Commodity Markets Reaction to the Russian Invasion

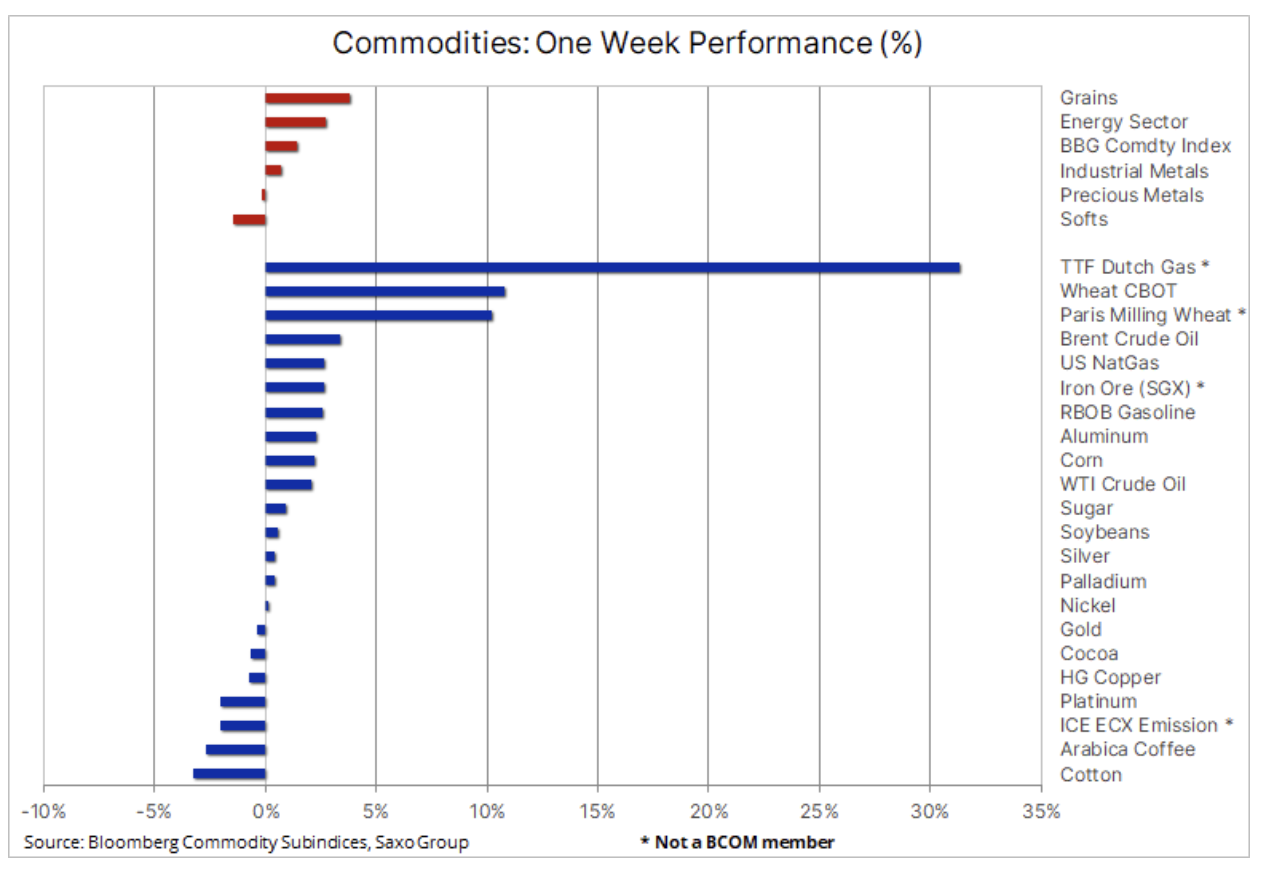

The commodities sector continued to grow last week and the Bloomberg spot commodity index hit a new record high on Thursday after Russia's unprovoked attack on a sovereign country caused volatility to spike in most asset classes. The stock market suffered significant losses, while investors sought refuge in bonds, the dollar and, above all, commodities - a sector that has been geopolitically specific and has a safe haven function due to the forecast of limited supply so far.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The temperature in the market dropped ahead of the weekend after a new round of sanctions imposed by Western countries did not negatively affect Russia's ability to produce and export raw materials such as oil and natural gas. As already mentioned, the Bloomberg commodity index surged and gains were visible in all sectors except the so-called "soft" products. The largest movements concerned gas, oil and wheat, all goods where a prolonged conflict could disrupt supplies from Russia and Ukraine.

