The cryptocurrency market cools as enthusiasm fades

During the summer, the cryptocurrency market was relatively dormant due to concerns over global inflation as well as geopolitical tensions. These were the main factors driving the decline in risk appetite among investors in both the stock market and the cryptocurrency market, and in 2022, these markets were largely synchronized. What will be the driving force of the cryptocurrency area in the coming months? Will the energy crisis limit the re-influx of investors, or will other segments of the cryptocurrency market be able to fuel a new rally?

Energy constraints are cause for concern

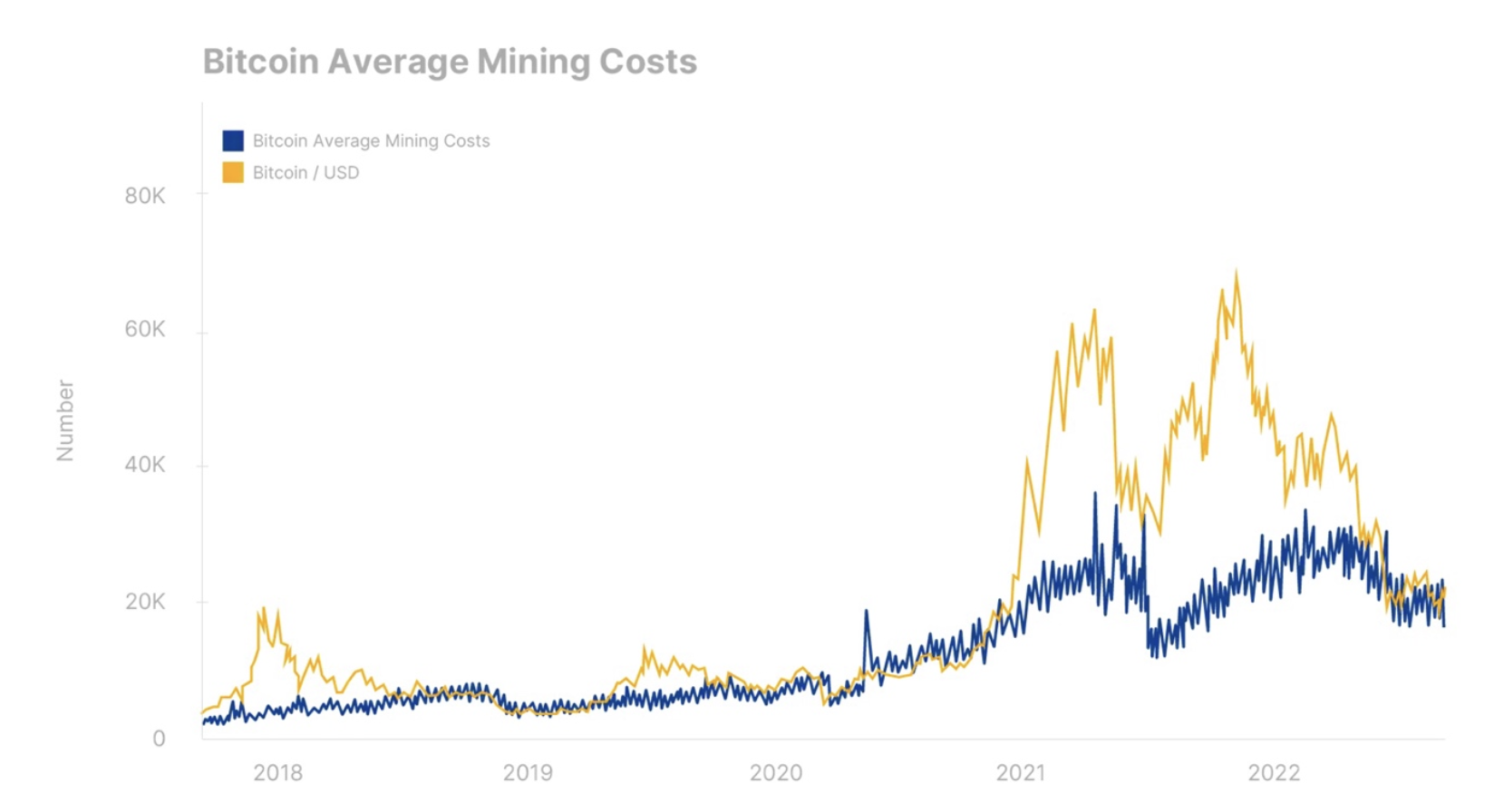

Bitcoin and a host of other significant cryptocurrencies rely on enormous computing power to get the network up and running and make sure the transaction is validated. According to estimates from the beginning of September, bitcoin will consume the same amount of energy per day as Sweden. Key feature Bitcoin is that the network is run in a decentralized manner - many independent brokers around the world validate transactions to ensure that the network is not under the control of any single entity. These so-called miners are rewarded with newly issued bitcoins, but with the falling value of the cryptocurrency market and rising energy costs, miners begin to face problems with profitability, as shown in the chart below. The drop in bitcoin prices in 2022 forces miners to move to countries with cheaper energy or to close their operations. With fewer miners running the network, it will become less secure and perhaps less decentralized as well. However, given the current number of bitcoin miners, we do not expect increased centralization to be the main source of risk in the next few years.

For the classic cryptocurrency trader, neither centralization nor energy consumption seem to be a significant concern. However, larger government institutions are increasingly concerned about a computationally-intensive type-validation system proof-of-workwhich uses bitcoin. In early September, the US Office of Science and Technology Policy at the White House said in a report that cryptocurrencies had a significant impact on energy consumption as well as greenhouse gas emissions, and recommended increased monitoring and potential regulation. This happened six months after the European Parliament discussed the ban on energy-intensive type validation proof-of-workthat bitcoin is using, which was eventually rejected. We see a significant risk to cryptocurrencies if government agencies begin to regulate the use of cryptocurrencies due to their energy consumption. If strict regulations are imposed, they can limit the use of cryptocurrencies and thus make the use of cryptocurrency technologies less attractive.

Estimated average cost of mining bitcoin according to MacroMicro based on data from the University of Cambridge - compared to the price of bitcoin. When the average cost of bitcoin mining is higher than the price at which bitcoin can be sold, the number of miners is likely to decrease.

