Raw Materials - July weakness driven by reflation and virus variants

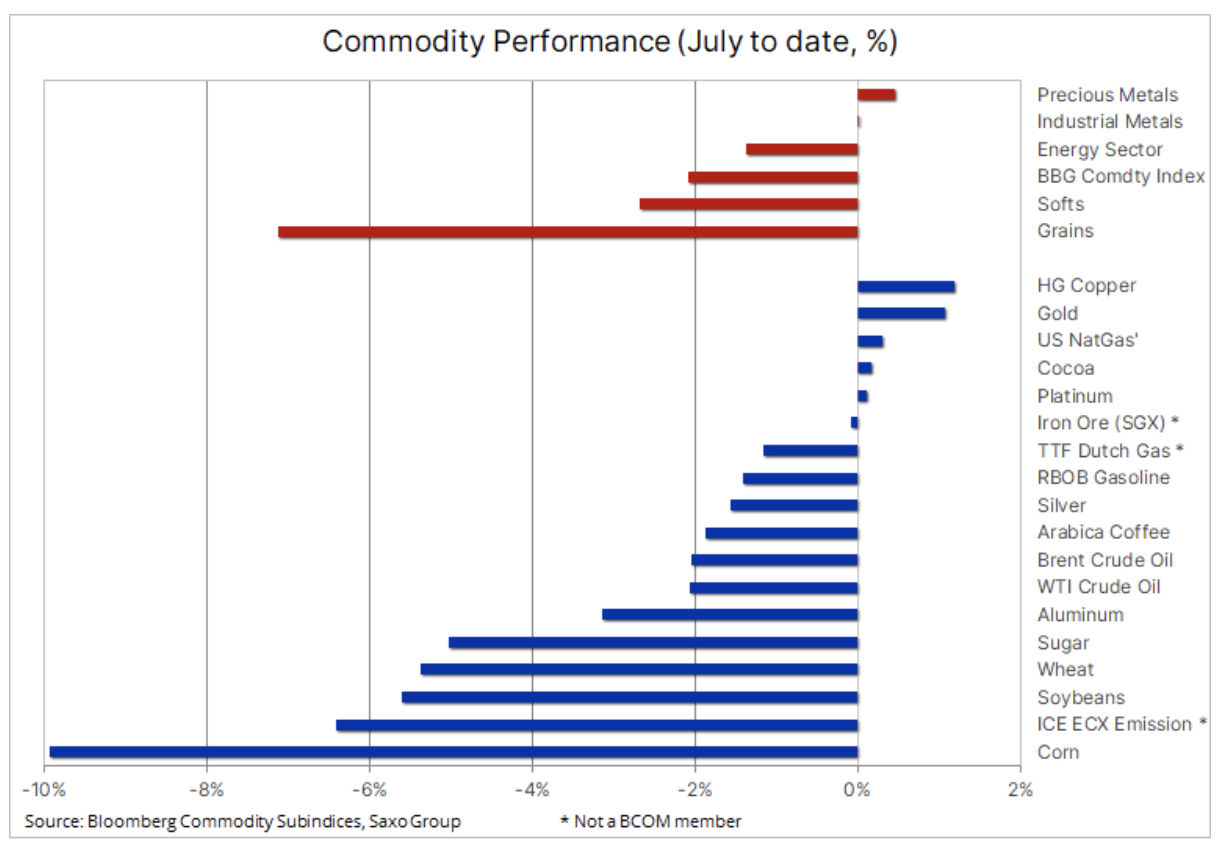

For commodities markets, the new quarter started problematically: throughout the past week, all sectors, except for precious metals, were depreciating; This concerned mainly broadly understood agricultural products, while in the energy sector, the hitherto overwhelmingly positive narrative stopped in response to the growing conflict in OPEC, which had a negative impact on the forecasts, with a simultaneous increase in delta infections, lowering the overall risk appetite.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Both physical and investment demand for commodities surged in the first half of the year with the prospect of a strong economic rebound, rising inflation and government intervention to combat climate change, which requires significant amounts of industrial metals and inputs.

However, in recent weeks, the bull market has started to slow down due to the fact that the improvement in weather conditions has contributed to a significant reduction in the prices of key crops, the uncertainty fueled by OPEC has hurt bull investment in oil, and the signs of economic recovery after the pandemic in China began to fade, which worsened the short-term prospects of raw materials important for China, such as copper, iron ore or steel. As a result, the People's Bank of China cut its reserve requirement (RRR) by 0,5% on Friday and plans a RMB 1 trillion liquidity injection into the system to support small and medium-sized enterprises as well as economic growth as such.

