Saxo Bank: 10 the most shocking forecasts for 2019.

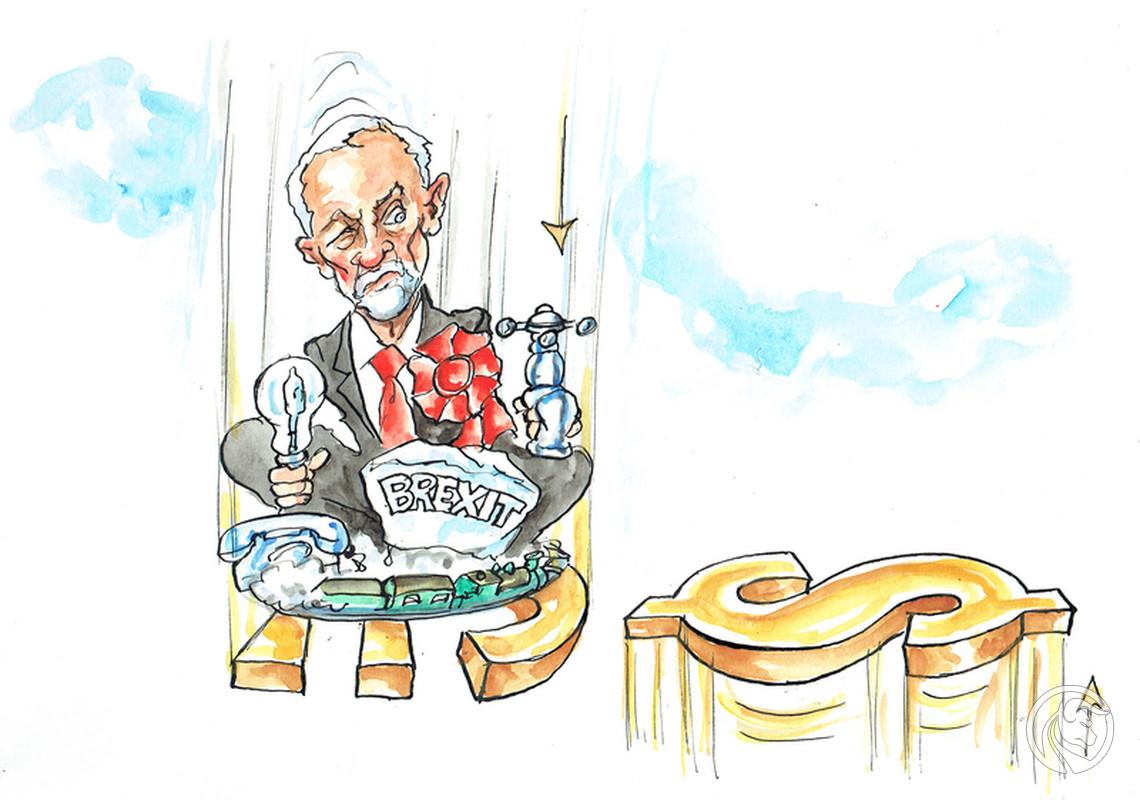

4. Prime Minister Corbyn is leading to the GBP / USD parity

source: Saxo Bank

The Labor Party is taking a spectacular victory and appoints Jeremy Corbyn as Prime Minister, announcing comprehensive, progressive reforms and a second referendum on Brexit conditions. With general support and an overwhelming majority in parliament, the Corbyn government launches a 'scorched earth' campaign in the style of the mid-twentieth century socialists, to address the huge social inequalities in the United Kingdom.

New tax streams emerge - Corbyn levies the UK's first progressive wealth tax on the richest and demands that the Bank of England help finance the new "popular quantitative easing" - universal guaranteed income. Municipal services and railways are being re-nationalized, and the fiscal expansion causes an increase in deficits of 5%. GDP.

Inflation is rising rapidly, enterprises' investments are stagnating and foreigners are leaving with the status of a resident, and with them their huge assets. The pound sterling depreciates strongly as a result of the increase in the double deficit and the lack of investment in the business sector due to the lack of a decision on Brexit. Couple GBP / USD from the regions of 1,30, in which it remained for most of the second half of 2018, it drops to parity, down by over 20%. For the first time in history, one dollar is worth one pound.

5. Netflix follows the GE path as a result of the crisis on the corporate bond market

source: Saxo Bank

2019 starts a domino effect on the US corporate bond market.First, General Electric loses credibility in credit markets, making the price of credit default swaps above 600 basis pointsas investors panic over the $ 100 billion rollover. GE commitments in the coming years with a simultaneous deterioration in cash flow.

Chaos engulfs even Netflix - investors fear the company's enormous debt: the net debt to EBITDA ratio after CAPEX is 3,4, and balance sheet debt exceeds $ 10 billion. Netflix's financing costs are doubling, holding back new content development and paralyzing stock prices. The situation is also worsened by Disney's planned entry into the streaming market in 2019. The negative chain reaction in the area of corporate bonds increases uncertainty among investors in high yield bonds.

This leads to a "Black Tuesday" for stock exchange funds following the US bond market with high yieldswhen ETF animators will not be able to determine significant spreads. This forces investors to completely withdraw from the market during a chaotic session. The stock market bust is the first warning signal regarding passive investment instruments and their negative impact on markets during the crisis.

6. After the nationalization of the four largest banks, Australia launches the "TARP in the Antipodes" program

source: Saxo Bank

In 2019, the recovery in the Australian real estate market ends in a catastrophic crash mainly caused by a sharp decline in credit growth. After the investigation of the Royal Commission, banks will be left with the highest credit activity and over-leveraging and overvalued mortgage real estate, which means that banks are forced to tighten their credit conditions.

Australia is in a recession for the first time since 27, because the collapse of property prices worsens the level of household wealth and will reduce consumer spending. It also contributes to a sharp decline in housing investment. GDP goes down. The increase in unpayable loans reduces margins and decrease profits. The banks' exposure is too great for solving this problem alone and the Australian central bank must provide a rescue package, perhaps based on recapitalization and mortgage securitization as part of its own balance sheet.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)