Marko review: stagflation is coming. SaxoStrats changes its forecast!

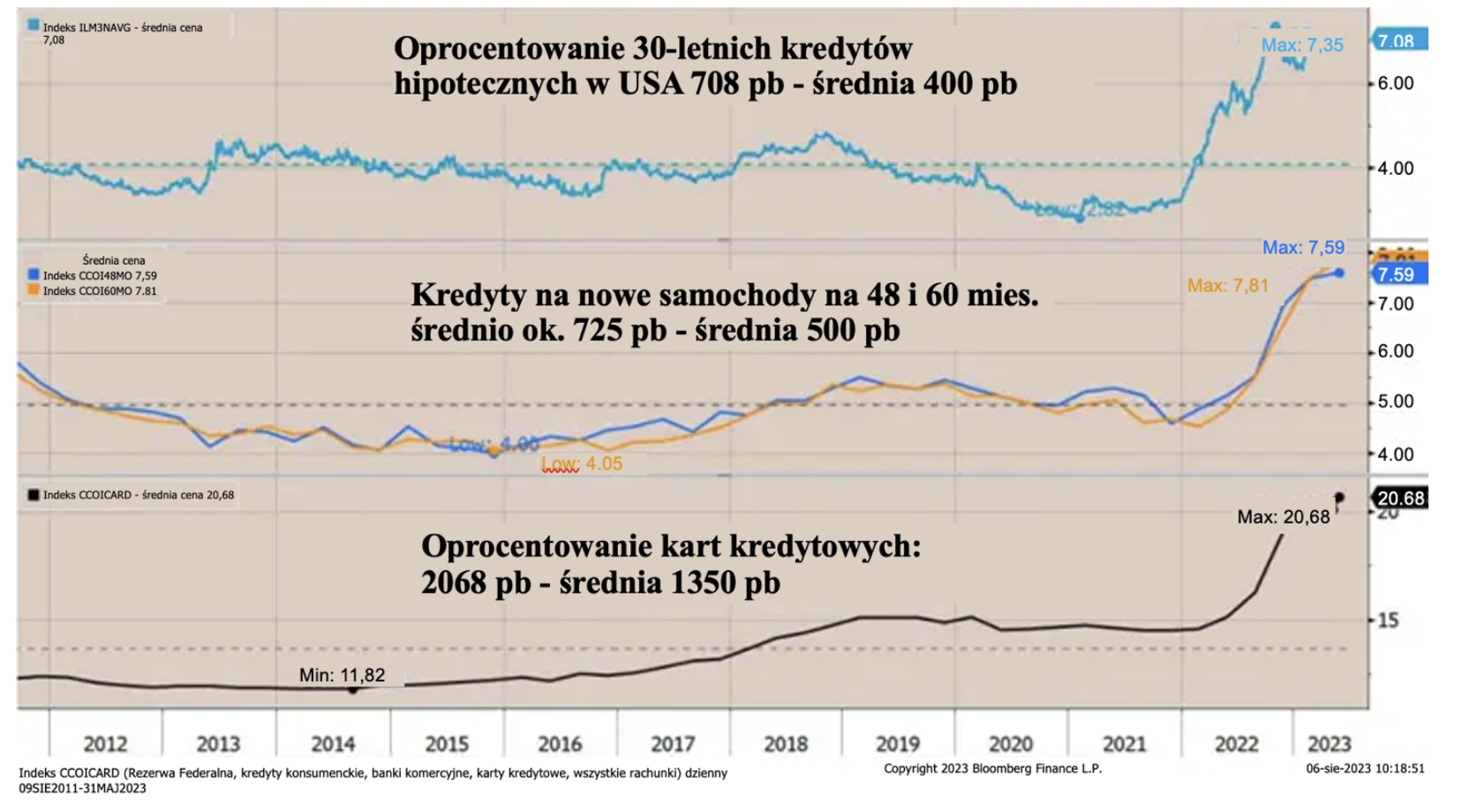

SaxoStrats changes its forecast for the US from no recession to stagflation, which means a change in the forecast for interest rates and stock markets. We predict a 1 in 3 chance of the Fed (and the ECB) cutting rates before the end of the year, and a 2024 in 2 chance of it happening in Q3/QXNUMX XNUMX. The main change is not only the result of a significant increase in real of interest rates, which has made the cost of financing in the US almost unbearable, as shown by the recent downward revision of the US rating by Fitch, but also a large increase in the cost of consumption. Interest rates on everything from credit cards to new cars to mortgages are twice the long-term average, if not overstated. Finally, employment and spending figures appear to be decelerating, while inflation remains stubborn due to wages and energy prices. As low economic growth and medium-high inflation mean stagflation, we are revising our forecast.

SaxoStrats currently anticipates a mild stagflation to kick off in Q2023 2024, with the impact felt strongest in QXNUMX/XNUMX.

Revised Economic and Monetary Policy Outlook

This is a big change from our projection of “no recession” so far in 2022 and 2023.

It also forces us to recalibrate our yield and stock market forecast. On yields, we are aware of the US Treasury "flooding the market" which means a 425bps US 525 year yield risk, but we anticipate the impact of a XNUMXbp rate hike to hit the economy with full force as of this release report. We believe that the probability of a rate cut by EBC i Fed in November/December it is 1 to 3, and in Q2024/Q2 3 - XNUMX to XNUMX.

