Rollercoaster on the stock market - the most popular companies in Q2020 XNUMX [Saxo Bank]

The three quarters of 2020 are behind us, which will be remembered for a long time, no matter what its last months will be. In the stock markets, 2020 was reminiscent of roller coaster - for investors with strong nerves it could be a time of opportunities, historic peaks, opening up to sectors of the economy so far underestimated, as well as strengthening in the markets of those who have already worked for their position.

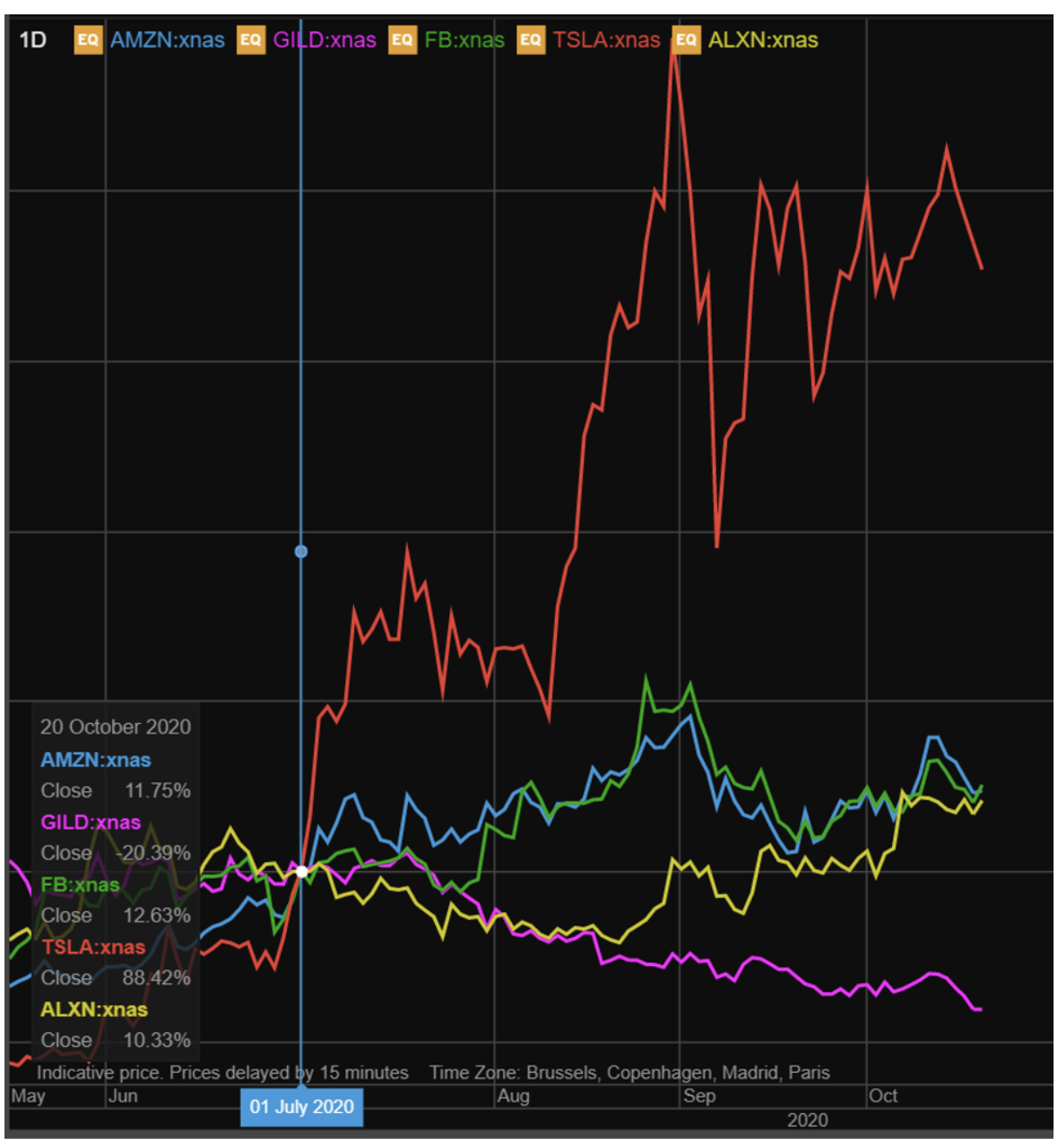

Polish Saxo Bank clients they reacted adequately to the changing situation. Among the consistently popular actions Tesla, Facebook and Amazona, domestic investors also believed in the pharmaceutical industry - Saxo's top five most popular companies are complemented by Gilead and Alexion Parmaceuticals. The latter proved to be a stable investment in the third quarter, and its popularity was probably related to the final phase of testing SOLIRIS - a drug for patients struggling with COVID-19, announced at the end of the second quarter.

Gilead

Gilead disappointed expectations, at least on the stock exchanges, as the company's stock was highly volatile. The maker of Remdesivir, the only FDA-approved antiviral drug to get President Trump on his feet at lightning speed, recorded the lowest values in nearly two years and is currently trading just above seven-year lows. This is due to the lack of 100% positive opinions about the effectiveness of the drug, as well as the September announcement of the acquisition of Immunomedics, which would be the largest in the company's history, worth 21 billion dollars. Gilead will report its third-quarter results next Thursday.

Tesla

Elon Musk's company is undoubtedly a hit this year. Despite many voices that the current valuation is too high, Tesla does not cease to surprise. Last week's report, despite huge expectations, did not disappoint, and even delighted. Year-on-year income grew by 39%. With the turbulence in the second quarter in mind, be careful. Adding Musk's narrative that profitability is not a priority, and that growth and market capture are the priorities, 2021 promises to be exciting for this electric car manufacturer.

HOW TO INVEST IN TESLA [GUIDE]

Facebook will report its results for the third quarter this coming Thursday. Expectations for the EPS index are around 1.9. In the same period last year, the company reported Earning Per Shares with a value of 2.12. This ratio is calculated as the company's earnings divided by its outstanding shares, in other words it is the net earnings per share. The company's future value will potentially be affected by the initiated antitrust case. A similar US administration has already started against Google.

HOW TO INVEST IN FACEBOOK [GUIDE]

Amazon

Amazon will be reporting third-quarter results this week, and it will also be on Thursday. To achieve the overall consensus expected for the S&P index, the results of a giant like Amazon are very important. In the current reality, in which a large part of life's activities has moved to the web, it is difficult to expect that the results of the giant online store will be worse than expected. In the case of Bezosa, sales growth is estimated at 30% year-on-year.

HOW TO INVEST IN AMAZON [GUIDE]

Author: Tomasz Szymula, Saxo Bank analyst

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Rollercoaster on the stock market - the most popular companies in Q2020 XNUMX [Saxo Bank] 2020 saxo bank shares](https://forexclub.pl/wp-content/uploads/2020/10/akcje-2020-saxo-bank.jpg?v=1603799920)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Rollercoaster on the stock market - the most popular companies in Q2020 XNUMX [Saxo Bank] Treasury bond contracts](https://forexclub.pl/wp-content/uploads/2020/10/kontrakty-na-obligacje-skarbowe-102x65.jpg?v=1603736694)

![Rollercoaster on the stock market - the most popular companies in Q2020 XNUMX [Saxo Bank] donald trump cryptocurrencies](https://forexclub.pl/wp-content/uploads/2020/10/donald-trump-kryptowaluty-102x65.jpg?v=1603880856)