Oil in 2024 – what to focus on?

Investors in the oil market started the year cautiously, with concerns about global growth and demand offset by the increasing geopolitical risks involved with events in the Red Sea region, where last month's attacks on merchant ships forced shippers to divert container ships from Middle Eastern and Asian routes, driving up costs and delivery times. It is also worth emphasizing that during the first weeks of trading, as in almost all previous years, trading will be characterized by some volatility as speculative investors will be on the lookout for signals to make trades, making trading conditions chaotic.

We believe this is increasingly likely to happen in the coming months oil prices will remain within the range, with no single factor proving strong enough to influence the dynamics in the market, which is currently focused - on the one hand - on concerns about economic growth, primarily in China and the United States, and also on growing production from outside OPEC+, and on the other - on reducing production by OPEC+ and geopolitical risk. Additionally, changes in the expected pace of interest rate cuts in the United States may impact risk appetite. Therefore, we predict that in the first quarter the price of Brent crude oil will remain within the range of around USD 80, with the greatest downside risk associated with a split in OPEC+ leading to the dissolution of the current agreement on limiting production, while the upside risk - with a significant a geopolitical event disrupting the flow of oil and gas from the Middle East.

The price of Brent crude oil has remained within a relatively tight range of $27,5 throughout last year, compared to the $64 range seen in 2022, when the war in Ukraine led to a sharp rise and then crash in prices. Overall, the price of the next expiration Brent crude oil futures contract declined by 6% on a year-to-date basis, while the price of the WTI crude oil contract declined by 7%. From an investor's perspective, both futures contracts were in deportation for most of the year, and given the positive rollover impact in these conditions, the negative result was reduced to just -1% for Brent and -2% for WTI.

A more detailed discussion of the technical forecast by Kim Cramer, technical analysis specialist at Saxo, is available here.