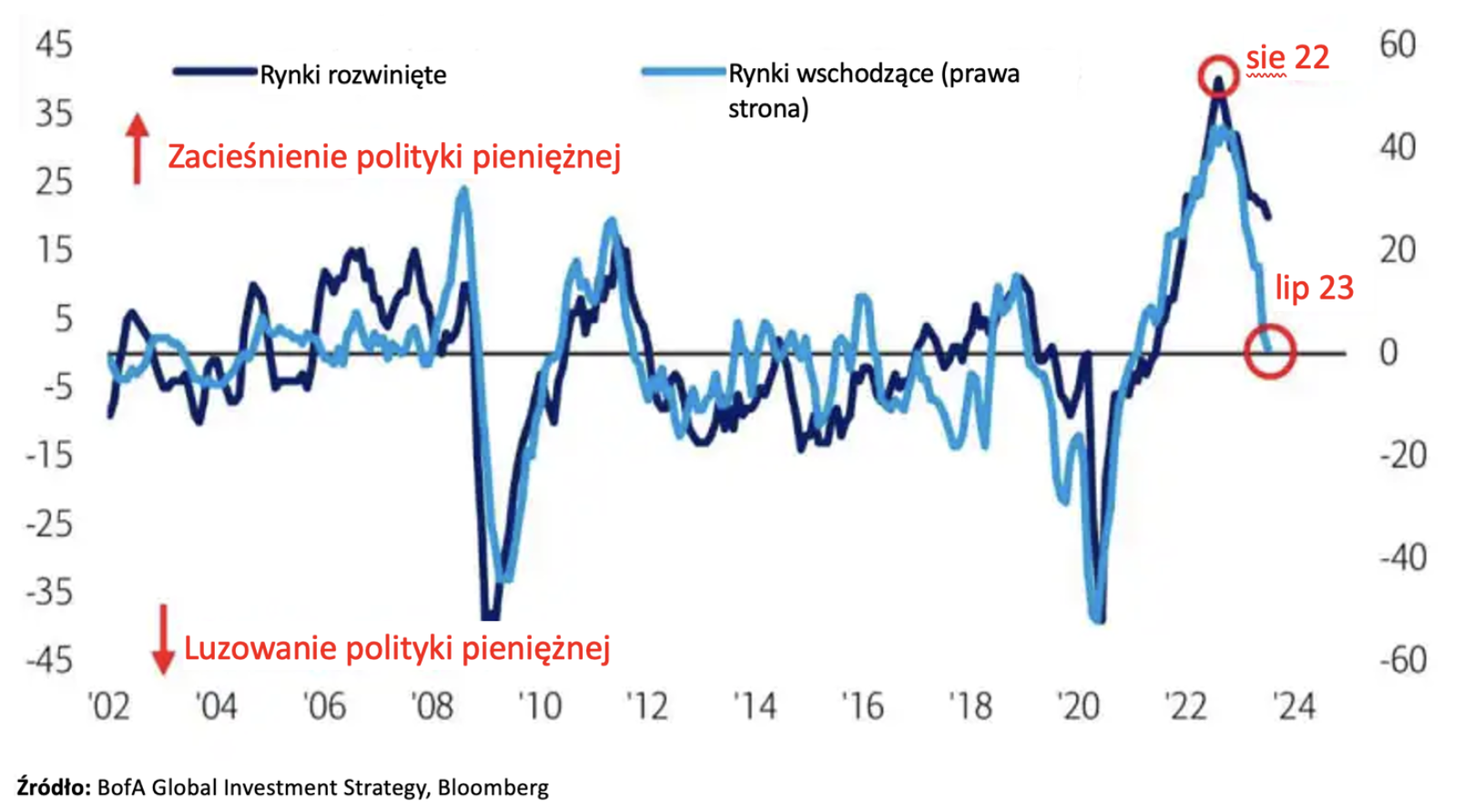

The first signs of this situation are already visible. Emerging markets have so far led the world in terms of tight monetary policy, but they are now starting to lower interest rates:

We expect Q500 and Q4 to be challenging for corporate profits as revenue growth slows while input costs (wages and energy) remain high. The full impact of this change should be visible in Q455 reports published in Q4. In the short term, we assume a target value of the S&P 045 index at 4, and if our scenario plays out, we expect a further weakening to the level of 050-XNUMX.

