Commodity market: Gas, gold and cocoa at the forefront in October

The Bloomberg Commodity Index looks set to post a modest gain in a month that has been packed with major events so far, with the Middle East crisis adding to supply risks oil in a period of slowing global demand, through increasingly intensive attempts by the Chinese government to support the economy, to the increase in the yield of American bonds to multi-year highs, which increases the risk of something going wrong. Additionally, orange juice futures are hitting new records, cocoa prices are at levels last seen in the late 70s, and sugar has surged to twelve-year highs.

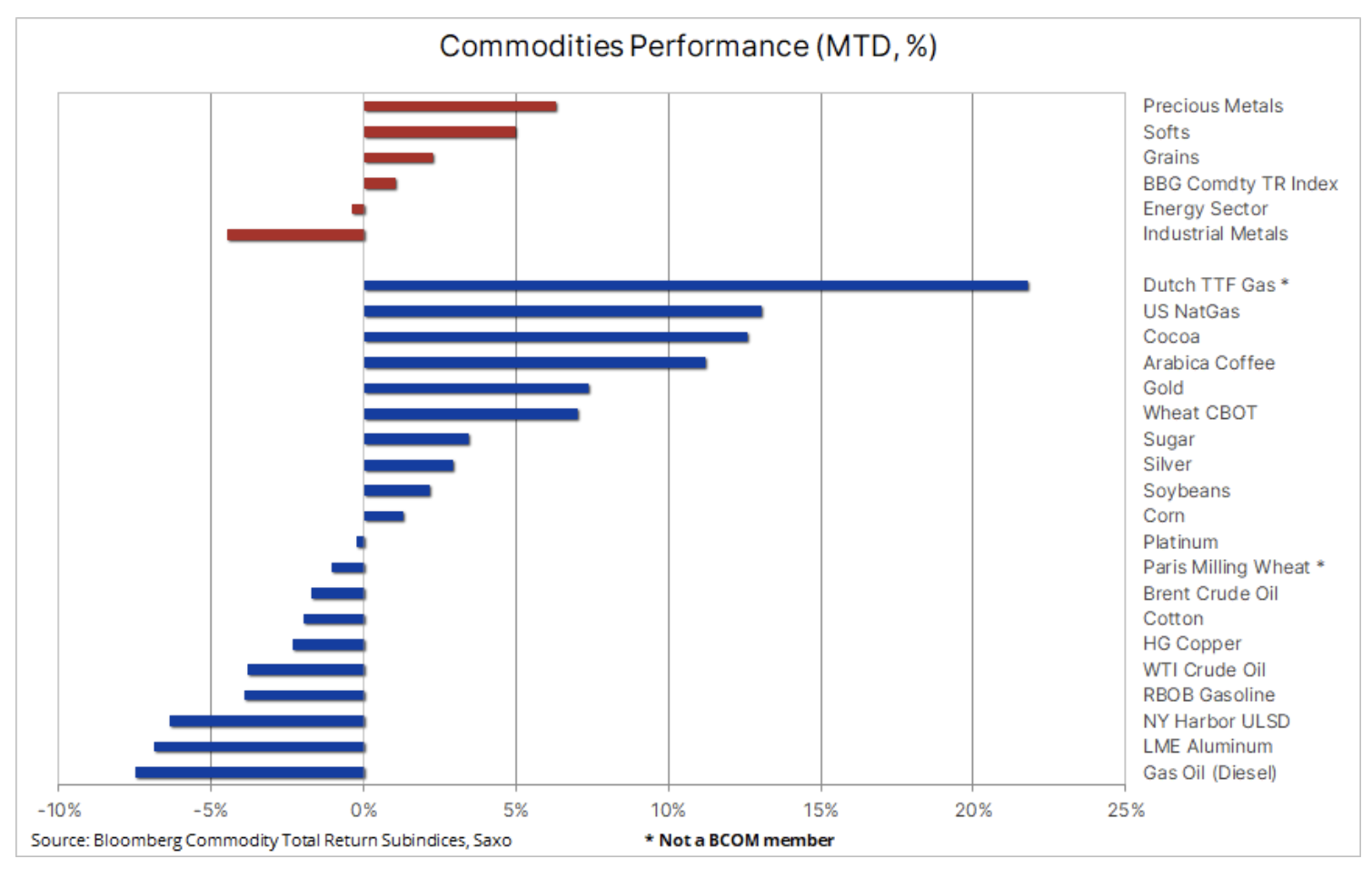

Overall, the Bloomberg Commodity Total Return (BCOMTR), which tracks a basket of 24 major commodity futures contracts, rose 1% month-over-month, reducing its year-over-day decline to just 2,5. 11% compared to -6,3% in June, before the energy sector led a recovery as OPEC+ cut production to support oil prices. Precious metals took the lead, led by gold, thanks to which this sector gained as much as 5%; soft products came in second place (XNUMX%), because both for cocoa and for Arabica coffee October was a good month due to supply concerns and El Niño. The cereals sector (2,3%) could show its first - admittedly modest - monthly increase in three months, with all three main crops rising, most notably CBOT wheat, which recently fell to its lowest level in over four years due to with plenty of supply following a better-than-expected harvest in the northern hemisphere.

Somewhat surprisingly, given the current tensions in the Middle East and concerns about an extension of the conflict negatively impacting supply from such an extremely important region, the energy sector recorded a decline this month, driven primarily by diesel and gasoline, as the seasonal slowdown in demand reduced refinery margins and with them the demand for crude oil. The lowest performer was the industrial metals sector (-4,5%), which, despite a slight rebound last week in response to new economic support from the Chinese government, continues to weaken on concerns about medium-term demand growth forecasts both in China and elsewhere .