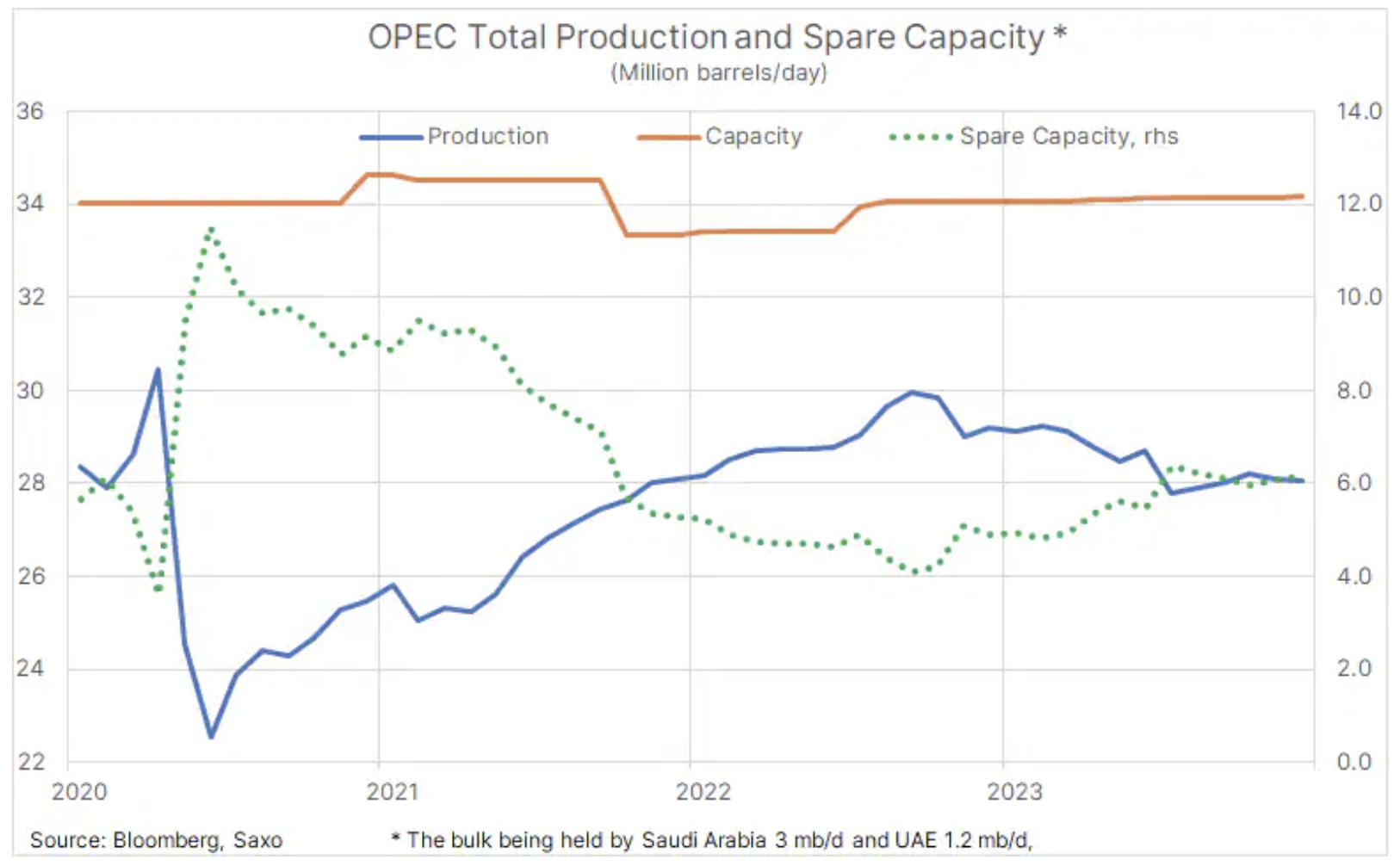

At the current price of almost $80, Brent crude is trading just a few dollars below its average price over the past year, and the current two-day moving average is just above $82, and although, as mentioned, this relatively tight range is a credit to OPEC+ and its desire to maintain stable prices through active supply management, there is no doubt that this group would prefer higher prices. However, rising production from the United States, Iran, Venezuela, Guyana and other countries, combined with weak demand in the fourth quarter, meant that the group achieved only a partial victory, given its failure to drive up prices while giving up market share.

Being forced to give up additional market share to keep prices above USD 70 remains a key threat to group unity, particularly given the prospect of weaker demand growth and continued high production from non-OPEC+ countries putting downward pressure on OPEC+ market share and on an increase in available production reserves, especially in Saudi Arabia, which has production reserves of over 3 million barrels per day, which under normal circumstances should help limit any price increases due to the strong incentive to put more oil back on the market.