Moreover, the American Federal Reserve goes in exactly the opposite direction, as FOMC members began to discuss the issue of limiting the purchase of debt used to stimulate the economy, and at the same time their comments have effectively (so far) contributed to dismissing the risk of galloping inflation. Coupled with the fact that there is still a flood of cash on the market, profitability US treasury bonds They fell sharply last week: at one point, ten-year bond yields hit 1,25%, the lowest level since February, which translated into a positive week for gold.

As the Northern Hemisphere summer holiday season starts, it should also be emphasized that in the next 4-6 weeks, markets will face the prospect of lower liquidity causing overreaction, which in turn could impact the fundamental and / or technical outlook. We saw examples of such excess movements last week in all three sectors.

Agriculture

Significant problems in the maize and wheat markets pushed the cereals sector sharply down just a week after weaker-than-predicted reports on US crop acreage and stocks contributed to growth in the sector. Overall, the year-long strong rise in world food prices slowed down in June after the FAO recorded its first decline in the global food price index in 13 months. In June, the index fell by 2,5%, bringing the y / y growth to a still high of 34%, compared with 40% in May. It was the result of a 10% decrease in edible oils, incl. palm, soybean and sunflower seeds, as well as the above-mentioned decline in corn prices.

Corn was the biggest loser last week in response to improving weather conditions in the US Midwest, as well as speculation that China's import demand has peaked as local corn futures trading volumes have dropped to their lowest level this year. This is the result of an increase in production in China and the expectation that the demand for fodder grains will decline as the loss-making pig farmers have stopped growing their pigs. In a recent report from Beijing, the US Department of Agriculture estimated that imports in this country in 2021-2022 will amount to 20 million tons, which is much less than the officially forecast 26 million tons.

The maize futures contract (CBOT) price with execution in December broke the support level, falling below the well moving average for the first time in 11 months. Further weakening could drop to $ 5 and then to the two-hundred-day moving average of $ 4,72.

Energy

Crude oil traders and investors were somewhat confused after oil prices fell almost 8% immediately after WTI crude oil hit its seven-year high and Brent crude oil reached its highest level since late 2018. This happened despite the possibility of further contracting supply in the market after The United Arab Emirates canceled OPEC + plans to increase production from August to December by 400. b / d monthly.

Uncertainty fueled by OPEC, coupled with the rapid increase in coronavirus infections - which once again called into question the trajectory of rising demand - has forced traders and investors to downsize without asking unnecessary questions; perhaps these questions should be answered at this point, before the end of August, when most of us will return from holidays. In addition, a longer no-deal period can mean an increasing non-compliance, and even another price war, if producers decide to unilaterally increase production. Under the worst-case scenario, the conflict between Saudi Arabia and the United Arab Emirates could lead to a split, and the UAE will pursue its program of selling off the maximum quantities of oil while demand remains strong.

Our baseline scenario assumes a favorable situation for oil prices, as the increasing shortage of supply will require an increase in production by a small group of producers with production reserves - primarily Russia, Saudi Arabia and the UAE. This is related to, inter alia, with the current lack of response from key non-OPEC manufacturers such as the Americans who remain focused on maintaining discipline. In the short term, however, in the coming weeks, the potential risk of an increase in price volatility and the possibility of a further spread of the Delta variant may prevent the price from returning to the last highs.

The upward trend in the crude oil market, which has continued for a year, is not yet threatened and will likely remain so, unless the conflict at OPEC leads to a split, as a result of which producers aggressively start to open taps. For now, the range for WTI oil is between USD 70 and the current double peak around USD 77.

Metals

Last week, the price of gold remained in the range of $ 1-795. Support in the form of a decline in US government bond yields had a limited effect as it was the result of another deflation of reflation transactions after the publication of the minutes of the June FOMC meeting. Other metals, such as copper, silver and platinum, faced problems due to information from around the world - from the United States to China - on the risks to economies, and growing doubts about projected growth as more variants of the coronavirus spread.

However, the reasoned decision of the People's Bank of China on Friday to lower the reserve requirement (RRR) by 0,5% eased some of these fears and also contributed to the weakening of the dollar. This move contributed to a slight appreciation of copper, while the price of silver rose after its relative value to gold at the beginning of the week fell to its lowest level in 3 months. This happened after the relationship XAU / XAG almost 70 ounces of silver to one ounce of gold.

We believe gold's popularity as a hedge against the unforeseen events of the past month has increased even further. After the June FOMC meeting, the market more and more often valued the outlook for moderate inflation in its valuations. In this context, we believe that gold has significant growth potential should the global recovery fail to play out as expected or inflation exceeds expected levels.

Last month's gold price correction exceeded all expectations in the context of the dollar exchange rate and yield levels. It triggered another wave of short selling and these losses are unlikely to be repaired unless the price exceeds $ 1, and above all $ 815, which is a 1% correction in June.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)