ETF investors continue to favor overall exposure over individual commodities

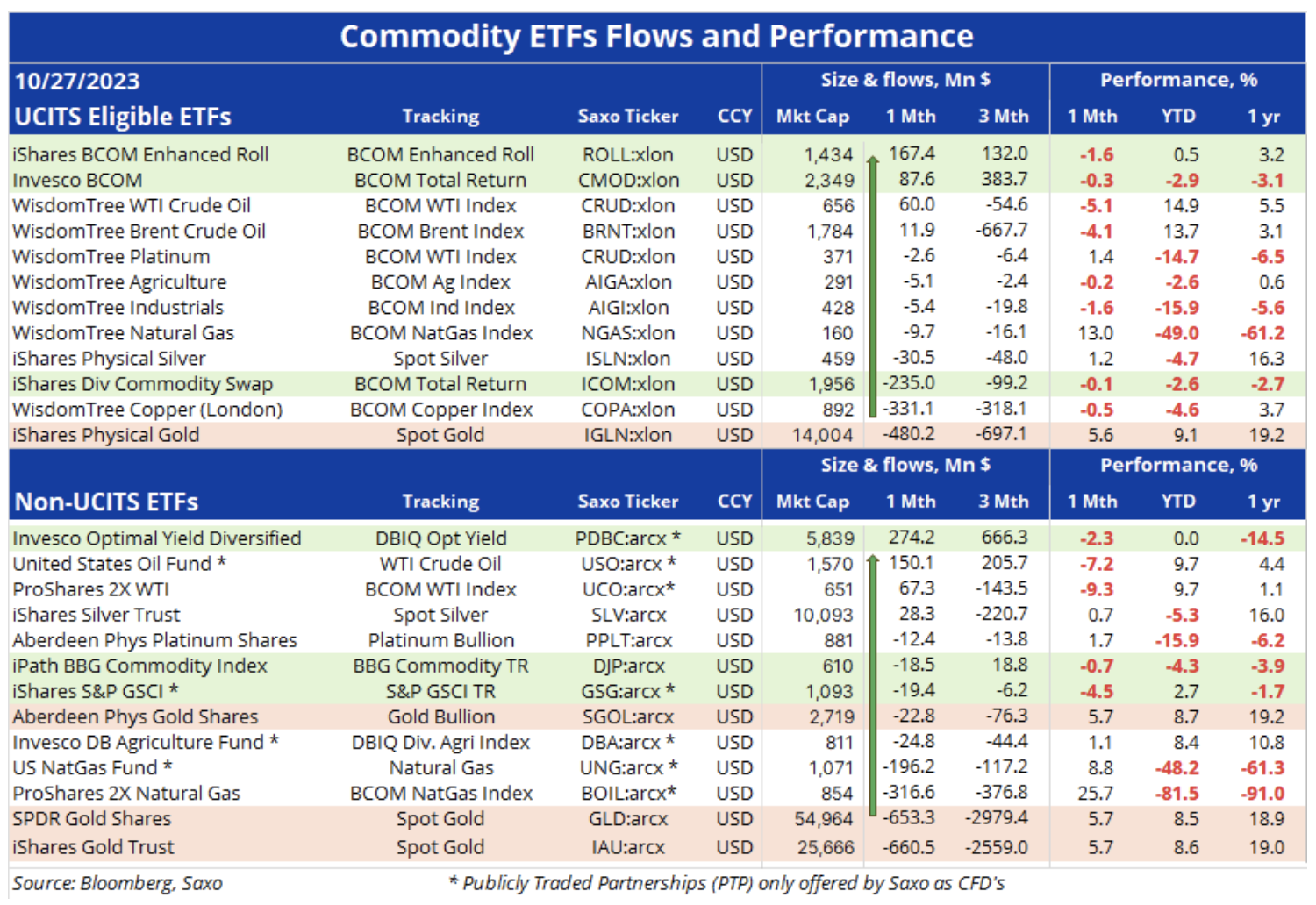

The table below shows some of the world's largest and most actively traded commodity ETFs, their latest performance and recent investor flows. There are many funds monitoring raw materials, so this list is by no means exhaustive and is primarily a source of information and inspiration.

The first part is an ETF that meets the UCITS criteria (obligations for collective investment in transferable securities – undertakings for collective investment in transferable securities) based on the EU Directive establishing a regulatory framework for funds managed and domiciled in the EU, while the second part mainly covers ETFs listed in the United States and therefore incompatible with UCITS. This group includes some of the world's largest funds in terms of market capitalization, but also several registered as PTP (publicly traded partnerships, a form of company similar to a Polish limited joint-stock partnership), which, due to American tax regulations, are often not offered outside the United States.

The main interest of investors are still commodity funds offering broad exposure, in particular the Bloomberg commodity index, monitoring the 24 most important commodity futures contracts, evenly distributed among energy, metals and agricultural products. Among the ETFs listed in the United States, the most popular is currently DBIQ Optimum Yield Diversified, which monitors a narrower group of 14 commodity futures contracts. At the bottom of the tables, we have been seeing outflows from bullion-backed funds for several months now, and below we discuss some of the reasons why this popular product has not yet responded to the strong rally in gold prices seen over the past few weeks.

Earnings status, bond yields and short-term interest rate forecasts

From a broader economic perspective, market sentiment deteriorated last week. Global stock markets have gone on the defensive after multiple earnings reports showed pressure on a number of sectors from significantly higher financing costs as rising U.S. Treasury yields are followed by yields around the world. While speculation continues as to whether interest rates in the world's largest economies have already peaked amid recession concerns and lower inflation, signs of stress have begun to emerge from the broader economy as bond yields continue to rise as it pushes interest rates higher. mortgage loans, causing significant losses both among borrowers and among many investment funds and banks, which in turn may lead to a reduction in lending in the economy. It is also driving up borrowing costs in developed countries and sucking money out of emerging markets, while raising the bar on the wisdom of investing in stocks.

While central bank governors will continue to talk about the prospect of additional interest rate increases to avoid the market getting ahead of announced future rate cuts, we believe that the FOMC and other central banks, particularly the ECB, have now ended the rate hike cycle. However, the timing of the first cut and the depth of future interest rate cuts remain in question - and depend on incoming data - unless the continued rise in US bond yields makes traders and investors increasingly concerned about US fiscal policy, in particular whether the recent jump in "something" will spoil both real and nominal yields.