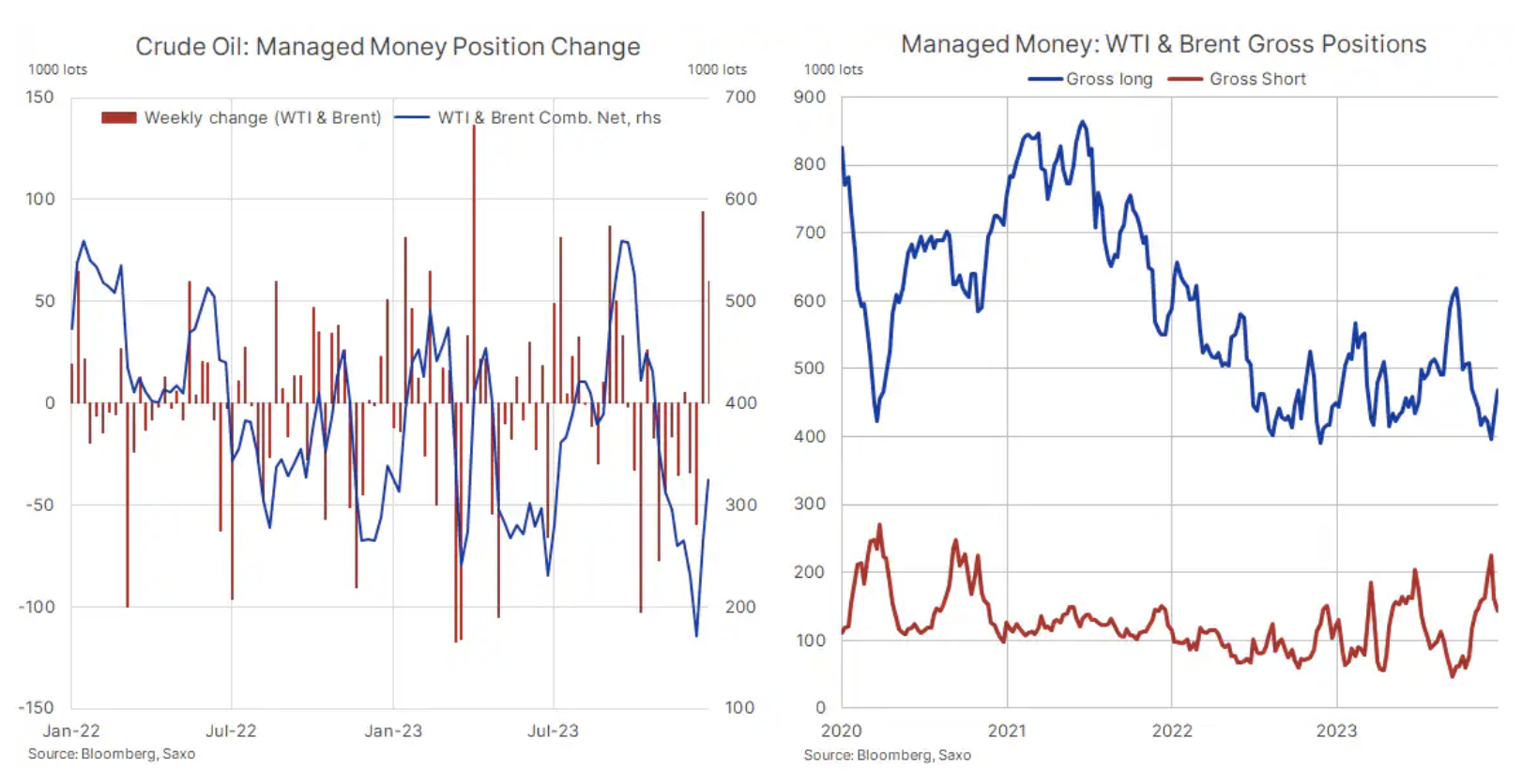

Much like last year, speculative investors such as hedge funds and CTAs will continue to play an important role in setting market highs and lows. These types of trading strategies - often following momentum - tend to anticipate, accelerate and amplify price movements initiated by fundamentals. However, following momentum often causes this group of traders to buy on strength and sell on weakness, which means they often find themselves holding the largest long position near the top of the cycle or the largest short position just before the market bottoms.

Last year's range-bound behavior by traders continued to challenge momentum-seeking speculative traders, leading to a number of situations in which they were held inappropriately when Brent and WTI crude oil - rather than continuing the trend - suddenly changed direction as the technical forecast changed , including in connection with OPEC+ production decisions, expectations of interest rate cuts in the United States, developments in China and geopolitical events. From a net long position of 491 million barrels in February, they went to a low of 231 million barrels in June, before reaching a two-year high in September of 560 million only to fall to an eleven-year low of 171 million in early December, until disruptions in the Red Sea did not contribute to a strong two-week rebound before the end of the year.

Wnioski

Brent crude is likely to remain range-bound around $80 in the coming quarter as non-OPEC+ supply and global growth concerns offset production cuts, tensions in the Middle East and another increase in global demand, albeit at a slower pace than last year. The OPEC+ group of producers will continue to support prices by extending and potentially deepening current production cuts, thus giving up market share while increasing available production reserves. The timing of the first and subsequent interest rate cuts in the United States will increase market volatility due to speculative investors focused on macroeconomic conditions.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)