Commodity market: After a week of slaughter, nobody is safe

The worst week on Wall Street since 2011 also disturbed the situation in the commodities markets. The Bloomberg Commodity Index has lost more than 6% and all its components are now red. The accelerated decline caused the inevitable news of the spread the Chinese coronavirus from Asia to the rest of the world. While the US has not yet seen an increase in incidence, the market has been concerned that Washington is clearly unprepared for this threat.

Crude oil down sharply

The increased risk of a global pandemic may have further significant negative economic effects. The decline in confidence, activity and consumer spending can further adversely affect the profits of companies that are already under pressure as a result of disruption of supply chains after China, the global center of everything production, is trying to get back to work.

The energy sector was the worst hit: oil and oil prices fell in response to the largest demand shock since the 2008-2009 global financial crisis. Crude oil dropped to the December 2018 low ($ 50 / b for Brent crude and $ 42,4 / b for WTI crude), and Brent crude oil has now depreciated over 20% since the OPEC + group's decision on December 6 in on production limitation. Faced with rapidly declining forecasts for growth in demand in 2020 and so far intense non-OPEC production, this group is under increasing pressure to make further cuts.

The meeting of OPEC and OPEC + members will be held on March 5 and 6 in Vienna, and unless it is canceled at the last minute due to the threat of the virus, further production restrictions may be announced. Saudi Arabia insists on deeper cuts; one million barrels a day is speculated. Russia has so far refrained from acting, but after the ruble-priced oil price has fallen to the minimum in October 2017, Moscow may turn out to be more willing to reach an agreement.

Brent crude oil price returned to the December 2018 low of $ 50 / barrel. This is a psychologically significant level from which a strong recovery in the market began in early 2019. Given that non-OPEC production may also suffer from the recent decline in prices and an increase in credit spreads, in our opinion the potential for a possible recovery should be sought around these levels.

Chart oil Brent, interval W1. Source: Saxo Trader Pro

The current demand shock has also contributed to another weakening of copper: HG copper price has fallen again towards the critical support at $ 2,48 / lb. The fact that mining companies continue to increase supply amid an extended slowdown in China, the world's largest consumer of this commodity, will most likely lead to an overhang in supply that could increase downward pressure on prices. According to the Fibonacci expansion theory, breaking this level implies a risk that the fall in prices may be around 2,38 USD / lb or even - in the worst case - 2,23 USD / lb.

In a recent commodity market review, I mentioned that gold is at the center of a perfect storm in the form of price-positive factors, and one of the few problems was the stronger dollar. Just a week later, despite the dollar weakening again and the fall in global bond yields, the situation became slightly more complicated.

Sale of gold and more

The largest weekly sell-off of stocks since 2011, combined with a spike in volatility, led to a deleveraging among hedge funds in most asset classes with the exception of safe government bonds. Despite the positive outlook, gold has also fallen victim to liquidation of long positions due to record-breaking "paper" long positions in the form of listed funds and futures.

Silver took a heavy blow and fell to its lowest level in two months at around $ 17 / oz. As half of the demand for silver comes from industry, concerns about global growth fueled sales. As a result, the ratio of gold to silver, measured by the value of one ounce of gold in ounces of silver, increased to almost the highest level in 30 years (95,5) - the technical level from which sales began.

