Resources are going up and they count on even more

We predict that the overall rise in commodity prices, which pushed the Bloomberg commodity index by 10% in the last quarter, will also continue in 2021. This will be the result of a number of positive factors as a result of the decline in supply and the flood of cash in the global market, which intensifies speculation in all markets and increases the demand for hedging against inflation. In addition, the prospect of a weakening dollar, a revival in global demand over the vaccine, and new weather concerns mean that elements of another super-cycle in the commodity market are already visible.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

At the same time, many countries are still facing the pandemic, particularly in the now winter regions of the Northern Hemisphere, and prospects for improvement, with the vaccine or otherwise, are slim until warming in March and April. As the bull market may hold back until the vaccine program gains momentum, the market remains hopeful that continued investment demand will prove strong enough to support markets in the coming months, when the negative effects of lockdowns and mobility constraints will be greatest.

Strong growth at the end of last year caused the Bloomberg commodity index to break the downward trend of 2011.

In 2021, the raw materials sector will be supported by a number of factors. This includes weaker dollar, rising demand for hedging inflation, an increase in demand for fuel as global mobility revives, as well as a green transition, increasing demand for key industrial metals, ranging from copper to silver, and increasing demand outside of China as government spending increases to support employment. Despite the prospect of rising US bond yields, precious metals will most likely continue to find buyers in reaction to the weaker dollar and rising inflation expectations. Added to this is the risk of rising food prices as the weather becomes more volatile - the recent strong rise in food prices was an important signal in this regard corn i variety up to a seven-year maximum.

One of the biggest obstacles to the boom in commodity markets in the last decade has been the widespread availability of raw materials. Oversupply during this period, and in particular over the past six years, kept the raw materials sector in a contagionwhere the immediate price, due to the widespread availability of goods, was lower than the strike price.

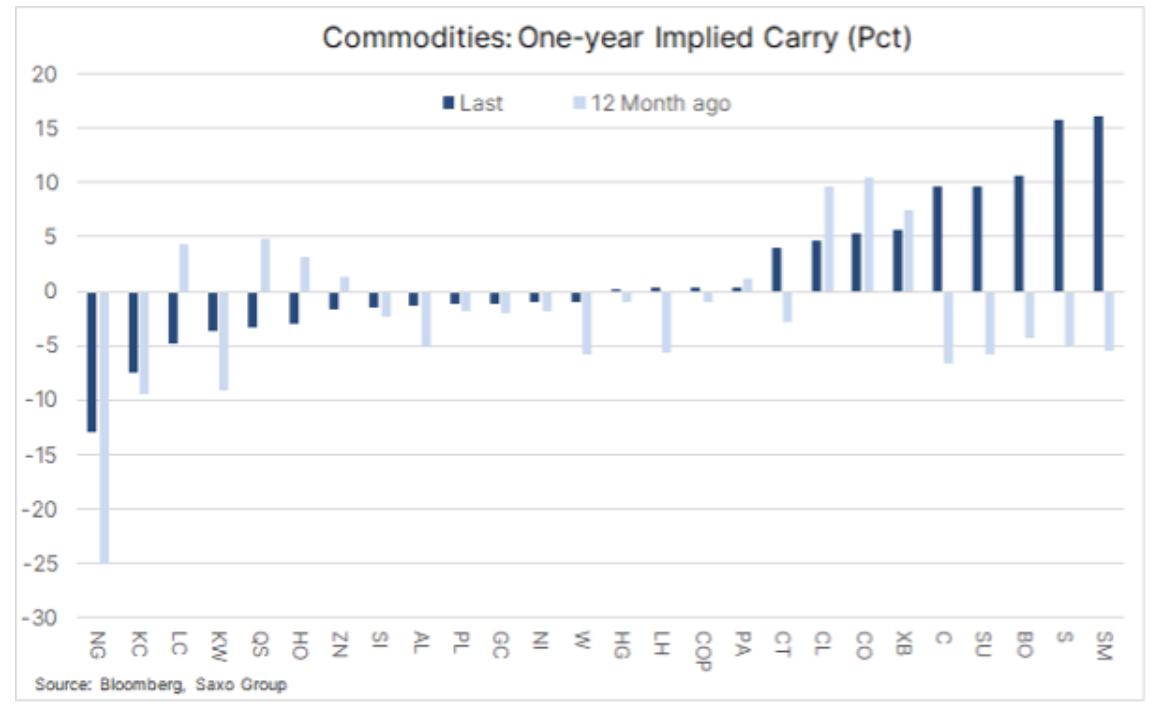

From 2014 to the last quarter, the profit on rollover of the key commodity portfolio, which sometimes reached 5% annualized, was negative. From an investment perspective, this handicap, coupled with the generally strong dollar and low inflation, negatively affected the attractiveness of commodities.

