Fuel market rises due to Chinese "buy at any price" command

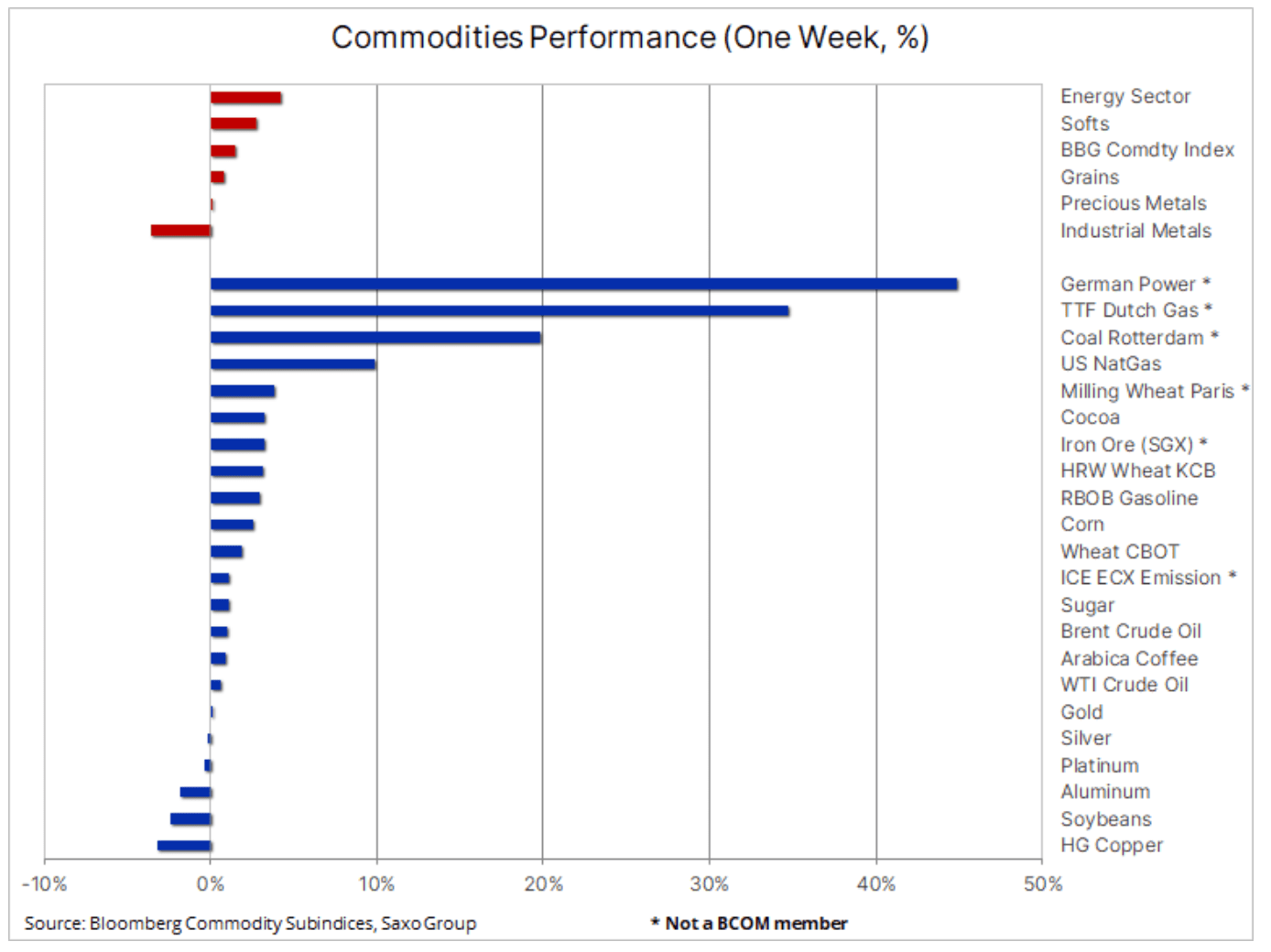

It was another week of extreme price movements for the commodities sector, and the impact of the energy crises in China and Europe echoed across global energy and commodity markets. In addition, the market had to deal with the strengthening dollar, which, along with rising fuel costs and rising financing costs through higher US Treasury yields, could ultimately have a negative impact on economic growth and stock market valuations. This development may lead some economies to stagflationwhich marks a period of inflation while slowing growth.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

This combination, which also covers supply chain bottlenecks and regulatory risks in China, made global equity markets the largest monthly loss since March 2020, marking the turbulent start of the last quarter. A quarter that is increasingly associated with the risk of worsening corporate profits, which have suffered as a result of rising production costs, the aforementioned bottlenecks in the supply chain and weakening consumer demand.

