Raw materials threatened by new concerns about Covid and the Omikron variant

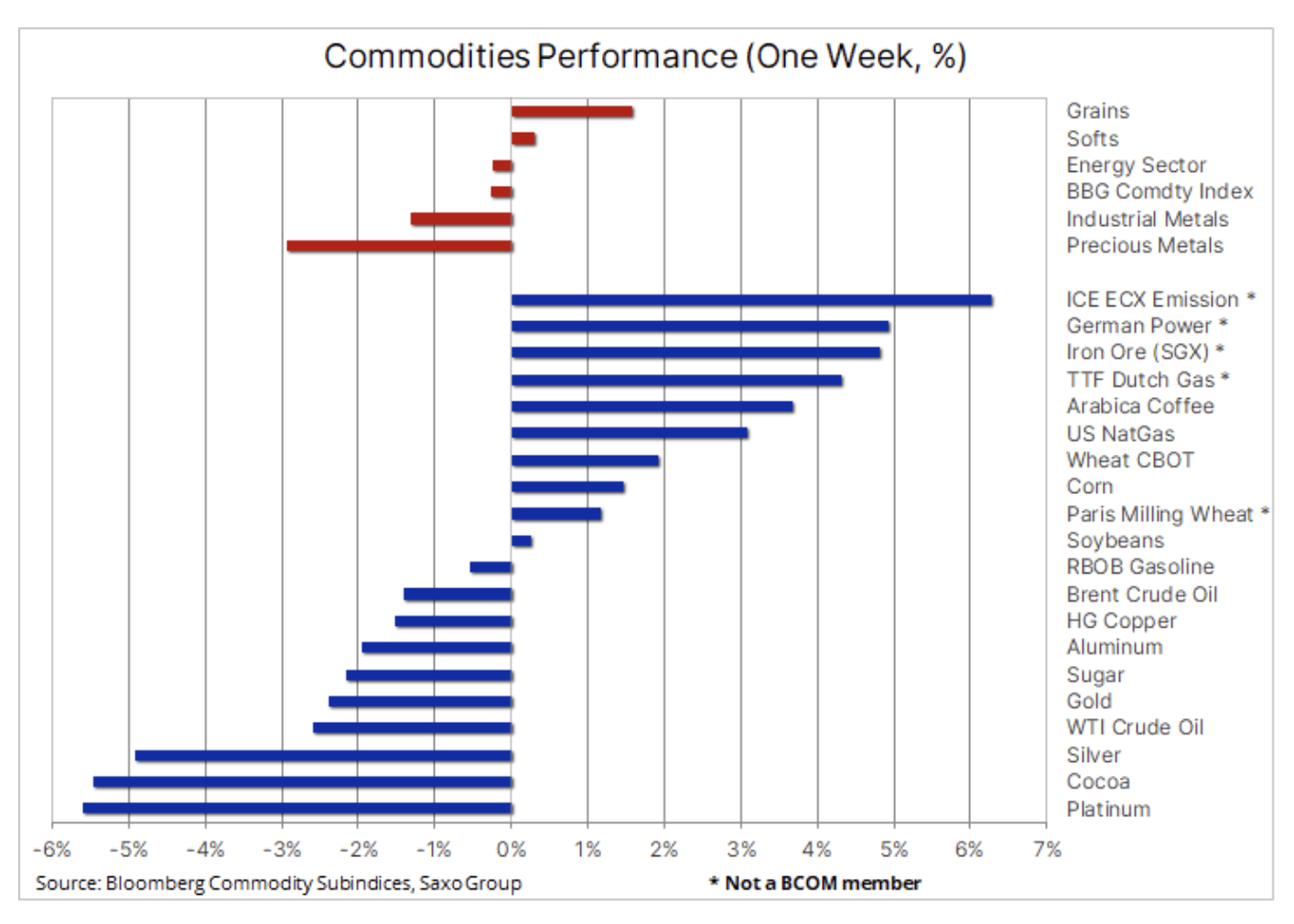

The commodities sector fell for the sixth consecutive week, with further losses in the energy and metals sectors, both precious and industrial, only slightly offset by another week of profits in the agricultural sector. In addition to the recent dollar strengthening, the renewed lockdowns of the Covid pandemic in Europe, and the risk of a slowdown in China, the world's biggest consumer of commodities, markets were shaken by the discovery of a new coronavirus variant - Omikron.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

A new variant of Covid, with the scientific designation B.1.1.529, has been detected in South Africa and observers are concerned that its significant mutations could mean that current vaccines may prove ineffective, putting new burdens on health systems and complicating efforts to re- opening up economies and borders.

These concerns triggered a wave of caution in global markets on Friday as stock markets around the world fell and US government bond yields reversed after rising earlier this week amid increased risk that central banks will speed up normalization efforts to fight rising inflation. In the foreign exchange market, the yen surged and the dollar, which had hit its 16-month high earlier this week, withdrew lower, undermining recent long positions.