However, in recent months, profits from rolling a range of commodities have risen sharply, bringing the average for the 25 commodities (excluding natural gas) to 2%, the highest level in seven years. As can be seen in the chart below, the agricultural sector has taken the lead in this respect, with key crops rising sharply in response to the weather-related decline in output and an increase in demand.

This sector appears to be experiencing an expected increase in demand and reflation in 2021, particularly in markets where supply may not match demand. This includes markets copper, platinum, soybeans and eventually also crude oil.

How to get comprehensive exposure to raw materials?

From an investment perspective, exposure to raw materials can be obtained through ETF and/ or CFD following major indexes.

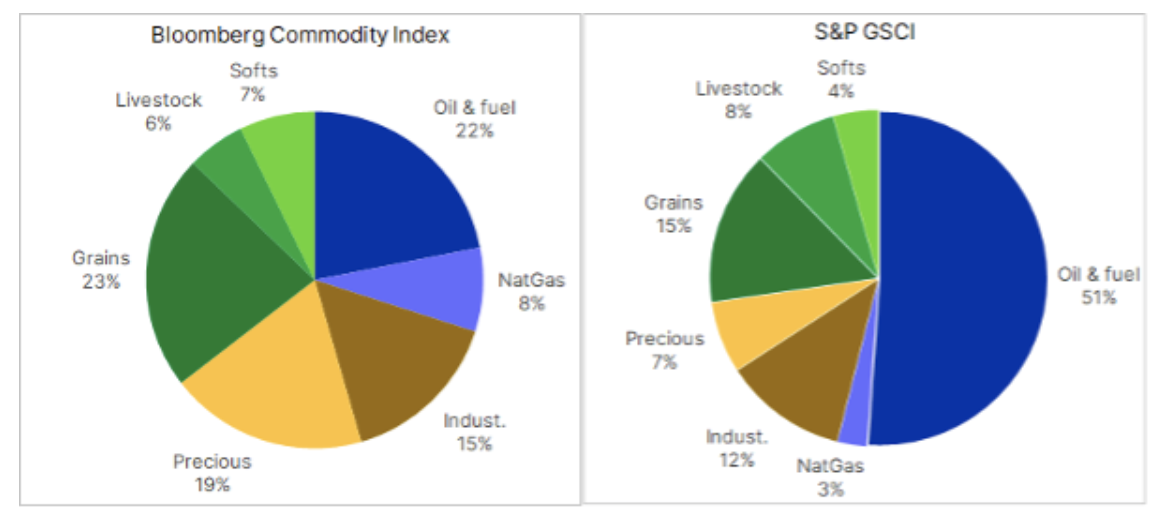

The chart below shows the compositions of two large commodity indices monitored by many different stock exchange funds. The S&P GSCI and the Bloomberg commodity index have exposure to 24 and 23 futures respectively, broken down into three main sectors: energy, metals and agriculture.

It is worth noting that investors who prefer the energy sector should choose funds that follow the S&P GSCI index, where the sector is strongly represented (54%); example tickers are GSG: arcx or GSP: arcx. In contrast, overall inflation hedging and positive rollover gains in the agricultural sector can be achieved through the Bloomberg Commodity Index due to its greater diversification and lower energy exposure, where holding gains are still low or even negative; example tickers are CMOD: xlon or DJP: arcx.

Energy

As a result of a strong bull market oil initiated by the information on the launch of vaccination in early November, the price of Brent crude oil has returned above USD 50 / bio, and unless there is another strong decline in global fuel demand in the current quarter, it can be assumed that further price increases in the following months of this year are on solid grounds. It was the result of, among others Saudi Arabia's unilateral decision to cut production in February and March to support the market in a potentially difficult period of lockdowns and reduced mobility.

Fundamental indicators appear to be solid and both Brent and WTI crude oil begin to show deportation as OPEC + keeps supply low until movement restrictions are lifted worldwide later this year. Before we start worrying about where to get the next barrel of oil, however, there must be a reduction in global production reserves - both from OPEC and non-OPEC producers - estimated at around 7,5 million barrels a day.

As global oil demand is still almost 6mbbl / day below pre-pandemic levels, we do not anticipate a significant risk of oil price increases until 2022, and perhaps even 2023, when a dramatic decline in capital expenditure among the largest global producers may start to translate the possibility of finding new barrels. On this basis, we expect Brent crude oil to remain steady in the $ 50-55 range this quarter until fundamentals turn out to be strong enough to support the move towards $ 65 / b.