Cereals versus soft products

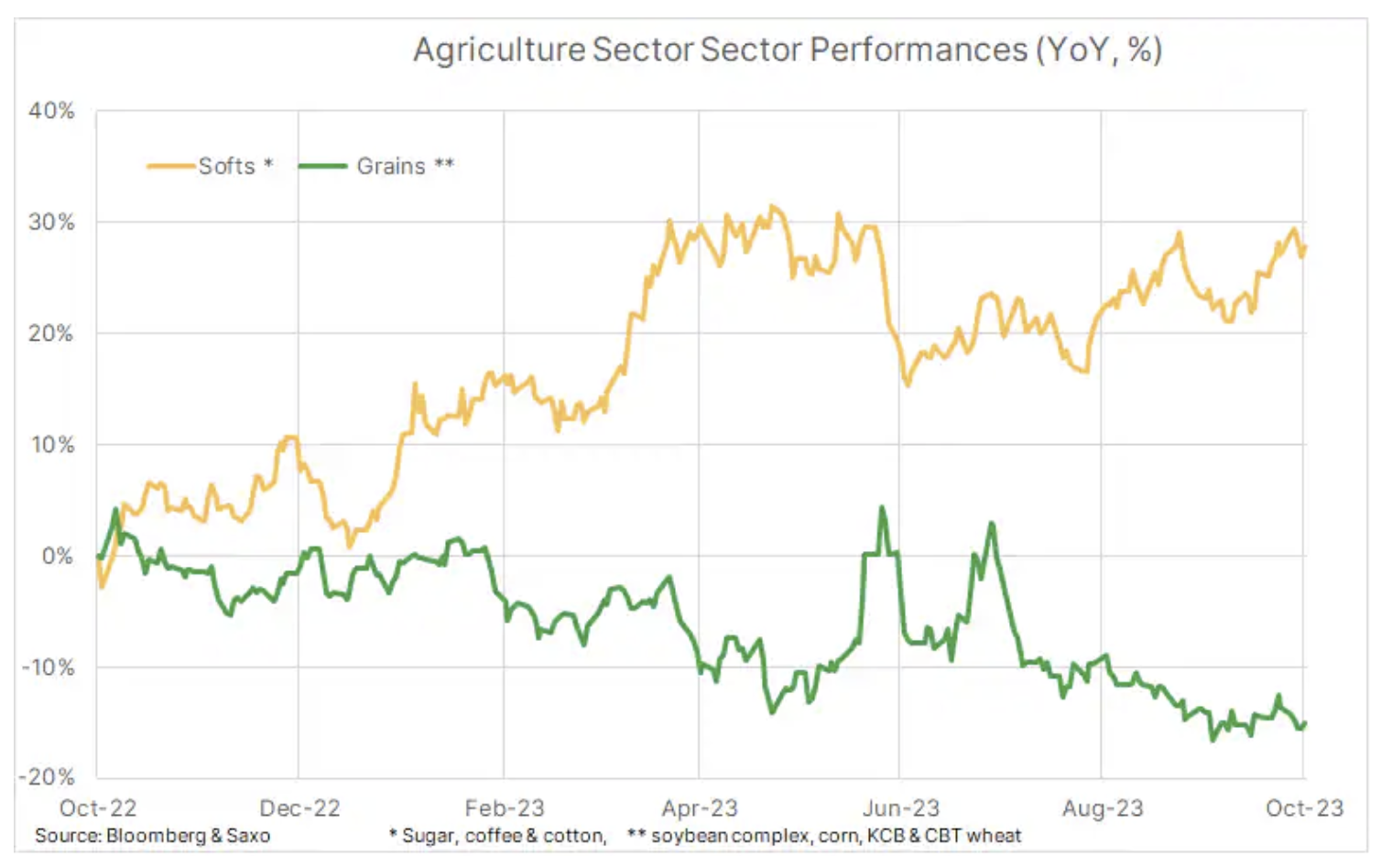

In the agricultural products sector, the difference in performance between soft products such as Kakao, kawa, Cotton or sugar, on the one hand, and the cereals and soybeans sector, on the other hand, continues to expand, with the soft products sector showing a 28% year-on-year growth so far, while the cereals sector is down 15%. Despite concerns about the weather at the beginning of the growing season, as well as about the situation in Ukraine, a good crop season in the Northern Hemisphere was followed by a bountiful harvest. Lower wheat, corn and soybean prices have contributed significantly to reducing inflationary pressures around the world. Improving forecasts for other major exporters such as Brazil and Argentina also contributed to falling prices of corn and other grains last week.

However, a different picture emerges for soft products, with cocoa futures hitting a 44-year high and sugar futures hitting a 12-year high, both due to unfavorable weather conditions in key growing regions, from West Africa to India and Thailand , while disastrously low orange juice production in Florida caused a significant squeeze resulting in record prices.