Gold rebounded after a fall of $ 70 earlier this week as a break below the key $ 1 triggered a wave of sales from hedge fund longs that had just opened. Crude oil fell after a dramatic week in the energy market that began with the US-initiated coordinated release of oil from strategic reserves. The move has raised concerns about a counterattack from OPEC + members who are scheduled to meet on December 830 to set production targets for January and potentially for the following months.

The agricultural commodities market remained relatively resilient to these developments, and the Bloomberg agricultural index hit its new seven-year high thanks to steady growth coffee prices and key crops: wheat, corn i variety. Such strong increases are due to various reasons, but the common element is a difficult year in terms of weather conditions and the prospect of production discontinuation next season due to the La Ninã phenomenon, a popandemic surge in demand leading to widespread disruptions in supply chains and labor shortages, and recently also rising production costs as a result of soaring fertilizer prices and rising costs of fuels such as diesel. On December 2, the FAO will publish its monthly food price indexand following an increase in November, this index is expected to reach a new ten-year high.

Apart from coffee, the highest-ranked commodity was iron ore, which, despite Friday's weakening, managed to offset the effects of the recent slump in the face of signs that the Chinese steel industry is gaining momentum again, thus fueling demand for China's most crucial raw material. In Europe, the energy crisis continues and exceptionally high gas and electricity prices have pushed the cost of the EU Emissions Reference Futures contract to a record high, both in an attempt to support demand for greener fuels such as gas, which is currently limited in supply. and to counterbalance the increased demand for more polluting fuels such as coal. In a situation where gas flows from Russia do not show any signs of recovery yet, the market has found some consolation in the LNG inflow, which reached its six-month high.

Petroleum

Clothing for the fifth week in a row, it recorded losses, mainly due to concerns that a new South African virus variant could re-lead to lockdowns and mobility restrictions. Stoxx 600 Travel and Leisure Index Down 16% in the past three weeks, and re-lockdowns in Europe have the potential to spread to other regions. The previously coordinated release by the United States of crude oil from strategic reserves pushed prices up in anticipation of a counterattack by OPEC +.

OPEC + described the release of strategic oil reserves as "unjustified" under the current conditions and, as a result, may decide to limit the future production expansion, currently amounting to almost 12 million barrels per month. The group will meet on December 2, and given the prospect of renewed Covid-related demand concerns, which will further reinforce the claim of a sustainable oil market early next year, OPEC + may decide to limit its planned production growth to counter and partially offset the release of resources by United States.

Given the above developments, the only thing oil traders can be sure of is greater volatility in the final, often illiquid, weeks of this year. After breaking below the July high of $ 77,85, there is little to prevent a return to trendline support from the 2020 low of $ 74,75 now.

However, we reiterate our long-term positive outlook for the oil market - although it may now be several months or quarters delayed - as it faces long years of potential underinvestment - major players are losing their appetite for large-scale ventures, partly due to an uncertain long-term outlook for demand, but also, increasingly, due to credit constraints on banks and investors due to ESG (environmental, social and governance issues) and the emphasis on a green transition.

Precious metals

Gold dropped below support in the region of $ 1-830 after Jerome Powell's reappointment as Fed chairman, which, coupled with speculation by the White House, forced a change in approach at the Federal Reserve. Faced with the prospect of more than 1 million workers being hit by the Fed's inaction on inflation to support job creation for 835 million unemployed, this likely prompted President Biden and his team to decide to keep Powell on board while reading to him. the British Riot Act (the Riot Act), requesting a change of approach.

Following reappointment, both Powell and Brainard, the new vice president, presented a marked shift in rhetoric. Powell said, inter alia: "We know that high inflation is dealing a blow to families, especially families who are less able to bear the higher costs of basic products and services such as food, housing and transport. We will use our tools both to support the economy and a strong labor market, and to prevent the strengthening of higher inflation".

These comments hurt the zloty as they gave the dollar an additional boost and increased the expected rate hikes by 25 basis points in 2022 to three. At the long end of the curve, 1,7Y bond yields started to approach the key resistance around XNUMX%. An additional factor behind the sell-off of gold was the data of the US commission for trading in commodities futures (Commodity Futures Trading Commission, CFTC), which showed that the level of speculative long positions in gold in the futures market tripled to the level of a fourteen-month high before and especially after shocking CPI reading from early November.

The situation reversed sharply on Friday following news of the virus, supporting a strong recovery of gold back above $ 1. While the liquidation of long positions created room for new longs, the initial recovery was clearly fueled by the demand for safe assets - cryptocurrencies plunged over 800%, while silver and platinum, due to their importance as industrial metals, found themselves at the bottom of the weekly scoreboard. This can make it difficult for gold to make further progress.

Technically, gold will have to break through a resistance band starting at $ 1, and only a break above $ 816 will signal that the momentum has returned enough to move towards a new cycle high above $ 1. Much will depend on whether the current vaccines prove effective against the new variant, potentially avoiding major economic consequences.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)