The easyMarkets platform, which was operating under the easyForex logo a year ago, arouses extreme emotions. We are dealing here with backwardness as well as with innovation. This interesting mix just provokes you to take a closer look. First things first.

Easy Forex Trading Limited, which owns the easyMarkets brand, is a broker that has been operating on the market since 2001, although under a Cypriot license only since 2007. The offer includes two platforms - old, honest MT4 and a proprietary web application (easyMarkets Web), which we will focus on. If we see comparison of functions both of these platforms on the broker's website, it immediately gives us the impression that the web version is the better one, which provides us with more possibilities. Only is it really like that? Let's see.

Admission word

easyMarkets Web is a platform like no other. Yes, even including the web ones! The broker itself clearly focused on creating a niche - beginner traders who value security and low risk above all. The spreads are not very competitive, but in return we get them in constant values, the possibility of freezing the rate and canceling the transaction (more on that later). We also see information on the risk of the transaction, the required security and other parameters, which are intended to make us aware of what we are actually doing with our money when concluding a given transaction.

Installation and logging in to EasyMarkets

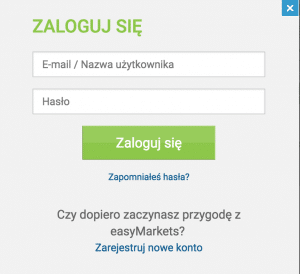

The browser platform does not require installation, so this "problem" is not for us. We also don't need to install additional software to run it. All you need to do is go to the broker's home page and log in using our e-mail address and the password defined during registration. It may not be very secure (especially if you use the same password for many things) but it is certainly convenient. We do not have to write down the 10-digit account number and password consisting of a random string of characters anywhere. This is a big plus for lazy traders.

The browser platform does not require installation, so this "problem" is not for us. We also don't need to install additional software to run it. All you need to do is go to the broker's home page and log in using our e-mail address and the password defined during registration. It may not be very secure (especially if you use the same password for many things) but it is certainly convenient. We do not have to write down the 10-digit account number and password consisting of a random string of characters anywhere. This is a big plus for lazy traders.

From the platform itself, we can switch from a demo account to a live one and vice versa with one click. The problem, however, is to use both types of account at the same time - for this we need a second browser.