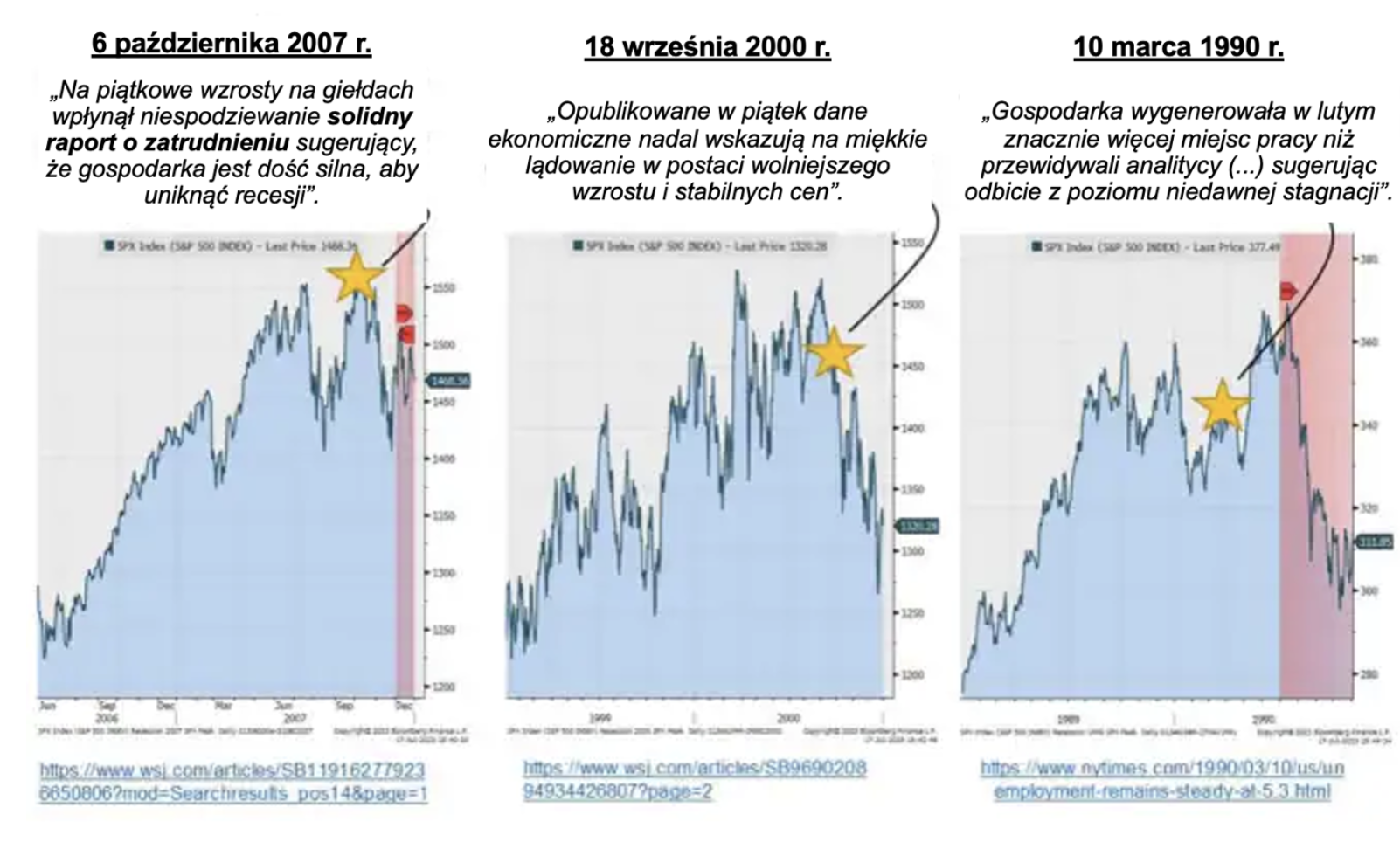

From early 2022, we advocated “no recession” as we realized that the largest-ever transfer from the public sector to the private sector during the Covid pandemic would have a long-term impact on US consumers and the ability of businesses to increase price margins. However, early in the second half of this year, a number of factors have deteriorated dramatically from the experts' prevailing forecasts of economic nirvana.

At SaxoStrats, we are not focused on the past, but on how political responses will change the dynamics of the markets in the future. The concept of "time" also remains relevant in our work and we attach great importance to the "passage of time" within the individual scenarios. Markets often misinterpret "time" as a concept - the longer we are "in the valuation phase or phase", the more its behavior and impact changes, and over time the impact becomes exponential. We believe we are entering this phase as evidenced by the dramatic increase in the cost of capital for consumers to spend:

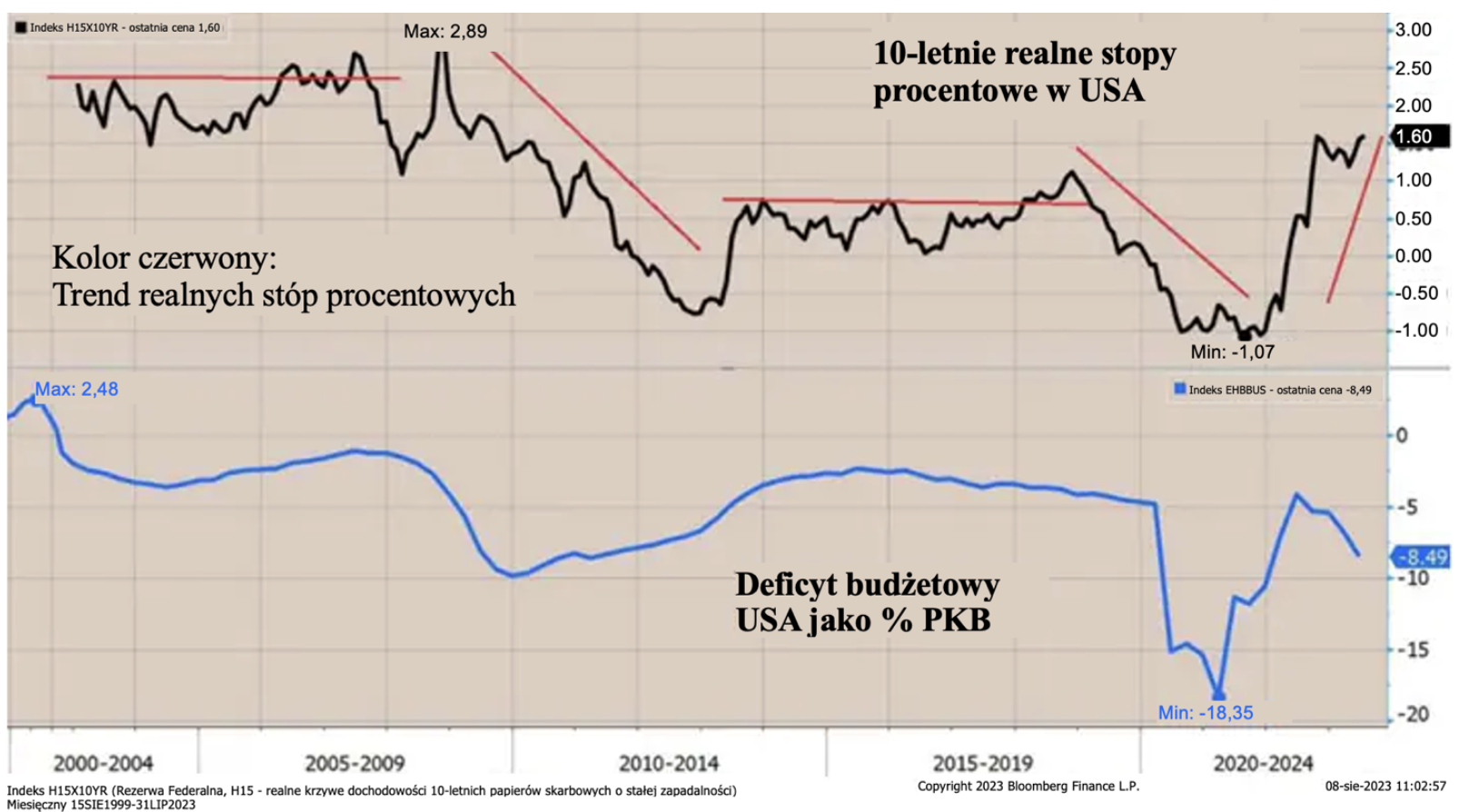

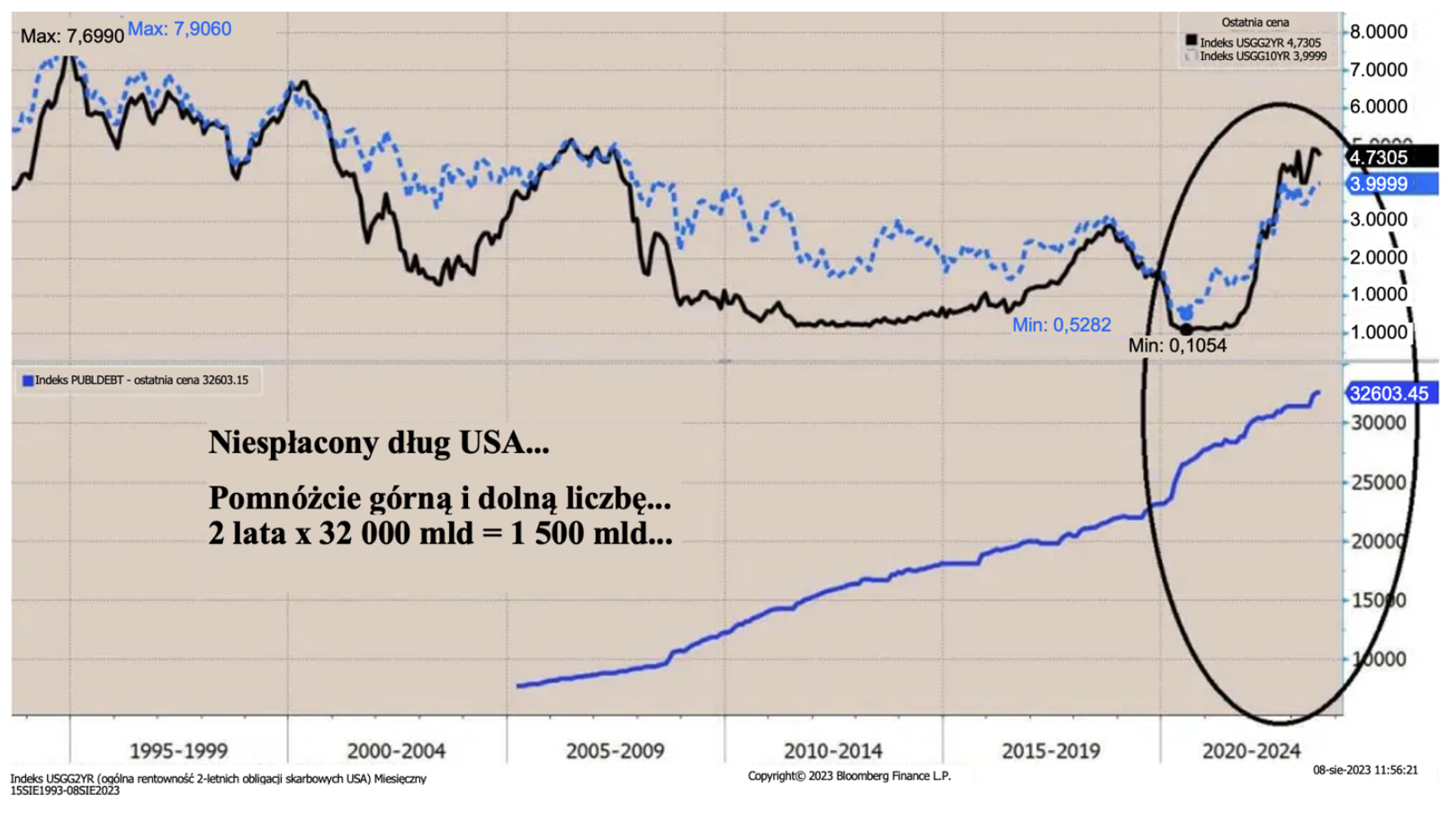

The main factor of the current economic and political platform in terms of concept is modern monetary theory (MMT). This policy is based on the view that debt in itself does not have any negative economic consequences. However, as we have seen over much of 2010-2020, this requires negative real interest rates, as much of the debt-driven activity takes place with negative productivity. In other words, the cost of MMT is the desperate need for negative interest rates to realize investments and reduce the cost of financing this debt.

