Speculation about a change in FOMC policy supports gold

Gold has strengthened as a result of changes in sentiment regarding bonds and the dollar amid speculation that we may be approaching the peak of aggressive monetary policy by the US Federal Reserve.

This assumption is supported by the potential readiness FOMC to allow more time to assess the economic effects of rapid pace of rate hikes and quantitative tightening. Following a second rejection in a key support area ($ 1), gold must at least break above $ 615 before it can be said to end its month-long downtrend.

Breakout of key support

Recent recovery following another failed attempt to break below key support at $ 1, which is now a double bottom, began on Friday when the now famous "Fed charmer" Nick Timiraos of the Wall Street Journal published an article suggesting that the Fed was preparing to slow the pace of rate hikes early next year. This assumption is supported by the potential readiness of the FOMC to allocate more time to assess the economic effects of the rapid pace of interest rate hikes and quantitative tightening.

The latest boost for gold came in response to the latest sharp declines in US bond yields and the dollar after economic data released Tuesday showed US house prices fell the most since 2009 and US consumer confidence plunged more than expected. In reaction to these data, the euro returned to parity after breaking the trendline, which had been rejected several times since it was established in February. In addition, bond yields have dropped somewhat across the curve, which has kept the 40Y and XNUMXY yield spreads still inverted at around XNUMXbp, thus signaling an elevated, but still unlikely, risk of a US recession next year.

Positive prospects for gold

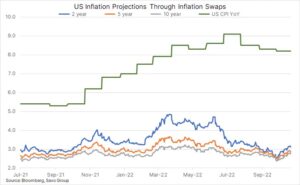

At Saxo, we stand by positive outlook for goldand in the last analysis we mentioned that the final recovery will require a proper configuration of all factors, with the first stimulus being the peak of aggressive FOMC policy, which will initiate a decline in yields and a weakening of the dollar. As a precautionary measure, it should be emphasized that in our opinion this has not happened yet, but there is a clear spread in the market that the FOMC may soon halt further aggressive policies to assess the economic impact of the current cycle of rate hikes, which is currently pricing in the peak federal funds rate. at just under 5% compared to the current level of 3,25%.

Moreover, we maintain the view that long-term inflation will be around 4-5%, well above current market expectations of below 3%. If it were to be true, it would cause a significant correction in the price of zero-coupon inflation swaps, which could support gold in the form of lower real yields.

However, speculative investors and others are likely to hold back until we have a clearer picture of the Federal Reserve's approach, which is why next week's FOMC meeting is so important. Speculative traders in the futures market have suffered significant losses over the past few weeks, which discouraged them from aggressively entering the market until more specific information was available, according to weekly reports by the Commitment of Traders.

The same applies to gold-backed stock traders, who have been almost continuously net sellers since June. The total amount of gold held by investors has dropped to 2 tonnes, a 968-month low, down 30% from the April peak.

Ending the downtrend?

On re-rejection in a key support area ($ 1) gold must at least break above $ 1 - and thus eliminate a series of lower highs - before we can talk about the end of the month-long downtrend. However, a number of minor resistance levels remain on the way to this level, notably $ 1 and $ 687. For now - until the momentum is restored - it is worth observing the dollar exchange rate, profitability and geopolitical developments to gain directional inspiration.

More analyzes of commodity markets are available here.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)