Appearance and interface

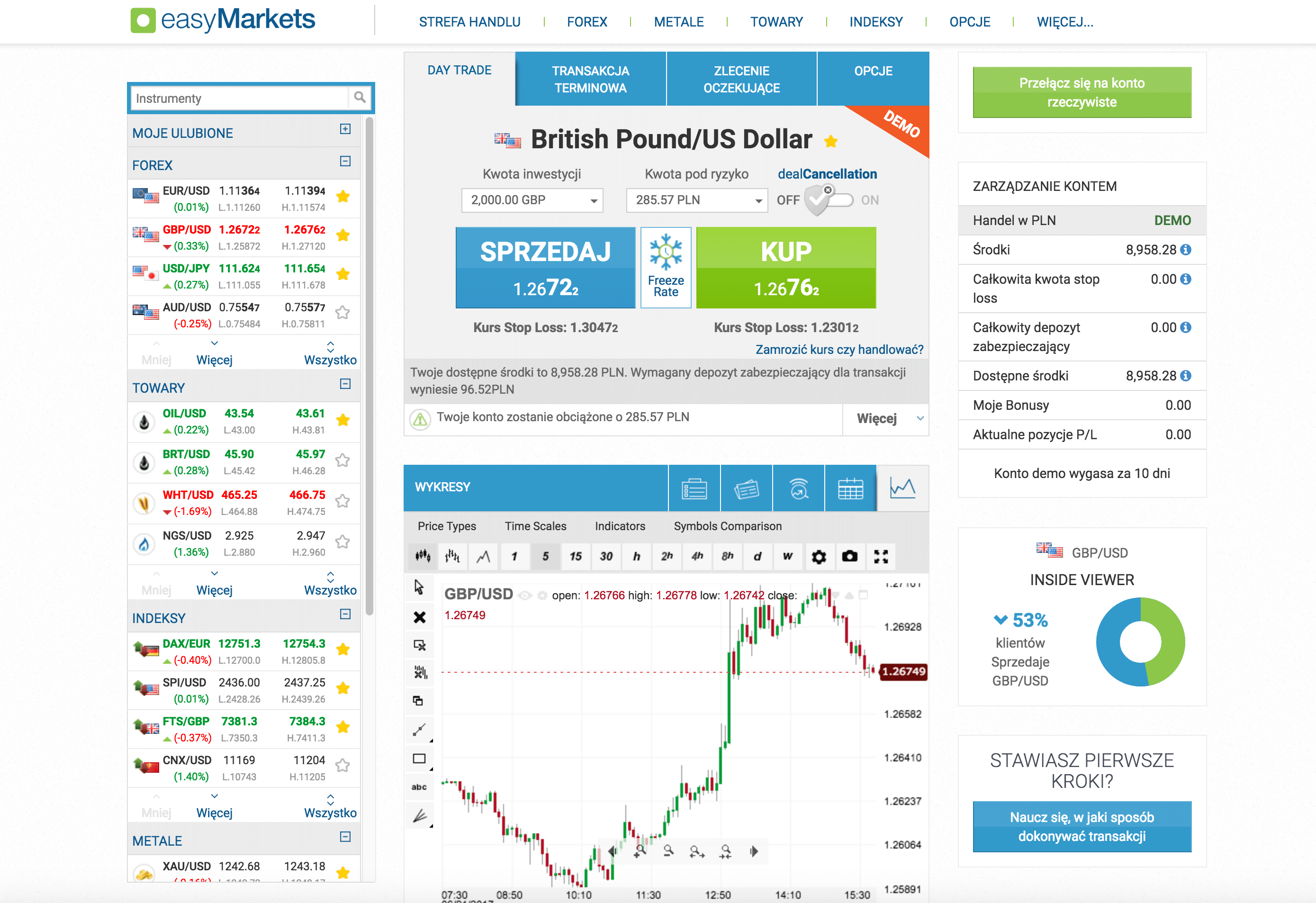

When it comes to appearance, we may experience a small shock. The arrangement of individual modules is radically different than what other platforms have got used to. In the foreground, in the middle column, there is an almost huge transaction panel. On the right side are the parameters of our account and a few less important modules.

But hello wait - where are the charts? Well, also in the middle column, but hidden in one of the five tabs - an unusual solution. They share an area with a transaction list, news panel, macro calendar and signals. Not only that - they are in the last place. This causes the module with charts to go down not to the second, but even to the third plan. One thing is placed traditionally - the instrument quotes are on the left.

Personalization. We cannot change the arrangement or size of any of the modules. The colors also remain rigid, except for a trace amount of change in the graphs. There aren't many settings.

Personalization. We cannot change the arrangement or size of any of the modules. The colors also remain rigid, except for a trace amount of change in the graphs. There aren't many settings.

The only thing that we can set under ourselves is the favorite instruments on the bar with quotes. easyMarkets offers them over 300 so this option definitely comes in handy. Unfortunately, we can not change their order.

Marketing on the platform. There is a lot of detail and text in each module. This interferes with readability and looks more like an "advertising flyer" than a trading platform. It would be worth thinking about relieving the trader's eyesight by reducing the amount of text. We can still see how much our account expires (it is only 10 days), and in the upper right corner there is a large green button "Switch to real account". It stings a bit in the eyes, but not as much as on Plus 500 platform.

EasyMarkets features and capabilities

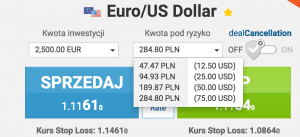

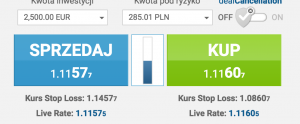

Transactions. Well, I'd go overboard if I said it's OK. The main panel, i.e. the one responsible for placing orders, consists of four tabs: day-trading, futures, pending orders and options. The average FX trader will rely on the former. And here is the first shock. The "investment amount" is the volume. It's just that we can only select it from predetermined values from the list (or at least I didn't discover the option to enter my own).