In the last week, we have seen the market reach what I would describe as "debt indigestion." When the U.S. Treasury Department increased issuance of short-term Treasury bills and announced an extremely aggressive balance sheet financing program for 2023 and 2024, the market refused to accept the imposed FOMC "low interest rate driven by MMT considerations", essentially a signal to the market that interest rate hikes are over (Powell once again showed that he is more of a politician than a central banker).

At the same time, high deficit financing and cascading issuances coincided with the rise of real interest rates in the US to the highest level in the current cycle. The premise of MMT is endless funding, but with negative real interest rates. At this point, real interest rates are positive. eureka!

The MMT regime also confirms the lack of action by Congress. This is illustrated by the forecasts of the Congressional Budget Office (Congressional Budget Office, CBO) on debt in 2007, 2011 and 2023. In fact, Congress doesn't care about debt. He turned American politics into a "play of powers." Stanley Druckenmiller has always dealt with this issue and one thing is clear:

Among other things, Druckenmiller described and detailed why, in his opinion, without today's cuts in government spending, programs such as Social Security (Social Security) or health (Medicare i Medicaid) will have to be completely eliminated in the future.

First, the U.S. national debt excluding these programs reached the now famous $32 trillion…

"This is what annoys me the most that no one talks about it... Did you know that this amount - $32 trillion - assumes no more Social Security or Medicare payments will be made by the federal government? Only government accountants would assume that the government would not make a single payment. Not for me… nor for you when you grow old.”

Just scary and confirms that MMT was in the game even before it became a "theory" (which it really isn't).

"If they make you ask the wrong questions, they won't have to answer" – the great American novelist Thomas Pynchon, Rainbow of gravity

This is my new favorite quote that explains how politics works and, since Greenspan, how the central bank works. Policy makers force us to ask the wrong questions, which is why they didn't care about the answers until recently.

Essentially, the "success" of central banks and politicians has been that they have been able to get their "audiences" to ask the wrong questions:

No one focused:

- on lack of productivity

- on how ESG kills the ability to find a real solution to environmental issues

- how the government is crowding out private capital and creating a massive fiscal stimulus through the IRA system of individual retirement accounts, the CHIP package and the bipartisan infrastructure investment bill, but now mostly the fact that too much debt has always killed the economy's ability to recover GDP over time and increase in real income for ALL members of society.

Debt is the transfer of final consumption from the future to today! The US is adding $5 billion a day to its debt, interest payments cost $1 billion a year and it's steadily increasing, and current and fiscal deficits make the country extremely vulnerable to foreign funding because the savings rate is well below the required.

This will have a significant impact on future activity: with positive real interest rates, capital will flow towards better and higher returns, but in the short term all "MMT support" will crowd out private investment and generate unsustainable unsustainable growth.

Yield curve control is here

American monetary policy is moreover de facto virtually yield curve control (Yield Curve Control, YCC). The Federal Reserve (Fed) for political and economic reasons does not want to raise interest rates. The US cannot afford 500-year Treasury yields above 2021 basis points (bps) and Fed Chairman Jerome Powell is very political, as evidenced by his "sudden focus" on inflation following his reappointment in XNUMX.

The Fed also does not want to lower interest rates because it still faces the generational problem of limited labor supply in the labor market as a result of lower labor force participation rates (more people are retiring early). The short-term consequence is a system in which interest rates approach their maximum (500 bp in the case of XNUMX-year bond yield?). We have reached a point where the "cost of holding assets" is increasing exponentially as there is no prospect of either significant debt reduction or lower interest rates/lower inflation.

Here are some more economic data:

The student loan forgiveness program ends in October 2023, which will mean that 40 million Americans will have to start paying back an average of $200-300 a month. This is a significant reduction in purchasing power at a time when the Fed's 5,25% rate hikes are beginning to impact the real economy. The White House estimates that this will cost 0,3% of GDP, but it is likely to be closer to 0,5% of GDP.

