There is a risk of a sharp drop in oil prices, the correction on the gold market is slowing down

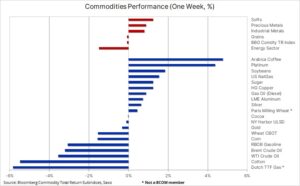

After a week that saw a wave of sales in all sectors except soft goods, the commodity sector is heading for its biggest weekly decline since March. The energy sector was once again in focus, with the liquidation of misplaced long positions beginning as the market increasingly focused on weaker demand rather than on tight supply and geopolitical risks after a week in which producers in the United States, Europe and China pointed to deterioration in business conditions in October. While gold is showing signs of stabilization, other metals such as silver, platinum and palladium remain under pressure from weaker industrial demand.

Dovish revaluation after the FOMC meeting

After a week that saw a wave of sales across all sectors except soft goods, buoyed by strong cocoa and coffee amid a deteriorating supply outlook, the commodities sector is heading for its biggest weekly decline since March. The energy sector was once again in focus, with the liquidation of misplaced long positions beginning as the market increasingly focused on weaker demand rather than on tight supply and geopolitical risks after a week in which producers in the United States, Europe and China pointed to a deterioration in business conditions in October, offsetting some of the gradual improvement from June to September.

The situation in the metals sector was mixed, with gold's recent correction showing signs of stalling, while silver, platinum and, most notably, palladium – three metals dependent on industrial demand – fell sharply with the appearance of hail clouds on the economic horizon. Additionally, the grain sector fell after the U.S. Department of Agriculture surprised traders by forecasting record U.S. corn production and elevated global soybean and wheat stocks after a production season that turned out to be much better than initially feared.

From a macroeconomic perspective, the US dollar strengthened against most of its peers, most notably the weak AUD, JPY and GBP, while US bond yields rose following Federal Reserve Chairman Jerome Powell's announcement that the US central bank would remain cautious but would not hesitate tighten policy if necessary to contain inflation. At the IMF conference, Powell struck a hawkish tone as he tried to reverse the dovish revaluation following the meeting FOMC and a weak nonfarm payrolls report last week, which pushed the 44-year U.S. bond yield as much as 4.5 basis points below 25% and the two-year monetary policy-sensitive bond yield down 500 basis points, while also dragging down the S&P 2021 best period since XNUMX. Easing financial conditions until inflation returns to desired levels cannot be tolerated, and while we believe the Fed is done raising interest rates, FOMC members will need to refrain from such a message until absolutely necessary to prevent markets from getting ahead of them.

The Bloomberg Commodity Index, which tracks 24 major commodity futures contracts spread almost evenly across the energy, metals and agricultural sectors, was headed for a weekly loss of 3% - its worst performance since March - primarily due to a 7% decline in the energy sector and 2,4% in the precious metals sector. The agricultural sector continues to see a growing divergence between the cereals sector, supported by abundant supply following a solid production season in the Northern Hemisphere, and the soft products sector, where the supply of coffee, cocoa and sugar is increasingly tight as weather patterns associated with El Niño continues to impact key producing regions in the Southern Hemisphere. As a result, the soft goods sector gained over 30% year-on-date, while the grain sector lost over 10%, providing some relief to consumers around the world.

Short-term cyclical weakness versus long-term structural growth

Despite the current price weakness due to concerns about economic growth in China, Europe and potentially the United States, Saxo maintains the view that key commodities are entering a multi-year bull market driven by a shortfall in capital spending due to rising financing costs, lower investment appetite and credit constraints . The green transition is generating 'green inflation' by increasing demand for industrial metals due to the shift towards 'new' energy at a time when mining companies are struggling with rising costs, deteriorating ore grades, growing social and environmental scrutiny and, in some cases, nationalism raw materials.

Moreover, we are observing increasing fragmentation, causing an increase in demand and prices of key raw materials. The agricultural sector will likely have to deal with increasing weather variability and price spikes. In principle, these supply and demand imbalances could take years to correct, ultimately supporting structural inflation above 3%, which is likely to increase investment demand for property, plant and equipment such as raw materials.

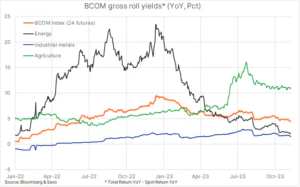

The tight supply of a number of key commodities since late 2021 gives the Bloomberg Commodity Index a positive year-over-year gross rollover yield. The gross rollover yield shows the difference between the performance of the spot price and the overall return, with the spot price being the spot price of the futures contract, typically observed by strategists and technical analysts, while the overall return indicator shows the actual realized return, including financing and storage costs, as well a positive return on rolling futures contracts in conditions of limited supply (such as today), known as deportation, or a negative return on rolling forward contracts in a market with large supply, known as contagion.