Precious metals

Both goldAnd silver saw a strong start in 2021, before rising US bond yields and the associated stronger dollar depressed them somewhat. Nevertheless, we maintain a constructive outlook for this sector, as higher yields are mainly due to the rise in inflation expectations favorable to gold, which will leave real yields - a key driver of gold prices - stuck in the negative area for good. Combined with accommodative policy of central banks and further weakening of the dollar, the line of least resistance continues to rise. In addition, the new Biden administration is likely to start massive spending to rebuild the economy devastated by the pandemic.

The vaccination program will undoubtedly act as a brake here, given the prospects for economic recovery, but with central banks signaling that interest rates will remain low, the risk of political error is increasing, fueling inflation even further.

Silver has reverted to its long-term value against gold with the prospect of further growth, depending on demand from both industry and investors. The green transition may surprise everyone in the context of industrial demand - the market for photovoltaic installations is predicted to grow in strength as many countries turn to renewable energies. Based on our forecast that gold will hit $ 2 / oz, the high beta of silver should add to the advantage and the gold-silver ratio in 200 will be slightly above 2021, bringing the silver price close to 60 USD / oz.

Agriculture

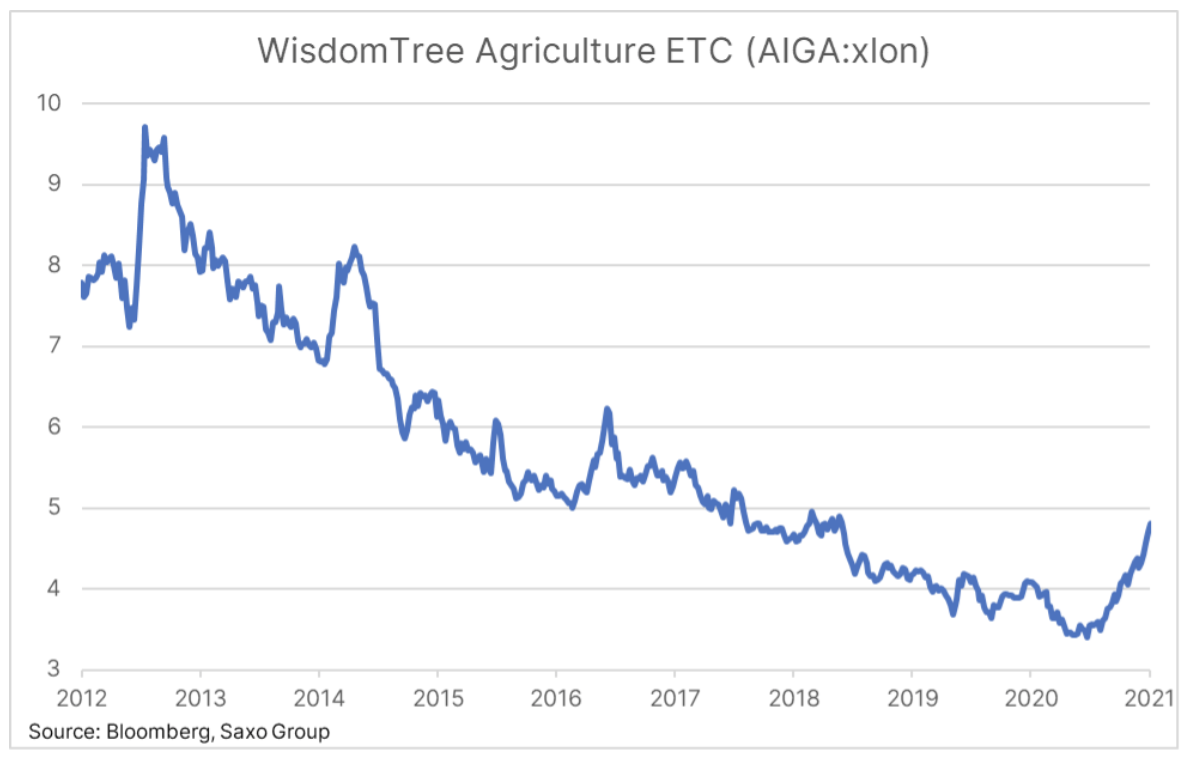

Weather permitting, in 2021 the agricultural sector should see a significant response from farmers in the form of an increase in supply following a surge in prices over the past six months. While oil producers and mining companies can take years to increase production in response to higher prices, farmers are able to react seasonally.

Be sure to read: Food market - how to invest in food?

Given that corn and soybean prices rose to their highest level in seven years in early 2021, the prospect of a significant response - again, weather permitting - from key crop farmers could limit growth potential as we approach the season seed in the United States. If we add to this the fact that speculative long positions in maize and soybeans peaked since 2012, we can expect an increase in volatility and risk of corrections in the coming months. Overall, however, we anticipate that the main positive factors in the agricultural sector will remain unpredictable weather conditions, solid Chinese demand and the prospect of a weakening dollar.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)