The price of natural gas increases before winter arrives

Futures contracts for natural gas in the EU and the United States they occupy the top two places this month; both are supported by the prospect of rising heating demand along with a downward trajectory of temperatures ahead of the arrival of winter in the Northern Hemisphere. In Europe, the war between Israel and Hamas has brought unwanted but so far manageable supply disruptions, but also the risk of the conflict spreading, potentially reducing flows from key Middle Eastern suppliers. Nevertheless, with warehouses 99% full and a mild recession forecast to reduce industrial demand, the region appears well-prepared to weather another winter.

The Dutch February 2024 gas contract, which reflects the peak demand period when the risk of supply cuts would be most severe, is currently trading at EUR 56/MWh ($17,4/MMBtu), or less than 10% above current spot contract at around EUR 51/MWh (USD 15,8/MMBtu), which indicates that the market is relatively calm. At the same time, the U.S. gas contract has returned above $3/MMBtu, and after weeks of above-average inventory growth due to mild weather and strong production, a significant cold snap from next week will boost heating demand ahead of the annual inventory release season, which typically begins around midway November.

Gold bulls are taking profits, USD 2 is getting closer

Gold has fully recovered from its recent sell-off, approaching the psychologically important $2 level. While geopolitical tensions following the October attacks in Israel were the main driver of the rally, buying pressure from funds forced to reverse back to net long positions contributed to the momentum. In the week ending October 000, surprised speculative investors bought 17 million ounces of gold - the fourth largest such purchase in the last decade - to reverse the unfortunate short position back to a net long position of 5,7 million ounces, still well below the 4,2 .14,8 million ounces of the long position achieved during the US banking crisis earlier this year.

It's also worth noting that the total position in bullion-backed ETFs is yet to show any signs of a comeback for long-term investors. It has been falling steadily for months and asset managers, many of whom trade gold through funds, continue to see US economic strength, rising bond yields and the potential for another delay in reaching peak interest rates as reasons not to get involved. These factors, together with rising costs of financing non-interest-bearing precious metals positions, have contributed significantly to the year-long reduction in gold positions; in recent analyses, we argued that this trend is likely to continue until we see clear signals of interest rate cuts and/or an upward break, forcing a response from real-money investors for fear of missing out on an opportunity.

Gold is in a very steep upward channel, highlighting not only the current strength of the rally but also the need for consolidation. Early last week, the price of the yellow metal corrected lower only to find support just above $1 at the first opportunity. A close above $950 could signal a move towards the two record closing highs of March 2 and May this year around $000.

The price of oil is fluctuating and the risk of war is offset by sagging demand

Oil futures remain range-bound as the war premium associated with Israel's war with Hamas continues to rise and fall in response to news and events in the region. Since Hamas attacked Israel on October 7, the market has been trying in vain to quantify and price the risk of a potential, or at worst, severe, supply disruption, but so far this geopolitical price premium has barely broken more than five dollars. This highlights the difficulty in pricing in an as-yet-unrealized disruption, knowing that the real impact on supply, particularly in Iran, could cause prices to soar, while no impact would result in a focus on demand, which is currently showing a seasonal slowdown.

As we have already mentioned, while the main focus of oil market participants is on the Middle East, fundamental fundamentals have started to loosen and demand is heading towards a seasonal slowdown, potentially worsened by the ongoing economic slowdown. Refining margins, particularly for gasoline, decline as the low demand season approaches, reducing refinery demand for crude oil due to lower profitability. Spot spreads for WTI and Brent crude have more than halved as supply concerns recede, while the premium for medium sour Dubai crude over light sweet Brent and WTI crude has fallen, a further sign that the market remains calm about risk of the conflict spreading in the Middle East.

While the upside potential remains unpredictable, the downside risk is limited due to the existence of a bottom beneath the market. Saudi Arabia and its Middle Eastern neighbors, who have fought so hard to support oil prices while sacrificing revenues in the process, are unlikely to accept significantly lower prices. As such, we believe that support for WTI and Brent crude has already been established and will be defended below the $80 level, and barring any war disruptions, price upside potential appears equally limited at this time. Therefore, the price of Brent crude oil is likely to stabilize in the range between USD 85 and USD 95, which is in the area that we would describe as "ideal" for now - not too low for producers and not too high for consumers.