The average gross rollover yield over the past 10 years is -3,25%, highlighting the long period of abundant supply leading up to a period of pandemic disruption in 2020 and a surge in demand for consumer goods. During this period, bond yields rose sharply, reaching a peak of 9,25% in December last year, and then fell to the current level of 4,5%. We believe that positive yield gains from tight supply will continue to support investment demand in this sector in the coming months and quarters.

The correction on the gold market is slowing down, the growth forecast remains unchanged

Gold has been undergoing a period of consolidation since hitting a high of $2 last month. This short-term high was reached after a near-$009 rally, supported by a return to long positions by surprised technical short sellers, geopolitical risks from Israel's war with Hamas, and concerns about a further rise in U.S. bond yields that have traders and investors are increasingly concerned about U.S. fiscal policy, particularly whether the recent spike in both real and nominal yields will “do something.”

These concerns eased following a dovish FOMC meeting on November 1, which, combined with easing fears of a conflict spreading to the Middle East, allowed traders to book some profits. At the same time, it increased the risk of additional liquidation of long positions by money managers such as hedge funds and trend-following funds (CTAs), who in just three weeks collectively purchased the second-largest value of gold futures contracts on record.

After a downward correction of around USD 60, but without a serious threat to key support levels, the first of which is located around USD 1, we believe that the correction phase is starting to slow down. Powell's hawkish turn mentioned earlier was not all that surprising given the need to maintain relatively tight financial conditions and explains why gold traders ignored his comments. We maintain the view that the Fed is now done with rate increases and that rate cuts starting around the middle of next year, along with record demand from central banks, will continue to support the push for a new record high next year.

Spot price support gold is currently trading near $1, a two-hundred-day moving average and a 933% rally line retracement. Given the length of the recent rally, gold could correct back below $38,2 without harming the bullish setup, while a new break above $1 could embolden traders enough to push the price towards $900.

Silver, platinum and palladium under pressure

In the short term, we will keep an eye on it silver and platinum, which are struggling as forecast growth declines, causing industrial users, particularly those in the green transition industry, to question the near-term outlook for these metals as rising financing costs hurt the wind and solar sectors, and increasingly to the hydrogen sector - the future source of expected demand for platinum. Also worth watching is palladium, which has fallen to a five-year low as speculative selling forces producers to hedge positions at levels that increasingly exceed the aggregate cost curve. Gross short position in futures contracts amounting to PLN 14. lots is close to four times the daily trading volume, which puts this metal at serious risk of a squeeze if the technical and/or fundamental forecast improves.

Crude oil at risk of falling

Energy sector heading for worst weekly performance since March; the biggest loss comes from the notoriously volatile natural gas contract, which is down more than 10% on a weekly basis due to low heating demand as November continues to be warm and production nears record highs. At the same time, there is a discount on the market oil and fuel products accelerated last week, with the price of Brent crude briefly falling below USD 80 for the first time since July, while the price of WTI crude fell below USD 75 before stabilizing.

Prices came under increasing pressure as market attention focused on tight supply supported by Saudi production cuts and a short-lived war bonus increase following the October 7 Hamas attack on Israel and the subsequent Israeli defense response in the Gaza Strip. But while the death toll in the Gaza Strip from Israeli counterattacks continues to rise to an unimaginable scale, the prospect of the conflict spreading to the oil-rich Middle East is increasingly close to zero.

Instead, the market focused on reducing forecast demand due to the deterioration of economic forecasts in Europe, the United States, and also in China, which is the largest importer of crude oil in the world. The change in the forecast and prices was also driven by selling pressure from speculative investors who, from the beginning of July to the end of September, purchased over 325 million barrels on the futures market due to the prospect of Saudi cuts driving up the price. During this period, the gross short position fell to a twelve-year low, leaving no positions able to absorb a correction like the one we have seen over the last few weeks; as a result, there is a risk of oil prices falling to low levels not justified by current fundamentals.

Support for Brent crude oil is around USD 78,34; below, there is no clear support until around USD 72, i.e. the lows from May and June. Over the medium term, Brent crude oil is on a downward trend, which would be further confirmed by a weekly close below USD 81,94. Similarly, a close above this level could signal short-term strengthening to $84,78, a 0,382 retracement from the last sell-off line from $93,80.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)