For example, EUR / USD. The minimum is EUR 2, and then each additional value increases by EUR 500 - of course, this is a leveraged value. The maximum is less than EUR 5 million (equivalent to approx. 000 lots). But that's not all of the surprises. This volume will vary depending on the instrument chosen - and here is another example. On GBP / USD the minimum is £ 2 and values increase by £ 20. But beware, the best is yet to come ...

Stop Loss can also be selected from the list - there are 4 values to choose from. To make it more interesting, they are expressed in USD and converted into the account currency at the current exchange rate (in my case PLN). For a minimum EUR / USD transaction of EUR 2, the smallest Stop Loss is USD 500. Then we have $ 12,50, $ 25 and $ 50. It grows similarly for a larger volume.

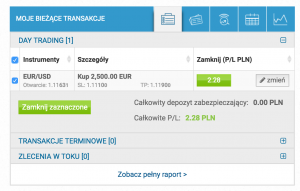

But calmly, we are talking only about the automatic, fast addition of SL. We can also define other values, and even add TP. It's just that this option is available only after entering into transactions and editing its parameters. Thus, the trade looks like this: 1) we include the order, 2) set SL from the list, 3) edit the order, 4) set the SL to the one we want.

Admit it is quite unusual.

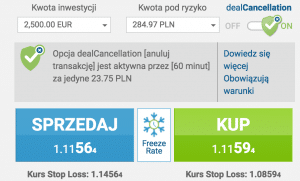

Freezing the course. 3 seconds - is it a lot or not? Well, it depends on what and where is going on :-). In the Forex market, this can mean many dollars. And the "Freeze Rate" option is to save us. By clicking this button, we can freeze the buy and sell rate for three seconds (the time is counted a'la hourglass), after which we can conclude a transaction. During these few seconds, the broker allows us to open a position without fear of a slippage or a gap. Cool thing!

Freezing the course. 3 seconds - is it a lot or not? Well, it depends on what and where is going on :-). In the Forex market, this can mean many dollars. And the "Freeze Rate" option is to save us. By clicking this button, we can freeze the buy and sell rate for three seconds (the time is counted a'la hourglass), after which we can conclude a transaction. During these few seconds, the broker allows us to open a position without fear of a slippage or a gap. Cool thing!

But there is a catch. easyMarkets reserves some exclusions and this option may be temporarily disabled depending on the market situation.

dealCancellation. Another pioneering option. The broker boasts that this is his original idea. And I must say that there is a method in this madness! On the platform, we have the option of canceling a transaction that is unfavorable to us (beneficial too, but it does not make sense). What does it mean?

Through 60 minutes from the moment of its conclusion, we can decide to completely withdraw it (along with the spread) without any consequences! This also applies to closed positions at that time on SL. Is not that great? But there are also certain conditions. We must mark the mentioned option before opening the position. And of course it is not free :-). The cost of such a service is based on the volatility of the given instrument and is not refundable. Thus, it is a kind of insurance that expires within an hour. For details, I refer to the broker's regulations.

We manage all open transactions at the bottom of the platform in the module, where there is e.g. calendar and charts. So we have a choice - we either manage the position or observe the graph, calendar, etc.

Pending orders and forward transactions. It cannot be that it will also be normal here. Setting a pending order requires going to the appropriate tab in the transaction module. As in a market transaction, we select the volume from the list, the amount at risk (initial SL), and then we have to manually enter the rate - inconvenient but survivable. We do not have to choose whether it will be a Limit or Stop order - the appropriate transaction will be set based on the price. In the case of futures, only the maturity date is selected.

Vanilla options. This is an additional type of instrument available at easyMarkets. Not many brokers offer it, which is a pity. The transition to these instruments takes us to another panel only for options. And here's the praise for the creators. A tutorial is available that quickly tells you how to make transactions. Good move.

