The market underestimates geopolitical risk

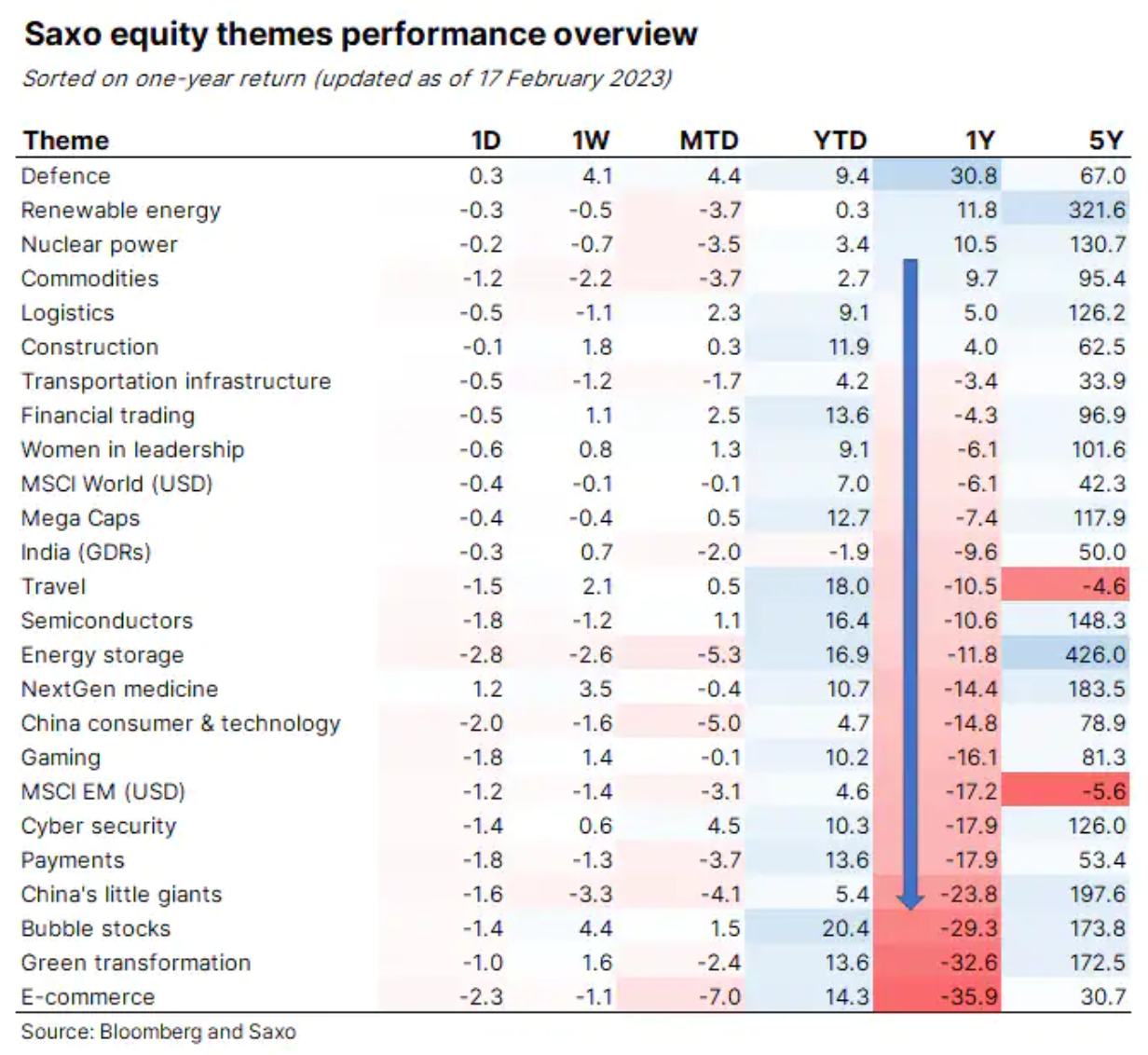

Bubble stocks have gone up more than 20% this year, signaling a return to reckless gambling behavior by retail investors. This is part of the mass speculation on options with zero days to expiration, absurd moves in the area of AI-related stocks, and investments in cryptocurrencies. What all these actions have in common is ignoring the growing geopolitical risks and the naive hope of bringing inflation back to past levels. The problem of growing geopolitical risks was highlighted at the Munich Security Conference this weekend, and this week's theme is recognizing the importance of these risks. Today, we are once again mentioning our defense basket, which was by far the best performer last year.