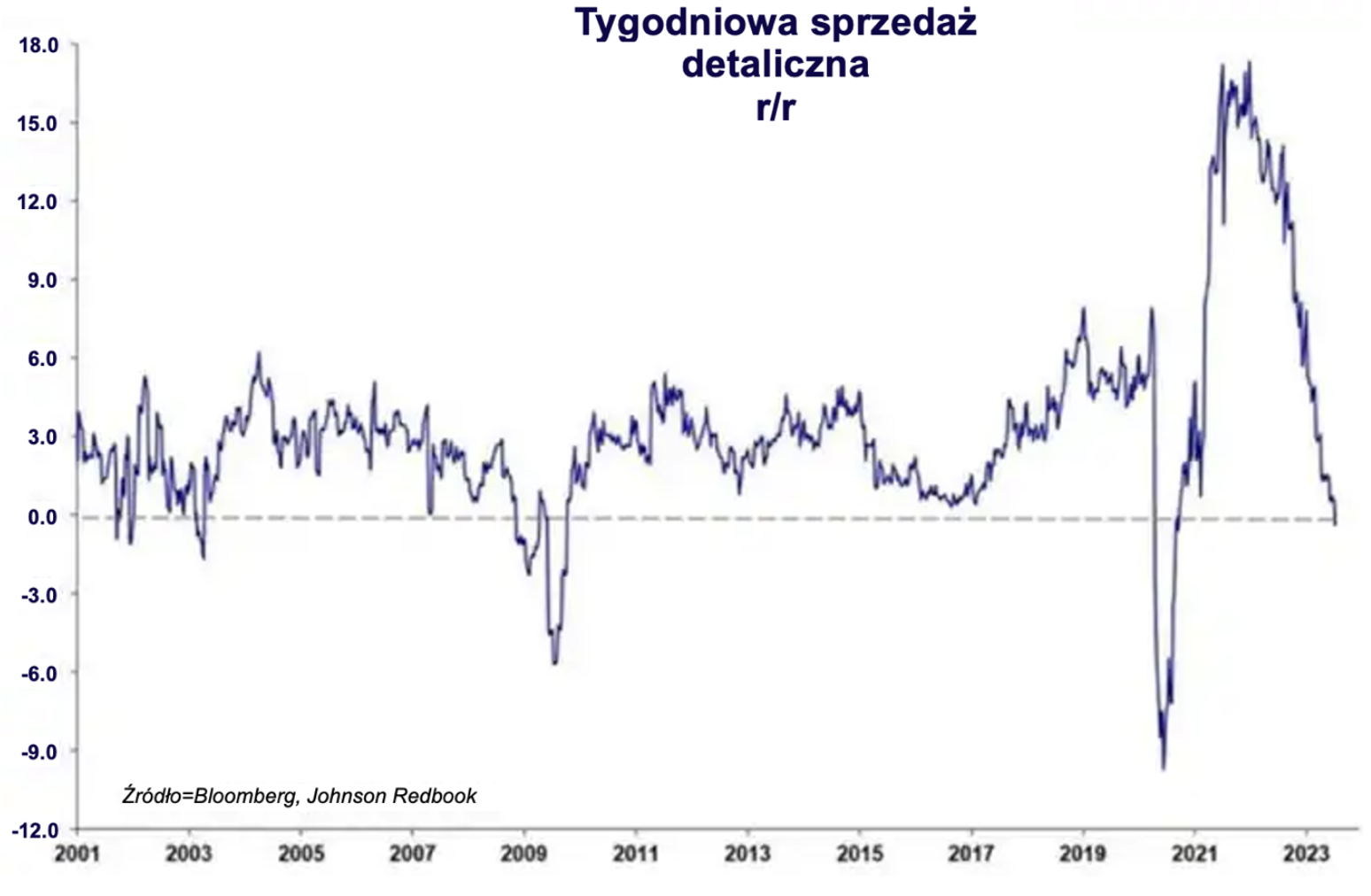

Private savings have reached saturation and are starting to take negative values. Retail sales took a negative value.