Retail investors are watching from the sidelines - institutions are still in the game

It seems that speculative traders disappeared from the cryptocurrency market in 2022 because trends related to the fear of omitting a phenomenon (the so-called fear-of-missing-out, FOMO), which were driving the price rally in 2021, have now disappeared. In addition, the trading volumes of non-convertible tokens (non-fungible tokens, NFT - digital versions of items, pictures, films, etc.) have been at a record low over the past year, confirming a decline in speculative enthusiasm. The only optimistic aspect this cryptocurrency winter seems to be the institutional commitment that has not expired in the same way as it has for retail cryptocurrency traders. Despite the market stagnation in the last few months, many larger institutions have invested in the cryptocurrency market or expanded their services with digital assets. An example is BlackRock, which announced a partnership with Coinbase to expand its investment services on the cryptocurrency market with institutional investors, while the Brevan Howard fund raised over $ 1 billion from institutional investors for a cryptocurrency fund.

However, there are some cracks in this beautiful painting. For example, in early September, Snap announced the closure of its Web 3.0 department, and cryptocurrency traders are seeking to reduce employment due to market conditions. According to Artemis data, the number of developers in the cryptocurrency area has been declining over the last three months, but the record high amount of venture capital that poured into the cryptocurrency market in 2021 and early 2022 could - hopefully - keep cryptocurrency organizations afloat for some time. time.

In our opinion, the driving force behind the increase in cryptocurrency prices will be applicability. There is likely to be a shift from investment in random cryptocurrency tokens and NFT to cryptocurrency technologies with a specific use case. Some such projects are already underway: Sony is considering creating NFT-backed media to provide artists with faster and fairer deals; GameStop works on ownership of digital items in games using NFT technology; while Ticketmaster began cooperation consisting in issuing tickets in the form of NFT.

The cryptocurrency winter is transforming the cryptocurrency market to become more mature and healthier by eliminating speculators and unreliable actors. The key focus in the near term will be scalability to be able to process more transactions, for example for payment processing, as this is crucial for the development of cryptocurrency applications. For cryptocurrencies, it is important that cryptocurrency applications are accepted by larger institutions to demonstrate that they are more than an arena for enthusiasts blockchain technology and speculative traders. At the same time, it is to be hoped that regulators will not put a stick in the spokes due to environmental concerns.

About the author

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)