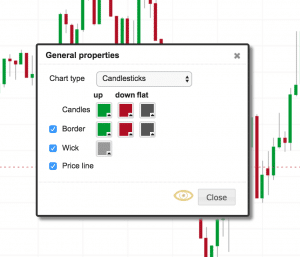

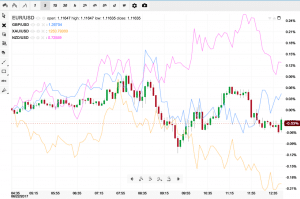

Chart support. To use the graph, I suggest to detach it to a new window from the platform. The mini-graph available at the platform level makes analysis impossible. The problem is that to change the instrument, return to the platform and click on a different quote. But it can be experienced. Quotes are available in three traditional scenes: candle, liner and bar. We have 10 intervals to choose from, including less typical ones like H2 or H8. There is a shortage of seconds and ticks.

A nice feature is the ability to place a graph of another instrument on the main graph and we are not limited by their number. Additionally, with one button  we can hide any instrument. A great option to assess the correlation.

we can hide any instrument. A great option to assess the correlation.

And a serious minus right away - the transactions concluded (neither open nor historical) are not displayed on the chart, not to mention the handling of orders from their level. The right-click button is also not available when operating charts.

Instruments. easyMarkets offers approximately 300 instruments. They all have fixed spreads, including commodities. They are grouped in a reasonable way, there is a search engine available, everything is quite transparent. Although there are some disadvantages - they cannot be reordered and the platform does not show us the value of the current spread. Each time we have to calculate them ourselves in our head - but here it is helpful that they are constant :-).

Indicators and tools. In terms of indicators, the easyMarkets platform has nothing to be ashamed of and is within the norm (48 indicators). It is also good in terms of the number of tools to draw on the chart. There are 25 of them - all popular, plus a few less known. An unusual solution is displaying the full list of tools only after hovering the cursor over one of the groups (no clicking!).

Of course, due to the fact that it is a Web platform, and in addition very unusual, we cannot add our own indicators, scripts or machines. But let's just say that this is not a flaw but something normal that we encounter in every browser based trading app.

Additional tools in EasyMarkets

News and calendar. Market news available in the lower module, where the area is shared with charts, is a bad idea. But that's the way it is. We see the 10 latest news - all in English. The published quantity is OK, but I see a different problem. To see more or older news, the platform takes us to a separate page where we can filter these news. It's just that we automatically "run away" from the platform. Unfortunately, on the downside.

News and calendar. Market news available in the lower module, where the area is shared with charts, is a bad idea. But that's the way it is. We see the 10 latest news - all in English. The published quantity is OK, but I see a different problem. To see more or older news, the platform takes us to a separate page where we can filter these news. It's just that we automatically "run away" from the platform. Unfortunately, on the downside.

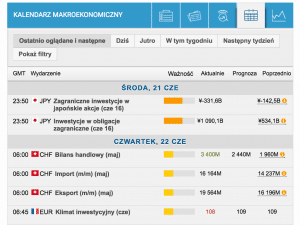

The calendar looks better. It is transparent and in Polish. It has a division into different time intervals and filtration options. However, it was not possible to choose the countries from which the data should be displayed (not everyone is interested in Mexico or Norway).

Keyboard shortcuts. Unfortunately, there is nothing to write about here. No keyboard shortcuts are available, unless ALT + F4 to disable the platform :-).

Notifications. Unfortunately, apart from the transaction report sent to the e-mail address, we can not configure any notifications or alerts.

Transaction history. History like history, there is no spectacular breakthrough here, but ... The possibility of exporting bank statements to Excel, CSV and PDF deserves praise. Other platforms lack this, and you usually have to struggle to get a PDF history file yourself.

Speed of action

You can't have any reservations. The entire platform is smooth and stable. I must admit that this is due to a small number of functions that offer charts, but also appropriate optimization. It takes the longest time to switch between panels depending on the type of transaction (Day Trade, futures, pending orders, options), where the platform has to load from the beginning with each change. And the time of this loading is primarily influenced by our link.

Summation

easyMarkets Web is a wild, slightly irrational thing. It offers interesting options, the final effect of which is ruined by ill-considered solutions for typical options (e.g. handling charts or concluding transactions). Demanding traders will be disappointed and will give up quickly. On the other hand, those with less needs or beginners may become very interested in it. Fundamental application options, which increase the feeling of control over the security of trade and dealCancellation, make sure there will be a group of recipients.

| Pros | Cons |

|

|

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)