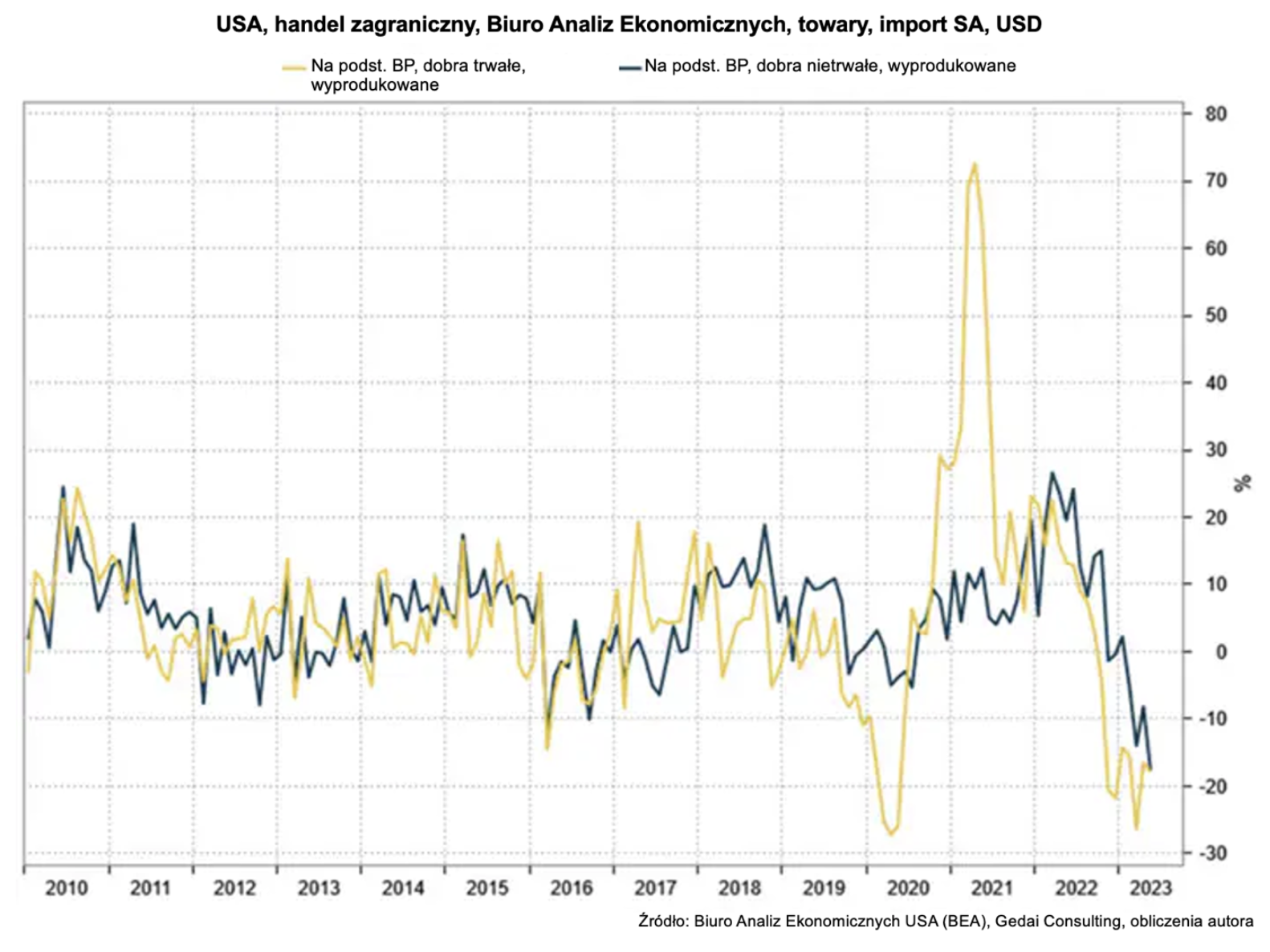

Imports into the United States are declining significantly (imports are an excellent indicator of future economic growth).

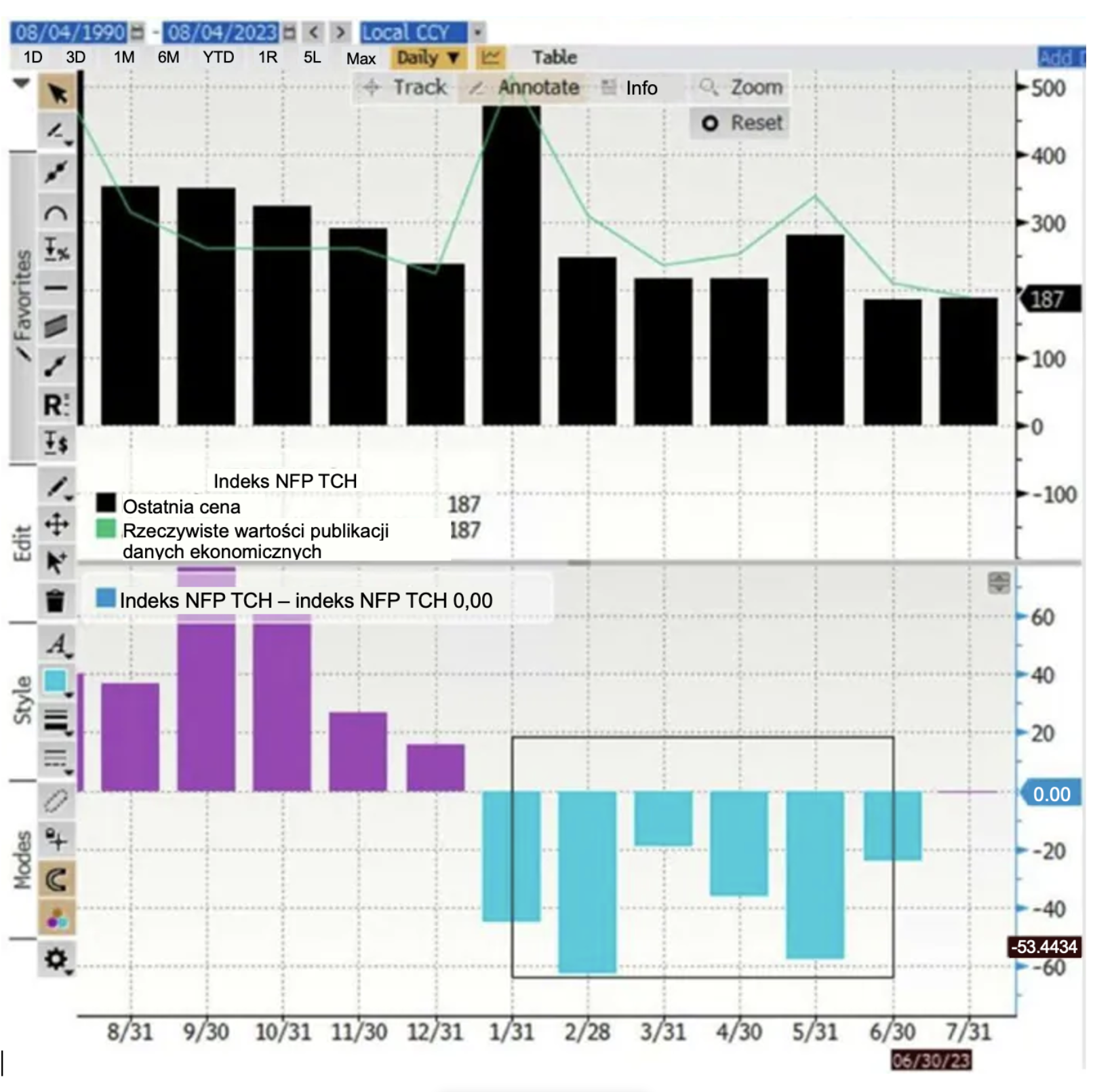

The US job market is starting to slow down. One of the indicators I value is a series of large adjustments in non-farm employment in the past.