Natural gas

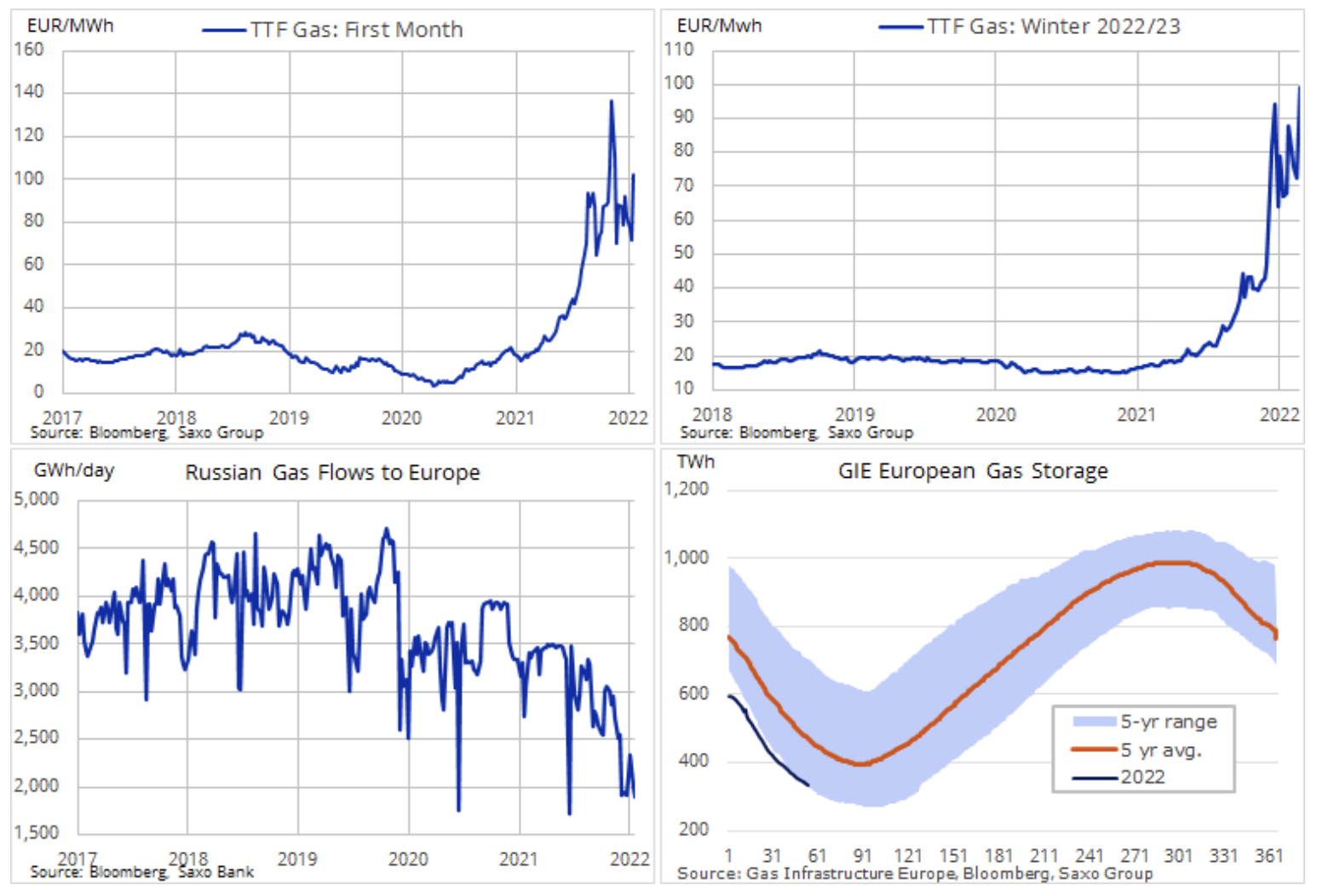

Dutch TTF gas futures felt most affected by the growing tensions, as Europe is 40% dependent on Russian supplies, most of which are transported through the largest pipelines, including the one that crosses Ukraine. After the initial panic reaction, which took the price above EUR 140 / MWh, gas was back below EUR 100 / MWh for most of Friday, which is still a very high price that will negatively affect European consumers and energy-intensive industries, including in associated with the production of other raw materials such as aluminum, as well as manufacturers of cars, machines and chemicals.

