the power of servers, the Bitcoin network allows only 6 transactions per second.

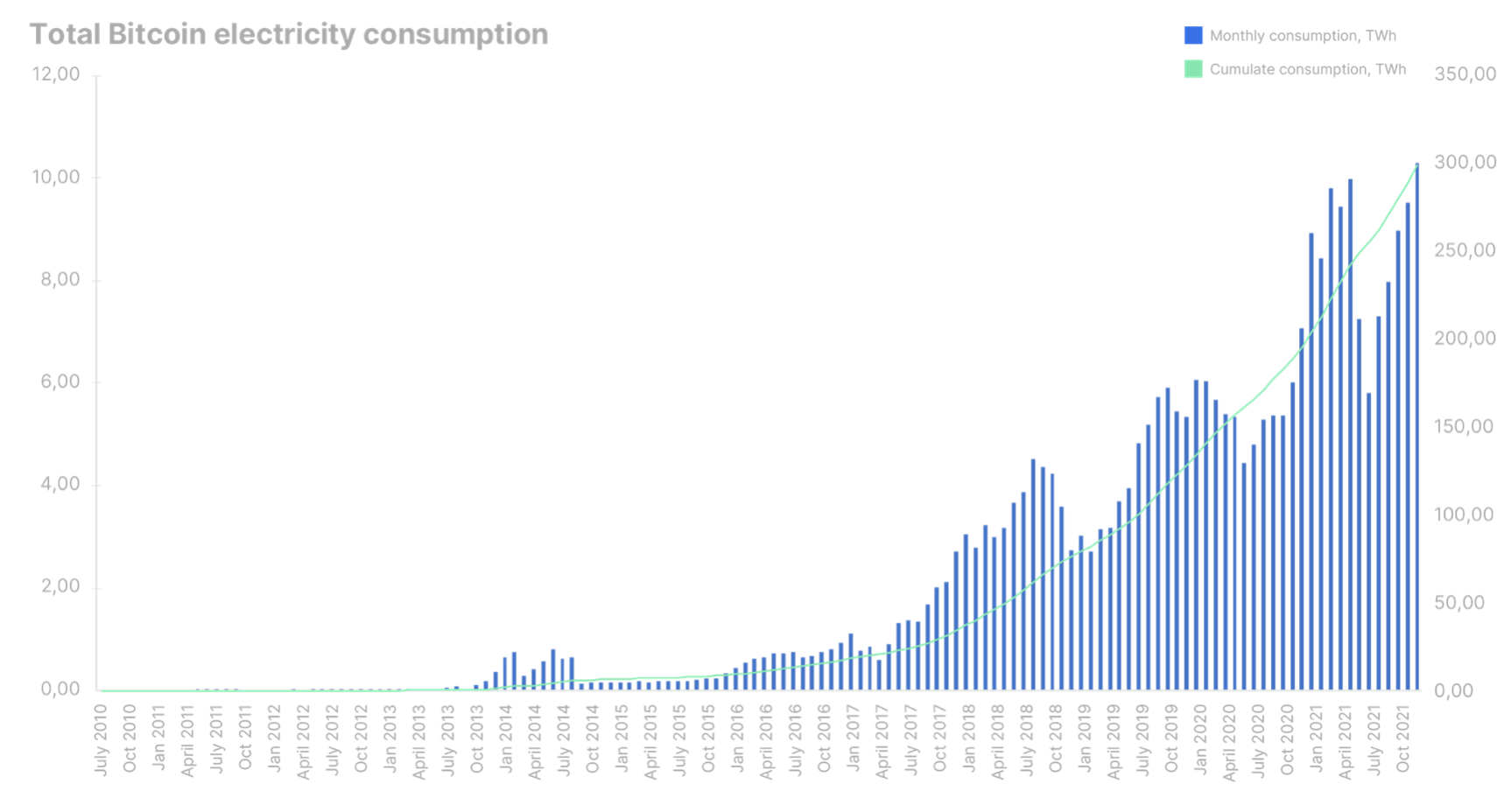

Według University of Cambridge Bitcoin is estimated to account for about 0,5% of the world's total electricity consumption - more than the Netherlands - even before the use of resources to manufacture servers. During the global energy crisis, when electricity is a rather scarce resource, consumption of 0,5% will not go unnoticed. To make matters worse, bitcoin's electricity consumption has risen sharply in parallel with its price, as miners can afford to spend more on electricity and mining equipment while maintaining profitability. If the price of bitcoin rises in the future, it is predicted that electricity consumption will follow suit, making the situation even worse.

Bitcoin Hash Rate - Several specific countries

Bitcoin's Total Mining Potential - Also known as hash rate (network computing power) - usually concentrated around a few countries. Before China tightened its approach to cryptocurrencies in May 2021, the country was responsible for approx 71% of the rate hash rate. Total indicator in the month following policy tightening hash rate bitcoin dropped by roughly half, and then spent practically six months returning to previous levels.

After tightening policies, Chinese miners moved their equipment to other countries, in particular to the United States and Kazakhstan; China's share of the total index hash rate it is basically nil today. Kazakhstan, with a population of less than 19 million, is a country with a small share in the overall figure hash rate became the second largest bitcoin mining country, with a share of 18%. With the previous ordinary annual increase electricity demand of 1-2%, last year Kazakhstan recorded an increase of 8%, which contributed to a serious shortage of electricity, as a result of which some residents were losing access to electricity. The government of Kazakhstan has expressed its willingness to impose possible restrictions on the extraction of cryptocurrencies. Earlier this month, with the internet going offline due to fuel cost protests, general indicator hash rate Bitcoin fell by 13,4%. This once again underlines that hash rate bitcoin covers territories of a few specific countries where the sentiment related to cryptocurrency mining can change quickly.

Bitcoin needs an alternative solution

The discussion on energy consumption would probably have been different if there were no alternatives to protocol proof-of-work. Since that's not the case anymore, staunch bitcoin backers who have been making the case for years proof-of-work above all its better security and history, they no longer have arguments to insist on its maintenance compared to the basic alternative, which is the protocol proof-of-stake.

Proof of stake is a consensual protocol by which the holders of original cryptocurrencies can stake some of their shares and therefore approve transactions instead of miners. In recent years, most of the newly launched cryptocurrencies have relied on the protocol proof-of-stakeand therefore the framework has probably shown its worth.

The second largest cryptocurrency - ethereum - has been preparing the transition from proof-of-work na proof-of-stake as part of an update known as ETH 2.0. This transition is expected to be finalized this year and will cut Ethereum's total energy consumption by 99,95%. The transformation of ethereum shows that it is not only possible to introduce new protocol-based cryptocurrencies proof-of-stakebut also adopting the framework that has already been launched with regard to proof-of-work. In addition to drastically reducing energy consumption, ETH 2.0 will make Ethereum much more scalable in terms of achievable trading performance.

At a time when the debate on sustainable development is very much needed, and at the same time we are dealing with the largest energy crisis in several decades, proof-of-work is a stone in the neck of the cryptocurrency market. Bitcoin and the cryptocurrency market as a whole face many challenges to realistically evolve into something more than just a speculative asset class, and it is not helped by the fact that the average person imagines a huge data center by the slogan "cryptocurrencies". As the sustainability debate is expected to become even more heated in the future, individual investors, institutions and developers are likely to reconsider investing time and money in bitcoin or other protocol-based cryptocurrencies. proof-of-work. As we can see, it's a consensus mechanism proof-of-work it is simply too fragile to operate unscathed in an energy crisis, in an ever-changing regulatory environment and with an increasing emphasis on sustainability.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)