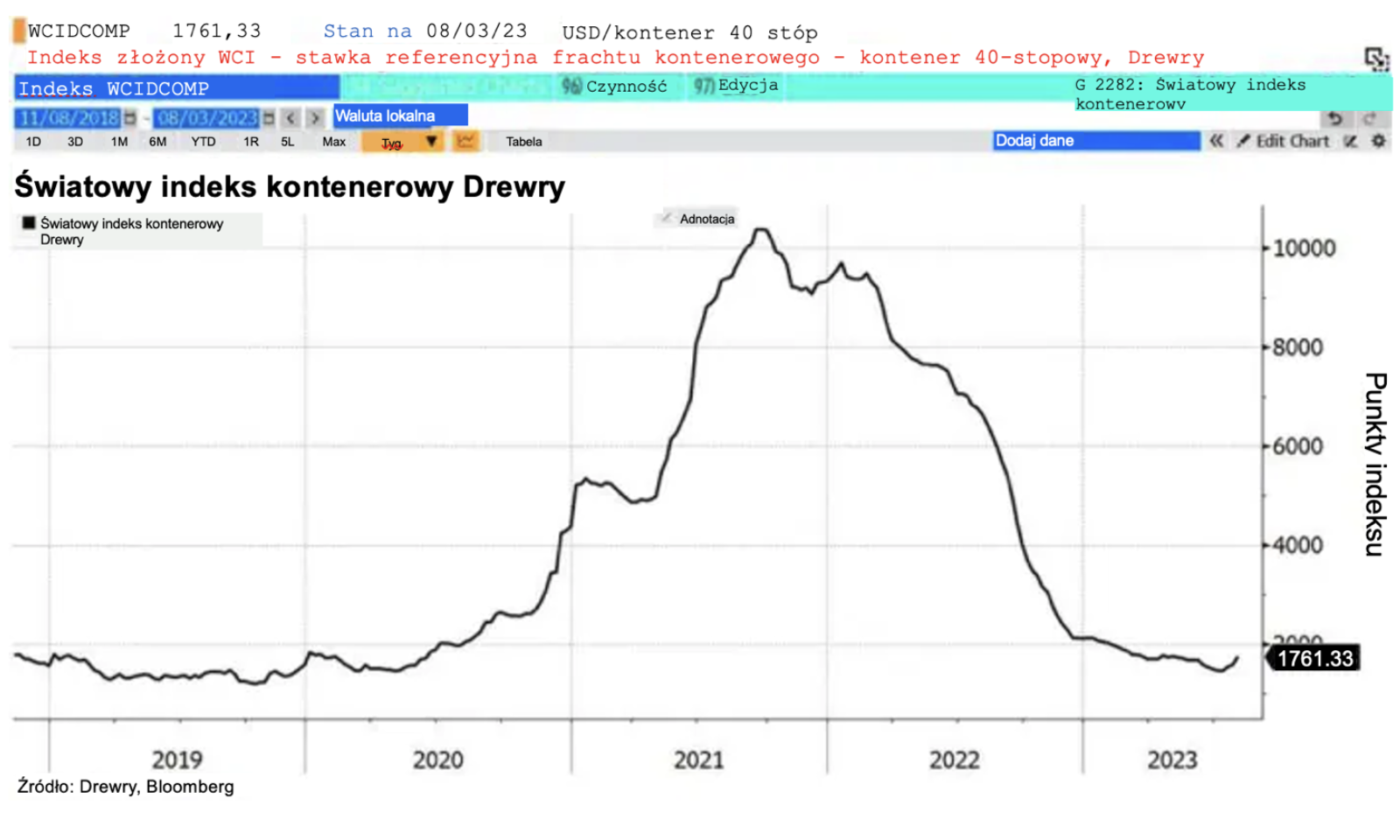

Global container freight prices (a global spending barometer) are plummeting.

Conclusions:

We believe that "time is up" the current economic model. Since the end of programs stimulating the economy, we are dealing with a progressive one recession, which is now shifting from global production to consumer spending. We continue to anticipate stubborn inflation (wages and energy) going forward.

The focus on programs and concepts similar to MMT must "die" for the economy to recover and turn towards productivity. This is signaled by the current positive real interest rates, as higher marginal costs of capital will now attract more capital, but will contribute to a higher return threshold, de facto forcing more investment in productivity.

As a result, we believe a slight stagflation is now a very real possibility. This will mean that the US will enter a period of high inflation and slow economic growth. It will be a difficult time for the US economy, but we believe it is inevitable.

So now is the time for policymakers to start fearing the answers to their questions: debt is not free, economies are not growing for lack of productivity, and you can't just leave voters and economic agents behind while government assets grow.

The coming stagflation will be a positive step towards resetting the economy to focus on the real challenges: better and cleaner energy, a bigger real economy, and much more effective education and social policies.

About the Author

Steen Jakobsen, Chief Economist and CIO Saxo Bank. Djoined Saxo in 2000. As a CIO, he focuses on developing asset allocation strategies and analyzing the overall macroeconomic and political situation. As head of the SaxoStrats team, Saxo Bank's internal team of experts, he is responsible for all research, including quarterly forecasts, and was the founder of Saxo Bank's outrageous forecasts. Before joining Saxo Bank he cooperated with Swiss Bank Corp, Citibank, Chase Manhattan, UBS and was the global head of trade, currency and options in Christiania (currently Nordea). Jakobsen's approach to trading and investing is thought-provoking and is not afraid to oppose consensus. This often causes debate among the global market community. Every day, Jakobsen and his team conduct research in various asset classes, covering major macroeconomic changes, market movements, political events and central bank policies. With over 30 years of experience, Jakobsen regularly appears as a guest at CNBC and Bloomberg News.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response