Germany and Italy are the two largest European countries relying mainly on Russian supplies, and as a large proportion of German exports are very energy intensive in terms of production, there is now an economic slowdown: producer prices have risen by 25%, the largest annual increase since 1949 r.

The current extreme volatility is driven by traders' pricing-in to the risk of Russia's further curtailing deliveries to Europe, which fears temporarily eased on Friday when Gazprom increased deliveries amid increased demand from European buyers. Long term forecast of a decline in gas prices seems increasingly limited as the Nord Stream 2 gas pipeline remains closed indefinitely and in the event of a prolonged supply interruption, EU gas stocks will not be able to be rebuilt before next winter, so the price of TTF gas for the winter season 2022/23 is now approaching 100 EUR / MWh, which is more than six times the long-term average.

Petroleum

For oil It was another week of wild volatility: the initial, albeit later reduced, threat of sanctions-related restrictions on supplies from Russia pushed Brent's oil price above $ 105, and WTI to $ 100 for the first time in seven years. After strengthening by $ 15 in a few days, crude oil nullified more than half of these gains ahead of the weekend after US sanctions did not affect Russia's ability to export crude oil. In addition, traders had to deal with the potential impact of another release of US strategic oil reserves, as well as the ongoing talks for a nuclear deal with Iran, the conclusion of which could boost supply.

This week there will be a meeting OPEC +, however, at this stage, the group is not likely to increase production, mainly due to the fact that many producers are already struggling to meet their production targets, while Russia, if allowed, is likely to reach its production limit in in a few months. For this reason, the oil market is likely to remain supportive, and the easing of tensions is unlikely to bring prices down by more than ten dollars.

With Saudi Arabia, as one of the few producers with significant production reserves, reluctant to increase supplies, the market is increasingly focused on Iran and resuming efforts towards the nuclear deal. According to the IEA, the deal could provide an additional 1,3 million barrels per day, which would help stabilize prices, although it would not likely lead to a drop in prices.

Unless there is a sharp economic downturn, global oil demand is not expected to peak any time soon, putting even more pressure on production reserves, which are already shrinking every month, increasing the risk that the current high, even even higher prices will remain in the long term.

Gold

For the market gold Thursday was a very difficult day: gold plunged almost $ 100 after hitting its 2-month high. As a result of a heavily bought up market where the momentum dropped before the USD 000 level, concerns that Russia would be forced to sell gold to support the ruble, and President Biden's sanctions that did not bring the expected results, there was a reversal in which there was a sell-off of oil crude oil and bonds, and there was a bull market in the stock market.

Leaving aside the difficult to measure geopolitical risk premium in the market, we maintain our positive outlook that inflation will remain high and central banks may struggle to slow down sufficiently amidst the risks of an economic slowdown. In our opinion, the Russian-Ukrainian crisis will continue to support the prospect of rising prices of precious metals, not only due to the potential short-term safe haven offer, which will change, but mainly due to what this tension will mean for inflation (increase), economic growth (decline) and expectations of rate hikes by central banks (lower frequency).

In the short term, however, the technical outlook has worsened to such an extent that descending below $ 1 may cause a decline towards another key support area around $ 877.

Wheat

As Russian troops, tanks and rockets entered Ukraine, world wheat prices soared to record levels and other key crops, such as maize and cooking oils, also found more buyers. As a result, the Bloomberg cereal index rose by 4% on a weekly basis, outperforming the energy sector. Wheat Futures Stocks in Paris and Chicago rose by more than 10% amid supply disruptions from the Black Sea region as well as potential threats to this season's harvest in Ukraine, known as "Europe's breadbasket," which bolstered the prospect of even greater increases in food prices.

However, considering that by November last year Ukraine had already shipped two-thirds of planned exports, the short-term effects should be limited. In this context, investors' attention will focus on this year's harvest, and with such a limited supply of both the global wheat market and many other commodities, any disruptions or lower yields will be felt on a global scale.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)