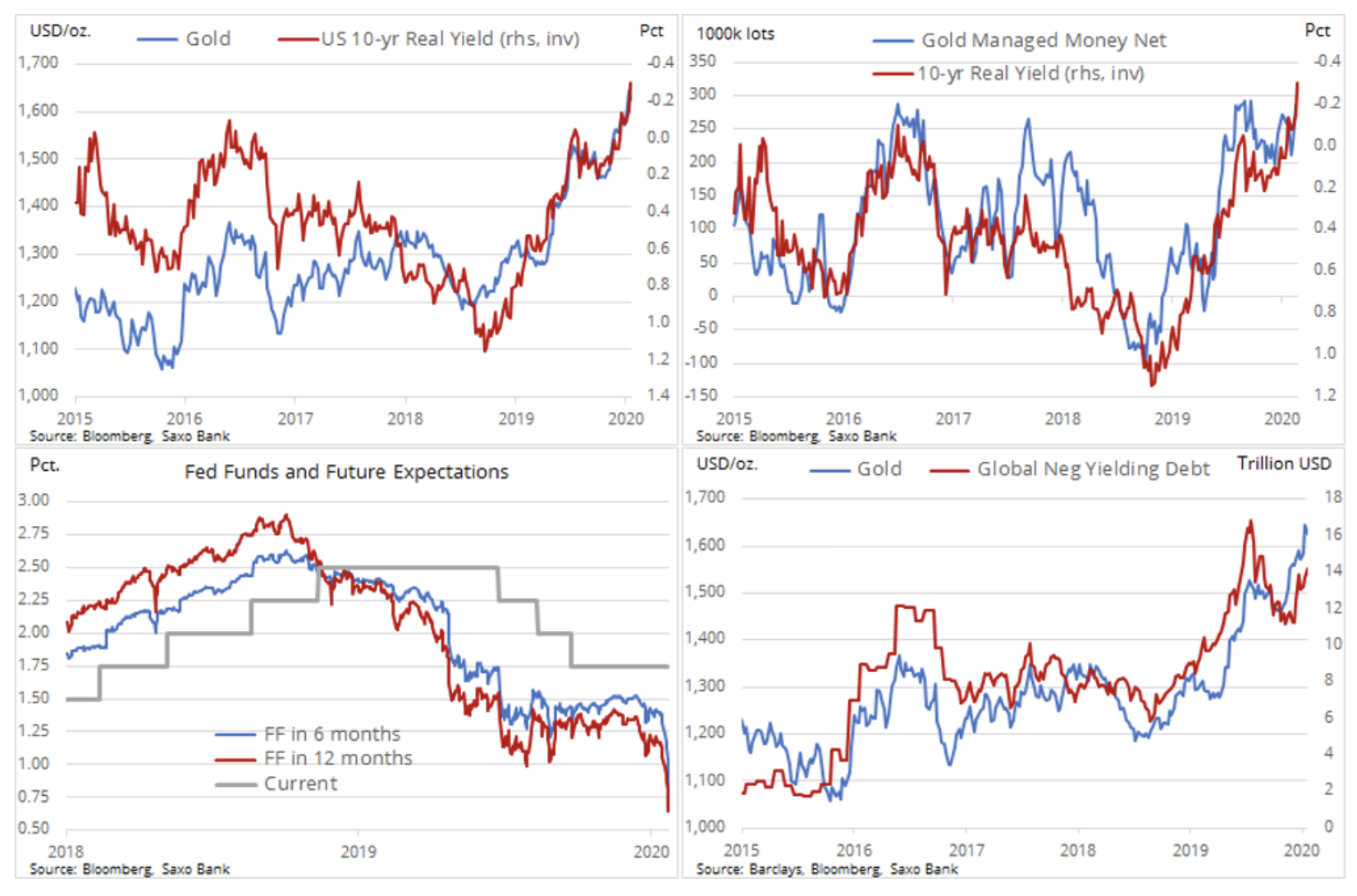

The fall in gold prices has occurred despite overall positive developments in interest rates and profitability. Expectations of future FOMC rate cuts have increased recently; Currently, for 2020, three cuts by 25 basis points are already priced in, the first of which should occur at the March 18 meeting. 0,30-year real yields fell to -14,2%, while the overall amount of negative yield debt increased to USD XNUMX trillion.

For a non-interest or dividend asset such as gold, these changes are favorable. The fact that the market was struggling to respond to the overwhelming need for measures to reduce exposure in all markets made the metal now ready for a correction. Given the potential for stock price stabilization, in the short term, prices may be lower and entry levels more favorable for investors who see gold as a long-term investment. As you can see in the chart below, support is currently around $ 1 / oz ahead of $ 600 / oz, which represents an uptrend from the June 1 low.

Chart gold, D1 interval. Source: Saxo Trader Pro

Source: Ole Hansen, head of department of commodity markets strategy, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)