The markets have gone blind

For the first seven weeks of this year, investors - increasingly including retail investors - engaged in a foolish game of gambling based on shares related to artificial intelligence (AI) due to the unique human tendency to extrapolate new technologies. Investors were also playing a foolish game based on the assumption that inflation would return to normal, despite mounting evidence of structural inflation emerging and the world shifting to a war economy mode that has historically always been inflationary. This year, share prices increased by 6,8% in total, while the prices of "bubble" shares increased by as much as 20,4%. This is because retail investors are once again expressing their gambling tendencies, most notably in the speculation of Tesla stocks and options with zero days to expiration (0DTE), causing liquidity and market behavior to be disrupted, making reality seem wrapped in glossy wrapping paper. Unfortunately, it is much darker and the market is currently blind to this risk.

The market underestimates geopolitical risk

There was a feeling of nervousness at this weekend's Munich Security Conference, which was perfect summarized w Politico. The key findings are that the production of munitions in NATO countries is not as standardized as was thought, and its pace is too slow. Europe seems to be on the verge of going into war economy mode if it moves away from the standard rules to fast-track arms production permits and unlimited government support for arms production in terms of both financing and infrastructure. Moreover, Vice President of the United States Kamala Harris now maintains that Moscow has committed crimes against humanity in Ukraine, which is a sharp escalation of rhetoric. U.S. Secretary of State Blinken also stated that Washington is concerned about China supplying Russia with deadly weapons for the war in Ukraine.

