Silver and copper continue to gain at the same time

When silver ignores gold and the dollar, it is usually largely guided by copper. This was the case in recent months, when the prices of both metals were strongly revised. It happened as a result of fear of recessionas central banks step up efforts to contain rising inflation, fears about economic growth in China, a strengthening dollar and an overall level of risk aversion. However, the changes in sentiment were driven by signs of recovery in China, the demand for fossil assets and the maintenance of significant short positions by speculative investors.

It seems that the sharp decline in the price of silver by 32% from March to July to the lowest level in two years has attracted new amateurs of this partly industrial and partly noble metal.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

After a temporary recovery copper prices in early June, as China began loosening lockdown restrictions, the rally quickly lost momentum and copper fell below key support before finally stabilizing after finding support at $ 3,14 / lb, a 61,8% retreat from the rally line from 2020-2022. It was this prolonged decline that brought the price of silver to its lowest level in two years, and also to its lowest level in two years, relative to the price of gold. However, in recent weeks, the gold-silver ratio has dropped from 94 ounces of silver to one ounce of gold to the current level of 86,8, and from a technical perspective, a drop below 85,65 could cause this ratio to move towards 83, signaling a further strengthening of silver by 4% relative to gold.

Precious metals

The most recent appreciation against gold on Monday was protracted after silver broke above its 20,33-day moving average - a level that is currently supporting ($ 20,85 / oz); the next resistance is close at $ 22,50 / oz and a break above could signal a potential extension of growth again towards June's high around $ XNUMX / oz. Just as the decline was fueled by the weakening of industrial metals prices, the recent rebound has been supported by a renewed rise in the price of copper.

There is potential for an improvement in the outlook for demand in China, and BHP has announced that it has made a bid to acquire OZ Minerals and its assets primarily related to nickel and copper - the latest in a series of global acquisitions to secure supplies of metals necessary for the energy transition. Due to its high electrical conductivity, copper is used in every electronic device we use, from smartphones to medical equipment. It already underpins existing electricity grids and is key to the electrification process that will be needed in the coming years to reduce the demand for fossil fuel energy.

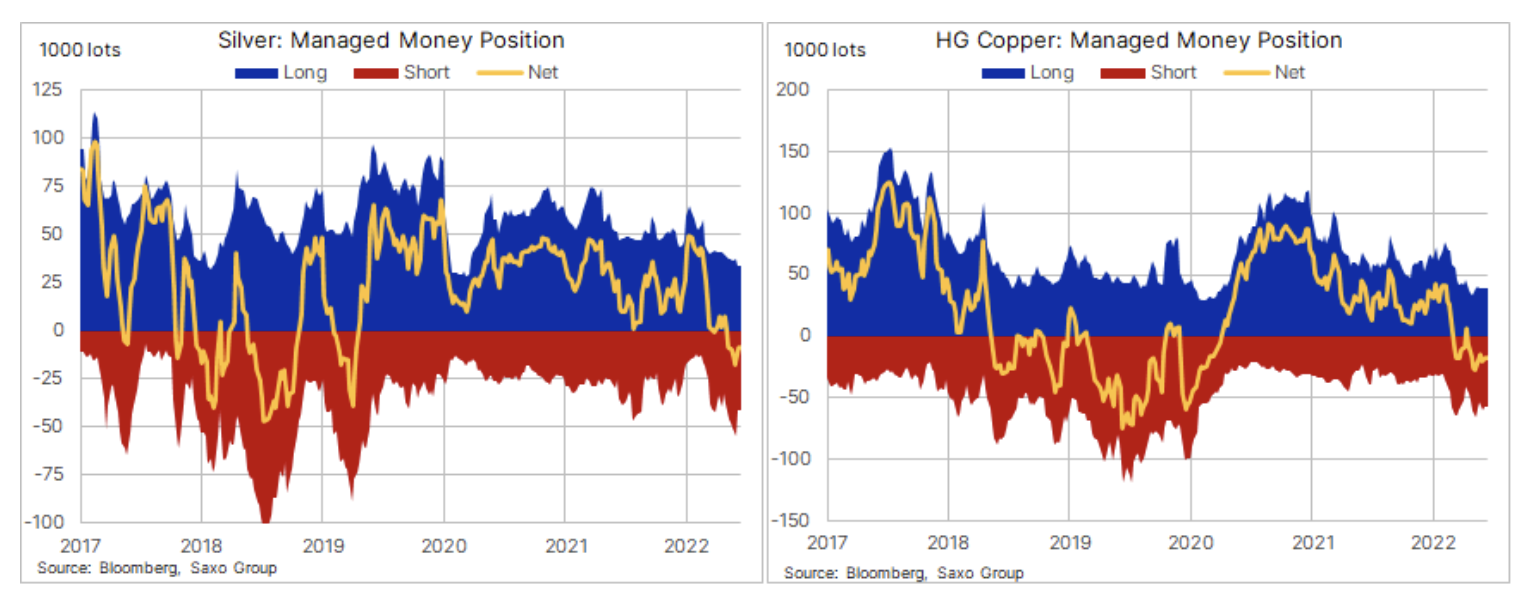

As a result of weeks of low prices, cash managers and other major speculative investors have accumulated a net short position in both metals. Until the recent improvement in risk appetite for these two metals, the funds held a short gross silver position of PLN 54,4 thousand. contracts (the area marked in red in the charts below), which was the highest result in three years, while the short gross position in HG copper reached 66 thousand. contracts - the highest in 28 months.

While speculative investors have cut short copper positions in recent weeks, price action has yet to convince those expecting another sell-off amid the recession. For this to change, copper prices must at least break above $ 3,69 / lb, a 38,2% retracement of the 31% correction line from June to July. As you can see in the chart below, only a return above $ 4 / lb would signal a possibility of a rebound towards the record high in March.

While speculative investors have cut short copper positions in recent weeks, price action has yet to convince those expecting another sell-off amid the recession. For this to change, copper prices must at least break above $ 3,69 / lb, a 38,2% retracement of the 31% correction line from June to July. As you can see in the chart below, only a return above $ 4 / lb would signal a possibility of a rebound towards the record high in March.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response