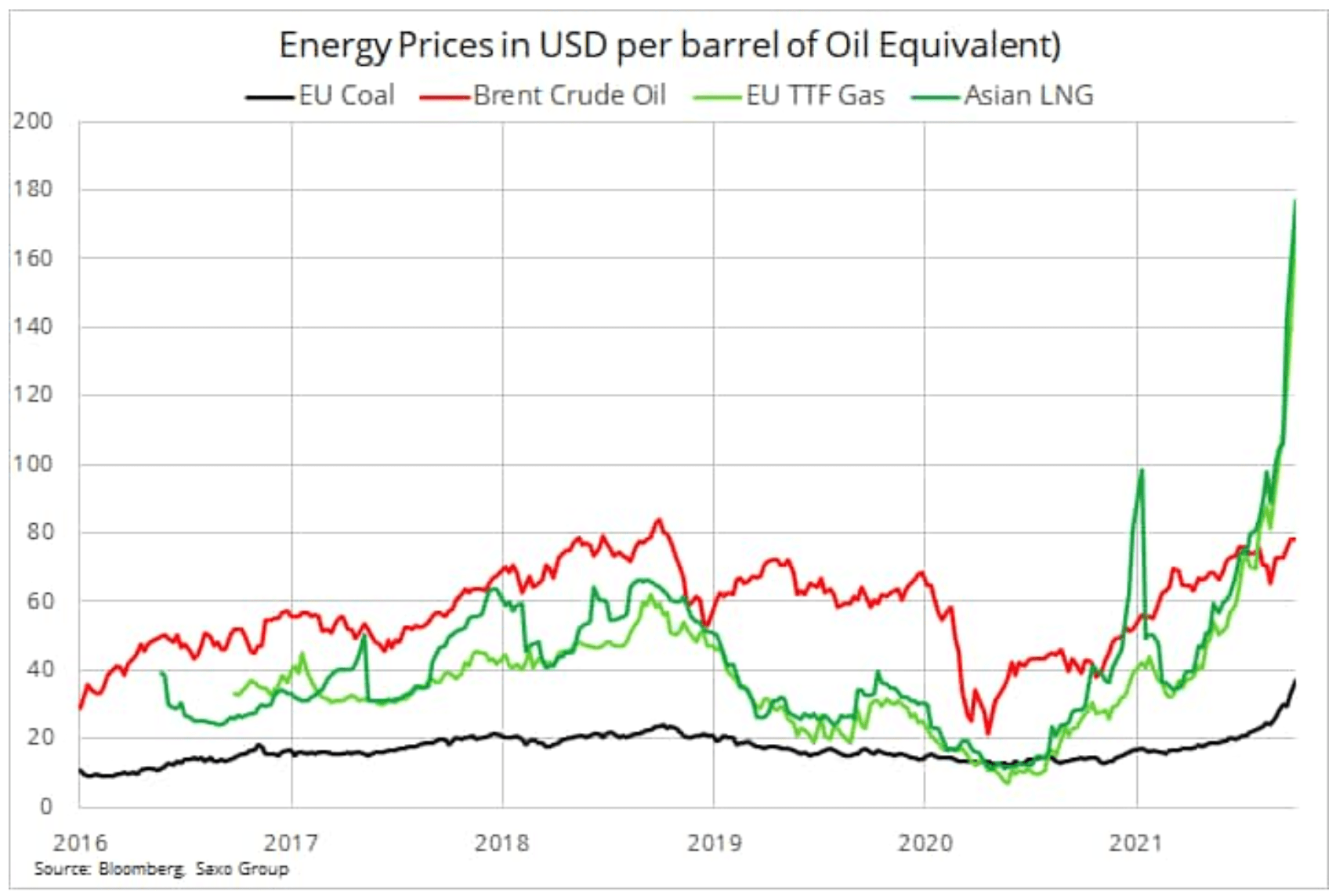

The sustained increase in fuel prices, above all, remains the main topic in commodity markets natural gas i coal. Low stocks of most fuels in the world and limited replenishment time before the peak demand season has made global consumers increasingly vulnerable to a supply crisis should winter turn out to be colder than usual. With very high gas and coal prices, we are now facing the next stage of the energy crisis, with oil prices also rising. This week, the price of Brent crude oil exceeded USD 80 for the first time in three years due to the prospect of increased demand for substitute crude oil production.

Concerns about fuel shortages this winter grew even more after China's deputy prime minister Han Zeng ordered major state-owned energy companies to secure winter supplies at all costs. In China, as in the rest of the world, there is a shortage of fuels to survive the winter. Central bank and government sponsored overstimulation in the global economy over the past 18 months has led to a surge in demand for consumer goods, many of which are manufactured in China.

This has led to higher transport costs, disruptions in supply chains and a spike in electricity demand in China as production surged to meet additional orders from consumers around the world. In order to alleviate this latest energy crisis, a number of regions have been forced to reduce their energy supply to the industrial sector. In Europe, we face the same problems, co results in record high gas, energy and emission pricesto compensate for the greater use of coal.

Industrial metals

Industrial metals prices fell as rising fuel costs and signs of a slowdown in China negatively impacted sentiment. The Bloomberg Industrial Metals Index returned to its five-week low, by contrast copper HG tested, but found support again ahead of the key area around $ 4 a pound. Widespread energy outages in China and the real estate debt crisis, along with regulatory risk and pollution abatement efforts, have contributed to a decline in industrial activity, potentially lowering the short-term demand outlook for copper and other metals such as nickel, tin or cynk. As a result of these developments, the Chinese PMI in the manufacturing sector in September fell for the first time in 19 months.

Precious metals

For gold it was a relatively good week, at least in relative terms, given the limited negative impact of the sharp dollar and rising yields US treasury bonds. There was some weakening in the middle of the week due to silver temporarily falling below the key support in the region of USD 22. Since almost half of the overall demand for silver concerns industrial applications, current fears of a slowdown in China have hurt sentiment more than gold as investors seek hedges against rising price pressures seen almost everywhere, most recently in the form of rising energy costs.