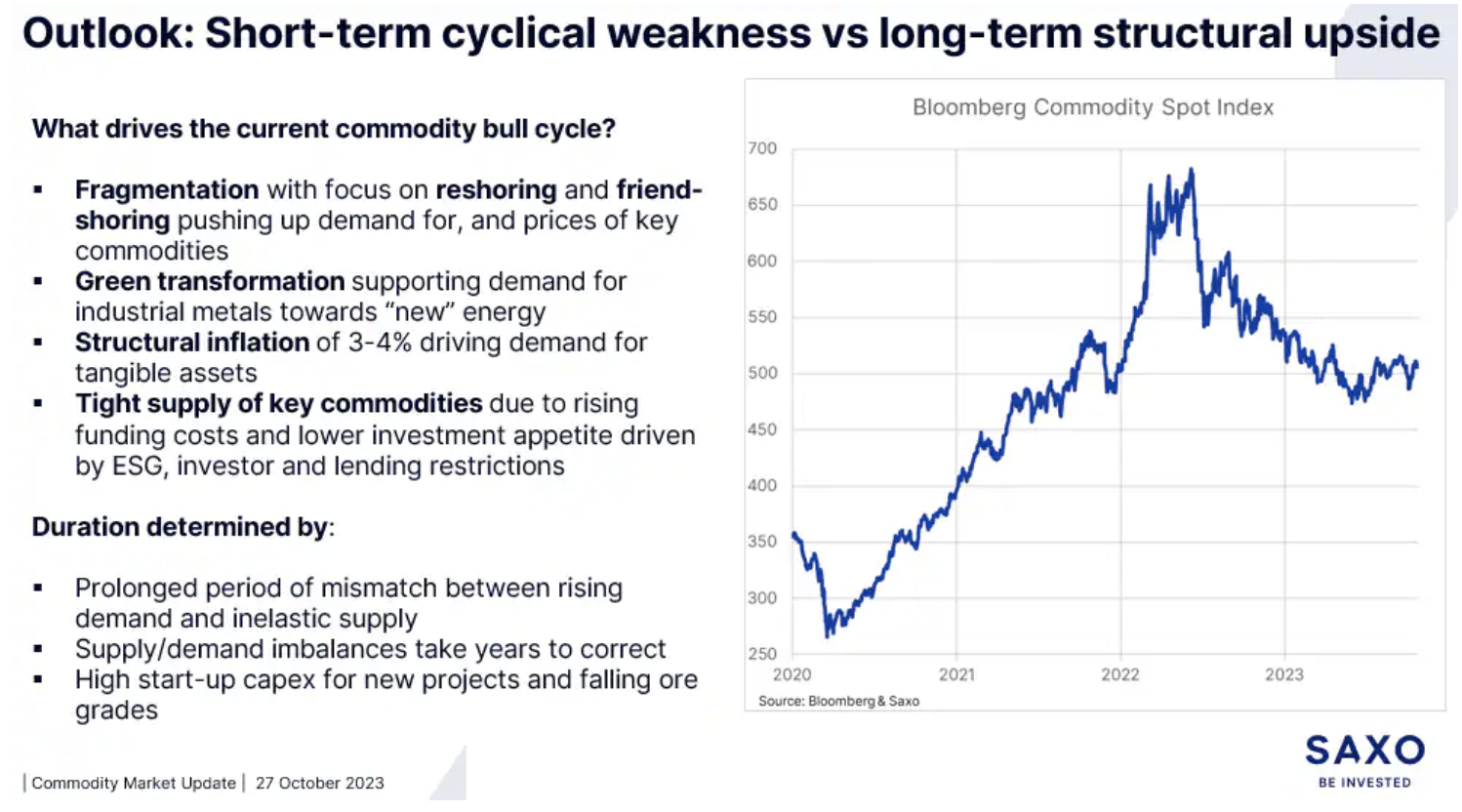

Last week I returned to Macrovoices.com and during my conversation with host Eric Townsend, I mentioned the reasons why we continue to expect commodity prices to rise in the medium term. We discussed a number of different topics including deportation vs contagion, gold's resilience despite rising yields and a strong dollar, trends in industrial metals and crude oil, and the report Commitment of Traders Report – what it is and how to use it.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response