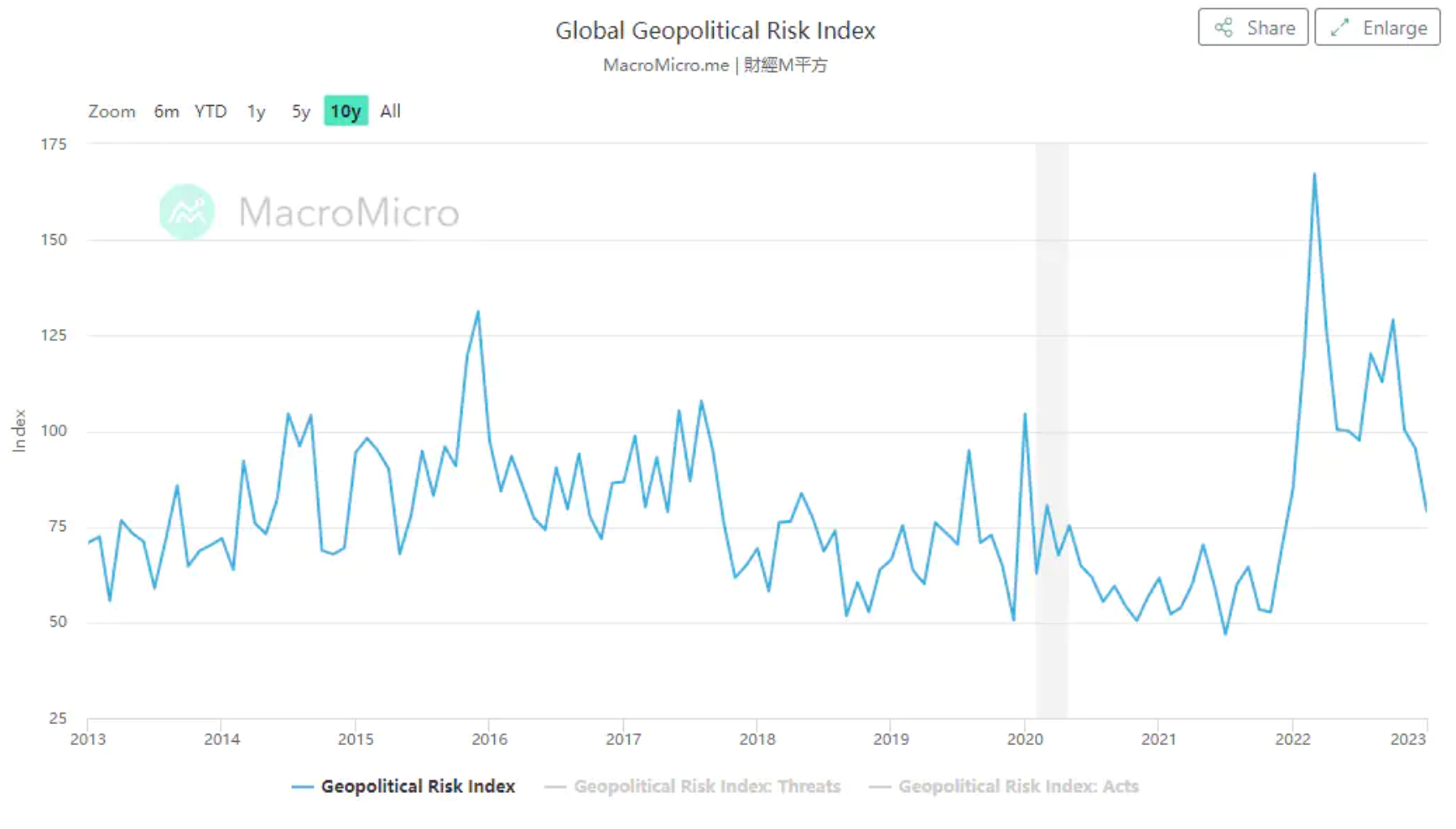

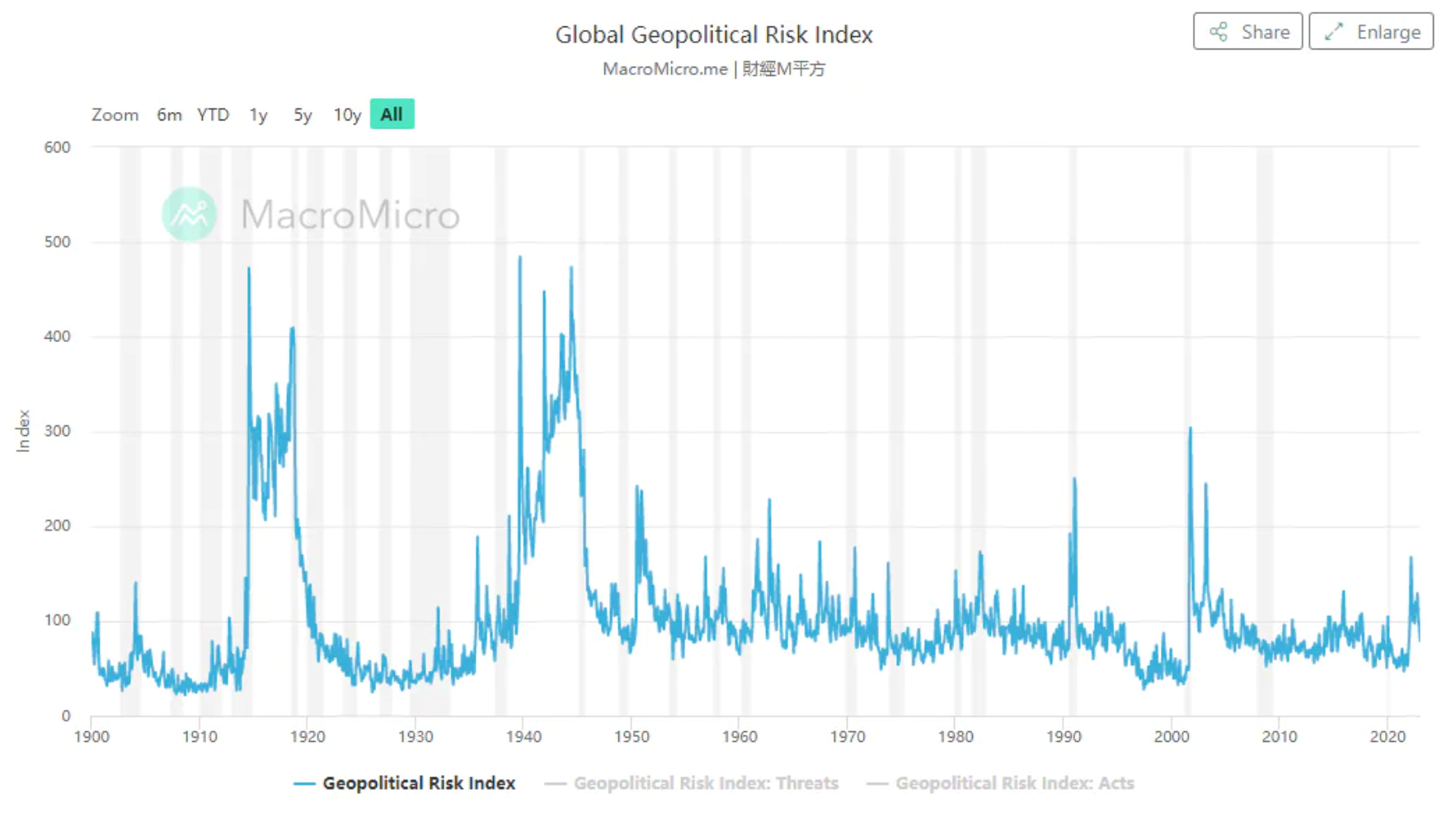

With the anniversary of Russia's invasion of Ukraine, Washington and Beijing's relationship on a collision course, and the nervousness at the Munich Security Conference, this week's theme will be an appraisal of the potential for rising geopolitical risks. If China decides to help Russia with weapons, it will be the end of globalization as we know it, and supply chains will once again be thrown into chaos. Geopolitical Risk Index, developed by economists Federal Reserve – Dario Caldara and Matteo Lacoviello – shows the scale of the decline in geopolitical risk since the beginning of Russia's invasion of Ukraine, which explains the current calm and optimism in the stock markets. However, if we broaden the geopolitical risk perspective, we can see that the upside potential is significant should the war in Ukraine take a turn for the worse.

Equity markets have always reacted negatively to rising geopolitical risks, but have shown considerable strength after the initial shock and have fully recovered. This has been seen in many wars, including World War II, and the Korean War of 1950-1953 didn't even pose a significant risk to the stock. These conclusions may be convenient, but it must be taken into account that the world economy is much more interconnected than in earlier periods due to 50 years of globalization. Our wealth and income levels are more sensitive to accelerating geopolitical risks than ever before. The price of geopolitical risk is clearly negative in the short term, while in the long term the price may remain high due to structurally higher inflation. We are dealing with a war with low inflation because a war economy pushes commodity prices up.