Gold is not only a metal that has a tendency to react to changes in the dollar and profitability levels, both of which continue to weigh on prices. It is also used by fund managers as a hedge or risk diversifier across all financial assets, and after a year in which interest in this metal has declined as financial assets and market valuations have hit near record highs, we are seeing a reversal of this trend. given the increasing uncertainty about the short-term direction of the world economy and volatility in stock markets.

If, as investors, we believe that the current market confidence and the moderate inflation outlook are wrong, given the signals from the bond market, the cost of buying insurance for this is declining with gold currently hitting the lower end of the annual range. We will be keeping a close eye on developments in profitability in the coming weeks as rising yields have the potential to re-increase uncertainty in other asset classes such as interest rate sensitive growth stocks. In addition, a further rise in the cost of most energy sources could ultimately support our view that inflation is not transitory and provide the necessary support for gold to get closer to and ultimately exceed $ 1.

Petroleum

Clothing remained at an almost unchanged level, with the prospect of an increase in demand, incl. from consumers replacing expensive gas with refined products such as heating oil, diesel and propane, was outweighed by a weakening in the stock market and the first surge in US crude oil inventories in eight weeks. In response to these developments, Brent crude oil initially rose above $ 80 for the first time since October 2018, followed by profit taking as risk appetite weakened. Increasing stock market volatility can also play a role, potentially forcing funds targeting a certain level of volatility to downscale their exposure overall to stay within their mandate.

The Chinese government's command to buy energy at all costs has little effect on oil given the level of state reserves that can be used when needed. Currently, investors' attention is focused on the meeting OPEC +which will take place in early October and the market speculates that the group may decide to increase production by more than the planned 400 barrels per day.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)