Defense stocks continue to lead

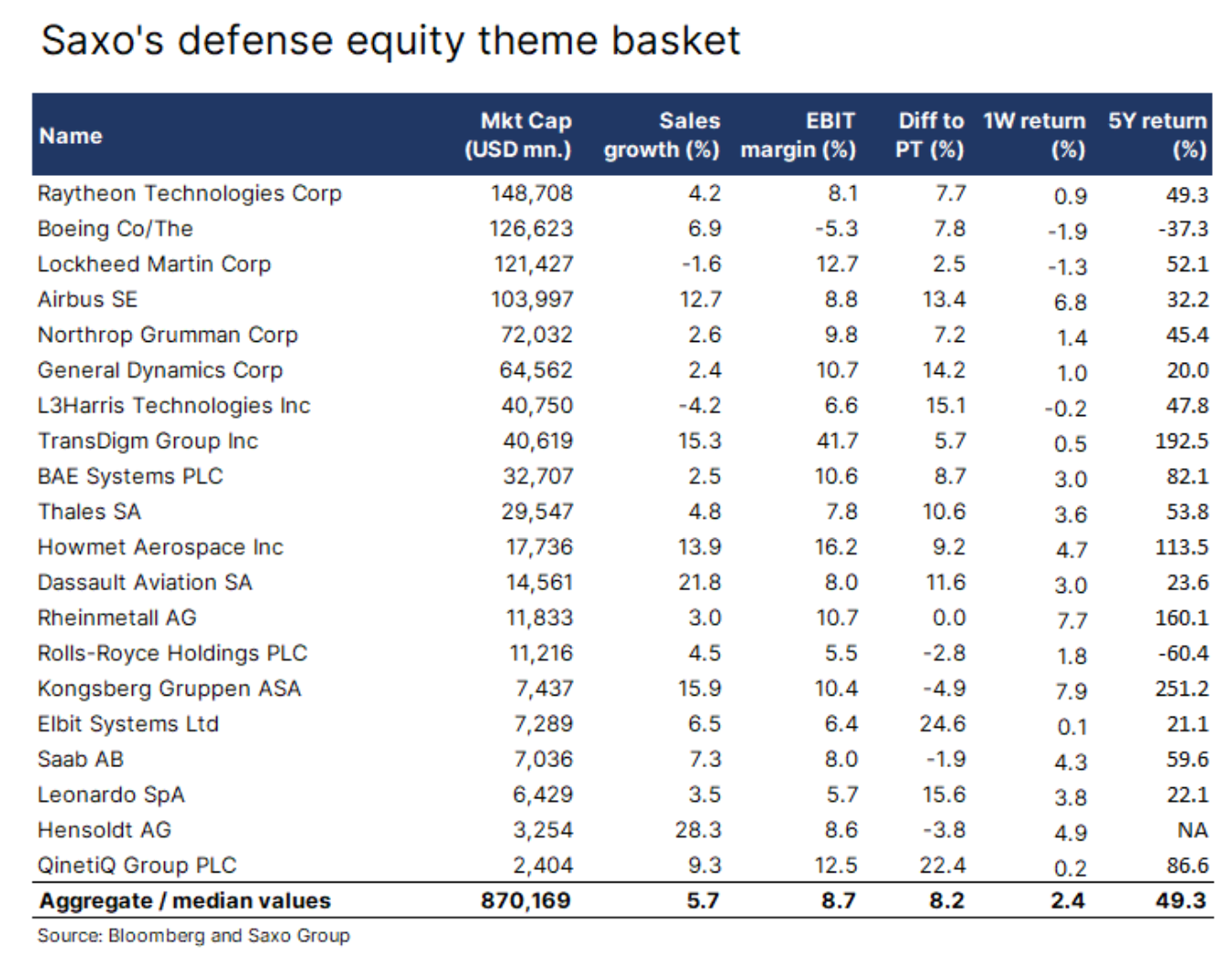

In a situation of increasing geopolitical risk, the only sensible hedge for investors is to lower market risk by lowering exposure to equities (selling to increase cash position), lowering market risk by selling equity futures, or adding basket of defense companies. Our defense basket has grown in value by 31% over the past year, fully outperforming the second basket, which is renewable energy, in terms of performance (up 12%). As we have repeatedly emphasized in our stock market analysis last year, defense budgets in Europe are set to be doubled, resulting in a tsunami of growth in this sector. The main theme is definitely not ESG, which in fact benefits investors, because they are not constrained in this context.

Tomorrow, one of the companies from the defense basket, BAE Systems, will announce the results for the second half of 2022 (ending on January 31). Analysts expect revenue growth of 23% y/y and EPS of £0,30, up 250%. Looking ahead, analysts have very low expectations for revenue growth (around 3% in 2023 and 5% in 2024), indicating significant potential for higher projected economic growth.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)